GST council has no right for deciding the classification- High Court

Classification of flavoured milk-

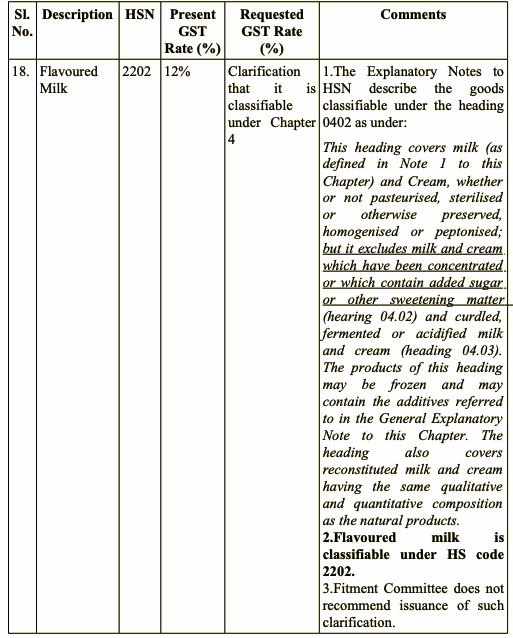

GST Council in its Minutes of Meeting dated 22nd December, 2018 classifying “flavoured milk” under HS Code No. 2202 reads as under:-

The author can be reached at Shaifaly.ca@gmail.com

Lateron the case is filed against the AAR in case of Britannia industries where in the milk was not classified as a dairy product.

The decision was-

“UHT Sterilized Flavoured Milk marketed under the brand name ‘Britannia Winkin’ Cow Thick Shake’ by the applicant is not classifiable under the Tariff heading ‘0402 /0404″ but classifiable under CTH 2202 99 30.””

The honourable court looked into the matter and give the following ruling-

119.Having adopted classification of ‘Goods’ and ‘Services’ under the First Schedule to the Customs Tariff Act, 1975, the 3 rd respondent GST Council cannot impose a wrong classification of “Flavoured Milk” as a “Beverage Containing Milk” under the residuary item as “NonAlcoholic Beverages” under Sub Heading 2202 90 30 of the Customs Tariff Act, 1975.

120.Therefore, the impugned recommendation of the 3 rd respondent GST Council cannot be upheld. Classification ought to have been independently determined by the Assessing Officer.

121.Further, the power of the 3 rd respondent GST Council is merely recommendatory. It is for the Government to fix appropriate rate on the goods that are classifiable under the Customs Tariff Act, 1975. As long as the Customs Tariff Act, 1975 is adopted for the purpose of interpretation of Notification No.1/2017-CT(Rate) dated 28.06.2017, classification has to be strictly in accordance with the classification under Customs Tariff Act, 1975, irrespective of the fact that concessions were given under the earlier regime by the Central Government under Sections 5 & 11C and Section 4A of the Central Excise Tariff Act, 1985.

122.While allowing this Writ Petition, I however leave it open for the Government to issue a fresh Notification for amending Entry Nos.8 & 50 to Notification No.1/2017-CT(Rate) dated 28.06.2017 to tweak the rate of tax, recognizing the well settled principle of law that in taxing matter, latitude can be given to the authorities while fixing the rate of tax.

123.The Central Government can either tweak the rate on the recommendation of the 3rd respondent GST Council or by itself.

124.In the result, these Writ Petitions stands allowed with the above observations. Consequently, the connected Miscellaneous Petitions are closed. No costs

Conclusion-

This is very important judgment related to the classification. The powers of GST council were also clarified.

Read and download pdf of the judgment

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.