Rule 86A of CGST Rules- Blockage of ITC

Rule 86A of CGST Rules-Conditions of use of amount available in the electronic credit ledger

(1) The Commissioner or an officer authorised by him in this behalf, not below the rank of an Assistant Commissioner, having reasons to believe that credit of input tax available in the electronic credit ledger has been fraudulently availed or is ineligible in as much as-

a) the credit of input tax has been availed on the strength of tax invoices or debit notes or any other document prescribed under rule 36-

i.issued by a registered person who has been found non-existent or not to be conducting any business from any place for which registration has been obtained; or

ii.without receipt of goods or services or both; or

b) the credit of input tax has been availed on the strength of tax invoices or debit notes or any other document prescribed under rule 36 in respect of any supply, the tax charged in respect of which has not been paid to the Government; or

c) the registered person availing the credit of input tax has been found non-existent or not to be conducting any business from any place for which registration has been obtained; or

d) the registered person availing any credit of input tax is not in possession of a tax invoice or debit note or any other document prescribed under rule 36,

may, for reasons to be recorded in writing, not allow debit of an amount equivalent to such credit in electronic credit ledger for discharge of any liability under section 49 or for claim of any refund of any unutilised amount.

(2)The Commissioner, or the officer authorised by him under sub-rule (1) may, upon being satisfied that conditions for disallowing debit of electronic credit ledger as above, no longer exist, allow such debit.

(3) Such restriction shall cease to have effect after the expiry of a period of one year from the date of imposing such restriction.”

Related Topic:

Rule 86A challenged in Gujarat High court

what is Rule 86A of CGST Rules?

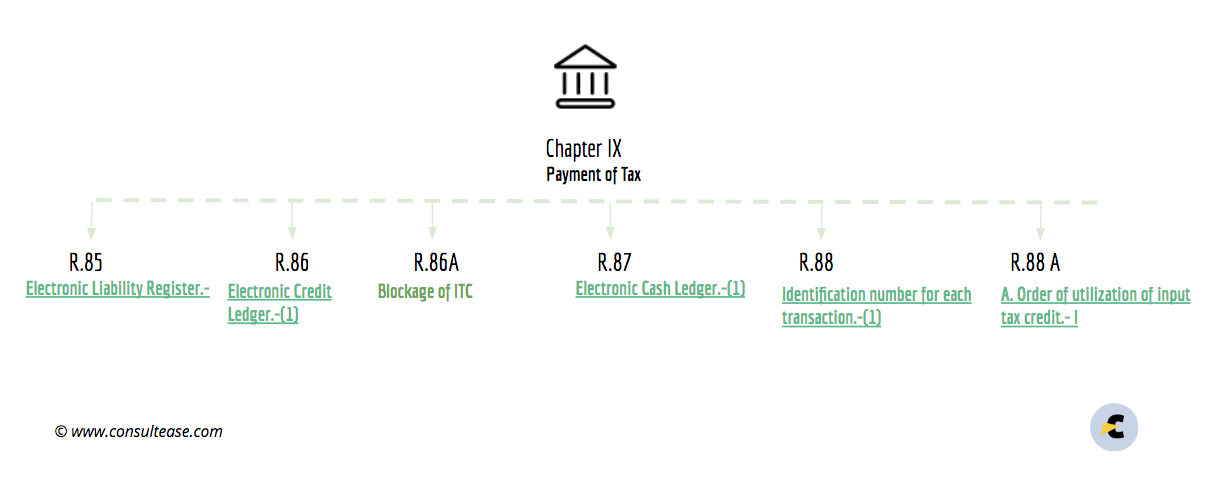

Blockage of the input tax credit in case of a non-existent supplier. Surprisingly a provision for the blockage of input tax credit introduced in the chapter of payment. It is part of Chapter IX of CGST rules. It provides a right to officer to block the input tax credit. In the time of CVID lockdown, it is a real hardship for taxpayers. Many businesses are locked or operating from home. The criteria of non-existent should be changed to meet the current situation. Visits from the department may result in spread of the virus.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.