GST on purchase from unregistered dealer

GST on purchase from unregistered dealer

Edit on 30.06.2017: A new notification is issued by the CBEC which says that daily limit for chargeability of this levy will be Rs. 5000 per day and a consolidated invoice can be prepared.(Click here to see notification)

[embedyt] https://www.youtube.com/watch?v=URAN5gebLfY[/embedyt]

With the changes in the definition of levy the threshold limit will be technically ineffective. The buyer will have to pay GST on purchase from unregistered dealer. Section 9 of GST Act provide for the levy of GST. Subsection 4 of section 9 read as:

“(4) The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on

reverse charge basis as the recipient and all the provisions of this Act shall apply to such

recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both”

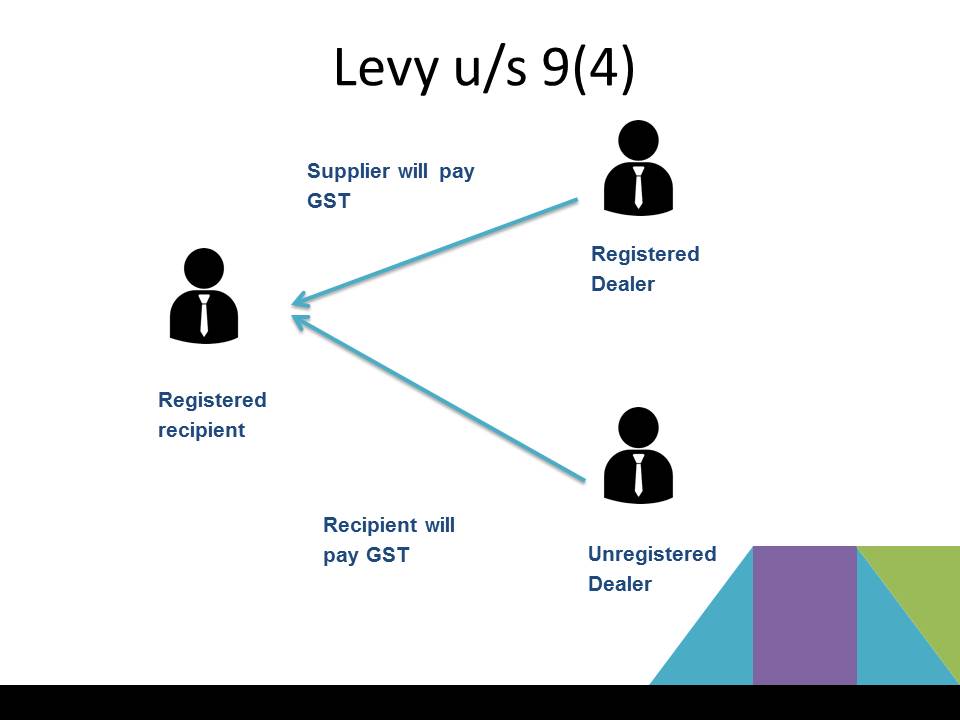

On reading of this pat of section we can divide all supplies into four parts:

- Supply by a registered taxpayer to a registered taxpayer. (Taxable)

- Supply by a registered taxpayer to an unregistered taxpayer (Taxable)

- Supply by an unregistered taxpayer to a registered taxpayer (Taxable)

- Supply by an unregistered taxpayer to an unregistered taxpayer( No taxable)

Impact of new GST levy for purchase from unregistered taxpayer:

Now every purchase you make will be liable to tax if you are registered. There are two scenarios.

- When you purchase from a registered dealer he will be liable to collect and pay the GST.

- When you purchase from unregistered dealer you will be liable to pay the GST.

This will bring all the supplies in GST net. Only the supply from and unregistered supplier to unregistered buyer will be out of GST scope. Threshold limit for taking registration is Rs. 20 lac but now it will lose its significance. Supplies of even unregistered person will be taxable.

This provisions is going to hurt the small business. In case of purchase from small business the liability to determine the correct tax and to pay it will be on buyer. It will increase the compliance on buyers so they will prefer to purchase from registered taxpayers only. On the other hand it may benefit also. Taxpayer who want to keep the control pf credit in their hands may prefer to buy from unregistered dealers. As in GST compliance is major issue. Non filing of supplier may result in denial of credit to recipient.

Still there is no doubt that this provision will bring all supplies in GST net. This may result in increase in inflation also.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.