CESTAT Order in the case of M/s. ICICI Econet Internet And Technology Fund

Table of Contents

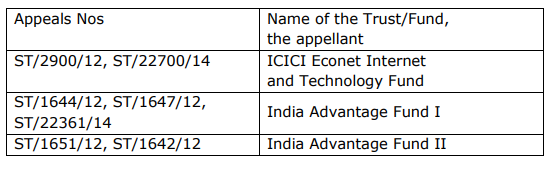

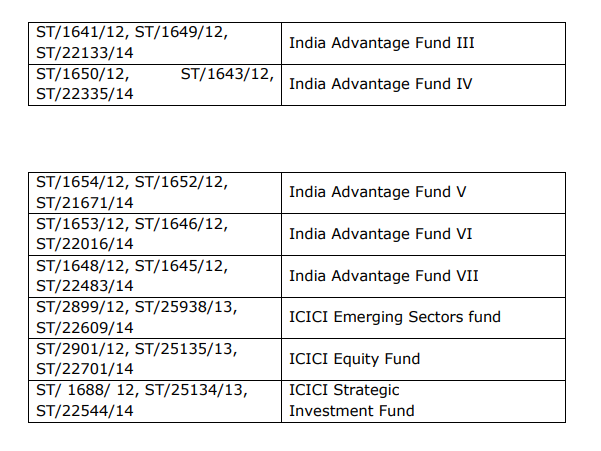

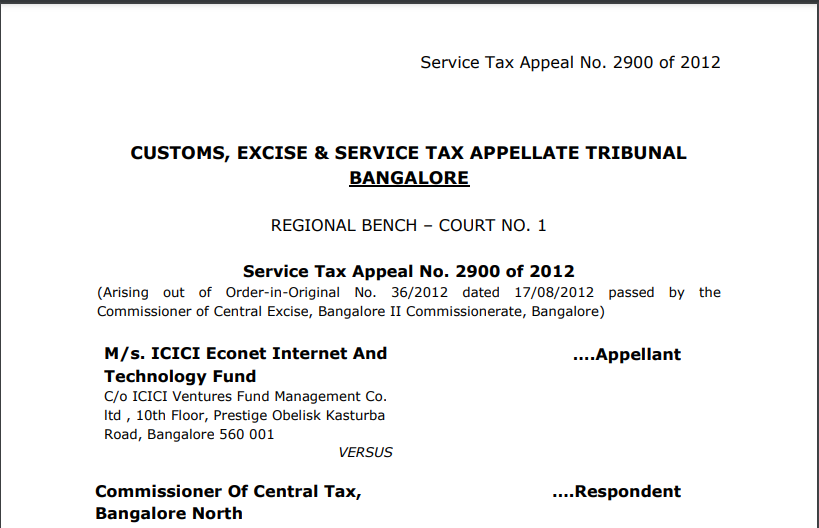

Case Covered:

M/s. ICICI Econet Internet And Technology Fund

Versus

Commissioner Of Central Tax

Facts of the Case:

Brief facts of the case are that the Appellants are venture capital funds established as a trust under the Indian Trusts Act, 1882, (“Trusts Act”) and registered with the Securities and Exchange Board of India (“SEBI”) as a Venture Capital Fund (“VCF”). The Appellants are represented and managed by a Trustee and the terms and conditions pertaining to the formation of the Appellants-Trust are contained in the Indenture of Trust (“Trust Deed or “IOT; a Private Placement Memorandum (PPM), which is an Offer Document for inviting contributors or subscribers to be part of the Trust set up by the Settlor, is issued with the intent of allowing evaluation of the possibility of investment in the units of the VCF; the Appellants‟ properties (i.e, money contributed by investors) are held in trust by the Trustee for the benefit of beneficiaries, who are contributors to the Funds (“Contributors/ Beneficiaries”); the Trust Deed executed for this purpose, lays down the objectives for which the Appellants‟ Trusts are set up, its establishment, management, and other allied matters; the Trustee receives remuneration in the form of Trusteeship fees for services rendered by it to the Appellants. To ensure that the Appellants receive relevant professional and experienced advice, the Trustee appoints an Investment Manager or Asset Manager to manage the assets of the Appellants. The terms for the appointment of the Investment Manager/ Asset Manager are contained in the “Investment Management Agreement” (“IMA”). The Investment Manager is responsible for managing the assets/ investments of the Appellants and receives remuneration in the form of management fees for the services rendered by it. The Department launched an investigation into the taxability of the services rendered by ICICI Econet Internet and Technology Fund floated by the Settlor (ICICI Ltd.) under the entry “Banking and other financial services” in Sec. 65 (12) of the Finance Act, 1994. The said investigation resulted in the issue of series of notices demanding Service tax on the said activities, which were confirmed by the adjudicating authority. Aggrieved by these OIOs, the appellants are before this Bench in the following.

Observations:

We find that in the instant case, the appellants have not obtained registration; have not paid applicable service tax, and have not filed due returns. Therefore, we find that penalty under Section 77 is imposable. We also find that an extended period is invokable; material facts have been deliberately suppressed by the appellants before the jurisdictional service tax authorities. Therefore, we find that imposition of penalty under Section 78 of the Finance Act, 1994 is justified. Coming to the imposition of penalty under both Sections 76 & 78, we find that Hon’ble Karnataka High Court in the case of Motor World, 2012 (27) STR 225 (Kar.) have held that simultaneous penalty cannot be imposed under Section 76 and Section 78 of Finance Act, 1994. Revenue relies upon Hon’ble Kerala High Court judgment in the case of Krishna Poduval (supra). However, with due regards to Hon’ble Kerala High Court, we find that Hon’ble Karnataka High Court in the judgment cited above, have distinguished the judgment of Hon’ble Kerala High Court. We further find that Hon’ble Kerala High Court’s judgement was in a writ appeal whereas, Karnataka High Court‟s order was in a Central Excise Appeal. Moreover, being the jurisdictional High Court, we are bound by the decision of the Hon’ble Karnataka High Court in the instant case. Therefore, we hold that penalty under Section 78 is sustained before or after 10.05.2008 in the instant case. The appellants have taken a plea that in terms of the non ostante provisions of Section 80 of the Finance Act, 1994, a penalty cannot be imposed. We find that as discussed above in view of the facts of the case, provisions of Section 80 are not attracted. Therefore, we are not inclined to accept the submissions of the appellant in this regard.

Ruling:

In view of the above, all the appeals are disposed of, by way of remand to the adjudicating authority, subject to the following conditions:

(i). Penalties imposed under Section 76 of Finance Act, 1994 are dropped.

(ii). the adjudicating authority shall verify the following claims of the appellants, with documentary proof that may be submitted by the appellants, and give due to allowance to the same if found otherwise in order as per law while computing the duty liability.

(a). the claim that the amounts on account of „Loss of sale of investment‟, “Accrued interest considered doubtful”, “Loss on revaluation of assets”, etc, are not actual expenses but are only accounting adjustments; and allow deduction if found in order.

(b) the claim of the appellants on the admissibility of the CENVAT

(c) claims of the appellants on the cum duty benefit.

(iii). The appellants shall submit necessary documentary proof with reference to the above claims within 4 weeks of the receipt of this order and the adjudicating authority shall complete the exercise within further 12 weeks of receipt of the documents from the appellants.

Related Topic:

Whether Online Coaching Outside India is Liable for GST?

Read & Download the full Copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.