Last date of ITC is filing of annual return

Table of Contents

The historical decision of Gujrat High court:

In Case of AAP AND CO., CHARTERED ACCOUNTS THROU AUTHORISED PARTNER VersusUNION OF INDIA & 3 other(s) a deep discussion was done on various GST provisions. This is a historical case as it set aside the press release of CBIC dated 18.10.2018. Let us discuss the details of the case here. the press release of CBIC mentioned that the last date to take ITC is due date of filing of GSTR 3b. This contention was made on the basis of section 16(4) of CGST Act read with section 39 and Rule 61(5) of CGST Rules. This decision has an impact on Last date of ITC u/s 16(4).

GSTR 3b is not a return

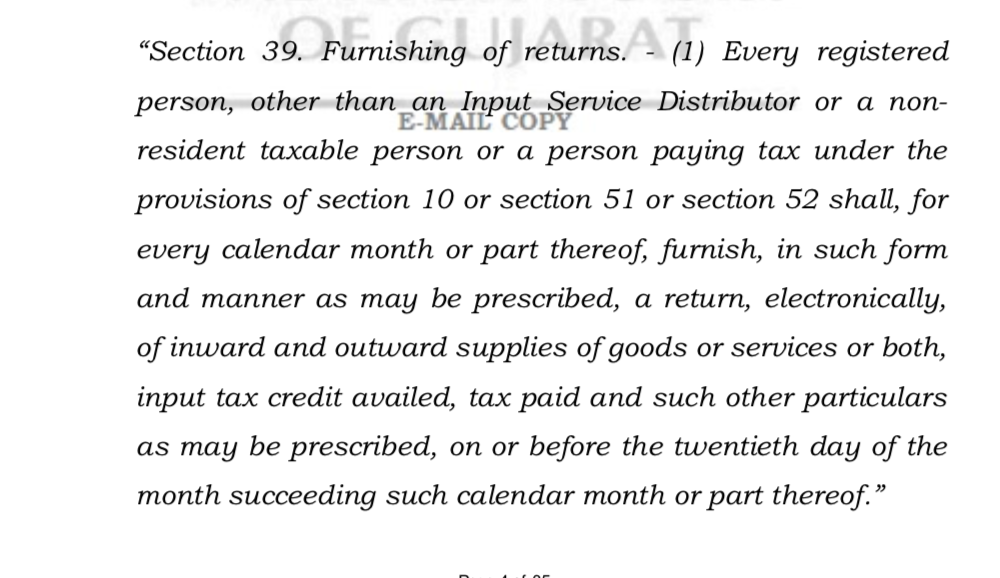

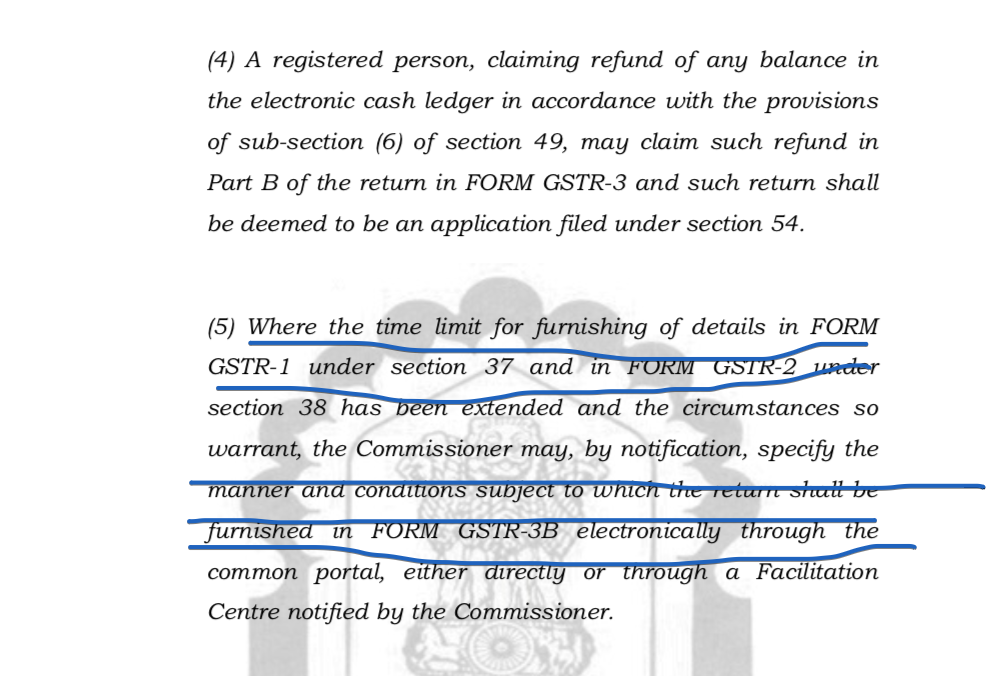

The basic issue that is discussed is whether GSTR 3b is a return or not. Section 39 provides a right to prescribe the return. No form is mentioned in the section itself. But rule 61(5) of CGST Rules prescribes a return be filed.

Rule 61 (5) of CGST Rules has prescribed the return as mentioned in section 39.

Last date of ITC u/s 16(4) of CGST Act:

This provision puts a bar on ITC after a certain time. That is the due date of return u/s 39 for the month of September after the end of the financial year. This provision was the bone of contention. Now if GSTR 3b is return prescribed u/s 39 then the time limit of ITC will end on its due date fo September or last date of annual return, earlier of these two.

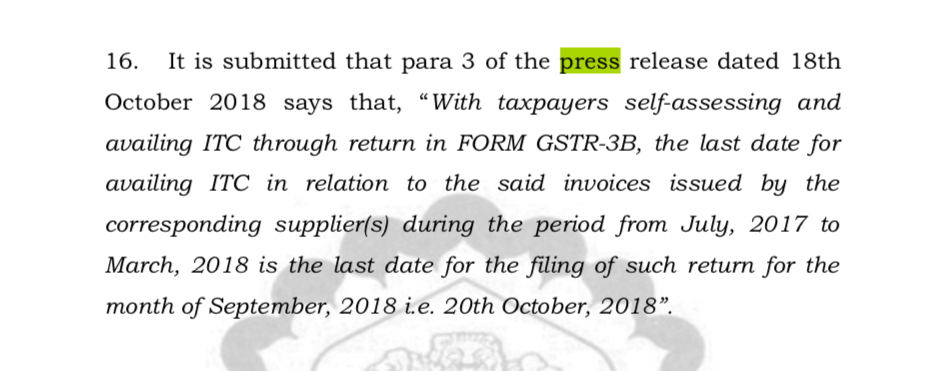

The validity of press release dated 18.10.2018.

On the basis on the above discussion press release of CBIC was challenged. Now if GSTR 3b is not the prescribed return u/s 39. The date of the annual return is the date for taking ITC. Para 3 of press release restricted the taxpayer from taking ITC.

Conclusion for the last date of ITC:

Hon’ble High court set aside the press release. It is held that GSTR 3b is not a return prescribed u/s 39 of CGST Act.

Download the full order:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.