Changes in GST introduced by Notifications and circulars issued on 23/04/2019

Summary of Changes in GST introduced by Notifications and circulars issued on 23/04/2019

|

S. No. |

Notification & Circular |

Summary |

|

1 |

Notification No.- 20/2019-CT |

Seeks to make Third amendment, 2019 to the CGST Rules. |

|

2 |

Notification No.- 21/2019-CT |

Seeks to notify procedure for quarterly tax payment and annual filing of return for taxpayers availing the benefit of Notification No. 02/2019– Central Tax (Rate), dated the 7th March 2019 |

|

3 |

Notification No.- 22/2019-CT |

Seeks to notify the provisions of rule 138E of the CGST Rules w.e.f 21st June 2019. |

|

4 |

Circular No.- 98/2019-CT |

Seeks to clarify the manner of utilization of input tax credit post insertion of the rule 88A of the CGST Rules |

|

5 |

Circular No.- 99/2019-CT |

Seeks to clarify the extension in time under sub-section (1) of section 30 of the Act to provide a one time opportunity to apply for revocation of cancellation of registration on or before the 22nd July 2019 for the specified class of persons for whom cancellation order has been passed up to 31st March 2019. |

|

6 |

ROD – 5/2019 – CT |

Seeks to extend the time limit for filing an application for revocation of cancellation of registration for specified taxpayers. |

Important changes by Notification No 20/2019 ( CGST third Amendment Rules)

This notification has introduced the third amendment into CGST rules during 2019.

- Rules related cancellation of registration: In rule 23 of CGST Rules 2017, the new proviso is inserted.

|

Cancellation of Registration |

In this case, said the person is required to file all the returns due for the period from the date of order of cancellation of registration till the date of order of revocation of cancellation of registration. |

Within 30 Days from the DORCR(Date of Order of Revocation of Cancellation of Registration). |

|

Retrospective Cancellation of registration |

In this case, said the person is required to file all the returns due for the period from the date of the effective date of cancellation of registration till the date of order of revocation of cancellation of registration. |

Within 30 Days from the DORCR(Date of Order of Revocation of Cancellation of Registration). |

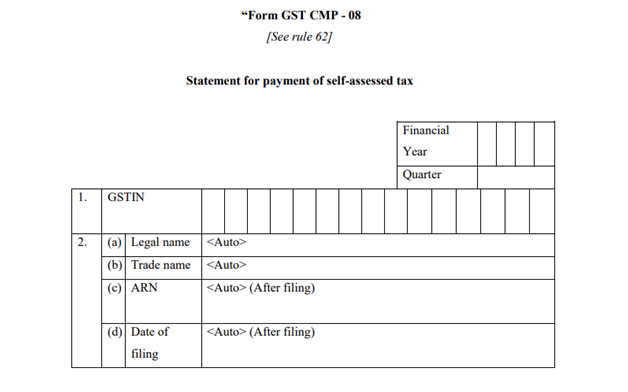

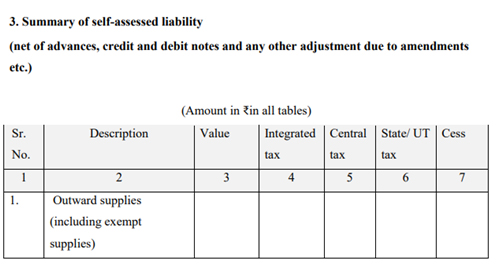

Changes in return of the composition dealer:

Now, the following person will be required to file a quarterly statement containing the details of the self-assessed tax. Inform CMP-08 till the 18th day of succeeding month after the end of the quarter. They are also required to file one return annually. FORM GSTR-04 will be filed till 30th April of Each year:

- A registered taxpayer making payment of tax under section 10 CGST Act, 2017.

- A registered taxpayer, who has opted to pay tax @ 6% under NNo. 2/2019-CT® dated 07/3/2019.

To be filed quarterly by Composition dealer and under Notification No. 2/2019-CT(R)]

Notification No. 21/2019. Procedure for the new return for the composition Dealer

This Notification Provide that the self-assessed tax is paid on the 18th day of succeeding month after the end of the quarter by the person paying tax under Notification No. 02/2019-CTR.

Notification No. 22/2019-CT, No e-way bill for return defaulter

This is a very important provision for non/compliant people. The habit of non-compliance may shut your business down. Notification No. 22/2019-CT has notified the date of applicability rule 138E of CGST Rules, 2017.

“138E. Restriction on furnishing of information in PART A of FORM GST EWB-01.- Notwithstanding anything contained in sub-rule (1) of rule 138, no person (including a consignor, consignee, transporter, an e-commerce operator or a courier agency) shall be allowed to furnish the information in PART A of FORM GST EWB-01 in respect of a registered person, whether as a supplier or a recipient, who,—

(a) being a person paying tax under section 10 has not furnished the returns for two consecutive tax periods; or

(b) being a person other than a person specified in clause (a) has not furnished the returns for a consecutive period of two months:

Provided that the Commissioner may, on sufficient cause being shown and for reasons to be recorded in writing, by order, allow furnishing of the said information in PART A of FORM GST EWB 01, subject to such conditions and restrictions as may be specified by him:

Provided further that no order rejecting the request of such person to furnish the information in PART A of FORM GST EWB 01 under the first proviso shall be passed without affording the said person a reasonable opportunity of being heard:

Provided also that the permission granted or rejected by the Commissioner of State tax or Commissioner of Union territory tax shall be deemed to be granted or, as the case may be, rejected by the Commissioner.

Explanation: – For the purposes of this rule, the expression ―Commissioner” shall mean the jurisdictional Commissioner in respect of the persons specified in clauses (a) and (b).”.

The above provision will have the following impact on the defaulters of GST returns:

- They will not be able to move any consignment, it will make inward and outward supply impossible

- There are many services which also requires mo0vement of goods. The taxpayer who will default in filing of the returns will not be able to make any movement of goods.

- They will not be able to receive any goods as consignee; this default makes them barred from part-A of EWB-1.

- Although, an application may be submitted to the Commissioner for the permission to enter the name in part-A of EWB-1.

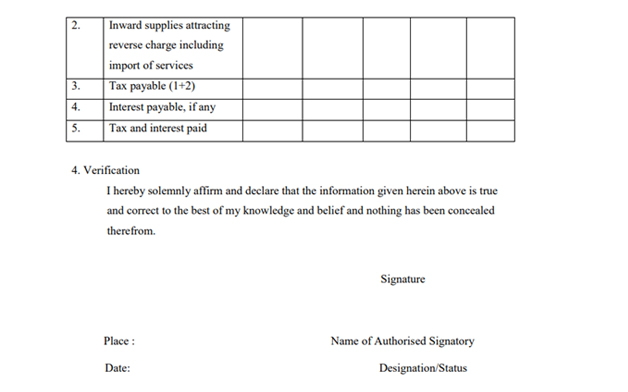

Circular No. 98/2019-CT

There was enough confusion in the mind of taxpayers about section 149A and rule 48A. Earlier the Section 49A restricted the manner of utilization of ITC. The IGST was supposed to be exhausted first only the CGST and SGST was allowed to be utilized. But the GST Portal was unable to implement the new, mechanism of ITC utilization. CBIC inserted rule 88A in CGST rules 2017 and it allows the utilization of ITC of IGST in any manner. Still, the confusion was there. It was not clear whether the partial utilization of ITC of IGST will be available for the output tax liability of CGST and SGST. A clarification in this regard issued by the aforesaid circular.

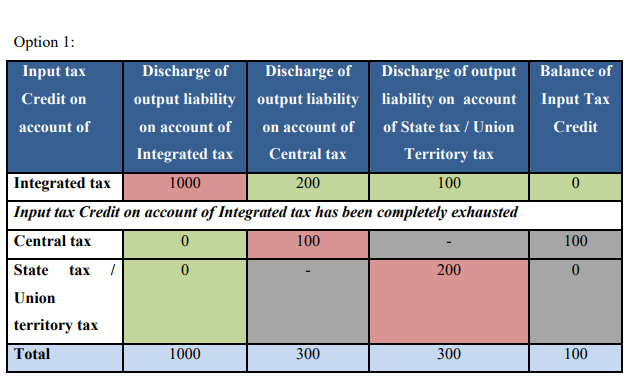

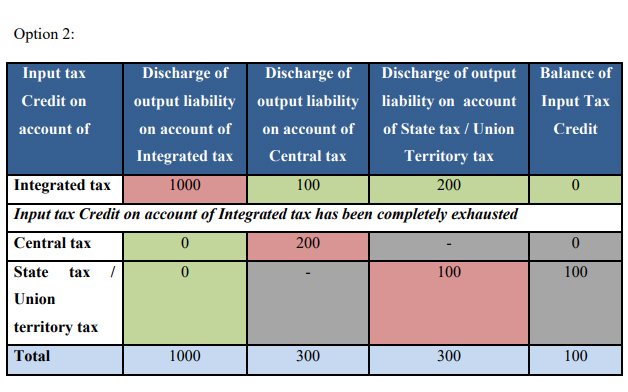

The newly inserted rule 88A in the CGST Rules allows utilization of input tax credit of Integrated tax towards the payment of Central tax and State tax, or as the case may be, Union territory tax, in any order subject to the condition that the entire input tax credit on account of Integrated tax is completely exhausted first before the input tax credit on account of Central tax or State / Union territory tax can be utilized. It is clarified that after the insertion of the said rule, the order of utilization of input tax credit will be as per the order (of numerals) given below:

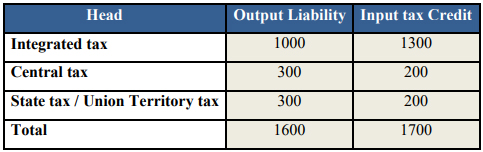

The following illustration would further amplify the impact of newly inserted rule 88A of the CGST Rules:

Illustration: Amount of Input Tax Credit available and output liability under different tax heads

Presently, the common portal supports the order of utilization of input tax credit in accordance with the provisions before the implementation of the provisions of the CGST (Amendment) Act i.e. pre-insertion of Section 49A and Section 49B of the CGST Act. Therefore, till the new order of utilization as per newly inserted Rule 88A of the CGST Rules is implemented on the common portal, taxpayers may continue to utilize their input tax credit as per the functionality available on the common portal.

Circular No. 99/2019-CT:

Registration of several persons was canceled under sub-section (2) of section 29 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as “the said Act”) due to non-furnishing of returns in FORM GSTR-3B or FORM GSTR-4. Sub-section (2) of section 29 of the said Act empowers the proper officer to cancel the registration, including from a retrospective date. Thus registration has been canceled either from the date of order of cancellation of registration or from a retrospective date.

A huge no. of representation was given to GSTN and CBIC regarding this matter. A taxpayer is given the time of 30days from the date cancellation of registration for the Revocation of Cancellation of Registration. Many of the taxpayers were not aware of this provision and the time period of 30 days lapsed. CBIC released or issued the Removal of Difficulty order – 5/2019. This ROD inserted a proviso in section 31(1) of CGST act, 2017.

“Provided that the registered person who was served notice under sub-section (2) of section 29 in the manner as provided in clause (c) or clause (d) of sub-section (1) of section 169 and who could not reply to the said notice, thereby resulting in cancellation of his registration certificate and is hence unable to file application for revocation of cancellation of registration under sub-section (1) of section 30 of the Act, against such order passed up to 31.03.2019, shall be allowed to file application for revocation of cancellation of the registration not later than 22.07.2019.”.

This proviso has provided one-time relief up to 31.03.2019.

All those taxpayers can file their Revocation of Cancellation of Registration up to 22.07.2019.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.