Rajasthan AAR Order in the case of M/s Clay Craft India Pvt Ltd

Table of Contents

Case Covered:

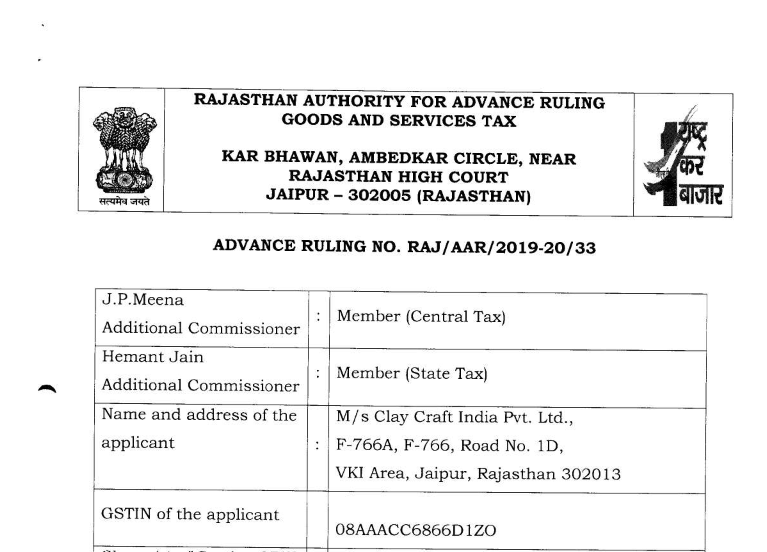

M/s Clay Craft India Pvt Ltd

|

J.P Meena Additional Commissioner |

; |

Member (Central Tax ) |

|

Hemant jain Additional Commissioner |

; |

Member (State tax) |

|

Name and address of the Applicant |

; |

M/s Clay Craft India Pvt Ltd .’ F – 766A, F -766 Road No. 1D, VKI Area, Jaipur, Rajasthan 302013 |

|

GSTIN of the applicant |

; |

08AAACC6866DIZO |

|

Clause (s) of section 97 (2) of CGST/SGST Act, 2017, under which the questions (s) raised |

; |

(e) Determination of the liability to pay tax on any goods or service or both |

|

Date of personal Hearing |

; |

05-02-2020 |

|

Present for the applicant |

; |

Shri Madhu sudan sharma (Authorised Representative) |

|

Date of ruling |

; |

20/02/2020 |

Note:

under section 100 of the CGST/RGST Act, 2017 an appeal against this ruling lies before the Appellate Authorise Ruling constituted under section 99 of the CGST/ RGST Act 2017, within a period of 30 days from the date of service of this orders.

- At the outset, we would like to make it clear that the provision of both the CGST Act, and the RGST Act are the same except for certain provisions. Therefore, uncles a mention is specifically made to such dissimilar provision, a reference to the CGST Act would also mean a reference to the same provision under the advance Ruling, a reference to such a similar provision under the CGST Act / RGST Act would be mentioned as being under the GST Act.

- The issues raised by M/s Clay Craft India Pvt Ltd., F-766A, F-766, Road no 1D, VKI Area Jaipur, Rajasthan 302013 (hereinafter the application) is fit to pronounce advance ruling as it falls under the ambit of Section 97 (e) given as under:

(e) Determination of the liability to pay tax on any goods or services or both ;

- Further, the application being a registered person (GSTIN is 08AAACC6866DIZO as per the declaration given by him in from ARA- 01) the issue raised by the application is neither pending for proceedings nor proceedings were passed by any authority. Based on the above observations, the application is admitted to pronounce advanced ruling.

Facts of the case:

1.1 The application is engaged in the manufacturing of the born China crockery transfer sheet Decalcomania, other Utensils item and moulds & Die falling under chapter heading No. 69111011, 49081000, 84801000, & 84801000 of the Tariff. He is registered with the Goods & service tax department and is having GST registration No. 08AAACC6866DIZO. He is availing input credit on inputs as well as input services used in or in relation to input credit manufacture of our final as per the provisions of GST Act, 2017;

1.2 that the application is a private limited company incorporated under the Companies Act, 1956 having a certificate of incorporation No. 17-04677 of 1988 – 1989;

1.3 Further that presently our Board of Director Consists of six (6) directors namely.

(i) Shri padam Narayan Agrawal.

(ii) Rajesh Narayan Agrawal.

(iii) Vikas Agarwal

(iv) Bharat Aggarwal

(v) Deepak Aggarwal

(vi) Pradip Aggarwal

1.4 that all the above- mentioned directors are performing all the duties and responsibilities and duties as required under the laws. However, along with that these all directors are also working in the company as holding charge of procurement of raw material, producing, quality checks, dispatch, accounting etc. In other words, they are also working as an employee of the company for which there are being compensated by the company by way of regular salary and other allowance as per the company policy and as per their employment contract, in fact these Directors are treated at par with any other employee of the company as far as their employment is concerned. The company is deducting TDS on their salary and pf laws are working as such besides being Director of the company;

1.5 that recently certain facts events have taken place which have made the applicant to reconsider the situation afresh;

The first one which has come to the knowledge of the applicant is the decision by the Hon’ble Authority of Advance Ruling, Karnataka(Bangaluru) given in the case of M/s Alcon Consulting Engineers (India) Pvt. Ltd. Bangaluru (AR No. KAR ADRG 83/2019) dated 25.09.2019 (copy enclosed). In this ruling the Hon’ble Authority of Advance Ruling has in para 5 ruled as under:

Regarding the remuneration to the Directors paid by the applicant, the services provided by the Directors to the company are not covered under clause (1) of the Schedule III to the Central Goods and Services Tax Act, 2017 as the Director is not the employee of the company. The consideration paid to the director in relation to the services provided by the Director to the company and the recipient of such services is the Company as per clause (93) of section of the CGST Act and the supplier of such services is the Director.

Ruling:

a. The consideration paid to Directors by the applicant company will attract GST under reverse charge mechanism as it is covered under entry No. 6 of Notification No. 13/2017 Central Tax (Rate) dated 28.06.2017 issued under Section 9(3) of the CGST Act, 2017.

b. Situation will remain same as (a) above and will attract GST under reverse charge mechanism.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.