GST ITC rules released by GSTIN

GST ITC rules released by GSTIN:

These rules contains the various provisions related to ITC. These GST ITC rules contains all major provisions related to ITC.

Main provisions covered under there rules are:

Main provisions covered under there rules are:

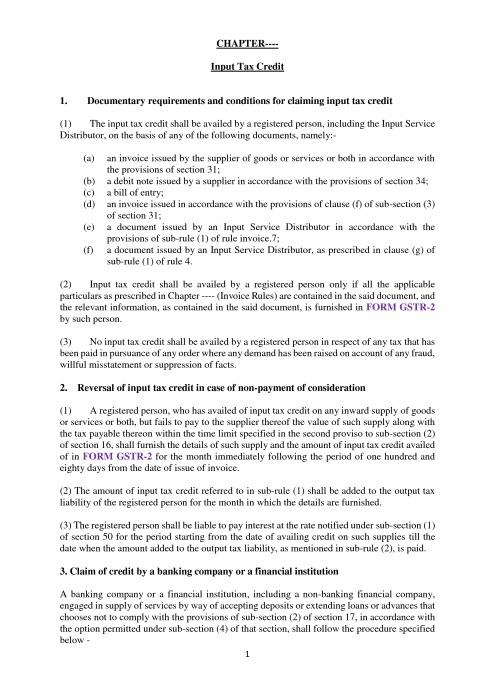

- Documentary requirements and conditions for claiming input tax credit

- Reversal of input tax credit in case of non-payment of consideration

- Claim of credit by a banking company or a financial institution

- Procedure for distribution of input tax credit by Input Service Distributor

- Manner of claiming credit in special circumstances

- Transfer of credit on sale, merger, amalgamation, lease or transfer of a business

- Manner of determination of input tax credit in certain cases and reversal thereof

- Mannerof determination of input tax credit in respect of capital goods and reversal thereof in certain cases

- Manner of reversal of credit under special circumstances

- Conditions and restriction in respect of inputs and capital goods sent to the job worker

These are the main provisions covered by GST ITC rules released. To see in detail you can download this PDF. Also we have analysed the GST ITC rules one by one in separate posts.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.