Park Nonwovens Pvt. Ltd. Versus CCE, Panchkula

Citations: Excel Health Corporation India Pvt. Ltd. vs UOI

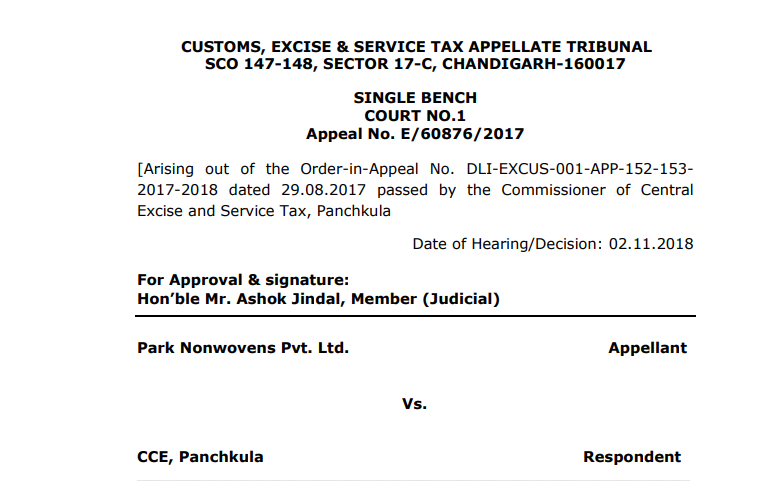

CUSTOMS, EXCISE & SERVICE TAX APPELLATE TRIBUNAL SCO 147-148, SECTOR 17-C, CHANDIGARH-160017 SINGLE BENCH COURT NO.1 Appeal No. E/60876/2017 [Arising out of the Order-in-Appeal No. DLI-EXCUS-001-APP-152-153- 2017-2018 dated 29.08.2017 passed by the Commissioner of Central Excise and Service Tax, Panchkula Date of Hearing/Decision: 02.11.2018 For Approval & signature: Hon’ble Mr. Ashok Jindal, Member (Judicial) Park Nonwovens Pvt. Ltd. Appellant Vs. CCE, Panchkula Respondent Appearance Shri. Dinesh Verma, Advocate- for the appellant Shri. A.K. Saini, AR. - for the respondent CORAM: Hon’ble Mr. Ashok Jindal, Member (Judicial) FINAL ORDER NO: 63382 / 2018 Per Ashok Jindal: The appellant is in appeal against the impugned order wherein cenvat credit sought to be reversed on inputs contained in work in progress by way of impugned order. 2. The brief facts of the case are that on 31.05.2013 fire took place in the factory premises of the appellant wherein, certain inputs issued for work in progress, semi finished goods and finished goods were destroyed. The appellant filed claim of remission of duty under Rule 21 of the Central Excise Rules, 2002, for semi finished goods and finished goods lost in fire. The ld. Commissioner (A) rejected their claim of remission of duty but on appeal before this Tribunal, this Tribunal allowed the remission of claim of duty. Later on, a show cause notice was issued to the appellant for recovery of cenvat credit on inputs contained in semi finished goods and finished goods which lost in fire. The matter was adjudicated and cenvat credit on inputs sought to be recovered in semi finished goods lost in fire by way of impugned order. Against the said order, the appellant is before me. 3. Heard the parties and considered the submissions. 4. Considering the fact that the said issue has already been settled by this Tribunal in appellant’s own case while entertaining the claim of remission of duty by this Tribunal vide Final Order No. A/60318/2017- SM(BR) dated 01.03.2017 wherein it has been held that the appellant is not required to reverse the cenvat credit contained in work in progress finished goods and semi finished goods. Taking note that the said order which has been accepted by the Revenue, the ld. Commissioner (A) was not required to pass the impugned order for recovery of cenvat credit on inputs contained in work in progress of semi finished goods which shows that the ld. Commissioner (A) have no regard to the order passed by this Tribunal, I find that recently the Hon’ble High Court of Karnataka in the case of Excel Health Corporation India Pvt. Ltd. vs UOI in writ Petition No. 37514/2017 dated 22.10.2018 observed that the ld. Commissioner (A) has not given any regard to the Tribunal’s orders imposed a fine of Rs. 1 Lac on the Ld. Commissioner (A). In that circumstances, the Commissioner (A) has not respected the order of this Tribunal required to be penalized. Therefore, the ld. Commissioner (A) is directed to take care in future to avoid any penal action from this Tribunal. 5. In view of the above, the impugned order is set aside. The appeal is allowed with consequential relief, if any.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.