Supreme Court stays Rajasthan High Court Order extending the deadline of GSTR-9 and GSTR-9C

Table of Contents

Case covered:

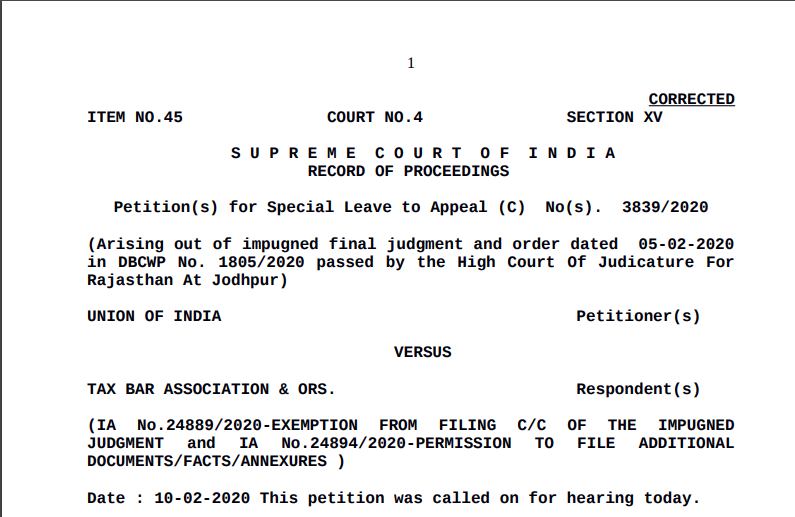

UNION OF INDIA Petitioner(s)

VERSUS

TAX BAR ASSOCIATION & ORS. Respondent(s)

Facts of the case:

A petition for Special Leave to Appeal (C) is filed by the Government of India in the Supreme Court of India (Arising out of impugned final judgment and order dated 05-02-2020 in DBCWP No. 1805/2020 passed by the High Court Of Judicature For Rajasthan At Jodhpur)

Earlier SC refused to interfere in the order of the Rajasthan high court

Order of the court:

We do not intend to interfere with the order passed by the High Court of Judicature for Rajasthan, Jodhpur. However, we only stay that part of the order which has extended the deadline for submitting the returns. This is on the basis of Mr. Tushar Mehta, learned Solicitor General’s statement to this Court that only Rs. 200/- per day is being charged for the filing of late returns, which subject to the outcome of the writ petition will be refunded. He has also assured us that the authorities, both under the Central as well as State Acts, will not invoke any penal powers in this behalf.

Related Topic:

Rajasthan HC in the case of M/s Gr Infraprojects Limited

We have been informed by the learned counsel appearing on behalf of the respondents that the capacity for on-line processing of GST applications is extremely limited. The applications being far more in number, we direct the petitioner to look into this problem and come out with a solution in accordance with the aforesaid capacity as soon as it is practicable.

We do not intend by this ad-hoc order to at all interfere with what the High Court may ultimately do on the facts of this case. The Special Leave Petition is disposed of accordingly. Pending applications also stand disposed of.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.