GST DRC01B shall be issued before recovery proceedings

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

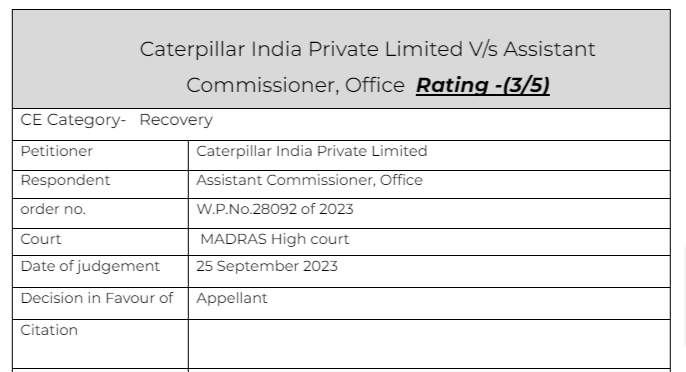

Caterpillar India Private Limited V/s Assistant Commissioner, Office

Facts of the cases:

The petitioner has now filed this writ petition challenging the recovery notice dated 13.09.2023. The challenge to the impugned recovery notice is primarily on the ground that the procedural safeguarded prescribed under Rule 88C inserted in the CGST Rules, 2017 vide Notification No.26/2022 dated 26.12.2022 has not been observed. It is submitted that the petitioner has replied the notice in GST DRC 01A dated 07.09.2023 on 11.09.2023. However, after the reply was given by the petitioner the impugned recovery notice seeks to invoke Section 75(12) read with Rule 88C of the CGST Rules, 2017.

It is submitted that the respondents ought to have mandatorily issued notice in Part A of Form GST DRC 01B electronically on the common portal. It is submitted that till date such an intimation has not been received by the petitioner either physically or in the electronic portal.

Observation & Judgement of the Court:

Under these circumstances, the impugned recovery notice issued under Rule 79 of the CGST Rules, 2017 is quashed with liberty to the respondents to issue appropriate notice in Form GST DRC 01B before proceedings to recover any amount based on the difference noticed in Form GSTR1 and Form GSTR 3B.

Comment:

The recovery notice under section 79 was quashed by the court. The authorities were asked to issue GSTDRC 01B first

Read & Download the Full Caterpillar India Private Limited V/s Assistant Commissioner, Office

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.