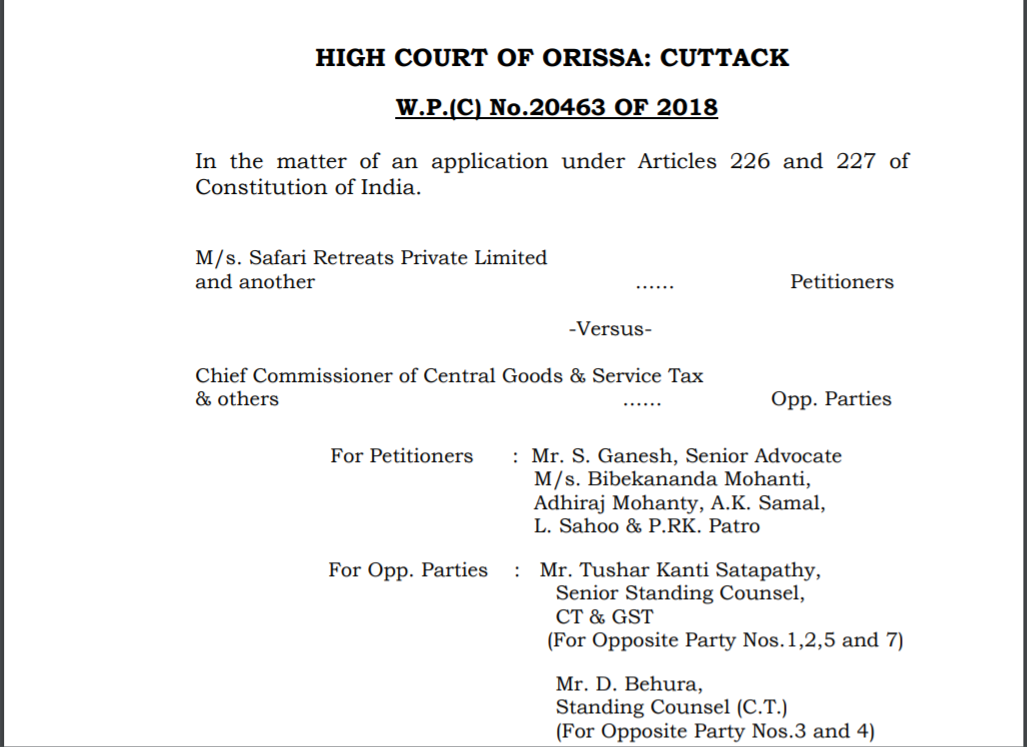

Analysis of writ petition of Safari retreats

Prayer Sought in Writ Petition of Safari retreats

1) An application for a declaration to the effect that Section 17(5)(d) of the Central Tax Goods & Service Tax Act, 2017 as well as of the Odisha GST Act, 2017 are not applicable to the petitioner company

2) An application alternatively challenging the validity and/or legality of Section 17(5)(d) of the CGST Act, 2017 and Odisha GST Act, 2017, if and to extent the said section are applied to the petitioner company.

FACTS of the writ petition of Safari retreats

The Petitioner is that the petitioners are mainly carrying on business activity of constructing shopping malls for the purpose of letting out of the same to numerous tenants. Huge Quantities of material and other inputs/ input services are required for construction purpose were purchased on which GST has been paid.

Whether the provisions restricting the credit of Input Tax as per Section 17(5)(d) is applicable to the petitioner company?

Representation by Ld Advocate of the Petitioner-

1. Denial of Input Tax Credit is a violation of Fundamental Rights to carry on business under Article 14 and 19(1)(g) of the Constitution.

2. CGST Act and OGST Act have been implemented to obviate the cascading effects of various indirect taxes and to reduce the multiplicity of indirect taxes.

3. Denial of the Input Tax Credit would defeat the object of enacting of CGST and OGST Act.

4. Denial of Input Tax Credit is discriminatory and arbitrary.

5. Petitioner even in business is continuous without break in tax chain, yet it has been placed under Section 17(5)(d)

6. Property has been held for letting out. The term letting out could not be imagined to conclude the said “LETTING OUT” under the words “intended for sale” or “on his own account”.

Cases Referred by Ld. Advocate of the Petitioner-

a. Hon’ble Supreme Court in case of Eicher Motors Ltd vs Union of India reported in (1999) 2 SCC 361,

b. Hon’ble Supreme Court in case of Collector of Central Excise, Pune Vs Dai Ichi Karkaria Ltd, reported in (1997) 7 SCC 448

c. Hon’ble Supreme Court in case of Spentex Industries Ltd Vs Commissioner of Central Excise and Others, reported in (2016) SCC 780 RACHIT AGARWAL CHARTERED ACCOUNTANT, KOLKATA EMAIL: rachitagarwal1@gmail.com

d. Hon’ble Supreme Court in case of Indian Metals and Ferro Alloys Ltd Vs Collector of Central Excise, Bhubaneswar reported in (1991) Supp (1) SCC 125

e. Hon’ble Supreme court in case of Shayara Bano vs Union of India and Others, reported in (2017) 9 SCC 1.

f. Hon’ble Supreme Court in case of Oxford University Press Vs. Commissioner of Income Tax, reported in (2001) 3 SCC 359

g. Hon’ble Supreme Court in case of K.P. Varghese vs Income Tax Officer, Ernakulum and another, reported in Vol 131 (1981) ITR 597

h. Hon’ble Supreme Court in case of Delhi Transport Corporation vs D.T.C Mazdoor Congress and Others, reported in 1991 Supp(1) SCC 600

Views of court in case of Safari retreats

The very purpose of the Act is to make the uniform provision for the levy collection of tax, intra state supply or goods and services or both central or state and prevent multi taxation

Considering the provisions of Section 17(5)(d), the narrow construction of interpretation put forward by department is frustrating the very objective of the Act, in as much as the petitioner in that case has to pay huge amount without any basis. Further, the petitioner would have paid GST if it is disposed of the property after the completion certificate is granted and in case the property is sold prior to the issue of the completion certificate, he would not be required to pay GST. But here he is retaining the property and is not for own purpose but is letting out the property on which he is covered under GST, but still he has to pay huge amount of GST, to which is not liable.

In that view of the matter, in our considered opinion provision of Section 17(5)(d) is to be read down and narrow restriction as imposed reading of the provision by Department is not required to be accepted in as much as keeping in mind the language used in (1999) 2 SC 361 (supra) the very purpose of the credit is to give benefit to the assessee.

Prayer as sought by the Petitioner is granted however provision of Section 17(5)(d) could not be hold ultra vires.. You can also download its copy .

Download the copy of the judgment;

CA Rachit Agarwal

CA Rachit Agarwal