GST on import of services

Table of Contents

- Introduction:GST on import of services

- What is import of service in GST?

- Do I need to pay tax on import of services for personal use?

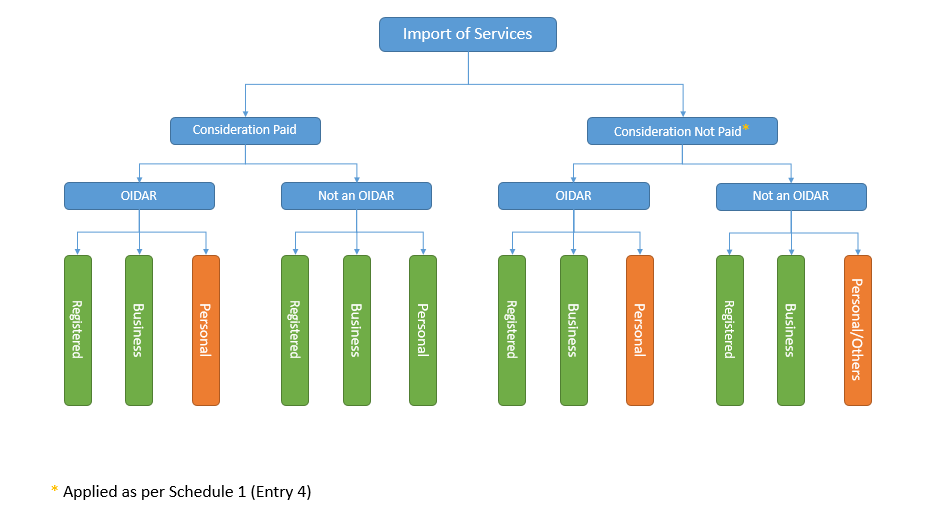

- Steps to know the RCM is applicable or not?

- Do I need to pay tax on import of services even if consideration is not paid?

- When a supplier of OIDAR services is required to get registered in India?

- Who is a non taxable online recipient?

- what is the rate of tax for import of services?

- Take away for GST on import of services from above write up:

Introduction:GST on import of services

In this article we have covered the GST on import of services. Import of services into India is taxable for the recipient. In GST the recipient importing services will be liable to pay GST on it in Reverse charge. Entry No. 1 of notification no. 10/2017 of IGST covers the entry for reverse charge on import of services. Although import of goods is also taxable in RCM. In case of goods the movement is made via port and necessary requirements of tax payment are done at port. This is very specific about services that they don’t have any physical movement. Only the recipient and exchange of foreign currency can be a indication for it.

What is import of service in GST?

That is the reason that import of services are defined in following manner. The services will be said to be imported when following three conditions will be fulfilled.

- Supplier of services is located outside India.

- Recipient of services is located in india.

- Place of supply of services is located in India.

Place of supply in case of service is covered by section 12 & section 13 of IGST Act.

Do I need to pay tax on import of services for personal use?

GST is levied on any transaction which can be called as supply. Section 7 of CGST Act provide for the meaning of supply. First part of this definition says that a supply shall be something for consideration and in course or furtherance of business. But there are some specific exceptions to this fundamental of supply. The second part of the definition provide that in case of import of services for a consideration, it will be taxable even if it is not in course or furtherance of business.

Thus we can say that if the services are imported for personal use but consideration is paid then it will be liable for RCM.

Example 1:

Mr. X of Delhi is constructing a house for his personal use. He availed the services of an architect in California and paid 20000$ for it. In this case Mr. X will be liable for payment of GST in RCM.

Example 2:

Mr. X went to USA and take training session for body Detox. He paid $10000 for this services. In this case he will not be liable for RCM as the place of supply is outside India.

I specifically covered this situation in example 2 where the PoS was not in India. Please take note that RCM is only for import of services and import of service will be fulfilling the three conditions I have enumerated earlier. PoS Should be in India for import of services. If it is not in India , the service is not import and thus the RCM will not be applicable.

Steps to know the RCM is applicable or not?

We should follow following steps to know whether we will be liable for RCM on Import of services or not.

- First of all check whether it is an import or not.

- Take care that for import of services there is no condition related to payment in any currency. Thus even if payment is made in Indian rupees it will be an import.

- Check whether the consideration was paid. If consideration was there then it will be covered in RCM even if it personally used.

- In case of OIDAR services the supplier will be registered in India and will be charging GST. In that case you are not liable to pay tax in RCM.

Do I need to pay tax on import of services even if consideration is not paid?

Again two basic components of supply are Consideration and in course or furtherance of business. In last para we read that import of service is an exception to “in course or furtherance of business part” component. In this part we will read that it is also an exception of “consideration” portion also. Entry no. 4 of schedule I of CGST Act provide that in case of import of services , it will be a supply if:

- There is no consideration involved.

- It is used in course or furtherance of business.

- It is received from a related person or from any other establishment outside India of same person.

- The term related person is defined in section 15 of CGST Act.

When a supplier of OIDAR services is required to get registered in India?

Section 24 of CGST Act provides for the instances where a person is required to take mandatory registration. In case a person is providing OIDAR services to a person located in taxable territory. The meaning of taxable territory is the territory where the provisions of GST are applicable.Section 1(2) of CGST Act says that CGST Act is applicable to whole of India except the state of Jammu & Kashmir. India means the territory of India as defined in article I of Constitution of India. It also include the territorial waters, sea bed and sub soil.

We can say that when a person supplying the OIDAR to a person in India. This provision is applicable only when services are provided to a person other than a registered person. In that case that person will pay tax in RCM.

Let us have a look on entry in notification no. 10/2017(IGST) CTR. It says that:

“Any service supplied by any person who is located in a non-taxable territory to any person other than nontaxable online recipient.”

Who is a non taxable online recipient?

Every single word of this provision is important.

“Non taxable online recipient” I will call it NTOR from now.

So import of services is covered in RCM if it is provided to anyone other than a NTOR. Now who is NTOR?

NTOR is expressed in IGST Act as:

- They should be unregistered.

- The services are received for non commercial use.

“Section 2(16) “non-taxable online recipient” means any Government, local authority, governmental authority, an individual or any other person not registered and receiving online information and database access or retrieval services in relation to any purpose other than commerce, industry or any other business or profession, located in taxable territory. Explanation.––For the purposes of this clause, the expression “governmental authority” means an authority or a board or any other body,–– (i) set up by an Act of Parliament or a State Legislature; or (ii) established by any Government.”

In this case the RCM will not be applicable for import of OIDAR services. All other cases will be liable for it.

GST on import of services

what is the rate of tax for import of services?

Normal tax on the supply of services as provided in rate notification will be applicable for RCM also. Rate for GST on import of services will be same as in case of domestic supply.

Take away for GST on import of services from above write up:

- If consideration is paid: GST on import of services will be applicable and RCM will also be levied

- If import is made by an unregistered person for personal use. Also It is an OIDAR service. It is a supply but RCM not applicable. But supplier will be liable to take registration and pay tax for it.

- If import is of OIDAR service in any other case then RCM will be applicable.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.