Analysis of GST on Drop Shipping business

Table of Contents

Introduction-

The latest trend in e-commerce is dropshipping. Shopify has expanded its horizons and helped in faster growth. But taxation is also an important aspect. GST on drop shipping business is applicable at the normal rate of items. But drop shipper and online seller, both have their impact. It is the most lucrative option for the least investment business ideas. Thus it is expected to grow exponentially in the near future. In this article, we will explore its taxability. Here an analysis of GST on drop shipping business is done.

What is dropshipping?

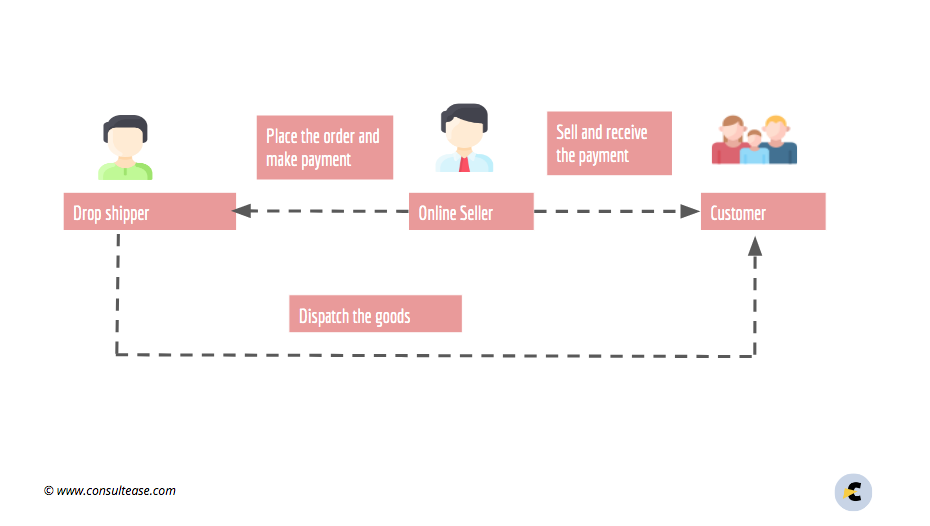

Dropshipping is the latest form of the e-commerce business. The online portal ties up with the manufacturers/wholesalers who also ship the goods. He generates sales and receives the payment. The wholesaler or manufacturer ships the goods to the customer. Then the portal transfers the payment.

What is the difference between E-commerce portals like Amazon and Flipkart and Drop shippers?

The e-commerce portals mediate in sales. But the invoice is raised by the actual supplier. In dropshipping, The actual invoice is raised by the online seller. E-commerce portals handle delivery in most cases. But in drop shipping, delivery is taken care of by the manufacturer/wholesaler.

Related Topic:

GST Impact On Death of A Proprietor – Law and Procedure

How to start a dropshipping business?

It is simple and fast to set up a dropshipping business. You need a portal to list the goods. Then tie-up with the wholesaler of the goods who is ready to deliver. Thus a person ready to dispatch the goods as and when the order is confirmed.

Applicability of GST on dropshipping business

Let us analyze the GST impact on the dropshipping business covering various forms of it. There can be different variants of this business. Taxability is different when goods are purchased from India or outside India. Like Goods may be sold in India or outside India.

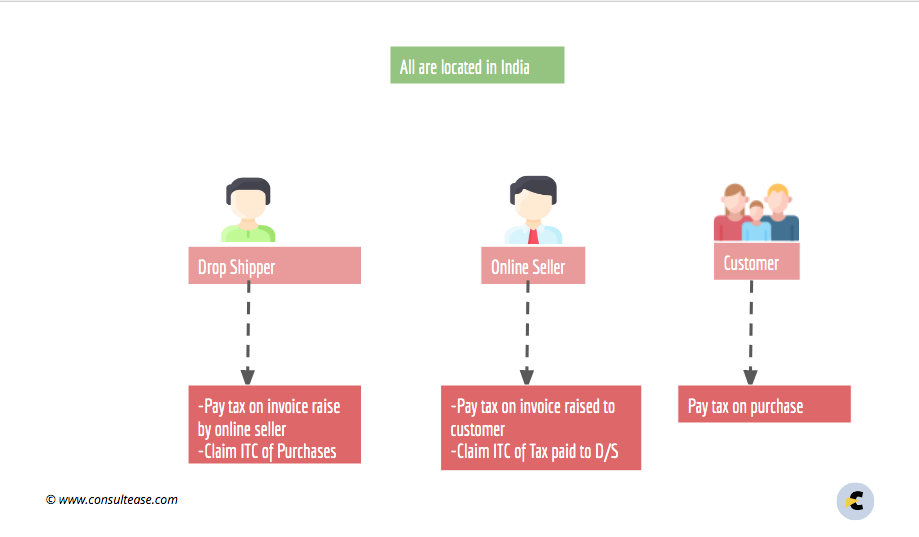

GST on Drop Shipping business when both purchase and sales are made in India

In this case, the Online seller will collect and pay the tax on the invoice raised by him to the customer. The wholesaler/manufacturer (Drop shipper) will raise an invoice for him. Both of them will be eligible for an input tax credit of purchase.

The E-way bill (if required) will be raised by the manufacturer/wholesaler with a bill in name of the online seller and ship to in name of the customer.

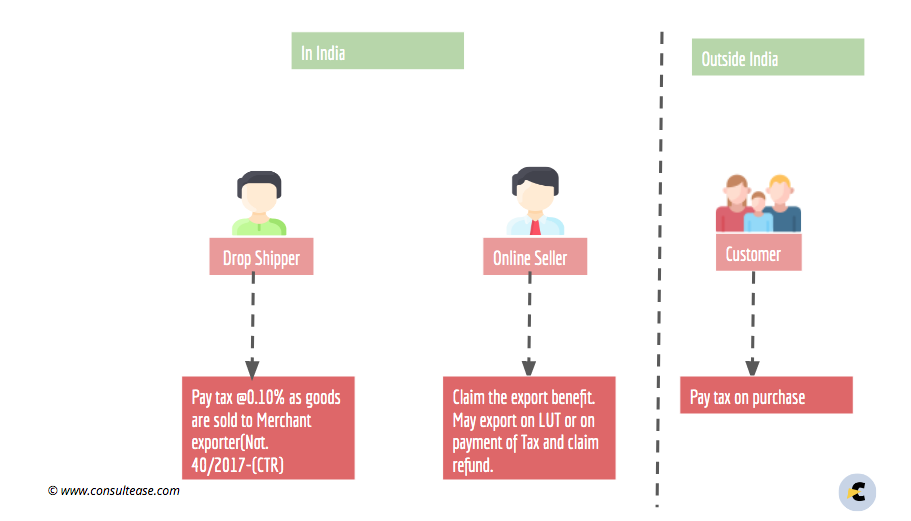

GST on Drop Shipping business when goods are purchased in India and sold outside India

In this case, the drop shipper will raise a bill at a nominal tax rate of 0.10%. As per notification no. 40/2017-CT. The online seller is eligible for the export benefits. He can export the goods on LUT or on payment of IGST. He can claim the refund of tax paid on export.

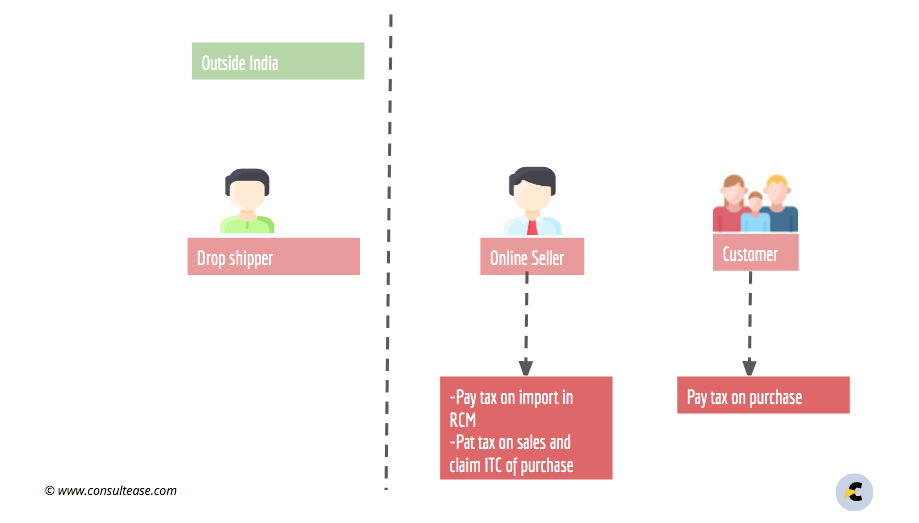

GST on Drop Shipping business when Purchase is from outside India and sales is in India

The online seller will be liable to pay the tax on a reverse charge basis on the goods imported. He will be eligible for the input tax credit of the Goods purchased. That input tax credit is adjustable against the payment of tax on the sale of such goods.

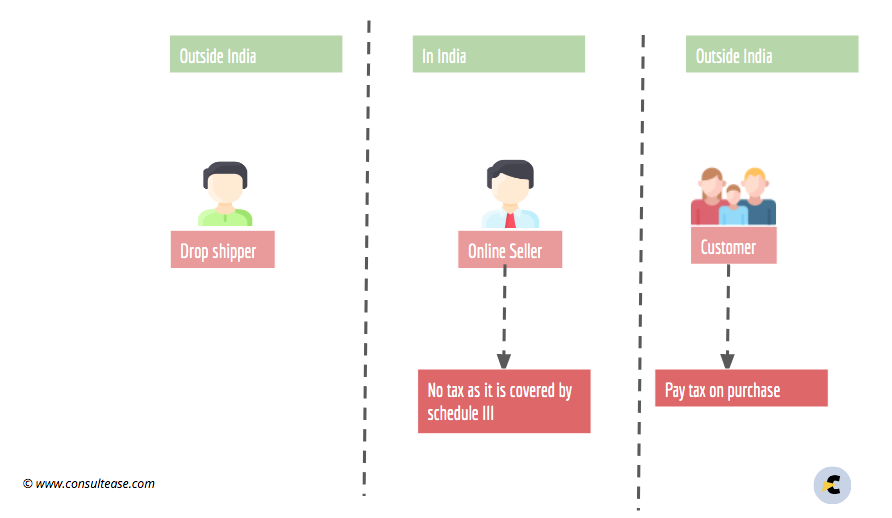

GST on Drop Shipping business when both purchase and sales are outside India

In this case, the goods are not entering into Indian territory. It is a high sea sale. As per Schedule III of the CGST Act, it is put from the GST scope. It is not a supply at all. Thus there is no GST levy on this supply.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.