Original copy of GST AAR of Vservglobal Private Limited

Original copy of GST AAR of Vservglobal Private Limited

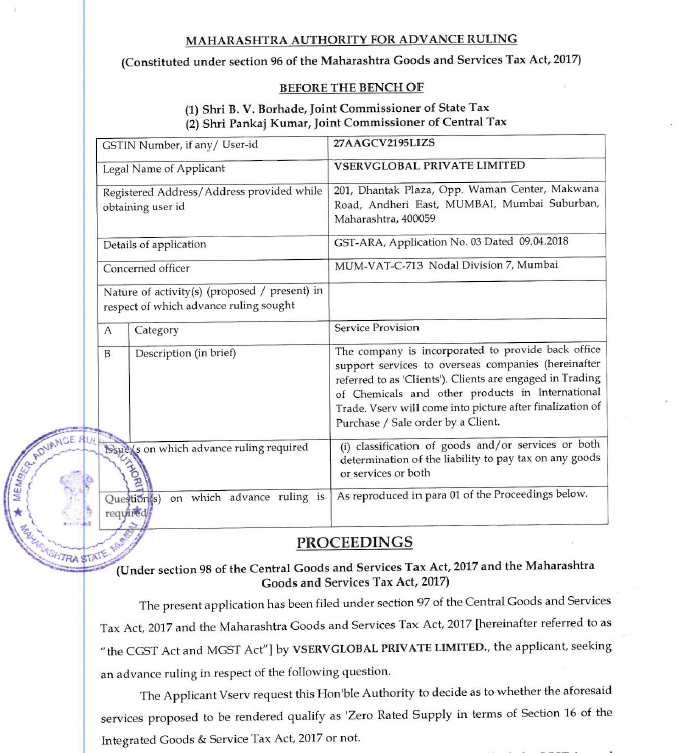

In GST AAR of Vservglobal Private Limited, the applicant has raised the query regarding the classification fo the services provided by them as a “Zero-rated” Supply. Following is the GST AAR of Vservglobal Private Limited:

Proceedings:

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharastra Goods and Services Tax Act, 2017)

The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act”) by VSERVGLOBAL PRIVATE LIMITED., the applicant, seeking an advance ruling in respect of the following question.

The Applicant Vserv request this Hon’ble Authority to decide as to whether the aforesaid services proposed to be rendered qualify as ‘Zero Rated Supply in terms of Section 16 of the Integrated Goods & Service Tax Act, 2017 or not.

At the outset, we would like to make it clear that the provisions of both the CGST Act and the GST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST Act / MGST Act would be mentioned as being under the “GST Act”.

02. FACTS AND CONTENTION – AS PER THE APPLICANT

The submission (Brief facts of the case), as reproduced verbatim, could be seen thus –

FACTS OF THE CASE

1. The Applicant M/s. Vservglobal Private Limited (hereinafter referred to as ‘Vserv’), is an Indian Company having its office at Mumbai. The company is incorporated to provide back office support services to overseas companies (hereinafter referred to as ‘Clients’). Clients are engaged in Trading of Chemicals and other products in International Trade. Vserv will come into picture after finalization of Purchase / Sale order by a Client. Vserv will undertake following activities for and on behalf of Clients.-

a) Get SDF (Sales Detail Form) & PDF (Purchase Detail Form) from concerned party

b) Generate order no in VOSS

c) Create PO (Purchase Order) & SC (Sales Contract) in VOSS

d) Send SC (Sales Contract) & PI (Proforma Invoice) to customer & get SI (Shipping Instructions) as well

e) Send PO (Purchase Order) to supplier & Seek PI (Proforma Invoice) & Share SI (Shipping Instructions)

f) Liaise with supplier for Cargo Readiness

g) Liaise with inspection authorities if pre-shipment inspection is needed

h) Inform Customer on tentative schedule

i) Process payment request in VOSS

j) Send payment request to Client.

k) Provide forwarder/ carrier nomination to supplier if FOB (Free on Board)

l) Seek carrier booking details and share with supplier & customer

m) follow up for smooth SOB (Shipping on Board) with supplier and forwarder

n) Log it in Excel Order Sheet – ETD -ETA (Estimated Date of Arrival -Estimated date of Departure)

o) Get draft BL (Bill of Lading) prior to sailing

p) Follow up for full shipping documents with supplier

q) Raise payment request in VOSS for supplier for balance or final payment

r) Send payment request to Group Company for supplier for balance or final payment.

s) Arrange inspection certificates if applicable

t) Raise payment request for freight and inspection charges as applicable

u) Arrange to send originals to Hong Kong

v) Follow up for Originals sent to Customer from Group Company

w) Notify ETA – reminder to Customer (ETA -Estimated time of arrival)

x) Troubleshooting.

2. Apart from above, Vserv will also maintain records of employees of Clients, their payroll processing etc. All the payments to third parties like, supplier, Inspection Agency, Shipping Line, employees etc. will be done directly by Clients and Vserv will maintain accounting of the same. Vserv will be compensated for its services either on fixed monthly basis or as per the volume of transactions, on mutually agreed terms, in convertible foreign Exchange.

Question,-

3. The Applicant Vserv request this Hon’ble Authority to decide as to whether the aforesaid services proposed to be rendered qualify as ‘Zero Rated Supply in terms of Section 16 of the Integrated Goods & Service Tax Act, 2017 or not.

Statement containing the applicant’s interpretation of law and/or facts, as the case may be. in respect of the questions(s) on which advance ruling is required

4. As per legal understanding of Applicant, the aforesaid services rendered by the Applicant qualify as “Zero Rated Supply” in terms of Section 16 of the Integrated Goods & Service Tax Act, 2017 for the reasons stated hereinafter. The provisions contained in Section 16 of the Act, ibid are reproduced below for ready reference.

“16. Zero rated supply.-

(1) “zero rated supply” means any of the following supplies of goods or services or both, namely:-

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

(2) Subject to the provisions of sub-section (5) of section 17 of the Central Goods and Services Tax Act, credit of input tax may be availed for making zero-rated supplies, notwithstanding that such supply may be an exempt supply.

(3) A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely:-

(a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit; or

(b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.”

As per the above stated legal provisions Export of Services is a zero rated supply. The phrase ‘Export of Service’ is defined in Section 2(6) of the Act, ibid and read as under:

“(6) “Export of services” means the supply of any service when,-

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8.

6. It is humbly submitted that the services rendered by applicant satisfy all the aforesaid conditions, as explained hereinafter.

7. The supplier of Service is located in India. – The phrase ‘location of Supplier of Service is defined in Section 2(71) of the Central Goods and Service Tax Act, 2017 which reads as under:

“(71) “Location of the supplier of services” means –

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business,

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provisions of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;”

7 (a). In the instant case, the applicant is supplier of Services, which is a corporate entity incorporated in India and having its registered office in Mumbai. The Appellant’s Mumbai office is registered under GST. The orders for supply of said services are received in its Mumbai office and also services are executed from its office situated in Mumbai. Therefore, the condition that the location of service provider should be in India is met.

8. The Recipient of Service is located Outside India – The phrase ‘Location of Recipient of Service’ is defined in Section 2(70) of the CGST Act, 2017 which reads as under.

“(70) “location of the recipient of services” means,-

(a) where a supply is received at a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; and

(d) in absence of such places, the location of the usual place of residence of the recipient;”

8(a). The Applicant is providing services to the overseas offices of Recipient of Services and such services are used by Recipients for their business conducted by such overseas offices. The said overseas offices of Recipients are covered under the definition of ‘fixed establishment’ as contained in Section 2(50) of the Central Goods & Service Tax Act, 2017, and therefore, the said second condition is also fulfilled. The definition of ‘fixed establishment is reproduced here for ready reference.

“(50) “fixed establishment” means a place (other than the registered place of business) which is characterized by a sufficient degree of permanence and suitable structure in terms of human and technical resources to supply services, or to receive and use services for its own needs;”

9. The place of supply of service is outside India – As per sub-section (2) of Section 13 of Act, ibid, the place of supply of services – other than those specified under Sub-section (3) to sub-section 13, will be the location of recipient of services. In simple terms, if the service is not specified under any sub-section from (3) to (13) then place of supply will be the location of Service Recipient. The aforesaid services, are prime-facie not specified under any of the sub-section from (3) to (13) of Section 13. The Government have notified Classification scheme of Services, Section 8 of the said classification scheme covers Business and Production Services. The relevant entries of said Section are reproduced below.

| Section 8: Business and Production Services | ||

| Heading no. 9981 | Research and development services | |

| Heading no. 9982 | Legal and accounting services | |

| Group 99821 | Legal services | |

| Group 99822 | Accounting, auditing and bookkeeping services | |

| 998221 | Financial auditing services | |

| 998222 | Accounting and bookkeeping services | |

| 998223 | Payroll services | |

| 998224 | Other similar services n.e.c | |

9(a). Vserv will be providing Accounting Services, Payroll Services and similar other Services. In view of Applicant, Services supplied /to be supplied by Applicant are covered under Group 99822 covering Accounting Services. The Accounting Services are not covered under any sub-section from Sub-section (3) to (13) of IGST Act, 2017 and hence, default provisions contained in Section 13(2) of the IGST Act, 2017 is applicable and place of supply would be the location of recipient of services which would be outside India.

10. Payment in Convertible Foreign Exchange – As stated above, the payment for services will be received in Convertible Foreign Exchange. Thus, the said condition is also satisfied.

11. Supplier & Recipient Not Establishment of Distinct Person – The last condition is that the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8. The said Explanation 1 to Section 8 of Integrated Goods and Service Tax Act, 2017 reads as under:

“Explanation 1. – For the purposes of this Act, where a person has,-

(i) an establishment in India and any other establishment outside India;

(ii) an establishment in a State or Union territory and any other establishment outside that State or Union territory; or

(iii) an establishment in a State or Union territory and any other establishment being a business vertical registered within that State or Union territory,

Then such establishments shall be treated as establishments of distinct persons.

11(a). As already submitted the supplier of service and recipient of services are separate incorporated companies and therefore they are not merely establishment of distinct person in terms of aforesaid statutory provisions. Thus the said condition is also satisfied.

12. From the above discussions it is clear that the services proposed to be rendered by the applicant satisfy all the condition of “Export of Services” and therefore, covered under the definition of “Zero Rated Supply”.

Further Submissions made on 02.07.2018-

1. That, applicant M/s Vservglobal Private Limited, is highly obliged to the Hon’ble Authority for patient Personal Hearing on 26th June 2018 and allowing to file Written Submissions within a weeks’ time. During Personal hearing a question was posed as to how the services rendered / proposed to be rendered by applicant is not covered under the definition of ‘Intermediary Services’ as defined under Section 2(13) of the Integrated Goods & Service Tax, 2017. The said definition is reproduced below for ready reference:

“(13) ”intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account; “

2. As per the above definition, a person who arranges or facilitates supply of goods or services between two persons is an intermediary. The said definition also contains an exclusion as per which the person who supplies goods or services on his own account is not included.

3. In the instant case, the applicant proposes to maintain accounts of its client, liaison with buyers and sellers of clients with respect to delivery, transportation of goods and payment etc. All the said services are proposed to be provided as a package and are bundled in natural course of business. Therefore, the said services are “Composite Supply’ as defined in Section 2 (30) of the Central Goods & Service Tax Act, 2017 and therefore tax would be levied in terms of Section 8 of the Act, ibid, above referred statutory provision are reproduced below for ready reference.

“(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

Illustration.- Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply;

8. Tax liability on composite and mixed supplies.-

The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:-

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

(b) a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax. “

4. In the instant case, the applicant proposes to supply “Business Support Service’ comprising of ‘Back Office Support’ and “Accounting’ which is its Principle Supply. If these services also facilitate supply of goods then it is only an incidental supply to the Principle Supply. As already submitted, the applicant would come into picture only after finalization of Purchase / Sale deals by the clients. They said ‘Business Support Services’ would be provided by applicant to its client would be on Principle to Principle basis. Therefore, the instant case is covered by exclusion clause in definition of ‘Intermediary’.

5 It is submitted that the term ‘Intermediary’ was also defined in aforesaid definition is exactly same, as it was in Service Tax Regime. In Service Tax the term was defined in Rule 2(f) of the Place of Provision Rules, 2012 which read as under.

(f) ‘intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates a provision of a service (hereinafter called the ‘main ‘ service) or a supply of goods, between two or more persons, but does not include a person who provides the main service or supplies the goods on his account; “

Download the original copy of GST AAR of Vservglobal Private Limited, by clicking the below Image:

6. From the above, it is clear that the definition of ‘intermediary’ in GST Law is identical to its definition under Service Tax. The above definition also contain an identical exclusion clause. CBEC in the Educational Guide released by it had explained the concept of ‘Intermediary’ and its exclusion clause in para 5.9.6, which read as under

“Similarly, persons such as call centers, who provide services to their clients by dealing with the customers of the client on the client’s behalf but actually provided these services on their own account “, will not be categorized as intermediaries. “

7. In the instant case also, the applicant is providing services to its clients on its own account and therefore, cannot be categorized as intermediary. An identical issue to the case in hand came before the Hon’ble Authority for Advance Ruling In Re: GoDaddy India Web Service Private Ltd., reported as 2016 (46) S.T.R. 806 (A.A.R.) (copy enclosed.).

8. In Godaddy (supra) the applicant proposed to provide support services in relation to marketing, branding, offline marketing, oversight of quality of third party customer care Centre and payment processing, on principal to principal basis. Those services were proposed to be provided with the sole intention of promoting the brand GoDaddy US in India and thus augmenting its business in India. Therefore, those services proposed to be provided by the applicant, would support the business interests of GoDaddy US in India. The said service were proposed to be provided as a package. Hon’ble Authority accepted that the said services are bundled in natural course of business. The relevant portion of the said Ruling is reproduced below for ready reference.-

“11. Applicant proposes to provide support services in relation to marketing, branding, offline marketing, oversight of quality of third party customer care Centre and payment processing, on principal to principal basis. These services are proposed to be provided with the sole intention of promoting the brand GoDaddy US in India and thus augmenting its business in India. Therefore, these services proposed to be provided by the applicant, would support the business interests of GoDaddy US in India.

12. It has been submitted by the applicant that services to be provided by the applicant are not peculiar only in applicant’s case but are provided by various Indian entities to their overseas customers in India as a single package. Further, supporting the business of GoDaddy US in India is the main service and processing payments and oversight of services of third party Call Centers are ancillary and incidental to the provision of main service, i.e., business support service. Further, applicant would provide said services as a package and the payment for the entire package would be a consolidated lump sum payment. Applicant submits that in view of all these indicators, service provided by them to GoDaddy US is a bundle of services, which is bundled in normal course of business. This point has not been controverted by the Revenue. We agree with the submissions of the applicant that proposed services are a bundle of services, bundled in normal course of business and not intermediary service.

19. It observed that business support services are proposed to be provided by the applicant to GoDaddy US on principal to principal basis. It is the main service. Further, applicant is not concerned in respect of services provided by GoDaddy US to Indian Customers, which relates to domain name registration, transfer services, web hosting services, designing services, etc. In case, applicant was providing service to Indian Customers, he would have received “consideration “from Indian Customers. Fact is that no remuneration/consideration is received by the applicant from Indian Customers. Applicant is to only receive from GoDaddy US, a fee equal to the operating cost incurred by the applicant plus mark up of 13% on such costs.It is noticed that applicant is to receive said fees from GoDaddy US, even in respect of Indian Customers, who directly remit service charges to GoDaddy US through International Credit Card, wherein applicant is not in the picture. This fact further shows that the applicant is not providing any service to Indian Customs. In view of above we rule as under; “

9. The law point involved in the instant case and Godaddy (supra) case is identical. Rather, in Godadddy, the applicant had proposed to render services in respect of Indian Customers of Godaddy, USA, and in the instant case, the services proposed to be provided would not be limited to Indian buyers / sellers of clients and they may be stationed anywhere in the world.

10 As submitted during Personal Hearing, the Applicant have already started serving M/s.Vikudha Overseas Corporation Limited, Hong Kong. A copy of Contract was also submitted. The trading business of M/s. Vikudha Overseas is spread in more than Twenty Countries and majority of its business is done with the suppliers/ customers situated in countries other than India. In Godaddy (supra) the applicant had to deal with Indian Customers of its client. Whereas, in the instant case, the buyers / sellers are not limited to India, but are spread across the Globe. Thus, the case of applicant is at much better footing.

11 It is correct that the Ruling of Authority for Advance Ruling is binding only in respect of Applicant. However, it certainly has persuasive value. It should also be taken into consideration that Authority for Advance Ruling under Service Tax was consisting of very senior Tax Officers and was headed by a retired Supreme Court Judge. Therefore, interpretation of law by such a senior body should be given due regard. Attention is also drawn to the relevant portion of judgment of Hon’ble Supreme Court in Columbia Sportswear Co. Vs. Director of Income Tax, 2012 (283) E.L.T. 321 (S.C.) (copy enclosed).

The Authority, thus, held that the advance ruling of the Authority is binding in the case of one transaction only and the parties involved in respect of that transaction and for other parties, the ruling will be of persuasive nature. The Authority, however, has clarified that this is not to say that a principle of law laid down in a case will not be followed in future. This decision of the Authority in Cyril Eugene Pereira, In re. (Supra) has been taken note of by this Court in Union of India & Anr. v. Azadi Bachao Andolan & Anr. [(2003) 263 ITR 706 at 742] to hold that the advance ruling of the Authority is binding on the applicant, in respect of the transaction in relation to which the ruling had been sought and, on the Commissioner, and the income-tax authorities subordinate to him and has persuasive value in respect of other parties. However, it has also been rightly held by the Authority itself that this does not mean that a principle of law laid down in a case will not be followed in future.

12 From the above, it is clear that the applicant cannot be termed as ‘intermediary’ and therefore Sub-section (8) of Section 13 Integrated Goods & Service Tax, 2017 have no application. In the instant case, the services being provided is not specified under any of the Sub-section from (3) to (13), Section 13 of the Integrated Goods & Service Tax, Act, 2017. Therefore, place of supply of these services will be determined under Section 13(2) of the Act, ibid and would be the location of Recipient of services which is outside India.

13 In view of the above and submissions already made, the Hon’ble Authority is humbly prayed to rule that the Services being provided / proposed to be provided are ‘Zero Rated Supplies’.

03. CONTENTION – AS PER THE CONCERNED OFFICER

The submission, as reproduced verbatim, could be seen thus-

Applicant has raised the question that “The applicant ‘Vserv’ request this Hon’ble Authority to decide as to whether the aforesaid services proposed to be rendered qualify as ‘Zero Rated Supply’ in terms of section 16 of the Integrated Goods & Service Tax Act, 2017 or not”.

In reply to this it is submitting as under:

As per provision of u/s 97(2) the application is not maintainable, due to the question pertains to “Zero rated Supply”, it means it relates to place of supply and question pertains to place of supply cannot sought before Hon. Advance Ruling Authority.

Erstly we have to see the provision same has reproduced as under:-

CGST Section 97 (1)- An applicant desirous of obtaining an advance ruling under this Chapter may make an application in such form and manner and accompanied by such fee as may be prescribed, stating the question on which the advance ruling is sought.

CGST Section 97 (2)-The question, on which the advance ruling is sought under this Act, shall be in respect of,-

(a) Classification of any goods or services or both;

(b) Applicability of a notification issued under the provisions of this Act;

(c) Determination of time and value of supply of goods or services or both;

(d) Admissibility of input tax credit of tax paid or deemed to have been paid;

(e) Determination of the liability to pay tax on any goods or services or both;

(f) Whether applicant is required to be registered;

(g) whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term.

The issue posed by the applicant before Advance Ruling Authority, is pertains to Zero Rated supply, it means it relates to place of supply, only above stated (a) to (g) questions are sought for Advance Ruling before Hon. Advance Ruling Authority, place of supply is not covered under the above (a) to (g), hence, my office argument is the application submitted by the applicant is not maintainable.

In this regard, if Advance Ruling Authority has accepted the application and treated is maintainable then my alternative submission is as under.

The dealer has stated that, he has exported the services, and claiming that, the said services are Zero rated supply u/s 16 of IGST Act 2017.

As per definition u/s 2 (23) of IGST Act 2017 ‘Zero Rated Supply’, means a supply of any goods or Services or both in terms of section 16 of IGST Act 2017.

As per Section 16 of IGST Act “Zero Rated Supply” means any of the following supplies of goods or services or both, namely:- Export of goods or services or both; or

1. Supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit. Means any supply of goods or service which is exported outside of India or supplied to any SEZ Developer or any SEZ unit will be treated as Zero rated supply.

We are here restricted up to Export of services, to qualify Zero Rated supply Export of service is The main condition. It means services should be exported.

In the instant case it is not happened, firstly we have to see the definition of Export of Services; same has reproduced for ready reference.

As per section 2 (6) Export of services means the supply of any service when,-

• The supplier of service is located in India;

• The recipient of service is located outside India;

• The place of supply of service is outside India.

• The payment for such service has been received by the supplier of service in convertible foreign exchange; and

• The supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8.

In this case supplier M/s Vservglobal Pvt Ltd is private Limited company situated at 201, Dhantak Plaza, Opp. Waman Center, Makwana Road Andheri (E), and Mumbai-400059. The said firm located in India.

In this case Recipient of service M/s Vikudha Overseas Corporation Limited, having registered office at Unit No. 1201-02A, 12th Floor, The Centrium, 60 Wyndham Street, and Central Hong Kong, China. The said firm is located outside India.

In this case main issue is the place of supply of service is outside India or inside India, and if it is inside India then, it is intra-state or inter-state. Firstly we have to crystallize supply of service.

Section 12 – Place of supply of services where location of supplier and recipient is in India.

IGST Section 12 (1) the provisions of this section shall apply to determine the place of supply of services where the location of supplier of services and the location of the recipient of services is in India.

IGST Section 12 (2) the place of supply of services, except the services specified in sub-sections (3) to (14),-

(a) made to a registered person shall be the location of such person;

(b) made to any person other than a registered person shall be,-

(i) The location of the recipient where the address on record exists; and

(ii) The location of the supplier of services in other cases.

Section 12 (1) – Place of Supply of Services Where Location of Supplier or Location of Recipient is Within India.

Section 12 (2) – Place of Supply of Services If Not Prescribed in Subsection (3) To (14). This section provides place of supply of services for all supplies of services where the location of supplier and recipient is in India.

1. If the location of supplier of service and the recipient is in India then the place of supply of services shall be determined under section 12 of IGST act.

2. When the place of supply of service cannot be determination under section 12(3) to 12(14) i.e. when there is no special provision specified for determination of place of supply then place of supply determined in section 12(2) which is as follows:-

a. Where the services made to registered person – Location of such recipient.

b. Where the services made to person other than registered person –

i. If address of recipient exists in records of supplier – Such address of the recipient.

ii. In any other case – Location of the supplier.

Location of the Recipient of Services – Section 2 (14)

1. Where a supply is received at a place of business for which the registration has been obtained, the location of such place of business.

2. Where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment.

3. Where a supply is received at more than one establishment, whether the place of business or fixed establishment the location of the establishment most directly concerned with the receipt of the supply, and

4. In absence of such places, the location of the usual place of residence of the recipient.

Now we have to see how above provision is applied to this case.

In the instant case M/s Vikudha Overseas Corporation Limited, having registered office at Unit No. 1201-02A, 12th Floor, The Centrum, 60 Wyndham Street, and Central Hong Kong, China, on website of company it is learnt that, company has operated throughout world, and it is operated his business in India. The company has stated in website pertains to his business as under:-

Some content of website http://vvwvv.vikudha.com/gIobal-presence/ has reproduced for ready reference:- Vikudha India is devoted to sourcing and trading varieties chemical products from India and subcontinent countries. The products are ranging from food & agriculture, pain & coating, water treatment, consumer care products raw materials. India is being a home ground for our well trained and experienced traders, those who are having close relationships with manufacturers. The thorough local chemical industry knowledge makes our India team to know the season, production cycle, market fluctuations, rules and regulations changes in advance and this helps ourselves to put ahead to the competitors.

The M/s Vikudha Overseas Corporation Limited, has operated in India through its Branch, whatever name called Group Company, sister concern, etc. M/s Vikudha India Trading Limited., having register office DHANTAK PLAZA, 201, OPP. WAMAN CENTER MAKWANA ROAD, MAROL, ANDHERI EAST MUMBAI Mumbai City MH 400059 IN (AS per Website of ministers of Commerce), and the director of companies are Mr. Deapkumar Balkishan Adukia, and Seema Sanjau Enand

The promoters M/s Vikudha Overseas Corporation Limited, is Vikash Balkishan Adukia , Group CEO and Mr. Deap Adukia, Group COO. Mr. Deap Balkishan Adukia is also Director of M/s Vikudha India Traning Limited.

From the above discussion it is clear that, the M/s Vikudha India Trading Limited, is operated through 201, Dhantak Plaza, Opp Waman Center Makwana Road, Marol, Andheri (E), Mumbai, for M/s a Overseas Corporation Limited.

The nature and scope of the works of services stated in agreement are provided by Vservglobal Pvt Ltd to M/s Vikhudha India Trading Limited, which is operated in India for M/s Vikhudha Overseas Corporation Limited. It means all services provided to M/s Vikudha India Trading Limited by the Applicant. It means location of recipient of service is in India, at 201, Dhantak Plaza, Opp Waman Center Makwana Road, Marol, Andheri (E), and Mumbai.

It is also pertinent to note that, The Applicant of this ARA M/s Vservglobal Pvt Ltd, is private Limited company situated at 201, Dhantak Plaza, Opp. Waman Center, Makwana Road Andheri (E), and Mumbai-400059.

Another condition of location of the recipient of service is located outside India, and the place of supply of service is outside India is not fulfilled. Only mere agreement by foreign company with Indian company is not suffice to determine Export of services.

It is also seen from the bank account of the M/s Vservglobal Pvt Ltd, that payment for such service has not been received by the supplier of service in convertible foreign exchange.

The last condition is that the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8, is also not satisfied. Section 8 of IGST Act is reproduced for ready reference.

IGST Section 8

(1) Subject to the provisions of section 10, supply of goods ……………………….

(2) Subject to the provisions of section 12, supply of services where the location of the supplier and the place of supply of services are in the same State or same Union territory shall be treated as intra-State supply:

Provided that the intra-State supply of services shall not include supply of services to or by a Special Economic Zone developer or a Special Economic Zone unit.

Explanation 1.- For the purposes of this Act, where a person has,-

(i) an establishment in India and any other establishment outside India;

(ii) an establishment in a State or Union territory and any other establishment outside that State or Union territory; or

(iii) an establishment in a State or Union territory and any other establishment being a business vertical registered within that State or Union territory, then such establishments shall be treated as establishments of distinct persons.

Explanation 2.- A person carrying on a business through a branch or an agency or a representational office in any territory shall be treated as having an establishment in that territory.

This section provides certain cases where the supply of goods and services will be treated as Intra-State supply; we are here restricted up to Supply of services.

Supply will be treated as intra state supply of service, if the location of supplier and place of supply of service( as provided under section 12) is in the same State or union Territory, on such supply CGST and SGST will be payable. Hence Supply of Services to be treated as Intra-state.

Distinct Person-

In the following cases the person will be required to take different registration as per section 25 of CGST Act and will be treated as distinct person(i.e. two different person) – Explanation 1

1. Person having establishment in India and outside India.

2. Establishment located in different states and union territory – As per section 25(5) Registration will be required to be obtained for each establishment located in different state or union territory.

3. Multiple business verticals in same state or union territory –

If the person is carrying out any business through its branch or agency or representational office in any territory, it will be considered as having establishment in that territory.

From the above after carefully perusal of distinct person provision, M/s Vikudha Overseas Corporation Limited, and M/s Vikhudha India Limited, and M/s Vservglobal Pvt Ltd, are not a distinct person, for this provision, thus there cannot be export of service to own branch outside India.

Form the above aforesaid fact, and related provision under the statute, the above transaction is not qualify export of services, hence not qualified under “Zero rated supply”, it is Supply of Services to be treated as Intra-state.

If we see the nature and scope of work, the all nature is office work, or we can call it back office work. Co ordination with buyer and sellers, and other parties for execution of purchase and sale contracts entered in to by M/s Vikudha Overseas Corporation Limited.

Explanation 1,- For the purposes of this Act, where a person has,-

(i) an establishment in India and any other establishment outside India;

(ii) an establishment in a State or Union territory and any other establishment outside that State or Union territory; or

(iii) an establishment in a State or Union territory and any other establishment being a business vertical registered within that State or Union territory, then such establishments shall be treated as establishments of distinct persons.

04. HEARING

The case was taken up for preliminary hearing on DT. 15.05.2018, with respect to admission or rejection of the application when Sh. Bharat Bhushan, Advocate along with Sh. Mukesh Bagri, Director appeared and requested time to submit copy of their contract with the Foreign Service recipient. Nobody was present from the side of the jurisdictional officer.

The application was admitted and final hearing was held on 26.06.2018, Sh. Bharat Bhushan, Advocate along with Sh. Mukesh Bagri, Director appeared and made contentions as per their written submissions and ARA application specifically insisting that they were not covered in definition of intermediary. They also requested for time to make further submissions latest by 02.07.2018 which was granted. The jurisdictional officer, Sh. Sachin Jadhav, State Tax Officer (C- 713), Nodal -7, Mumbai appeared and stated that they would be making submissions in due course.

05. OBSERVATIONS

We have perused the records on file and gone through the facts of the case and the submissions made by the applicant and the departmental authority. It is seen that:-

The applicant is registered person under GST ACT who is supplier of Services, which is a corporate entity incorporated in India and having its registered office in Mumbai. The orders for supply of said services are received in its Mumbai office and also services are executed from its offices situated in Mumbai.

The applicant has submitted sample copy of service agreement entered into between the parties, Tax invoices issued, bank statements etc. to represent the transactions effected between parties. The relevant clauses of the agreement for the present purpose are as below:

1. This service agreement is made between the party M/s. Vikhuda Overseas Corporation Ltd. Hong Kong (Herein referred party A) and M/s. Vservglobal Pvt. Ltd. Andheri, (Herein referred party B) .This agreement is executed on 30.12.2017 of the office of party A situated in Hong Kong. Party A is global firm specializing in trading and distribution of chemical and Agricultural/Consumer products in different geographies. Party B is an India based corporate entity and has started its operation in the year 2017.

2. Party A is desirous of obtaining back office administrative and accounting service and party B is having necessary competence to provide the said services. As such the party A has agreed to hire the party B to provide the said services and the Party B agreed to render the same in accordance with the provision of this contract.

3. Article-1 :-Object of contract:-

This service agreement aims to establish terms and conditions under which the party B commits to provide for party A for the services of back office administrative and accounting support. The nature and details of services to be provided to the party A by the party B throughout this are specified in Article 2 of this contract.

Article 2: Nature and scope of work:-

The Party B will coordinate with buyer, seller and other necessary parties for execution of purchase and sale contracts entered into by the party A. The party B will also maintain accounting of all these transactions. Party A will provide access to its software “VOSS” to the Party B for rendering the agreed services. The major service activities to be undertaken by the Party B for and on behalf of party A are mentioned at [(a) to (x) of the facts of the case at para 2 of this agreement as above.

Article 3: Obligation of parties:-

• The party B commits itself carrying out hereby services in accordance with the instruction of party A.

• Party B commits not to disclose business dealing of party A to any third party/parties.

• The party B commits no to allow access “VOSS” to anybody except its employees entrusted with the job of working on it.

• Both the parties commit not to represent each other before a third party/parties as an agent/principal of the other parties and entered in to any kind of binding agreements.

Article 4: The Service Fee and Invoicing:-

In return for the performance of services entrusted on the basis of the terms of this contract, the party B shall receive a remuneration of US $ 380 per purchase/sale transaction handled, subject to minimum of US $ 10,000/- per month. Rates may be 10% or less depending upon man hours involved in each transaction. The services performer will be invoiced by 7th day of the following month. This invoice thus issued shall be payable by the end of the month in which the invoice is issued.

On the basis of this service agreement applicant submits that the services proposed to be rendered such as back office administrative and accounting support services, a Pay roll processing and maintenance of records of employees of the client satisfy all the elements of “export of services as defined under the GST Act and therefore qualify as zero rated supply as per section 16 of the IGST Act.

This proposition of law is strongly opposed by the jurisdictional officer. The jurisdictional officer has collected information about M/s Vikudha Overseas Corporation Limited Hong Kong China (the client), sister concern, etc. M/s Vikudha India Trading Limited., having registered office at DHANTAK PLAZA/201, OPP. WAMAN CENTER MAKWANA ROAD, MAROL, ANDHER EAST Mumbai City MH 1400059 IN (AS per website of Ministry of Commerce), and The Applicant of this ARA M/s Vserv Global Pvt Ltd, is private Limited company situated at 201, Dhantak Plaza, Opp. Waman Center, Makwana Road Andheri (E), Mumbai-400059. The officer has collected this information from the website of the client. He has also collected information pertaining to the promoters of the client and the sister concern. Based on this information the officer submits that all the above firms are related companies. He further has drawn a conclusion that the applicant is providing services to M/s. Vikudha India Trading Limited, a sister concern located in India and thus the provision of services is in India and not as export of services contended by the applicant.

During the course of final hearing held on 26.06.2018 and having regards to the facts of the case applicant was called on to submit his written contention specifically insisting that how they are not covered in the definition of ‘ intermediary’ as defined u/s.2(26) of the IGST Act. In response applicant made further submission dated 02.07.2018 which is already reproduced above.

We carefully have considered rival submissions and also scrutinized in detail different clauses of service agreement, Invoices and the bank statement. Admittedly appellant is to provide back office support services, payroll processing, to maintain records of employee to overseas companies i.e. clients and after finalization of purchase /sale between the client and its customer. As per the legal understanding of the applicant aforesaid services proposed to be rendered qualify as ‘Zero rated supply‘ in term of sec.16 of the IGST Act. In order to have seal of approval on the issue, the present application is made and applicant has requested this authority to decide the issue. In order to examine the issue at hand the provisions contained in sec.16 of the IGST Act are relevant, which are reproduced below for ready reference-

Section 16 of the IGST Act: (1) “zero rated supply” means any of the following supplies of goods or services or both, namely:-

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

(2) Subject to the provisions of sub-section (5) of section 17 of the Central Goods and Services Tax Act, credit of input tax may be availed for making zero-rated supplies, notwithstanding that such supply may be an exempt supply.

(3) A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely:-

(a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit; or

(b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.

Further considering the nature of the transaction covered by the application understanding of the definition export of services as defined in the IGST Act is must, we reproduce the definition herein below:

Section 2(6) of the IGST Act:

“export of services” means the supply of any service when,-

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

In the course of final hearing a reasonable doubt was raised by the members whether the applicant is an ‘intermediary’ as defined under the act. On this issue the contention made by the applicant and the jurisdictional officer is already reproduced above. It is therefore necessary first to understand the definition of ‘intermediary’ as defined in the act.

Section 2(13) of the IGST Act:

“intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account;

In the context of definition of ‘Intermediary’ as mentioned above, we now examine the service agreement as a whole to ascertain whether the applicant is an Intermediary or not. This is necessary because the provisions of place of supply which decide the nature of supply of a transaction as to Intrastate supply, interstate supply or export supply. For a supply to be called as ‘export of services’ one of the condition is that the place of supply shall be outside India. The important clauses of the service agreements are as below:-

• Applicant commits to client to provide for services of back office administrative and accounting support.

• Applicant will coordinate with buyers, sellers and other necessary parties for execution of purchase and sell contract entered into by the clients.

• Clients will provide access to its software ‘VOSS’ to the applicant for rendering agreed services.

• Get SDF(Sales Detail Form) & PDF(Purchase Detail Form) from concerned party

• Generate order no in VOSS

• Create PO (Purchase Order) & SC(Sales Contract) in VOSS

• Send SC (Sales Contract) & PI (Proforma Invoice) to customer & get Si(Shipping Instructions) as well Send PO (Purchase Order) to supplier & Seek PI (Proforma Invoice) & Share SI (Shipping Instructions)

• Liaise with supplier for Cargo Readiness

• Liaise with inspection authorities if pre-shipment inspection is needed

• Inform Customers on tentative schedule

• send payment request to client

• Provide forwarder/ carrier nomination to supplier if FOB (Free on Board)

• Seek carrier booking details and share with supplier & customer

• Follow up for smooth SOB (Shipping on Board) with supplier and forwarder

• Log it in Excel Order Sheet – ETD -ETA(Estimated Date of Arrival -Estimated date of Departure)

• Get draft BL(BilI of Lading) prior to sailing

• Follow up for full shipping documents with supplier

• Raise payment request in VOSS for supplier for balance or final payment

• Send payment request to Group Company for supplier for balance or final payment.

• Arrange inspection certificates if applicable

• Raise payment request for freight and inspection charges as applicable

• Arrange to send originals to Hong Kong

• Follow up for Originals sent to Customer from Group Company

• Notify ETA – reminder to Customer (ETA -Estimated time of arrival)

• Troubleshooting

• Applicants commits itself carrying out services in accordance with the instructions of the client.

• Applicant commits not to disclose business dealing of client to any third party / parties

• Applicant and client commit not to represent each other before a third party as agent and principal of the other party and entered into any kind of binding agreements.

• Applicant shall receive remuneration per purchase per sale.

A sum of all activities mentioned above indicate applicant as a person who arranges or facilitate supply of goods or services or both between the overseas client and customers of the overseas client, and therefore applicant is clearly covered and falls in the definition of an intermediary as defined under the IGST Act. As the applicant is held as Intermediary the provisions pertaining to place of supply in case of intermediary services as provided in sub-section 8 of section 13 are relevant. In the instant case and as per applicants own admission of fact that applicant is supplier of Services, which is a corporate entity incorporated in India and having registered office in Mumbai. We find that the place of supply in case of services provided py the applicant being intermediary would be the location of the supplier of services i.e. location of the applicant which is located in the state of Maharashtra, India. To qualify a transaction of supply of services as export of services that transaction has to satisfy all five ingredients of the definition of export of services simultaneously. In the present case we find that the condition at (iii) of the above definition is not satisfied and hence without examining and getting into the contention of the jurisdictional officer with regards to condition at (v) of the said definition as to distinct person which would require more specific and detailed examination and verification on their part to get correct factual position in this regard, we hold that the services proposed to be rendered by the applicant do not qualify as ‘export of services’ as defined u/s.2(6) and thus not a ‘zero rated supply’ as per sec,16(1) of the IGST Act, 2017.

Applicant submits that his case is covered by exclusion clause in definition of intermediary and in support of the same has strongly relied upon decision of advance ruling authority New Delhi in case of Godaddy India Web services Pvt Ltd reported as 2016(46) STR806(AAR) dated 04.03.2016 (in short Godaddy). We have gone through the facts of the case and the ruling and we find that facts of the present case are different and not similar to facts of M/s. Godaddy. In case of Godaddy the provision of support services was admittedly on principal to principal basis and were provided with sole intention of promoting the brand Godaddy US in India for augmenting its business. In the present case we find that the activities undertaken by the applicant are for and on behalf of clients to facilitate supply of goods and services between the clients their customers. In view of this we are of the opinion that the judgement cited by the applicant is not applicable to the facts of the present case.

06. In view of the extensive deliberations as held hereinabove, we pass an order as follows

ORDER:

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

For reasons as discussed in the body of the order, the questions are answered thus.-

Question:- The Applicant Vserv request this Hon’ble Authority to decide as to whether the aforesaid services proposed to be rendered qualify as ‘Zero Rated Supply in terms of Section 16 of the Integrated Goods & Service Tax Act, 2017 or not.

Answer:- Answered in the negative.

Source: GST AAR Maharastra

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.