No GST on director’s salary

Table of Contents

Case Covered:

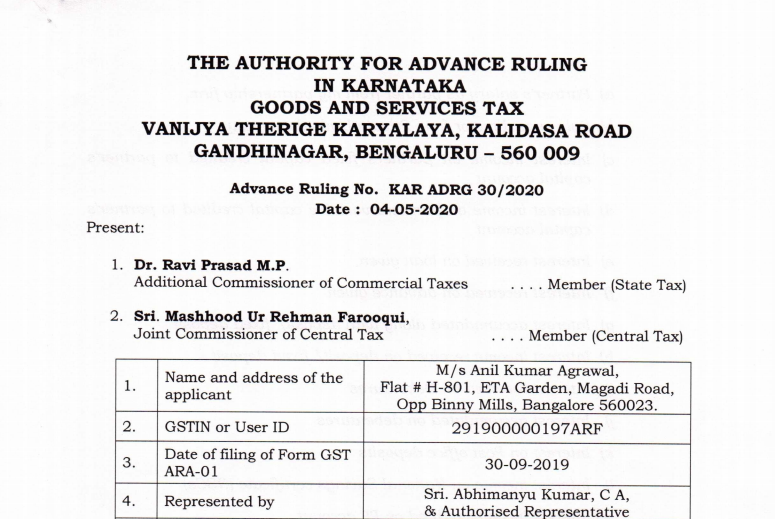

M/s Anil Kumar Agarwal

Facts of the case:

Mr. Anil Kumar Agarwal, Flat # H-801, ETA Garden, Magadi Road, Oppo. Binny Hills, Banglore 560023, an unregistered person having User ID 29100000213ART, has filed an application for Advance Ruling under Section 97 of the CGST Act, 2017 read with Rule 104 of the CGST Rules & Section 97 of the KGST Act, 2017 read with Rule 104 of the KGST Rules, 2017, in FORM GST ARA-01 discharging the fee of Rs.5,000_00 each under the CGST Act and KGST Act.

The applicant is an unregistered person and is in receipt of various types of income/ revenue, mentioned as under:

a) Partner’s salary as a partner from my partnership firm,

b) Salary as director from Private Limited company,

c) Interest income on the partner’s fixed capital credited to partners’ capital account.

d) Interest income on the partner’s variable capital credited to partners’ capital account.

e) Interest received on loan given.

f) Interest received on advance given.

g) Interest accumulated along with deposit/ fixed deposit

h) Interest income received on deposit/ fixed deposit

i) Interest received on Debentures

j) Interest accumulated on debentures

k) Interest on Post office deposit

l) Interest income on National Savings Certificate (NSCs)

m) Interest income credited on the PF account.

n) Accumulated Interest ( along with principal) received on the closure of PF account.

o) Interest income on PPF.

p) Interest income on the National Pension Scheme (NPS)

q) Receipt of maturity proceeds of life insurance policies

r) Dividends on shares

s) Rent on Commercial Property

t) Residential Rent

u) Capital gain/loss on the sale of shares.

Ruling:

The incomes received towards (i) salary/ remuneration as a Non-executive Director of a private limited company, (ii) renting of commercial property and (iii) renting of residential property and (iv) the values of amounts extended as deposits/ loans/ advances out of which interest is being received are to be included in the aggregate turnover, for registration.

The income received from the renting of residential property is to be included in the aggregate turnover, though it is an exempted supply.

No GST on director’s salary

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.