GST Returns – One Stop Solution

GST Returns – One Stop Solution

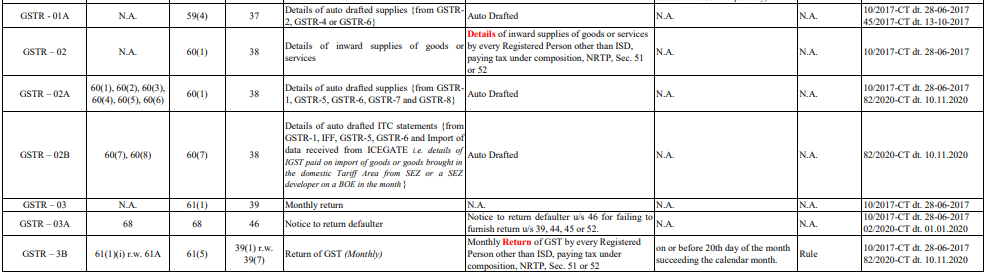

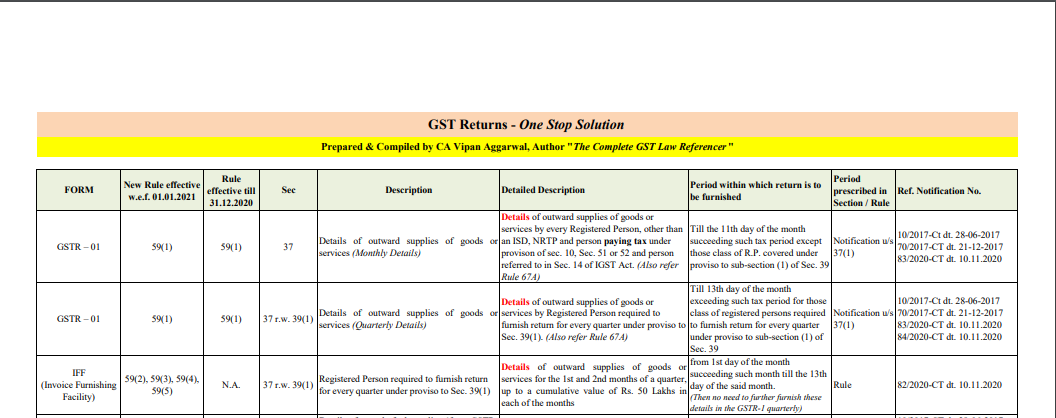

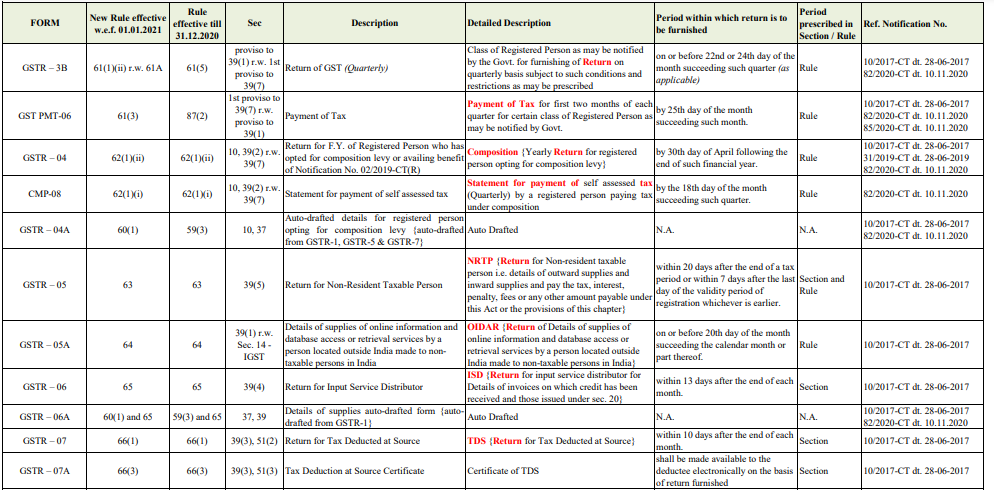

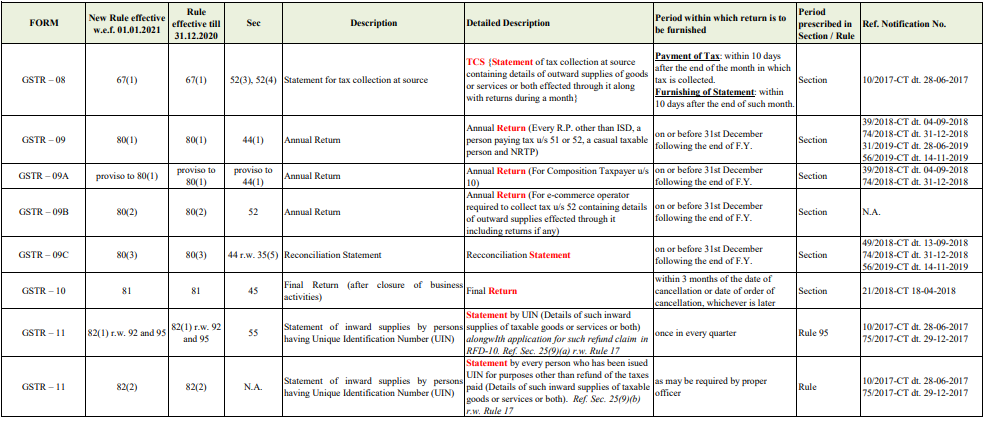

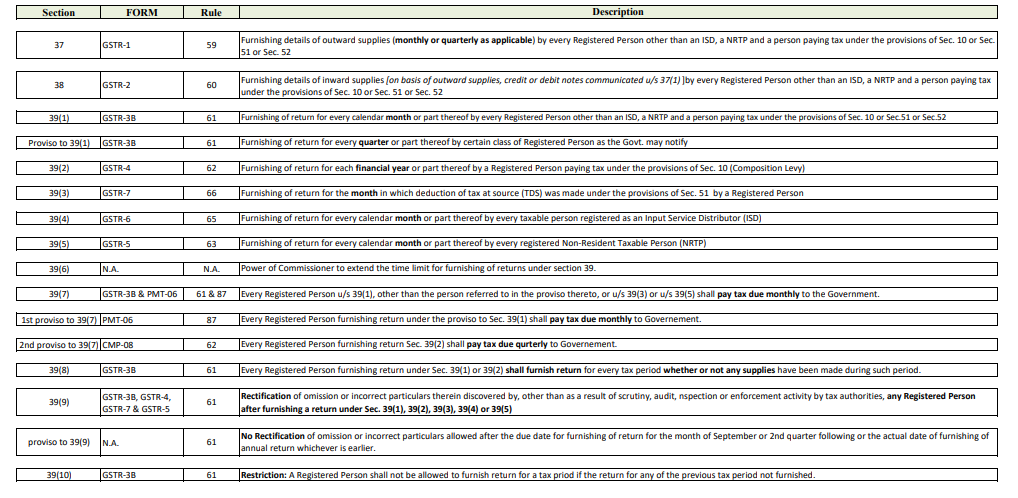

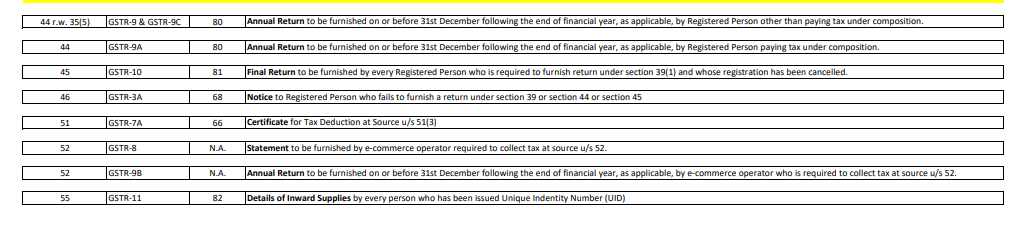

| FORM | New Rule effective w.e.f. 01.01.2021 | Rule effective till 31.12.2020 | Sec | Description | Detailed Description | Period within which return is to be furnished | The period prescribed in Section / Rule | Ref. Notification No. |

| GSTR – 01 | 59(1) | 59(1) | 37 | Details of outward supplies of goods or services (Monthly Details) | Details of outward supplies of goods or services by every Registered Person, other than an ISD, NRTP, and the person paying tax under the provision of sec. 10, Sec. 51 or 52 and person referred to in Sec. 14 of IGST Act. (Also refer Rule 67A) | Till the 11th day of the month succeeding such tax period except for those class of R.P. covered under proviso to sub-section (1) of Sec. 39 | Notification u/s 37(1) | 10/2017-Ct dt. 28-06-2017

70/2017-CT dt. 21-12-2017 |

| GSTR – 01 | 59(1) | 59(1) | 37 r.w. 39(1) | Details of outward supplies of goods or services (Quarterly Details) | Details of outward supplies of goods or services by Registered Person required to furnish a return for every quarter under proviso to Sec. 39(1). (Also refer Rule 67A) | Till 13th day of the month exceeding such tax period for those class of registered persons required to furnish a return for every quarter under proviso to sub-section (1) of Sec. 39 | Notification u/s 37(1) | 10/2017-Ct dt. 28-06-2017

70/2017-CT dt. 21-12-2017 |

| IFF (Invoice Furnishing Facility) | 59(2), 59(3), 59(4), 59(5) | N.A. | 37 r.w. 39(1) | Registered Person required to furnish a return for every quarter under proviso to Sec. 39(1) | Details of outward supplies of goods or services for the 1st and 2nd months of a quarter, up to a cumulative value of Rs. 50 Lakhs in each of the months | from the 1st day of the month succeeding such month till the 13th day of the said month. (Then no need to further furnish these details in the GSTR-1 quarterly) | Rule | 82/2020-CT dt. 10.11.2020 |

| GSTR – 01A | N.A. | 59(4) | 37 | Details of auto drafted supplies {from GSTR2, GSTR-4 or GSTR-6} | Auto Drafted | N.A. | N.A. | 10/2017-CT dt. 28-06-2017

45/2017-CT dt. 13-10-2017 |

Disclaimer

This document has been prepared for academic use only to share with fellow professionals and all concerned about the related provisions of the GST Law. Though every effort has been made to avoid errors or omissions in this document yet any error or omission may creep in. Therefore, it is notified that I shall not be responsible for any damage or loss to anyone, of any kind, in any manner therefrom. I shall also not be liable or responsible for any loss or damage to anyone in any matter due to the difference of opinion or interpretation in respect of the text. On the contrary, it is suggested that to avoid any doubt the user should cross-check the correct law and the contents with the published/notified / Gazetted materials including the referred amended provisions.

Read & Download the full Copy in pdf:

CA Vipan Aggarwal

CA Vipan Aggarwal