Forest produce is not agriculture produce

Table of Contents

Case covered:

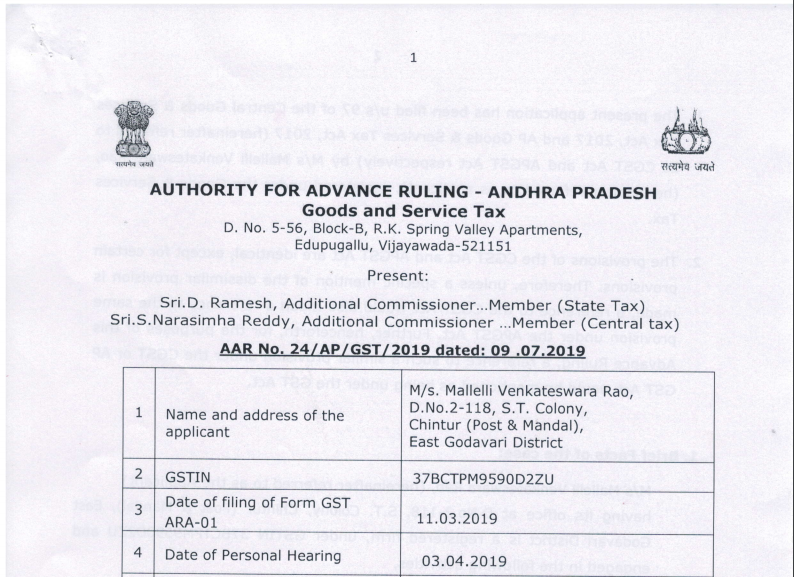

M/s. Mallelli Venkateswara Rao

Facts of the case:

M/s Mallelli Venkateswara Rao, (hereinafter referred to as the Applicant) having its office at D.No.2-118, S.T. Colony, Chintur (Post & Mandal)’ East Godavari District is a registered firm, under GSTIN 37BCTPM9590D2ZU and engaged in the following activities,

1.Extraction of Timber/ Bamboo in natural forests,

2.Transportation of Timber / Bamboo from natural Forests to the Government Depots,

3.Maintenance of Government. Depots like classification I grading of Timber and bamboo and Wages to mastris for supervision.

The applicant had filed an application in form GST ARA-01, Dt: 11.03.2019, by paying the required amount of fee for seeking Advance Ruling. On Verification of basic information of the applicant, it is observed that the applicant falls under state jurisdiction, Assistant commissioner, Aryapuram Circle O/o. the Kakinada Division, East Godavari Dist. Accordingly, the application has been forwarded to the State jurisdictional officer, Assistant Commissioner, Aryapuram Circle and a copy marked to the Central Tax authorities to offer their remarks as per the section 98(1) of CGST /APGST Act 2017. In response, the jurisdictional officer concerned stated that there are no pending proceedings relating to the applicant and no proceedings were passed on the issue, for which the advance ruling sought by the applicant.

Observation of AAR:

- It is a settled law that an exemption or a relief provided in an enactment shall only be interpreted in the exact wording employed in the legislature.

- Agriculture produce are different from forest produce, Hence not exempt but taxable @18%.

Download the copy:

The above entry is examined and the version of the applicant that the transactions made by him fall under the above entry is not tenable. What is a support service in relation to the above had been defined by means of an explanation to the same entry. And the explanation had employed the word ‘mean’ which is restrictive in nature. Thus what is given in explanation shall only mean as support services and nothing else shall. From the explanation given to the entry, the support services mentioned are only in relation to agriculture and fishery and animal husbandry. None of the services are mentioned in relation to natural forests.

Moreover, agricultural produce and natural forest produce are entirely different and involve different processes starting from plantation to harvesting. Hence in the absence of any specific exemption to that effect, one cannot extend the services that are mentioned in relation to agriculture to those of natural forests. Moreover, it is a settled law that an exemption or a relief provided in an enactment shall only be interpreted in the exact wording employed in the legislature. Nothing can be extrapolated or inferred to extend the scope of an exemption. Therefore, the service in question viz., a) cutting logging b) Transportation c) maintenance of depots of forest department cannot be covered under the said entry 24(i).

The transactions referred to are taxable at the rate of 9% CGST + 9% SGST as per the general entry 35 of the notification no 11/2OL7 dt:28-O6-2O17.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.