GST on slump sale in the light of amendment in Supply

GST on slump sale in the light of amendment in definition of Supply

Coverage of transfer of business in the definition of supply:

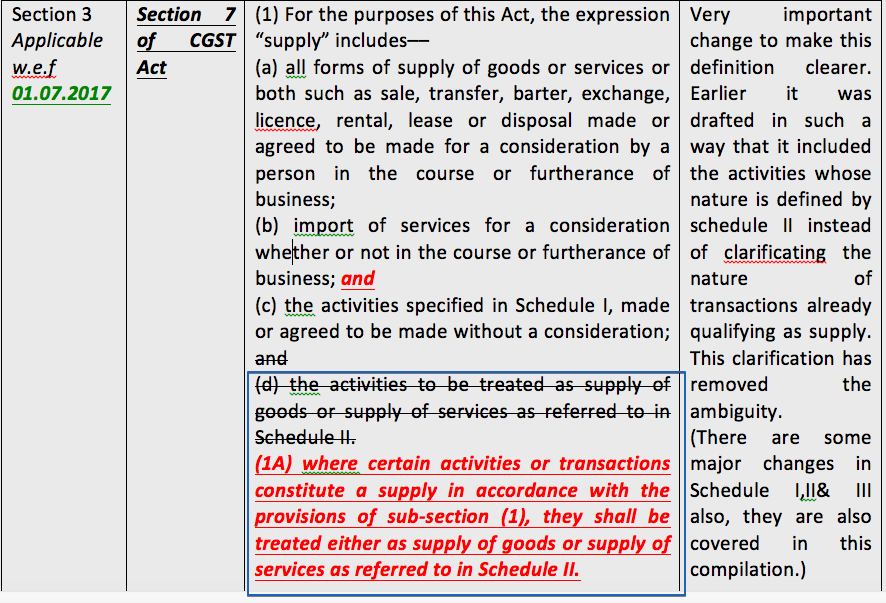

It is interesting to see that definition of supply is changed retrospectively. The definition earlier cover the schedule II in include portion. Now that para is deleted and a new para is added out of that include portion and it clearly sates that schedule II will be used only when the activity will be a supply as per para 1. If it is out of that para schedule II wont come into picture. Let us now come to the relevant portion. Transfer of a business as a going concern. Some experts believe that is should not be a supply for the purpose of GST. The definition of supply provides that activities in course or furtherance of business will be covered in supply. Transfer of business is definitely not in course or furtherance of business.

Change in supply definition

Stance taken by AAR Karnatka in case of Rajshree Foods Pvt Ltd. for GST on Slump Sale

Para 7.3.1 of said advance ruling find that transfer of business as a going concern will also be covered in supply. I am pasting here the exact part of their observation.

“Section 7 of the CGST Act, 2017 defines the Scope of Supply. Section 7(1) provides that „Supply‟ includes activities such as sale, transfer, barter, exchange etc made for a consideration in the course or furtherance of business. This implies that the activity undertaken shall be an action which takes place in the course of regular conduct of business, such as sale or it should have the effect of furtherance of the business. Therefore the activity to be called as supply should be such that undertaking that activity shall amount to conduct of business or enhancing the business. The transfer of a going concern, either as a whole or an independent part thereof, for a lump sum consideration does not constitute an activity taking place in the course of business or for furtherance of business. However since the word „includes‟ has been used in Section 7(1) the scope of supply goes beyond the meaning of the expression „in the course or furtherance of business‟. Therefore in the case of the transfer of a going concern even if the act of transfer does not constitute an activity carried out in the course of regular business or for furtherance of business, the activity may still qualify to be termed as a supply.”

Although they agreed that an activity, which take place as a transfer of a going concern, don’t constitute an activity in course or furtherance of business. But in very next line they mentioned that because the definition of supply is inclusive it may include what is not mentioned there. Even the transfer of business will be covered in supply. This interpretation is quite dangerous. If anything can be bring into taxability by making an inclusive definition it will not serve any purpose. The definition is trying to set the basis fundamentals to understand what will form a supply. If we will start adding anything into supply, tomorrow something not a goods or service may also be pushed into it. Even if it is inclusive we cant push anything into it which doesn’t pass the basic test. To be a supply as the definition itself requires two basic things are required.

- It should have consideration.

- It should be in course or furtherance of business.

When the definition wanted to add something into supply not fulfilling these two basic features it expressly included them via para 1(b) or schedule I. If it is not mentioning anything about transfer of business it means it doesn’t want it to be an exception to the normal sense of supply.

Does inclusion of it in exempted supply will make it good?

The transfer is included in the list of exempted items in notification no. 12/2017. Is this the right way to express it? We need t remember that “not a supply” and “exempt supply” have different treatment in GST Taxation. If something is not a supply it means we don’t even need to report it. No reversal of input tax credit will be required for it. We don’t need to include it while calculating aggregate turnover. Now we will treat it as an exempt supply it will have its own consequences. It will be reportable. It will attract reversal of input tax credit. Sometime it may be a big reversal as sale price at the time of transfer may include goodwill also. It may lend you liable for audit in GST.

The moot question is can we push something into the definition of supply by including it into an exemption notification. This is not a good practice because then anything can be inserted like that.

You can contact the author at shaifaly.ca@gmail.com

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.