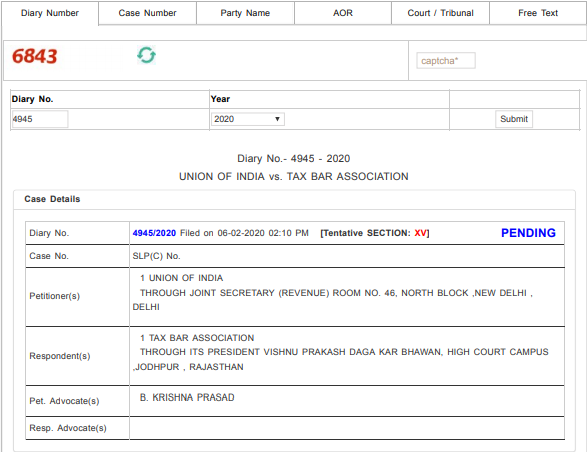

The government has filed an SLP against the order of Rajasthan high court.

Table of Contents

The government has filed an SLP against the order of Rajasthan high court.

The ruling extended the date of GSTR 9 & 9C filing without late fees up to 12th Feb. Earlier Rajasthan high court ordered filing of 9 & 9C without a late fee.

There was an interim order by Hon’ble Court for seeking instruction for an extension by 2 P.M. for which UOI did not agree and asked its Counsel to vehemently oppose matter when listed again at 2 P.M…So Hon’ble Court gave them the option to exercise good gestures but not exercised and filing of SLP was thus on expected lines.

Relevant Extract of Hon’ble Rajasthan High Court Judgement in the matter of:

Tax Bar Association Jodhpur V/s UOI…

Case Argued by:

Adv Sanjay Jhanwar and one of Group Members Adv Prateek Gattani

“However, keeping the aforesaid situation being faced by assessee in view, we are of the considered opinion that an interim order needs to be passed in light of the fact that the GST portal of the Govt. of India has not been effectively functioning and clearly there appears to be a physical limit, to which extent returns/forms can be uploaded on any one day (apart from admitted intermittent technical shutdowns).

We are prima facie satisfied that even if an assessee is ready and willing to comply with the statutory duty, so far as filing of returns are concerned, the website appears to be having technical bottlenecks, which appears to limit the opportunity of an assessee from uploading the forms. We also keep in view the fact that the option suggested by the petitioner for submitting their returns on the e-mail of a responsible officer has also been turned down by the Union of India.

Consequently, we hereby direct that the petitioner Association and the assessee, for whom they represent, may keep uploading their returns at the earliest possible and we direct that no late fee shall be charged till 12th of February, 2020 for uploading. The respondents are directed to enable compliance with such uploading by making necessary/consequential corrections on its official portal.

We further direct that the Union of India may file an affidavit by the portal operators regarding the status of its working and the magnitude of the ability of such a portal or system for accepting a requisite number of returns/forms. We further direct that if necessary, the Union of India may also direct the service provider to enhance its capacity to accept returns/forms. Since it is well-settled that where the last date of submission has been prescribed by law, it would be incumbent on the part of the revenue to provide for an adequate facility for accepting such declarations or returns or forms within the period stipulated.”

It is hereby informed that in response to SLP filed by the Union of India through the Ministry of Finance, Tax Bar Association Jodhpur has today filed Caveat before Hon’ble Supreme Court of India

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.