GST E-way bill rules released

GST E-way bill rules released

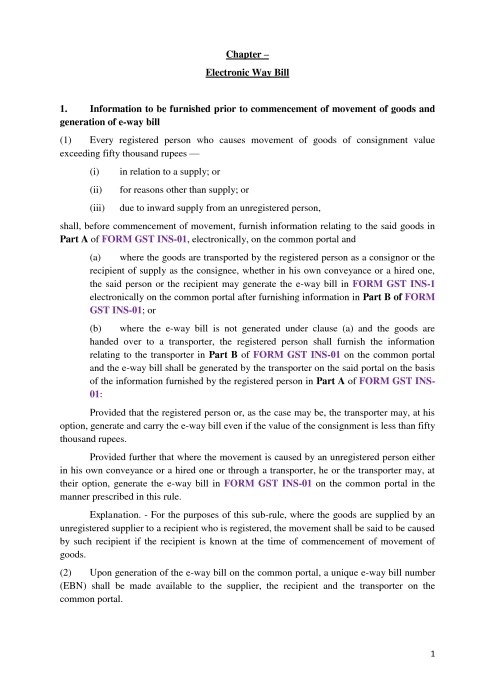

GST E-way bill rules released are released by CBEC today. These rules are draft rules. It contains the provisions related to E-way bill in GST. We can generate an E-way online through GST common portal. A supplier,recipient or transporter can generate an e-way bill. It is required when the value of consignment is more than Fifty Lac rupees. Although a person can generate and carry the e-way bill even when the consignment is less than Fifty thousand rupees.An unregistered supplier is also required to generate an E-way bill. Where the government will notify , the RFID device is also required too be placed in a conveyance.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.