GST on Liquidated Damages – A Complete Detail

Damages means,” reparation for the aggrieved person in money terms in lieu of suffering loss or injury”. Liquidated means,” to sell something in order to get cash”. Liquidated Damages,” are the damages in the monetary form which are received by the aggrieved party from the other party for the nonperformance of his part in the contract.”

When parties enter into contractual arrangements, they generally insist on including a clause for liquidated damages, to preventatively agree upon the amount of compensation that would be payable by either party on failure to meet its obligation. Normally, such commitments are in the nature of adhering to timelines, fulfillment of promised conditions, quality of products used, etc.

Table of Contents

- 1. Position under Indian contract act

- 2. Position under GST Act

- C) According to the Central Tax (Rate) Notification no.11/2017 dated 28.06.2017

- D) Sec 34 debit note/credit note

- E) Combined interpretation of Circular No 12 and sec 34

- F) Section 15 – Value of Taxable Supply

- G) Notification No. 12/2017- Central Tax (Rate) entry No.27

- H) Definition of interest in GST act

- I) Circular No. 102/21/2019-GST

- J) Services provided by the Central/state/ various govt agencies Notification No. 12/2017- Central Tax (Rate) entry No. 65

- K) Various rulings of AARs on Liquidated Damages In GST, favoring its inclusion in entry No 35 as per clause 5(e) of schedule II

- L) Case laws where the Appellate Tribunal took a contrarian view of the above

1. Position under Indian contract act

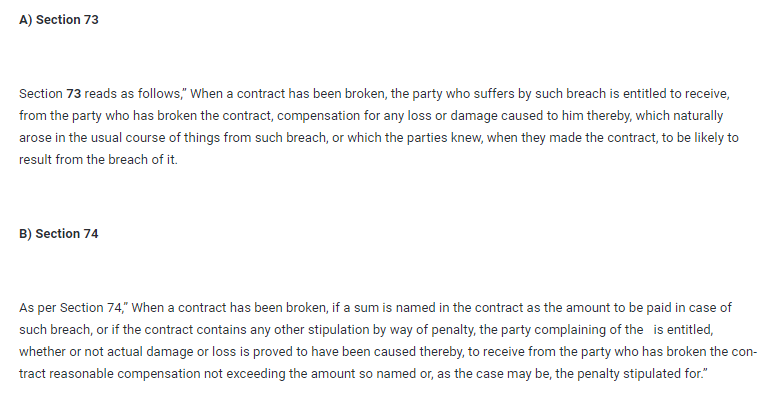

According to the Indian contract act, Liquidated damages have not been defined. But we can understand it by the combined reading of sec 73 and sec 74 of the Indian contract act.

Hence you can see that sec 73 talks for the provision of compensation for the aggrieved party. It says that the party should have suffered, meaning it must have endured a loss due to the breach of the contract by the other party. Therefore it gives the impression that this section presupposes that the happening of loss is compulsory for receipt of damages. The entitlement to damages is contingent upon the suffering of loss. It means that the damages are provided to compensate the aggrieved party for the consequences which arise directly and naturally from the breach. However, there is also an established principle that no one can be allowed to make an unjust enrichment under the shroud of claiming compensation for a breach.

Sec 74 describes the amount, method, or manner of ascertaining the compensation. It merely dispenses away the necessity to prove the actual loss or damages. It does not justify the award of compensation, where the breach has caused no injury. Compensation for breach of contract can be awarded, only to make good the loss or damage which actually arose or which the parties knew when they made the contract to be likely to result from the breach.

These sections ensure the performance of their part from the parties to the contract. This assures either party that performance would be made by the other party or has to face the consequences of nonperformance.

These liquidated damages can be for two purposes;

- As a penalty to punish the party for his nonperformance. Like payment of a penal fee or interest (3% per month interest for not paying the credit card balance amount on time). It acts as a deterrent for either party not to resort to nonperformance. It also precludes non-serious persons to enter into a contract.

2. As a genuine compensation, which the aggrieved party has suffered because of the unsatisfactory performance/nonfulfillment of the promise made by the other party.

C) Therefore a question arises, is there a difference between Liquidated Damages and Penalty?

The Liquidated Damages is a reasonable, pre-emptive, pre-assessed, estimated loss, agreed to between the parties at the time of entering into a contract, as likely to arise from the breach. The purpose is to compensate the party against the losses it would have to suffer from the nonperformance of the other. It is important to note that Liquidated damages are an amount that is already agreed upon by the parties and is not any special compensation awarded by the court, which was not conceived earlier, as an act of remedy or restitution for the aggrieved party. Its effect is to reduce the amount of payable consideration.

On the other hand, the Penalty clause in the contract is a stipulation that is so exorbitant or excessive that no sane person would consider it the same as a reasonable assessment of damages arising out of the breach. It is prohibitory and inhibitory in nature so that the parties to the contract dare not to breach the contract. It also prevents incompetent or frivolous people from entering into the contract.

For example, there is a fine of Rs 2000 for not wearing a face mask properly in this Corona pandemic which costs only say Rs 200. There is a fine of 5000 for driving without a driving license. There is a penalty of two times the GST tax for transporting goods above Rs 50000 without an E-way bill. All these provisions are to refrain the public from breaking the law. They are in the form of a penalty.

The late fee for not filing a return on time is a penalty, and the interest on the balance tax amount is the interest cost on the offender, which he would earn from wrongfully appropriating the government’s funds. It can be construed as a loss of official exchequer which is recovered from the offender in the form of liquidated damages.

Related Topic:

Important changes in GST returns, GSTR 3b and 1

Now we come to the GST law for understanding the concept of Liquidated damages under this Act

2. Position under GST Act

There is no definition of Liquidated damages under this act.

Scope of Supply is defined in the CGST Act, 2017 as per section 7. We are quoting section 7(1) for the reference of the viewers. (after amendment as on 1.2.2019)

sec7(1) For the purposes of this Act, the expression “supply” includes––

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(b) import of services for a consideration whether or not in the course or furtherance of business and ;

(c) the activities specified in Schedule I, made or agreed to be made without a consideration;

7(1A) where certain activities or transactions, constitute a supply in accordance with the provisions of sub-section (1), they shall be treated either as supply of goods or supply of services as referred to in Schedule II

Schedule II only gives the classification of treatment of activities which are to be treated as supply of goods or supply of service

According to schedule II,Clause 5(e) is as under; (e) agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act.

Related Topic:

Original copy of GST AAR of M/s. Ernakulam Medical Centre Pvt. Ltd.

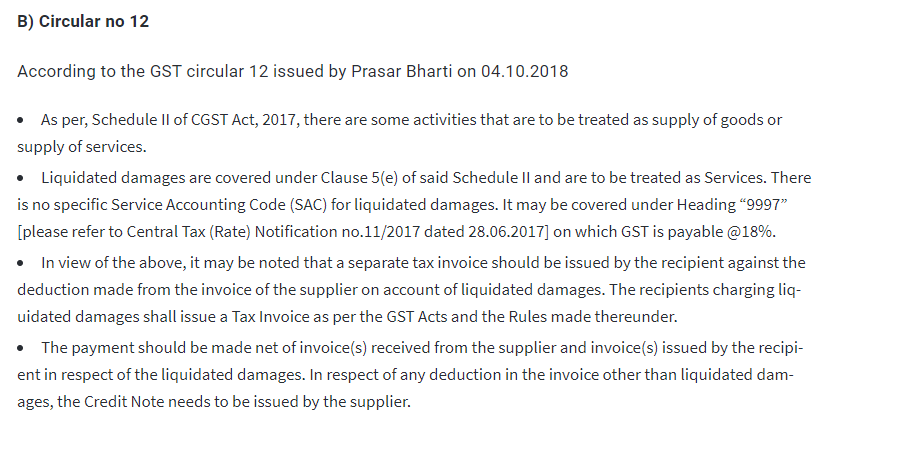

C) According to the Central Tax (Rate) Notification no.11/2017 dated 28.06.2017

| Entry No. | Heading | Description of service | Rate |

| 35 | Heading 9997 | Other services (washing, cleaning, and dyeing services; beauty and physical well-being services; and other miscellaneous services including services nowhere else classified). | 9% |

Therefore Liquidated damages have been covered in the residual entry of services.

D) Sec 34 debit note/credit note

Section 34 of the Central Goods & Services Tax Act, 2017 deals with the issue of Debit and Credit Notes. As per Section 34(1), where a tax invoice has been issued for supply of any goods or services or both and – ( we are giving here only clause c )

c) where goods or services or both supplied are found to be deficient the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note.

Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted accordingly. No time limit has been prescribed for issuing a Debit Note.

It may be noted that;

- The debit notes, as well as credit notes under GST, can be issued only by the supplier of the goods or services. These notes cannot be issued by the recipient of the supply.

2. The supplier shall mention the details of debit or credit notes in GSTR-1. On filing the details it will get auto-populated in form GSTR-2A for the recipient. The recipient can either modify or accept or reject these details and claim an input tax credit (ITC) accordingly.

E) Combined interpretation of Circular No 12 and sec 34

- It can be understood that under GST Act, it is envisaged that only recipients can charge Liquidated damages from the supplier i.e. breach of contract can only be done from the supplier’s side. To claim damages he has to issue a separate invoice to the supplier under SAC 9997, according to clause 5(e) of schedule II, and deduct the amount from his balance payment. It means by the virtue of this entry, he suddenly converts to a service provider from a recipient.

2. It is also possible that the supplier may issue a credit note to the recipient on the basis of sec 34(1) c, i.e. he is cognizant of the deficiency on his part in the supply of such goods or service or both. That is only possible when the supplier has supplied some goods or services. It implies that if GST has to be applicable on any such amount, then there has to be a concurrence of both parties.

3. There may be a possibility where the supplier does not supply the agreed goods or services at all, OR the recipient has already made the payment and the supplier has supplied defective, damaged, or different from the promised goods or services. Then the recipient has no leverage against the supplier, and he has to take the legal route if the supplier neither performs nor provides the liquidated damages. Then any award arising from a legal injury would be outside the scope of supply and hence will not attract GST.

4.Under this act, it is presumed that deficiency from the supplier has to be condoned by the recipient, and it has to be settled in monetary terms. This act of condoning, or tolerating the nonperformance of the supplier by the recipient is considered to be a service, for which he is getting consideration.

5.From the recipient’s side, the only breach can be in the form of a delay of payment. This scenario is covered under levy of late fee/ additional/ penal interest as per sec 15(2) d. It is not considered Liquidated damages.

- According to Circular No. 102/21/2019-GST

- It is further clarified that the transaction of levy of additional/penal interest does not fall within the ambit of entry 5(e) of Schedule II of the CGST Act i.e. “agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act”, as this levy of additional/penal interest satisfies the definition of “interest” as contained in notification No. 12/2017- Central Tax (Rate) dated 28.06.2017. It will become a part of the value of taxable supply as per sec15(2) clause (d).

Related Topic:

43rd GST Council Meeting Recommendations

F) Section 15 – Value of Taxable Supply

According to Sec 15 (2) Clause d

(d) interest or late fee or penalty for delayed payment of any consideration for any supply;

G) Notification No. 12/2017- Central Tax (Rate) entry No.27

| Entry No | Heading No | Description | rate |

| 27 | Heading 9971 | Services by way of—

(a) extending deposits, loans, or advances in so far as the consideration is represented by way of interest or discount (other than interest involved in credit card services); (b) inter sale or purchase of foreign currency amongst banks or authorized dealers of foreign exchange or amongst banks and such dealers. |

Nil |

H) Definition of interest in GST act

As per Sec 2 (zk) “interest” means interest payable in any manner in respect of any amounts of money borrowed or debt incurred (including a deposit, claim, or other similar right or obligation) but does not include any service fee or other charge in respect of the money borrowed or debt incurred or in respect of any credit facility which has not been utilized;

If the interest charged (for the first time) is the consideration for providing loans/advances, then the rate of GST charged on this interest is Nil.

Interest on unpaid interest will attract GST.

I) Circular No. 102/21/2019-GST

Clarification regarding applicability of GST on additional/penal interest In case of EMIs (Equated monthly installments) for repayment of Loan

When the bank/financial institution provides a loan to any person, then the consideration for providing such a loan is the interest. An EMI is a fixed amount paid by a borrower to a lender at a specified date every calendar month. EMIs are used to pay off both interest and principal every month so that over a specified period, the loan is fully paid off along with interest. Such interest is to be paid for the first time when it becomes due. It is covered under entry no 27 of Notification No. 12/2017- Central Tax (Rate). Hence the rate of tax on such interest is Nil.

Interest and the penal fee charged by the bank on non-payment of EMI on the due date

Whenever the EMI is not paid by the person on the due date, there is a levy of additional/penal interest on account of the delay in payment of EMI by the bank. This additional interest or fee is levied on the unpaid EMI, hence it will attract GST as per section 15(2) d.

As per the provisions of sub-clause (d) of sub-section (2) of section 15 of the CGST Act, the amount of late fee/penal/ additional interest is to be included in the value of supply.

Related Topic:

Memorandum To Hon. FM On GST Problems

Payment of any goods or service in the form of EMIs

Case – 1: X sells a mobile phone to Y. The cost of a mobile phone on cash payment is Rs 40,000/-. However, X gives Y an option to pay in installments, Rs 11,000/- every month before the 10th day of the following month, over the next four months (Rs 11,000/- *4 = Rs. 44,000/- ). Further, as per the contract, if there is any delay in payment by Y beyond the scheduled date, Y would be liable to pay additional/penal interest amounting to Rs. 500/- per month for the delay. X is charging YRs. 40,000/- for the mobile and is separately issuing another invoice of Rs 4000/- for providing the services of extending loans to Y, the consideration for which is the interest of 2.5% per month and an additional/penal interest amounting to Rs. 500/- per month for each delay in payment.

GST liability- In this situation, GST will not be levied on the interest portion of 4000 as it is covered under entry no 27 of Notification No. 12/2017- Central Tax (Rate). It implies that X has advanced a loan to Y of Rs 40000 to purchase the mobile phone. But if Y fails to pay the installment on time, then the penal interest of Rs 500 will attract GST.

Related Topic:

Important amendments in GST via 15/2021 in refund, registration, and forms

Case – 2: X sells a mobile phone to Y. The cost of a mobile phone is Rs 40,000/-. Y has the option to avail of a loan at an interest of 2.5% per month for purchasing the mobile from M/s ABC Ltd. The terms of the loan from M/s ABC Ltd. allow Y a period of four months to repay the loan and an additional/penal interest @ 1.25% per month for any delay in payment. 4.

GST viability- In this situation, GST will not be levied on the interest portion (2.5%) which is against the principle of Rs 40000. But if Y is unable to pay in time, then GST will be levied on the penal interest of 1.25%.

Interest charged by the credit card company If a person is unable to pay the balance amount on time, the credit card company charges interest on the balance amount @3%. If he is unable to pay even the minimum amount, then a penal charge is also levied. According to the Proviso in entry No. 27, the interest amount will attract GST and the penal charge will also attract GST because of Sec 15(2) d

Note-It is further clarified that the transaction of levy of additional/penal interest does not fall within the ambit of entry 5(e) of Schedule II of the CGST Act i.e. “agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act”, as this levy of additional/penal interest satisfies the definition of “interest” as contained in notification No. 12/2017- Central Tax (Rate) dated 28.06.2017

J) Services provided by the Central/state/ various govt agencies Notification No. 12/2017- Central Tax (Rate) entry No. 65

| 65 | Heading 9991 | Services provided by the Central Government, State Government, Union territory by way of deputing officers after office hours or on holidays for inspection or container stuffing or such other duties in relation to import export cargo on payment of Merchant Overtime charges. | Nil |

We have already seen that penal/additional late fees and interest because of delay in payment forms a part of supply and attracts GST.

Therefore you can see that penal interest and the late fee charged by the government does not attract GST as its rate is nil, whereas the same penal interest and the late fee charged by the banks and other financial institutions have GST levied on it.

Related Topic:

GST SAC Code For Real Estate Services

K) Various rulings of AARs on Liquidated Damages In GST, favoring its inclusion in entry No 35 as per clause 5(e) of schedule II

(i) 2018 (13) G.S.T.L. 177 (A.A.R. – GST) = 2018 (5) TMI 1332 – AUTHORITY FOR ADVANCE RULING – MAHARASHTRA IN RE : MAHARASHTRA STATE POWER GENERATION COMPANY LIMITED

In this case, the Applicant had entered into contracts with various contractors for “construction and renovation of its power plants” and “operation and management activities”.

The Applicant had the authority to collect liquidated damages from the supplier in case of deficiency in services owing to the terms of the covenant. Moreover, the contract provided that if a contractor failed to pay any amount of damages or costs to the Applicant, it could deduct such amount from the future consideration payable to the contractor which could be pertaining to some other contract.

The Applicant had approached the AAR for a ruling, inter alia, on whether GST is applicable on such liquidated damages, and if GST applies, whether it is covered under Schedule II entry no. 5(2)(e) under HSN Code 9997 – Other Services at the rate of 18%;

The Maharashtra Authority for Advance Ruling (“AAR”) held that Goods and Services Tax (“GST”) at the rate of 18% would be payable on liquidated damages (“LD”) received by the Applicant for delayed supply/unsatisfactory performance under a contract. The AAR has considered LD to be a consideration for agreeing to the obligation to tolerate an act or a situation, which is treated as a supply of service under para 5(e) of Schedule II of the Central Goods and Services Act, 2017 (“CGST Act”)

The Applicant had relied on the definition of “value of taxable supply” under Section 15 of the GST Act and concluded that the net transaction value would be calculated by reducing the amount of LD from the gross contract price. The Applicant placed reliance on the rulings of Customs, Excise and Service Tax Tribunal (“CESTAT”) in the cases of Commissioner of Chandigarh v. M/s HFCL and Commissioner of Customs and Central Excise v.Victory Electricals Ltd- where it was held that LD reduces the contract price for the purpose of levying excise duty. Applicant argued that these rulings are based on the definition of ‘transaction value’ under the erstwhile Central Excise Act, 1944, which is similar in its construction to the definition of “value of taxable supply” under the GST Act.

When this matter reached the Appellate authority, the ruling of the AAR was upheld.

2018 (17) G.S.T.L. 451 (App. A.A.R. – GST) = 2018 (9) TMI 1185 – APPELLATE AUTHORITY FOR ADVANCE RULING MAHARASHTRA IN RE: MAHARASHTRA STATE POWER GENERATION COMPANY LIMITED

Similar Rulings are made by AAR in the following cases.

(ii) In re M/s. North American Coal Corporation India Private Limited (GST AAR Maharashtra); Advance Ruling No. GST-ARA-07/2018-19/B-63; 11/07/2018

(iii) In re Rashtriya Ispat Nigam Ltd (GST AAR Andhra Pradesh); Advance Ruling No. AAR 01/AP/GST/2019; 11/01/2019

(iv) In re M/s. Dholera Industrial City Development Project ltd. (GST AAR Gujarat); Advance Ruling No. GUJ/GAAR/R/2019/06; 04/03/2019

(v) In re Bajaj Finance Limited (GST AAAR Maharashtra); Order No. MAH/AAAR/SS-RJ/24/2018-19; 14/03/2019

Related Topic:

Compliances of GST in Banking Sector: ICAI

Does the question arise why the applicant felt the need to go for an advance ruling?

There existed a lack of clarity, whether this failure to adhere to timelines by the supplier would be treated as a breach of contract and the amount received from the supplier or deducted by the recipient from the supplier’s balance payment would be treated as liquidated damages; Or it would be treated as a condoning fee to tolerate the act of late supply of service. Treating the said amount as some kind of consideration against the provision of service of, “tolerating the act of failure to adhere to timelines” is contradictory to the legal and commercial understanding of Liquidated Damages as a measure of compensation for a pre-estimated loss from breach of contract.

(vi) Re: M/s Amneal Pharmaceuticals Pvt. Ltd., Advance Ruling no. GUJ/GAAR/R/51/2020 dated 30 July 2020

AAR (Gujarat) ruled that notice pay recovery is taxable under GST (Clause 5(e) to Schedule II of CGST Act) as the employer has tolerated the act of the employee of not serving the notice period which was the employee’s contractual obligation.

Note:

- However, AAR is in different states. There may be a situation where the interpretation/ ruling of the AAR of a state may be contradictory to the interpretation/ ruling of the AAR of another state. Hence there may not be uniformity in the decisions made by the AARs across the country on similar matters.

2. Some AARs have failed to appreciate the fact that Entry 5(e) to Schedule II of CGST Act is akin to Section 66E(e) of Finance Act, 1994.

3. Furthermore, Advance Rulings do not form a precedent and are applicable only to the Applicant who has sought such Advance Ruling. Therefore the decisions and observations of various Tribunals and High Courts still hold valid under the GST regime.

L) Case laws where the Appellate Tribunal took a contrarian view of the above

(i) Ruchi Soya Industries Ltd Vs Commissioner of Customs (CESTAT Delhi)

Facts of the case

The Appellant M/s Ruchi Soya Industries Ltd had established a project for generating electricity using wind energy consisting of one Suzlon-made Wind Turbine Generator (WTG). The contract for the maintenance of that generator was given to M/s. Suzlon Global Services Ltd. (SGSL). There was a clause in the said agreement that in case the Machine Availability (WTG) falls between below 95.5% and up to 92.5 %, then the M/s. SGSL shall compensate the owner an amount from the service charges recovered, so as to make good for an annual average machine availability of 95.5% per year. The amount received was Rs.1.33 crores from M/s. SGSL during the period 2015-16 which was in accordance with the Maintenance Agreement dated 17.12.14.

The department opined that this amount is a consideration for service covered under ‘Declared Services’ defined under, section 66E clause (e) of Finance Act as explained by section 65 B(44) of Finance Act,1994 i.e (e)” agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act .”

The department issued a show-cause notice bearing No. 3185 dated 1.12.17 to the appellant, for the recovery of the Service tax of Rs.19,34,212/- on the said amount along with appropriate interest and the proportionate penalties. This proposal was confirmed via the order-in-original No. 27 of 2018-19 dated 12.10.2018.

Related Topic:

List of SAC’s for CA Professionals for GST

The ruling of the Tribunal

The appellate tribunal ruled that the amount received by the appellant in terms of the Machine Availability clause, from the service provider with reference to the maintenance of the WTG due to shortcoming in the said service is merely an amount to safeguard the loss of the appellant. The said amount cannot be called as consideration for the service of ‘tolerance to the machine availability falling below the benchmark’. This does not make the recipient of service into a service provider. The intention of this Machine Availability clause is to assure the recipient that the service supplier is fully capable of providing the service, for creating a benchmark of the level of service, and has the best interest of the recipient at his heart. It is to ensure that the terms of the agreement shall not be violated and that the service provider shall not compromise the quality of service. The intention of this clause was never to gain any consideration, by invoking the said clause.

Moreover, the recipient has already paid the service tax on the invoices raised by the supplier and hence there is no question of again paying the tax on the same amount.

(ii) South Eastern Coalfields Ltd Vs Commissioner of Central Excise Final order No. 51651 of 2020 Service Tax Appeal No. 50567 of 2019

Facts of the case

The appellant is a subsidiary of Coal India Ltd. It is engaged in the business of mining and selling coal, which is an excisable good. It has entered into various contracts during the course of business, having certain clauses providing a penalty for non-observance/ breach of the terms of the contract. These clauses have been provided to safeguard the interest of the appellant. The appellant had collected the following amounts;

- an amount towards compensation/penalty from the buyers of coal on the short lifted/un-lifted quantity of coal;

- collected amount towards compensation/penalty from the contractors engaged for breach of terms and conditions

- collected amount in the name of damages from the suppliers of material for breach of the terms and conditions of the contract.

According to the Department, this amount charged by the appellant during the period from July 2012 to March 2016 appeared to be taxable as a declared service under section 66E (e) of the Finance Act 1994 A show cause notice dated April 10, 2017, was issued to the appellant under section 73(1) of the Finance Act

The ruling of the Tribunal

The Hon’ble Delhi CESTAT, while setting aside the demand of Service Tax, inter-alia observed that,

The entry 66E(e) has three parts, which are;

- agreeing to the obligation to refrain from an act,

- to tolerate an act or a situation

- to do an act

According to this declared service entry, the scope of levy of service tax has been widened to the extent that, the tax would apply to even a situation where the actual activity of supply of service is nonexistent and consequently a person would be required to pay tax even for not doing anything. Even if a person refrains from doing a particular activity for which a consideration is received or receivable, such consideration would be taxed.

Related Topic:

Important changes in GST Return, Interest, and Rules

Thus, it is evident that as per the law, the action of restraining oneself with financial gain would constitute a service under the perception of declared Service

Thus, it is clear that the essence of service is not required in the case of Declared Service relating to the activity of “agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act.”

The amounts collected by the Appellant were applicable to be described under the said entry. But the tribunal relied on a more profound concept of law i.e. ‘means rea’ or ‘Intention’

The intention of the appellant and the parties was for the supply of coal; for the supply of goods; and for availing various types of services. The consideration contemplated under the agreements was for such supply of coal, materials or for availing various types of services. The intention of the parties certainly was not for flouting the terms of the agreement so that the penal clauses get attracted. The business activity in accordance with the contracts was the primary source of consideration.

The penal clauses are in the nature of providing a safeguard to the commercial interest of the appellant and it cannot, by any stretch of the imagination, be construed that recovering any sum from the counterparty, by invoking the penalty clauses is the reason behind the execution of the contract. It is not the intention of the appellant to impose any penalty upon the other party nor is it the intention of the other party to get penalized. Hence the demand notice was revoked.

(iii) M/s Lemon Tree Hotel v. Commissioner, Goods & Service Tax, Central Excise & Customs (Delhi CESTAT) – Final Order No. 50820/2019 dated 08 March 2019

Facts of the case

The Appellant, in the course of their business of running a hotel, has offered advance booking to its customers, on payment of rent or deposit. In the event of cancellation or of no show, i.e. if the guest does not come for a stay, the Appellant retains the full or part of the amount towards cancellation charges.

The appellant paid the requisite service tax upon the retained amount, for the provision of Accommodation services by availing the benefit under permissible abated value. The revenue department demanded Service tax on the Gross amount retained by the Appellant under Section 66E(e), by holding that such amount is received by the Appellant since the customers had not availed the said services, which the Appellant has tolerated.

The ruling of the Tribunal

The Hon’ble CESTAT observed that the customers pay an amount to the Appellant in order to avail themselves of the hotel accommodation services. The appellant also keeps his services ready for the customers to come and avail themselves. It is not in the hands of the appellant if the customers are unable to consume them by not coming on the reserved dates. There is no restriction or hindrance from his side for their availability.

Hence it does not change the nature of the amount collected. It was held that the retention amount (on cancellation made) by the Appellant does not undergo a change after receipt and thus, the gross amount was not taxable under Section 66E(e).

(iv) Bai Mamumbai Trust And 2 Ors vs Suchitra Wd/Of Sadhu Koraga … on 13 September 2019 Bombay High court

Facts of the case

In this case, the premises owned by the plaintiff was illegally occupied by the defendant. The court-appointed a receiver, who took formal possession of the premises, but the physical possession remained with the defendant. The receiver fixed a royalty/ compensation of 45000 per month to be paid by the defendant. The question arose whether such royalty/ compensation was under the ambit of GST.

Verdict

The Bombay High Court held that in circumstances of violation of a legal right, and the compensation paid to make right for such a violation of a legal right, was not considered a ‘supply’ under Section 7 of the CGST Act. Such payment made in the nature of damages and the doctrine of ‘supply’ did not encompass wrongful unilateral acts that resulted in the payment of damages.

These damages were not predetermined. They were not given voluntarily by the defendant. The court had to intervene for the grievance redressal of the plaintiff. The plaintiff had not agreed that the defendant should occupy that premises. It was a unilateral act by the defendant.

Related Topic:

GST Case 6- Saji s. v. Commissioner, State GST Department

The court’s order to direct payment/damages was to bring the plaintiff in an equitable position with respect to the defendant. Moreover, there were no enforceable reciprocal obligations that were essential to make it a supply under GST.

Note- Hence we can conclude that for the liveability of GST, it has to be a bilateral, voluntary agreement to be covered under the definition of supply. Awards given by the court for a legal injury are not covered under the ambit of GST.

(v) Amit Metaliks Limited Vs Commissioner of Central Goods & Service Tax (CESTAT Kolkata)

Facts of the case

The appellant, Amit Metaliks Limited received a sum of Rs. 1,97,50,000/- for non supply of manganese ore on account of rate difference from M/s Amit Mines Limited. It further received an amount of Rs. 45,08,09,200/ as per ‘Settlement Agreement’ from different companies for a ‘Development Agreement’ dated May 21, 2010, with 31 different companies for the development of land and construction of premises thereon.

Demand for service tax along with interest and penalty was issued by the department, holding that Rs. 1,97,50,000/- taxable under the provisions of Section 65B (44) of the Finance Act1994 under sub-heading 65 b(44)(A)(iii). Also Rs. 45,08,09,200/ was taxable under sec 66E. This demand had been raised in terms of Show Cause Notice, F No. 99/KZU/KOL/GR.C/14 dated 28/12/2016, issued by the Directorate General of Central Excise Intelligence for the period 2012-13.

Verdict

The Tribunal held that payments received towards the compensation for non-performance of contract would not be within the definition of Section Section 65B (44) of the Finance Act 1994 under sub-heading 65 b(44)(A)(iii) of the Taxation of Liquidated Damages. Also, section 66E was introduced on 1.7.2012. All The transactions related to the settlement agreement and development contracts were completed before that period. Hence it was also not taxable. As any new law has to be construed prospectively unless expressed otherwise.

Related Topic:

Draft disclosures in GST audit report

CONCLUSION

Sometimes, In their zeal of tax collection, the authorities overrule the essence and purpose of the law, nature of the transaction and go relentlessly after the taxpayer without caring for the consequences. This is termed as Tax terrorism rather than Tax rationalization.

There should be a distinction between liquidated damages and penalties in the GST act and the contracts entered by the parties to bring clarity on the tax treatment of that amount. The penalty can be taxed and liquidated damages should be left out of the scope of GST.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.