Madras HC in the case of BGR Energy Systems Limited

Citations: Union of India v. NITDIP Textile Processors Pvt.Ltd. Commissioner of Central Excise, Bhopal, v. Minwool Rock Fibres Ltd. Kirloskar Oil Engines Ltd. v. Union of India Commissioner of Customs, Chennai-I v. Avenue Impex Sundaram clayton Ltd. v. Superintendent of Central Excise, Madras Mechanical Packing Industries Pvt. Ltd. v. C.L.Nangia Birla Jute and Industries Ltd. v. Assistant Collector of Central Excise

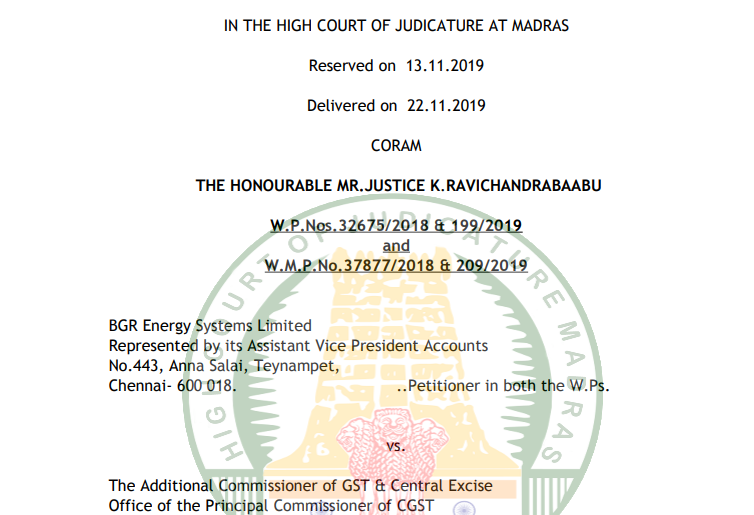

IN THE HIGH COURT OF JUDICATURE AT MADRAS Reserved on 13.11.2019 Delivered on 22.11.2019 CORAM THE HONOURABLE MR.JUSTICE K.RAVICHANDRABAABU W.P.Nos.32675/2018 & 199/2019 and W.M.P.No.37877/2018 & 209/2019 BGR Energy Systems Limited Represented by its Assistant Vice President Accounts No.443, Anna Salai, Teynampet, Chennai- 600 018. ..Petitioner in both the W.Ps. vs. The Additional Commissioner of GST & Central Excise Office of the Principal Commissioner of CGST & Central Excise, No.26/1, Mahatma Gandhi Road, Nungambakkam, Chennai - 600 034. ..Respondent in W.P.No.32675/2018 Commissioner of GST & Central Excise (Appeals-I) Office of the Commissioner of GST & Central Excise (Appeals-I), No.26/1, Mahatma Gandhi Road, Nungambakkam, Chennai - 600 034. ..Respondent in W.P.No.199/2019 W.P.No.32675/2018 is filed under Article 226 of the Constitution of India praying for the issuance of a Writ of Certiorari to call for the records on the file of the respondent in proceedings Order in Original No.147/2018-CH-N (ADC) dated 31.08.2018 and to quash the same. W.P.No.199/2019 is filed under Article 226 of the Constitution of India praying for the issuance of a Writ of Certiorari to call for the records on the file of the respondent in proceedings Order in Appeal No.489-492/2018 (CTA-I) dated 17.09.2018 and to quash the same. For Petitioner in both the W.Ps. : Mr.Joseph Prabakar For Respondent in both the W.Ps. : Mr.K.Magesh, Standing counsel C O M M O N O R D E R W.P.No.32675/2018 is filed challenging the order of the respondent made in Order in Original No.147/2018-CH.N(ADC) dated 31.08.2018. 2. The case of the petitioner in W.P.No.32675/2018 is as follows: The petitioner is registered with the Service Tax Department as service provider and service recipient under various categories. The petitioner has entered into certain contracts with Overseas Customers for supply of goods. One such case is where the petitioner has entered into an Agreement to supply/ export certain goods to Oil Company situated in Iraq. For the duecontract performance, the petitioner has to issue Advance Bank Guarantee as well as Performance Bank Guarantee. Both the guarantees are to be issued from an Iraqi Bank in favour of the customer. The petitioner's banker, namely Indian Bank, Adyar, Chennai, does not have any direct relationship with any of the Iraqi Banks to issue the Guarantee and therefore, there was no possibility for the customer in Iraq accepting the Bank Guarantee issued by Indian Bank, Adyar. Therefore, the Indian Bank would have to necessarily identify the intermediary foreign Bank, who should have relationship either with the customer or with any of the Iraqi banks to have the bank guarantees issued. Accordingly, Indian Bank, Adyar Branch, engaged the services of two foreign banks, namely JP Morgan Bank, Singapore and Credit Agricole Bank,Paris, to issue the Bank Guarantees in this transaction. Those two banks, since do not have any direct relationship with the end customer, engaged the services of a local corresponding Bank in Iraq, namely, Trade Bank of Iraq, Bagdad, Iraq, who is also the banker to the customer of the petitioner in Iraq. On the request of the Indian Bank, in the form of a Counter Guarantee, the Intermediary Bank issued the Counter Guarantee to the Corresponding Bank, namely Trade Bank of Iraq and the actual Bank Guarantee was issued to the customer by Trade Bank of Iraq which is accepted by the customer. In this transaction, Indian Bank debited the Account of the Petitioner for charges forthe services of providing Counter Bank Guarantee. Indian Bank charged Service Tax on the petitioner for the services rendered and the Service Tax so charged and collected from the petitioner was paid by the Indian Bank to the Government of India. Thereafter, the Intermediary Bank raised an Invoice addressed to Indian Bank for the services provided to Indian Bank on account of Counter Guarantee issued by them to Trade Bank of Iraq in relation to issue of Bank Guarantee. These charges are paid by Indian Bank, Adyar, by debiting the account of the petitioner to the extent of these charges and remitting those charges to the Intermediary Bank. There has been no direct remittance of Bank Guarantee commission by the petitioner to any of the intermediary Banks. Similarly, Trade Bank of Iraq charged their Guarantee Commission including Iraqi stamp duty charges on the intermediary bank for issue of actual Bank Guarantee to the customer. The intermediary Bank, in turn would collect these charges from Indian Bank and again, Indian Bank debited the account of the petitioner to the extent of these charges and thus, Trade Bank of Iraq got paid from Indian Bank, Adyar Branch through Intermediary Bank. The Bank Guarantee Commission were paid by the petitioner Bankers directly to the Intermediary banks by debiting from the account of the petitioner. It is contended by the Department that the petitioner had made remittance to Foreign Service Provider relating to Bank Guarantee Commission andRealisation charges and other Bank charges and that the Foreign service Providers are Intermediary Banks which are situated outside India. Accordingly, it is stated that the petitioner has received these services from these entities and thus, liable to pay Service Tax under Place of Provision of Services Rules, 2012. Periodically, show cause notices were issued for the period April 2007 to March 2015. The petitioner filed their reply to the show cause notices and the petitioner also appeared for personal hearing. Thereafter, the matter was adjudicated by passing a common order in Original Nos.48-51/2018 (ADC) dated 27.03.2018 confirming the demand of Service Tax, interest and penalty. The petitioner filed Appeal against the Order in Original before the Commissioner (Appeal) who confirmed the demand. Thereafter, the statement of demand dated 13.04.2018 for the period from April 2015 to March 2017 was issued demanding Service Tax of Rs.77,72,633/-. The matter was adjudicated by the respondent who passed the impugned order dated 31.08.2018, confirming the demand of Service Tax, interest and penalty. The petitioner relied on Trade Notice dated 10.02.2014 issued by the Commissioner of Service Tax-I, Mumbai, wherein it was clarified that Service Tax would not be applicable for commission/ charges paid to intermediary/ foreign Banks for providing the services in question. The petitioner also relied on the order passed by the Commissioner (Appeals), dated 04.08.2016 in the case of GEABGR Energy Systems India Limited. However, the respondent failed to appreciate the submissions and erroneously passed the impugned order. The respondent thus, failed to follow the order of Commissioner (Appeals) dated 04.08.2018 under similar circumstances as well as the ratio laid down in Trade Notice dated 10.02.2014. Hence, the present writ petition. 3. W.P.No.199/2019 is filed against the order of the respondent dated 17.09.2018 made in Order in Appeal No.489-492/2018 (CTA-I). 4. The case of the petitioner in this writ petition is also similar to the one as stated in W.P.No.32675/2018. The only difference is that the present challenge is against the order passed by the Appellate Authority confirming the order of the Adjudicating Authority made in Order in Original No.48-51/2018 dated 27.03.2018 in respect of the period, namely April 2007 to March 2011; April 2011 to December 2012; January 2013 to March 2014 and April 2014 to March 2015. 5. Counter affidavit is filed in W.P.No.32675/2018 wherein it is stated as follows: The writ petition is not maintainable on the ground of availability of alternative remedy of filing an appeal before the Commissioner (Appeals). The earlier order relied on by the petitioner in Order in Appeal No.124 & 125/2015 dated 04.08.2016 passed by the Commissioner (Appeals) in the case of GEABGR Energy Systems India Limited, cannot be applied as a precedent in this case, since the same was not accepted by the Department on merits. However, the same could not be challenged only on the bar placed by the monetary policy of the litigation framed. Trade notice dated 10.02.2014 issued by the Commissioner of Service Tax-I,Mumbai, is not binding on the jurisdiction of Chennai Customs, as the same is not issued by the Central Board of Customs, New Delhi. The Trade notice issued by the Commissioner for Service Tax-I, Mumbai, is not binding the authorities in other jurisdiction. The service rendered by the petitioner comes under the category of taxable services and therefore, this finding rendered by the respondent has to be agitated only before the appellate forum, which again, a fact finding authority. 6. In W.P.No.199/2019, a separate counter affidavit is filed by the respondent raising similar objections as raised in W.P.No.32675/2018. 7. Mr.Joseph Prabakar, learned counsel for the petitioner submitted that the trade notice dated 10.02.2014 issued by the Commissioner, Service Tax, Mumbai, squarely covers the case in favour of the petitioner and therefore, the respondents are not justified in refusing to look into the saidtrade notice. He further submitted that the trade notice issued by one Commissionerate is binding on the other Commissionerate. As per the above said trade notice, only the Bank is liable to pay the service tax and not the petitioner. In support of his contention that the trade notice issued by one Commissionerate is binding on the other Commissionerate, learned counsel relied on 2011(273) ELT 321 (SC) (Union of India v. NITDIP Textile Processors Pvt.Ltd.) 8. Per contra, the learned counsel appearing for the respondents on both the cases submitted as follows: The trade notice relied on by the petitioner issued by the Mumbai Commissionerate was issued based on the stay order passed by the Mumbai Tribunal and that the Appeal before the Tribunal is still pending. The impugned orders challenged in these writ petitions are issued by the quasi judicial authorities, one by the Adjudicating Authority and the other by the Appellate Authority. Therefore, such authorities, exercising the quasi jurisdiction function, even otherwise, are not bound by the trade notices or circulars, as they have to apply their independent mind and decide the matter. 9. In support of the above contentions, the learned counsel for the Revenue relied on the following decisions. (i) 2012 (228) ELT 581 (SC) (Commissioner of Central Excise, Bhopal, v. Minwool Rock Fibres Ltd.) (ii) 1995 (77) ELT 479 (SC) (Kirloskar Oil Engines Ltd. v. Union of India) (iii) 2014 (306) ELT 69 (Mad.) (Commissioner of Customs, Chennai-I v. Avenue Impex) (iv) 1994(70) ELT 190 (Mad.) (Sundaram clayton Ltd. v. Superintendent of Central Excise, Madras) (v) 1981 (8) ELT 144 (Bom.) (Mechanical Packing Industries Pvt. Ltd. v. C.L.Nangia) (vi) 1992(57) ELT 674 (Cal.) (Birla Jute and Industries Ltd. v. Assistant Collector of Central Excise). 10. Heard both sides. 11. The petitioner is a service provider and service recipient under various categories. The petitioner had entered into certain contracts with Overseas Customers for supply of goods. One such contract was entered into with Oil Company situated in Iraq. As per the terms of the contract, the petitioner has to furnish Performance Bank Guarantee and Advance BankGuarantee to the said Oil Company situated in Iraq. It is not in dispute that both the guarantees are to be issued by a Bank situated in Iraq in favour of the said Company. The petitioner's banker is Indian Bank, Adyar, Chennai. However, as the Indian Bank does not have any direct relationship with the said foreign Company as well as any of the Iraqi Banks, the Indian Bank identified two intermediary foreign banks, namely JP Morgan Bank, Singapore and Credit Agricole Bank, Paris, and engaged their services for the purpose of issuing the Bank Guarantees in respect of the subject matter transaction. Those intermediary banks in turn engaged the service of local bank in Iraq, namely Trade Bank of Iraq, Bagdad, Iraq, which is the Banker to the said foreign Bank. Accordingly, on the request of the Indian Bank, the intermediary Banks issued their counter guarantee to the correspondent Bank at Iraq and consequently, the actual bank guarantee was issued to the said foreign company by the Trade Bank of Iraq 12. The contentions of the petitioner is that they have not received the service of the foreign bank at Iraq or the intermediary bank situated outside this country directly and therefore, the petitioner is not bound to pay service tax in respect of the service rendered by those banks for the purpose of furnishing bank guarantees. On the other hand, it is the contention of thepetitioner that it is only the Indian Bank, Adyar, which is the recipient of service of those foreign banks and thus, only such Banker has to pay the service tax and not the petitioner. 13. In support of the above contention, the learned counsel for the petitioner heavily relied on the trade notice issued by the Commissioner of Service Tax-I, Mumbai dated 10.02.2014, wherein the said authority clarified that in cases where the foreign banks are recovering certain charges for process of import/export documents regarding the remittance of foreign currency, the banks in India would be treated as recipient of service and therefore, required to pay Service Tax. Thus, by placing much reliance on the above said Trade Notice, the petitioner seeks to challenge the impugned orders. 14. According to the petitioner, the said Trade Notice issued by Mumbai Commisionerate is binding on all the Commissionerate situated throughout the country. In support of the above contention, the learned counsel relied on the decision of the Apex Court reported in 2011(273) ELT 321 (SC) (Union of India v. NITDIP Textile Processors Pvt.Ltd.) wherein it is held that the trade notice, even if it is issued by the Revenue Department of any one State is binding on all other Departments with equal force all over the country. However, it is seen that in a later decision reported in 2012 (228) ELT 581 (SC) (Commissioner of Central Excise, Bhopal, v. MinwoolRock Fibres Ltd.), the Apex Court has observed that the departmental circulars are not binding on the assessee or quasi judicial authorities or Courts. The Division Bench of this Court in a case reported in 2014 (306) ELT 69(Mad.) (Commissioner of Customs, Chennai-1 v. Annexe Impex) has observed at paragraph No.18 as follows: It is settled position of law that circulars are in the nature of administrative instructions and are binding on the assessing officers of the concerned departments and the Hon'ble Supreme Court, in a catena of decisions has held that department circulars and notifications in the fields of Customs, Central Excise and Service Tax are not binding on the assessee or quasi-judicial authorities and the assessees can question the correctness of the same before a quasi-judicial authority and also before a Court. 15. In this case, the claim of the petitioner is that the Adjudicating Authority in both the cases ought to have followed the said trade notice issued by Mumbai Commissionerate and granted the relief to the petitioner. I am not convinced with the above submissions made by the learned counsel for the petitioner for two reasons. Firstly, the Hon'ble Apex Court in NITDIP Textile Processors case has not stated that Trade Notice issued by oneCommissionerate is binding on the Adjudicating Authorities as well of other Commissionerate who are undoubtedly, quasi judicial authorities. Therefore, the petitioner is not justified in relying on the above said decision of the Hon'ble Apex Court in support of their contention. Further, the later decision of the Hon'ble Apex Court in MinwoolRock Fabres case as well as the Division Bench decision of this Court in Anex Impex case as discussed supra would negative the claim of the petitioner on the reliance placed on the above said Trade Notice. In other words, the petitioner is not entitled to claim that the quasi judicial authority, namely, the Adjudicating Authority in this case, is bound by the Trade Notice issued by the Mumbai Commissionerate. Thus, the above contention raised by the petitioner on the applicability of the Trade Notice issued by Mumbai Commissionerate is rejected. 16. Even otherwise, it is to be noted at this juncture in the very same decision made in NITDIP Textile Processors case, the Hon'ble Apex Court has also observed that the trade notice as such, is not binding on the Courts. Since this Court is inclined to decide the issue involved in this case on merits, it is to be stated that the Trade Notice relied on by the petitioner is not binding on this Court as well for deciding the matter on merits. At this juncture, it is to be noted that this Court has to decide the merits of the matter, since inW.P.No.199/2019, the challenge made is against the order of the Appellate Authority, confirming the order of the original authority. Therefore, it is evident that the appellate remedy already availed by the petitioner in respect of one set of period has also resulted in passing an order against the petitioner thereby confirming the view of the order of the Adjudicating Authority. 17. With this background, let me consider as to whether the petitioner or their Banker namely Indian Bank, Adyar, is liable to pay the same in respect of the service rendered by intermediary Bank as well as the Banker at Iraq which furnished the Bank Guarantee to the supplier of the petitioner. 18. In this case, there is no dispute to the fact that the petitioner's bank in this country namely Indian Bank, Adyar has not furnished the Bank Guarantee to the foreign supplier of the petitioner. On the other hand, the Indian Bank approached the intermediary Banks which are admittedly located outside this country, which in turn approached the bank situated in Iraq only for the purpose of furnishing Bank guarantee on behalf of the petitioner to its foreign supplier at Iraq. Therefore, there is no doubt that though the event of furnishing the bank guarantee had taken place in three parts, the chain of events connecting those three parts will undoubtedly lead to an irrebuttableconclusion that all those three events were aimed only to provide the service to the petitioner, namely furnishing of Bank guarantee to its foreign supplier. As rightly pointed out by the authorities who passed the impugned order, the petitioner had incurred expenditure in foreign currency towards Bank Guarantee Commission and export proceeds realisation charges paid to the intermediary Banks situated outside India. Certainly, a taxable service has been provided to the petitioner namely, Banking or other financial services. It is the categorical finding of the authorities who passed the impugned orders that taxable service by way of issuing bank guarantee to the petitioner's customer at Iraq and by way of remitting the exports proceeds to the petitioner, had been performed by the intermediary banks for the petitioner. Therefore, the petitioner cannot claim that they are not the recipient of the service. Though the petitioner had not made any remittance to the foreign intermediary banks directly, there cannot be any dispute that the expenses met out towards rendering of such service by the Indian Bank were borne by the petitioner. In other words, at no stretch of imagination, it can be said that the petitioner's Bank at Chennai, namely, Indian Bank, Adyar, is recipient of the Service provided by the intermediary Bank or the foreign bank situated in Iraq. Needless to say that the Indian Bank, Adyar, namely, the banker of the petitioner has facilitated the service to be rendered by the intermediaryBanks and the foreign Bank in Iraq only for the purpose of providing bank guarantee on behalf of the petitioner. Therefore, the petitioner is not justified in shirking its liability to pay service tax relatable to the Bank Guarantee Commission and realisation charges involved in this case. 19. Further, as rightly pointed out by the Appellate Authority in his order made in Appeal No.489-492/2018 dated 17.09.2018, the recipient of Service involved in this case namely, furnishing of bank Guarantee, is only the petitioner and not the Banker. Since the service receiver is the petitioner and the place of provision of such service is also the location of the petitioner, which is within India, the Service Tax liability is rightly fastened on the petitioner, with which, I find no reason to interfere. Since the only point raised in this writ petition is based on the Trade Circular issued by the Mumbai Commissionerate and that the said issue is answered against the petitioner as discussed supra, I find that both the Writ Petitions are devoid of any merit. Accordingly, both the Writ Petitions are dismissed. No costs. Consequently, connected miscellaneous petitions are closed.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.