GSTN Has Released FAQs On Filing Nil GSTN-1 Through SMS

Table of Contents

- 1. When can Form GSTR-1 be filed as Nil?

- 2. Who can file Nil Form GSTR-1?

- 3. Is filing of Form GSTR-1 as Nil return mandatory?

- 4. From when can I file Nil Form GSTR-1 for a tax period?

- About Filing Nil Form GSTR-1 through SMS

- 5. Can I file Nil Form GSTR-1 through SMS, instead of filing online through GST Portal?

- 6. Who is eligible to file Nil Form GSTR-1 through SMS?

- 7. Who is authorized to file Nil Form GSTR-1 through SMS, on behalf of the taxpayer?

- 8. I am an Authorized Signatory and my mobile number has been registered for more than one GSTIN. Can I file Nil Form GSTR-1, through SMS for all GSTINs?

- 9. My Authorized Signatories have been reset by the Tax Official. Can I file Form GSTR-1 Nil return through SMS?

- Help SMS Format

- 10. How do I get help on Nil Form GSTR-1 filing through SMS?

- Filing Nil Form GSTR-1 through SMS

- 11. How can I file Nil Form GSTR-1 through SMS?

- 12. I have saved my data/summary for a particular return period on the GST Portal. Can I file Nil Form GSTR-1 through SMS for that period?

- 13. Is there any difference in filing Nil Form GSTR-3B and Form GSTR-1 through SMS?

- Verification Code

- 14. What is the validity of the Verification Code?

- 15. The verification code consists of how many digits?

- 16. Can I use Verification Code multiple times?

- 17. Is SMS text case sensitive, in case of filing Nil Form GSTR-1 through SMS?

- 18. I have received a message that my mobile number has been blocked for 24 hours. Why?

- 19. I have sent the correct Verification Code, but I have received SMS that the code is not valid. Why?

- Post Filing of Nil Form GSTR-1 through SMS

- 20. What will happen after the successful filing of Nil Form GSTR-1, through SMS?

- 21. I have filed Nil Form GSTR-1 through SMS. Do I need to log in again to the GST Portal to file Nil Form GSTR-1?

- 22. I have filed Nil Form GSTR-1 through SMS. Can I revise the filed return for the requested tax period?

- 23. From where can I track the status of my filed Form GSTR-1 return?

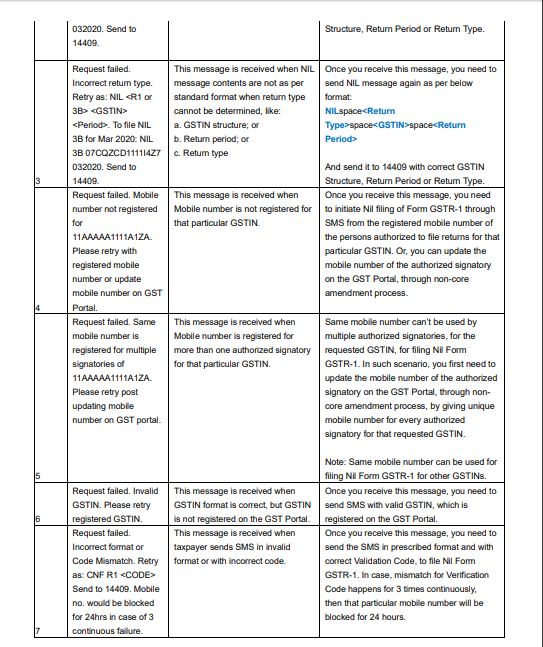

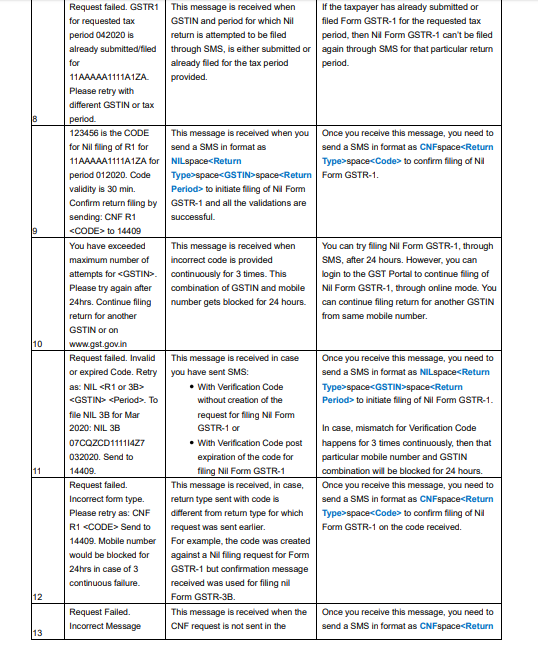

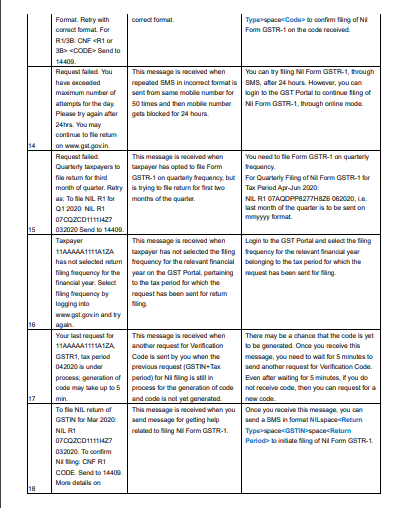

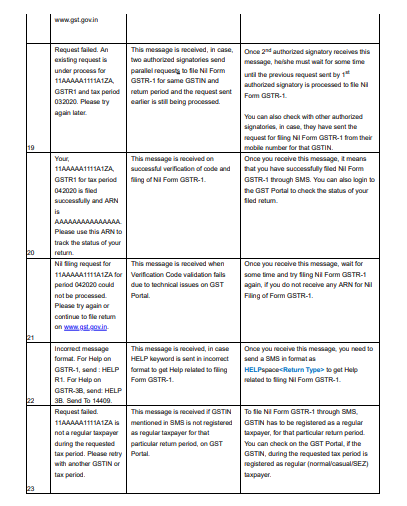

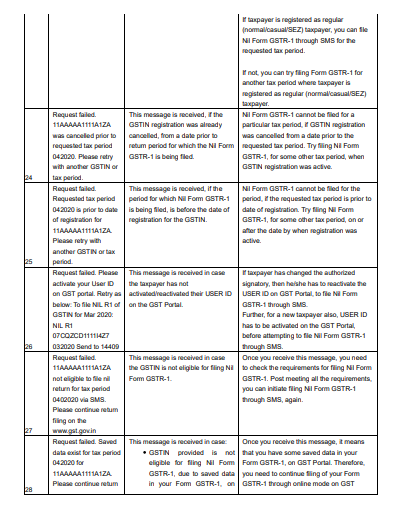

- Error Messages, Description, and Solution

- 24. What are the various error messages, their description, and solution?

- Read the copy:

1. When can Form GSTR-1 be filed as Nil?

Form GSTR-1 can be filed as a nil return if there are no outward supplies (including supplies on which tax is to be charged on a reverse charge basis, zero-rated supplies, and deemed exports) during the month or quarter, for which the return is being filed for.

2. Who can file Nil Form GSTR-1?

Nil Form GSTR-1 for a tax period can be filed, if:

- There are no Outward Supplies (including supplies on which tax is to be charged on a reverse charge basis, zero-rated supplies and deemed exports) during the month or quarter for which the return is being filed for

- No Amendments is to be made to any of the supplies declared in an earlier return

- No Credit or Debit Notes is to be declared/amended

- No details of advances received for services is to be declared or adjusted

3. Is filing of Form GSTR-1 as Nil return mandatory?

Filing of Form GSTR-1 is mandatory for all normal (including SEZ Unit & SEZ developer) and casual taxpayers, even if there is no business activity in any particular tax period. So, for such tax period(s), the return can be filed as NIL (if all conditions for filing Nil return are satisfied).

4. From when can I file Nil Form GSTR-1 for a tax period?

A taxpayer can file Nil Form GSTR-1, anytime from 1st of the month subsequent to the tax period onwards. For example, Form GSTR-1 for the calendar month of April can be filed from 1st May onwards. Form GSTR-1 for the quarter of April to June can be filed from 1st July onwards.

About Filing Nil Form GSTR-1 through SMS

5. Can I file Nil Form GSTR-1 through SMS, instead of filing online through GST Portal?

Yes, you can file Nil Form GSTR-1 through SMS, instead of filing it through online mode on GST Portal.

6. Who is eligible to file Nil Form GSTR-1 through SMS?

Any taxpayer who fulfills below conditions are eligible to file Nil Form GSTR-1, through SMS:

- The taxpayer must be registered as Normal taxpayer/ Casual taxpayer/ SEZ Unit / SEZ Developer and must have a valid GSTIN

- Taxpayer must have opted for the filing frequency as either monthly or quarterly on the GST Portal

- Authorized signatory and his/ her phone number must be registered on the GST Portal.

- There must not be any data in the saved or submitted stage in the online version of Form GSTR-1, on the GST Portal.

7. Who is authorized to file Nil Form GSTR-1 through SMS, on behalf of the taxpayer?

All the authorized representatives, for a particular GSTIN, are allowed to file Nil Form GSTR-1 through SMS.

Note:

- If more than one Authorized Signatories/ Representatives have the same mobile number registered on the GST Portal, such Authorized Signatories cannot file Nil Form GSTR-1 through SMS. In such a scenario, Authorized Signatory first needs to update their mobile number on the GST Portal, through the non-core amendment process, by giving a unique mobile number for every authorized signatory for that requested GSTIN.

- Any Authorized Signatory/ Representative with a unique mobile number registered on the GST Portal, can file Nil Form GSTR-1 through SMS.

8. I am an Authorized Signatory and my mobile number has been registered for more than one GSTIN. Can I file Nil Form GSTR-1, through SMS for all GSTINs?

Yes, you can file Nil Form GSTR-1, through SMS for all GSTINs, for whom you are an Authorized Signatory, from the same mobile number.

9. My Authorized Signatories have been reset by the Tax Official. Can I file Form GSTR-1 Nil return through SMS?

In case, your Authorized Signatories have been reset by the Tax Official, you need to first reactivate your User ID by navigating to GST Portal > Login > here link. Click here to know more about it.

Post reactivating your User ID, you can file Nil Form GSTR-1 through SMS.

Help SMS Format

10. How do I get help on Nil Form GSTR-1 filing through SMS?

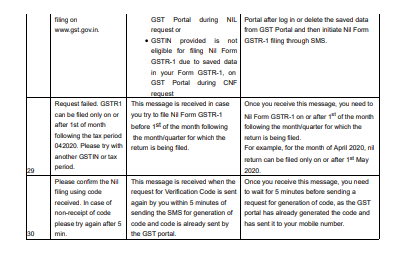

You need to send SMS in below format to get help related to filing Nil Form GSTR-1 through SMS to 14409:

SMS Format: HELP space<Return Type>

Example: HELP R1

Filing Nil Form GSTR-1 through SMS

11. How can I file Nil Form GSTR-1 through SMS?

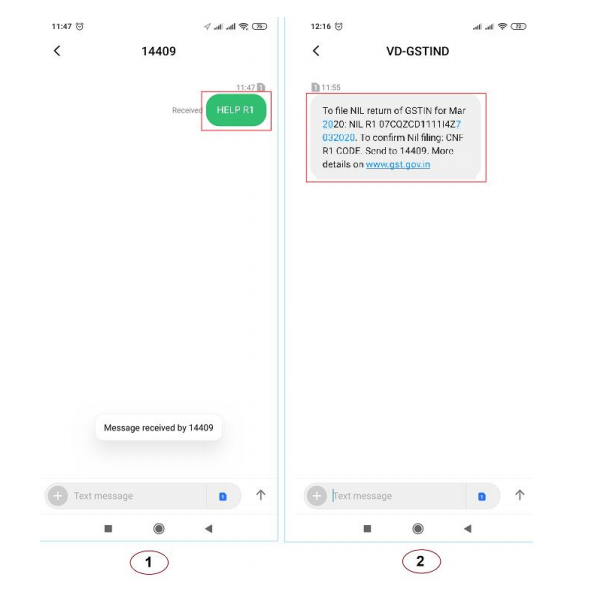

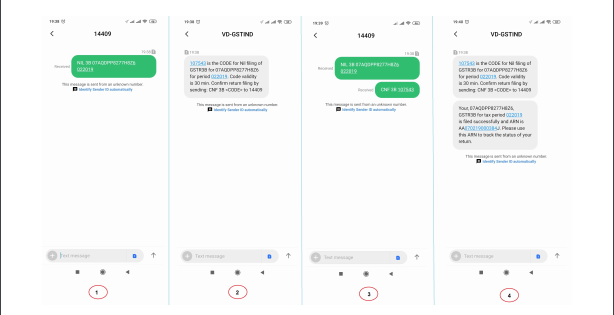

To file Nil Form GSTR-1 through SMS, follow the below-mentioned steps. Let’s take an example that you need to file Nil Form GSTR-1 through SMS for a GSTIN 07AQDPP8277H8Z6 for tax period April 2020 (monthly).

Note: The example also contains steps for filing Form GSTR-1 for quarter April to June 2020 for the same GSTIN for user information.

| S.No. | Step-List | SMS Format | Example |

| 1. | Send SMS to 14409 number to file Nil Form GSTR-1. | NILspace<Return Type>space<GSTIN>space<Return Period> |

For Monthly Filing of Nil Form GSTR-1 for Tax Period April 2020: NIL R1 07AQDPP8277H8Z6 042020 For Quarterly Filing of Nil Form GSTR-1 for Tax Period Apr-Jun 2020: NIL R1 07AQDPP8277H8Z6 062020 |

| 2. |

After receiving the SMS, GST Portal will check for the validations. Note:

Note: Verification Code is usable only once and will expire within 30 minutes. Please do not share it with anyone. |

||

| 3. |

Send SMS again on the same number 14409 with the Verification Code (For Example: Verification Code received here is 324961) to confirm the filing of Nil Form GSTR-1. Note: Taxpayers are required to compose a new text message to send it to 14409. |

CNFspace<Return Type>space<code> | CNF R1 324961 |

| 4. | After successful validation of the “Verification Code”, GST Portal will send back ARN to the same mobile number and on registered e-mail ID of the taxpayer to intimate successful Nil filing of Form GSTR-1. | ||

The above is illustrated as texts images as given below:

12. I have saved my data/summary for a particular return period on the GST Portal. Can I file Nil Form GSTR-1 through SMS for that period?

You cannot file Nil Form GSTR-1 through SMS, for the tax period, for which you have saved data/summary on the GST Portal. If you have some saved data in your Form GSTR-1 on GST Portal, you need to either file your Form GSTR-1 through online mode on GST Portal or delete the saved data from the portal and then file Nil Form GSTR-1 through SMS.

13. Is there any difference in filing Nil Form GSTR-3B and Form GSTR-1 through SMS?

There is no difference in filing Nil Form GSTR-3B and Form GSTR-1 through SMS except the return type format. The return type format for Form GSTR-3B is 3B and Form GSTR-1 is R1.

| Send SMS to 14409 for | Filing Form GSTR-1 | Filing Form GSTR-3B |

| Getting Help Assistance | Help R1 | Help 3B |

| Filing Nil Return | Monthly Filing – NIL R1 07AQDPP8277H8Z6 042020 Quarterly Filing – NIL R1 07AQDPP8277H8Z6 062020 |

NIL 3B 07AQDPP8277H8Z6 042020 |

| Sending Verification Code | CNF R1 324961 | CNF 3B 324961 |

For help on filing Nil Form GSTR-3B by SMS, click here.

Verification Code

14. What is the validity of the Verification Code?

Verification Code is valid for 30 minutes.

15. The verification code consists of how many digits?

The verification code consists of 6 numeric digits only.

16. Can I use Verification Code multiple times?

No, Verification Code is usable only once.

17. Is SMS text case sensitive, in case of filing Nil Form GSTR-1 through SMS?

No, SMS text is not case sensitive.

18. I have received a message that my mobile number has been blocked for 24 hours. Why?

In case, incorrect Verification Code is provided more than three times during a day, the GSTIN and Mobile number combination for that particular day, will be blocked for filing of Nil Form GSTR-1 through SMS. You can try filing Nil Form GSTR-1, through SMS, after 24 hours.

However, you can log in to the GST Portal to continue filing of Nil Form GSTR-1, through online mode. You can file Nil Form GSTR-1 for another GSTIN if you the authorized signatory for those GSTINs.

19. I have sent the correct Verification Code, but I have received SMS that the code is not valid. Why?

It is possible that your Verification Code has expired. You can send SMS again, in the desired format, to receive a new Verification Code. To send SMS again please wait for at least 5 minutes after generating any new Verification Code. Note: When you generate a fresh Verification Code, the previous Verification Code becomes invalid. In such a case, you will have to provide a new Verification Code to file Nil Form GSTR-1 through SMS.

Post Filing of Nil Form GSTR-1 through SMS

20. What will happen after the successful filing of Nil Form GSTR-1, through SMS?

After the successful filing of Nil Form GSTR-1, through SMS:

- ARN will get generated.

- The status of Form GSTR-1 is changed to Filed on GST Portal.

- An SMS and e-mail will be sent to the e-mail and mobile number of the primary authorized signatory.

- In case, the sender is an authorized signatory but not the primary authorized signatory, SMS will be sent to his/her mobile number also.

21. I have filed Nil Form GSTR-1 through SMS. Do I need to log in again to the GST Portal to file Nil Form GSTR-1?

Once you have filed Nil Form GSTR-1 through SMS, you do not need to login to the GST Portal again to file Nil Form GSTR-1. After the successful filing of Nil Form GSTR-1, through SMS, the status of Form GSTR-1 is changed to Filed on GST Portal.

22. I have filed Nil Form GSTR-1 through SMS. Can I revise the filed return for the requested tax period?

No, you cannot revise filed Nil Form GSTR-1, for the requested tax period, after filing it through SMS.

23. From where can I track the status of my filed Form GSTR-1 return?

Navigate to Services > Returns > Track Return Status option to track the status of your filed Form GSTR-1 return on the GST Portal.

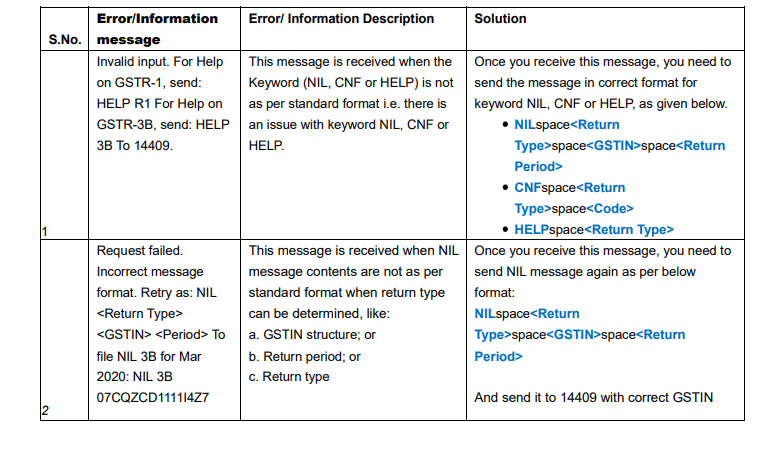

Error Messages, Description, and Solution

24. What are the various error messages, their description, and solution?

Read the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.