(with examples) GST interest to be levied on the net

GST interest to be levied on the net

After a long journey of confusion. It is clarified that the charge of GST interest is on net liability. Notification no. 63/2020 issued in this regard. But in that notification, the date to notify the proviso to section 50 was 1st September. (You can download updated CGST Act here) It again raised the concerns of the taxpayer. But in a tweet, it was clarified by the CBIC. They said the GST interest to be levied on the net only.

How to calculate the GST interest?

Now the question is, How we can calculate the GST interest?

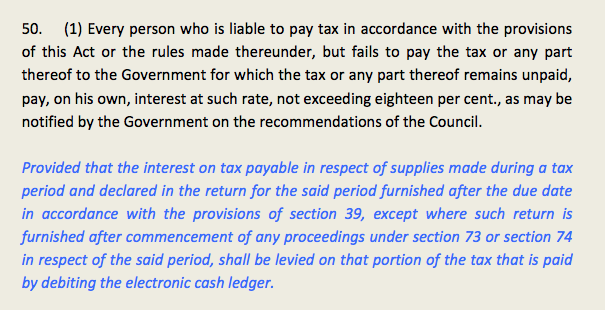

Let us read the provision first. Section 50 of CGST provides for the interest. Let us have a look at section 50 of the CGST act itself.

It covers the supplies of a period, declared in the return of the same period. But that return is furnished on a later date. We need to make it clear that the supply of a period, declared in some other period’s return are not covered here.

Example-

M/s AB Ltd is registered in GST. They made the following supplies for the month of March 2019.

- Sale of cardboard Boxes- Rs. 5,00,000 taxable @18%.

- Sale of Cotton gift boxes- Rs. 2,00,000 taxable @18%.

- Rent from office building let out to Doctor Rs. 20000 taxable @18%.

They filed the return of March 2019 on 30th June 2019. They had input tax credit of Rs. 30000. Calculate their interest liability.

Solution-

Scenario I-

Let us first calculate their tax liability.

- (Rs. 5,00,000+Rs. 200,000+Rs. 20000)*18% = Rs.1,29,600.

- Net tax liability= Rs. (1,29,600-30000)= Rs.99400. (This amount is required to be paid via cash ledger)

Period of delay- Due date for filing of return of March Month is 20th April.

Delay = 30th June 2019-20th March 2019= 10+31+30= 71 Days

Scenario-II

Now let us assume that the supply of Rs. 20,000 i.e of rent skipped the return. Although return was filed on time.

Now it can be reflected in the return of April month. It will be added to outward supply. Now let us assume that they had ITC for the full amount. There was no outward tax liability. Whether there is still an interest liability for the amount of tax on Rs. 20,000.

As per the above provision interest on the tax of Rs. 20,000 is still payable @18%. Thus interest is payable on this amount for a month.

This was a small analysis of the interest provisions. I hope it is useful for you. Pls send me an email for any confusion at shaifaly.ca @gmail.com

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.