GST on secondment of employees -SC judgment and instruction of CBIC

Table of Contents

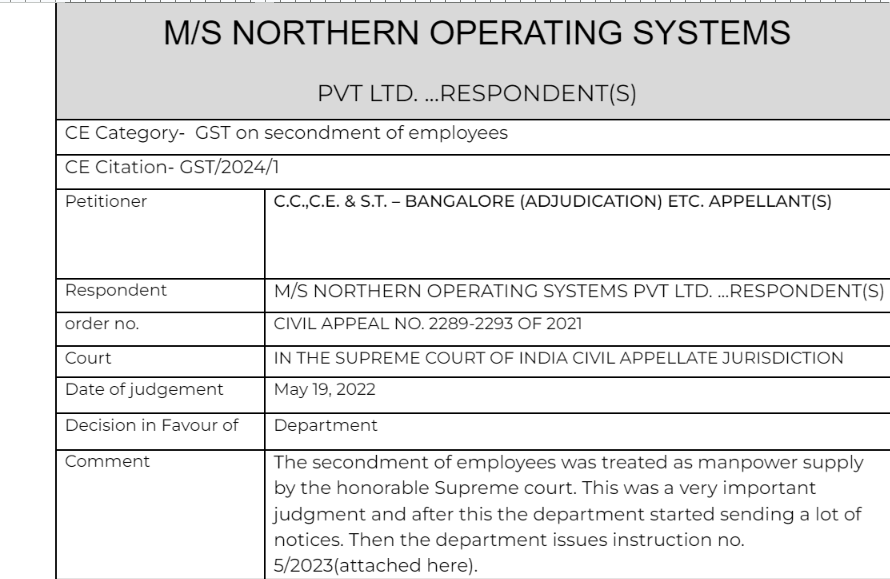

Comment

The secondment of employees was treated as manpower supply by the honorable Supreme court. This was a very important judgment and after this the department started sending a lot of notices. Then the department issues instruction no. 5/2023(attached here).

Details of the case

Citation

Volkswagen India Pvt. Ltd,Commissioner of Income Tax v. M/s. Eli Lilly & Company India Pvt. Ltd.,Smt. Savita Garg v. The Director, National Heart Institute13; Workmen of Nilgiri Cooperative Marketing Limited v. State of Tamil Nadu & Ors.14; Silver Jubilee Tailoring House v. Chief Inspector of Shops15; Hussain Bhai Calicut v. Alath Factory Thozhilali16 and Sushilaben Indravadan Gandhi v. New India Assurance Co. Ltd.17,Collector of Central Excise & Service Tax v. Nissin Brake India (P) Ltd,Intercontinental Consultants and Technocrats Pvt. Ltd. v. Union of India,SRF Ltd. v. Commissioner21 and Commissioner of Central Excise v. Coca Cola India Pvt. Ltd,Director Income Tax v. M/S Morgan Stanley & Co. Inc,M/s Eli Lilly, Netherlands B.V. and Ranbaxy Laboratories (Ltd.),Honeywell Technology Solutions Pvt. Ltd. v. CST, Bangalore,Volkswagen India Pvt. Ltd. v. CCE, Pune,Computer Sciences Corporation India Pvt. Ltd. v. Commissioner of Service Tax, Noida,Dharangadhara Chemical Works Ltd. v. State of Saurashtra,D.C. Dewan Mohideen Sahib and Sons v. Secretary, United Beedi Workers’ Union,Silver Jubilee Tailoring House v. Chief Inspector of Shops & Establishments,Indian Banks Association v. Workmen of Syndicate Bank36 and Indian Overseas Bank v. Workmen,State of Orissa v. Titaghur Paper Mills Co. Ltd,Prakash Roadlines (P) Ltd. v. Oriental Fire & General Insurance Co. Ltd,Volkswagen and Computer Sciences Corporation,Cosmic Dye Chemical v. Collector of Central Excise,Escorts v. Commissioner of Central Excise42 , Commissioner of Customs v. Magus Metals4

Pleading

The Commissioner of Central Excise and Service Tax (hereafter variously described as “the revenue” or “the appellant”) has preferred appeals1 , directed against the impugned orders of the Customs, Excise and Service Tax Appellate Tribunal (hereafter “CESTAT”)2 which set aside two orders dated 03.03.2014 and 04.03.2014 by the Commissioner of Service Tax (hereafter “the Commissioner”). The Commissioner had confirmed demands, made through show cause notices, for service tax along with interest and penalty. The commissioner had discharged, by an order (dated 27.02.2017/16.06.2017) the proceedings arising from another show cause notice (hereafter “SCN”) in respect of a similar demand. That led to the revenue’s appeal to CESTAT, challenging that order, discharging proceedings initiated by the revenue for the subsequent period. The CESTAT, by its common order, rejected the revenue’s appeals, and allowed that of the respondent, Northern Operating Systems (Pvt.) Ltd. (hereafter “the assessee” or “NOS”).

Facts

The assessee was registered with the revenue, as a service provider under the categories of “Manpower Recruitment Agency Service”, “Business Auxiliary Service”, “Commercial Training and Coaching Service”, “TTSS”, “Telecommunication and Legal Consultancy Service” etc., under the Finance Act, 1994 (hereafter “the Act”). Following an audit of the records by the revenue’s officials, proceedings were initiated against the assessee alleging non-payment of service tax concerning agreements entered into by it with its group companies located in USA, UK, Dublin (Ireland), Singapore, etc. to provide general backoffice and operational support to such group companies.

As a matter of fact, the assessee issues the prescribed forms to the seconded employees, in terms of the Income Tax Act, 1961 (hereafter “IT Act”). Those individuals too file income tax returns and contribute to the provident fund. Furthermore, NOS remits the above amounts in foreign exchange, which are reflected in its financial statements. The assessee is reimbursed (by the foreign entity, Northern Trust Company – hereafter described as such) for the amounts it pays as salaries, to these seconded employees. The assessee pays for certain services received from the group companies. The assessee used to discharge service tax on payments for such services in terms of Section 66A of the Act. The appropriate major expense heads were ‘Salaries & Allowances’, ‘Relocation expenses’, ‘Consultancy Charges’, ‘Communication Expenses’ and ‘Computer Maintenance and repairs.’ The revenue issued four show cause notices3 alleging that the assessee failed to discharge service tax under the category of “manpower recruitment or supply agency service” with regard to certain employees who were seconded to the assessee by the foreign group companies. The first two of these notices also invoked the proviso to Section 73 (1) read with Section 66A of the Act, proposing to demand service tax for the extended period. The assessee resisted these notices, refuting the allegations in the four SCNs. It was also given a hearing. By two orders4 the commissioner confirmed the proposals in the notice (except the demand for the period from April 2006 to September 2006) accepting the fact that part of the demand has been raised @ 12.3% instead of 10.3%. The Commissioner confirmed the demand, holding that firstly, providing skilled manpower, on secondment basis, is manpower recruitment or supply agency service in the meaning of Section 65(68) read with Section 65(105) (k) of the Act.

Observation

Observation of Honourable Supreme Court in M/S NORTHERN OPERATING SYSTEMS Judgment- In light of the above, the revenue’s appeals succeed in part; the assessee is liable to pay service tax for the periods spelt out in the SCNs. However, the invocation of the extended period of limitation, in this court’s opinion, was unjustified and unreasonable. Resultantly, the assessee is held liable to discharge its service tax liability for the normal period or periods, covered by the four SCNs issued to it. The consequential demands therefore, shall be recovered from the assessee. The impugned common order of the CESTAT is accordingly set aside. The commissioner’s orders in original are accordingly restored, except to the extent they seek to recover amounts for the extended period of limitation. The demand against the assessee, for the two separate periods, shall now be modified, excluding any liability for the extended period of limitation.

Read copy of[C.C.,C.E. & S.T. – BANGALORE vs M/S NORTHERN OPERATING SYSTEMS PVT LTD]

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.