GST Impact On Death of A Proprietor – Law and Procedure

Table of Contents

- Upon Death of the Proprietor, what are the options available to the legal heir?

- FAQ1: What are the actions to be taken if the legal heir wants to close down the business?

- FAQ2: How the cancellation application needs to be filed by legal heir in case of closure as per Section 29?

- FAQ3: Within how many days the application for cancellation of registration need to be filed?

- Read & Download the full copy in pdf:

Upon Death of the Proprietor, what are the options available to the legal heir?

REPLY-

On the death of the proprietor, the legal heir has the following two options

• Option 1: Legal Heir to close down the business

• Option 2: Legal Heir to continue with the same business

Option- 1: Legal Heir to close down the business

FAQ1: What are the actions to be taken if the legal heir wants to close down the business?

REPLY-

The following actions are to be taken if the legal heir wants to close down the business –

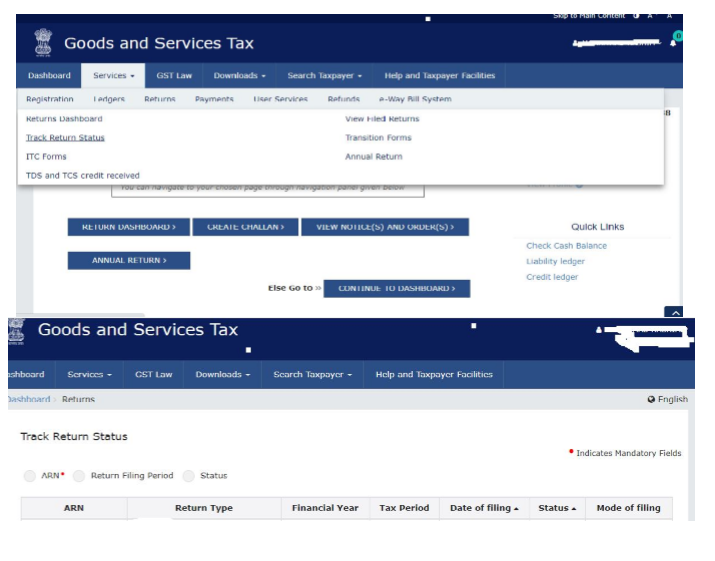

- Incase GST Log in credential is available, then the legal heir needs to visit the GST website and navigate the following path- services tab > returns > track return status, to check the current return filing status of the deceased proprietor.

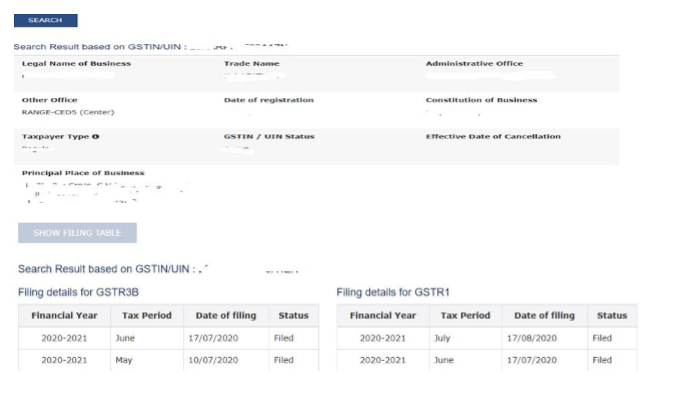

- Incase the GST Log-in credential is not available, then the legal heir needs to visit the GST website and go to the tab Search as a taxpayer. There you would need to key in the GSTIN and you will get the details of the jurisdiction and also the filing status.

- Once the above filing details are available the legal heir needs to arrange the following docs

1. Death Certificate / Succession Certificate

2. Identity Proof of the deceased

3. Identity Proof of the legal heir which will prove the relationship status with the deceased

4. GST Certificate of the deceased

5. Return filing status ( as presented above)

Once the above documents are arranged the legal heir can visit the Proper Officer for the change of the authorized signatory. On verification of the same, the Proper Officer will change the authorized signatory and send a temporary link for updation of details. Once the signatory has been changed then the process of cancellation of registration can be initiated.

FAQ2: How the cancellation application needs to be filed by legal heir in case of closure as per Section 29?

REPLY-

- It is recommended to file all pending returns till the date of death after payment of tax, if any.

- The legal heir has to file an application for cancellation of registration by giving the reason as death of proprietor as he wants to discontinue the business along with necessary documents.

- The process of cancellation of the registration which the legal heir needs to follow is mentionedas below

- Rule 22(3)- If a person who has submitted an application for cancellation of his registration is no longer liable to be registered or his registration is liable to be cancelled, the proper officer shall issue an order in form GST REG-19, within thirty days from the date of submission of the application submitted by the registered person or the date of reply to the show-cause notice issued to him and cancel the registration, with effect from a date to be determined by him. He will notify the taxable person, directing to pay arrears of any tax, interest or penalty including the amount liable to be paid under section 29(5)

- Rule 22(5)- The provisions of Rule 22(3) shall, mutatis mutandis, apply to the legal heirs of a deceased proprietor, as if the application had been submitted by the proprietor himself.

Related Topic:

8 tips on how to grow your CA firm Practice

Documents to be attached for cancellation of registration are mentioned below1 Death certificate of the deceased 2. Identity Proof and Address Proof of the deceased 3. Proof of the business closure 4. Proof of the bank closure ( if available) 5 Indemnity Certificate 6. Detail of the stock held on the date of death

Note- In case of death of the sole Proprietor, application can be made manually by the legal heir/successor before the concerned tax authorities.

FAQ3: Within how many days the application for cancellation of registration need to be filed?

REPLY-

As per Rule 20, the application should be submitted within thirty days of the occurrence of the event warranting cancellation, herein due to the death of the proprietor.

Read & Download the full copy in pdf:

CA Arup Das Gupta

CA Arup Das Gupta

• Arup is a hardcore Compliance professional with deep interest in tax litigations and advisories and is based in City of Joy, India. • He is qualified Chartered Accountant from ICAI in the year 2000, Company Secretary from ICSI in the same year and CISA from ISACA, US in the year 2010. He has also earned a Diploma in IFRS from ACCA, Uk. • He has over 2 decades of experience in tax laws and other allied laws. • In 2000, Arup started his career with a mid sized CA firm as a Partner. • In 2009, after a brief stint with IFB Agro Industries he joined Rediffusion a leading advertisement agencies as General Manager Finance. • In 2012, Arup left Rediffusion to set up his own practice, primarily handling tax litigations and advisories only • After the introduction of GST in 2017, he has put on many hats as implementer, advisor, trainer, compliance consultant, litigations consultant and also advisor to Government and other trade bodies on GST issues. • He has hands on experience in providing opinion & advisory services to some leading corporates based in India and also outside India, carrying out strategic review of business processes to evaluate the GST implications, filing returns, replying to SCN, undertaking litigation services and representations before the adjudicating authorities, appellate authorities and CESTAT. • He was a co opted member of Indirect Tax Committee, EIRC, ICAI for the FY 2019-20. • He has published articles in journals and leading online websites. • He has trained students, professionals, senior government officers, professional bodies and trade bodies on GST and other IDT related topics across multiple states in India. • He is a faculty on GST with the ICAI and some of the leading universities • While he is away from Indirect Taxations, Startup ideas keep him engaged as he tries to mentor on pro bono, the start ups with his huge exposure of last twenty years in the areas of compliance, taxation and business structuring.