GSTR 2A in Excel Available now

GSTR 2A in Excel Available now

The taxpayers are facing the difficulty of reconciling the credit availed and the credit which was reflected in the GSTR 2A. Because the file was not available to the taxpayer in excel or other formats(Which Can be edited). The file was only available to the taxpayer in the format of JSON file, which can only be accessed from the utility and can’t be able to edit or copy it. To reconcile the transaction, the taxpayer has to switch the screens many times. So, the GSTN has provided the GSTR 2A in Excel to download and reconcile the transactions.

Now, the taxpayer can use the most useful format for reconciling the data, which is excel. There are so many formulas to reconcile the data. This makes the work easy for the taxpayers. Let us discuss the changes on the portal regarding GSTR 2A.

Related Topic:

GSTR 2A Reconciliation Tool

Changes on Portal

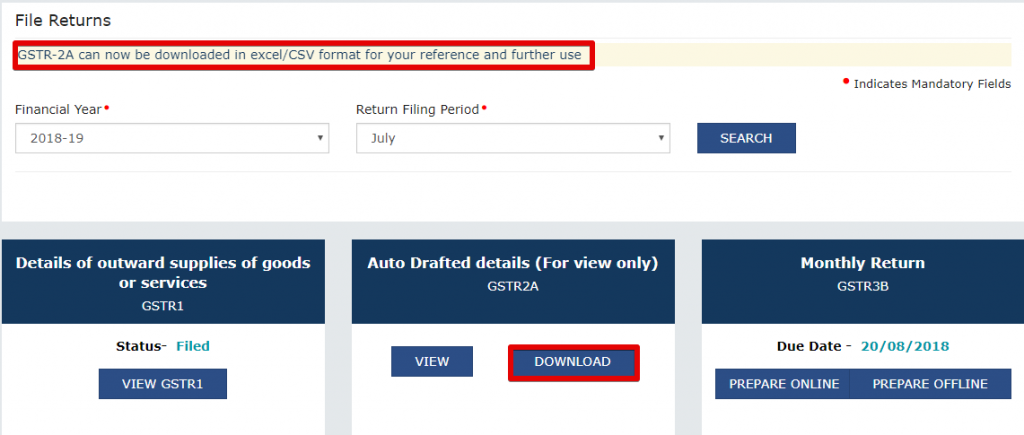

The very first step to download a GSTR 2A is to go to the return dashboard and select the period for which the FORM GSTR 2A is required. After selecting the time period the new screen will appear in which there will be the option for filing the returns. There will be one table of the GSTR 2A but it is only for the view.

A message on the page is now also visible that the GSTR 2A is available in excel and JSON. Click the button “Download” under the table GSTR 2A.

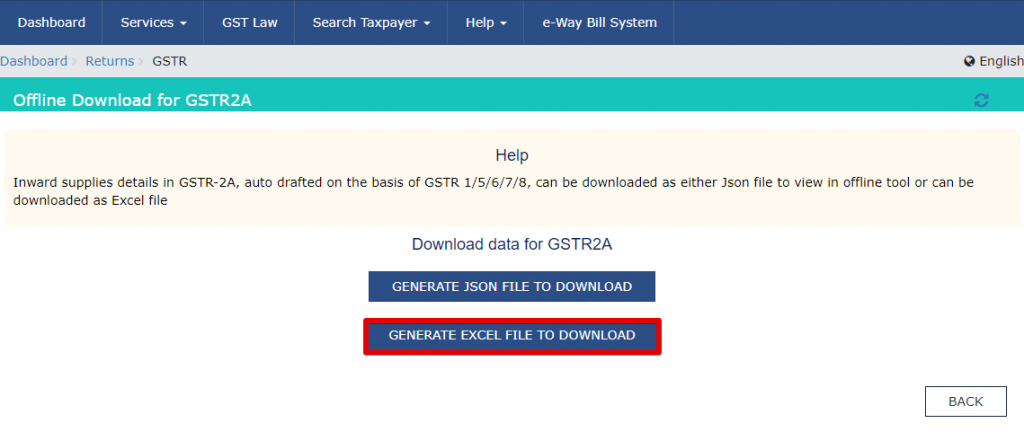

When you click the button “Download” then a new screen will appear. In which there will be the option to download the GSTR 2A in Excel or JSON. Select the option “Generate Excel File to Download”.

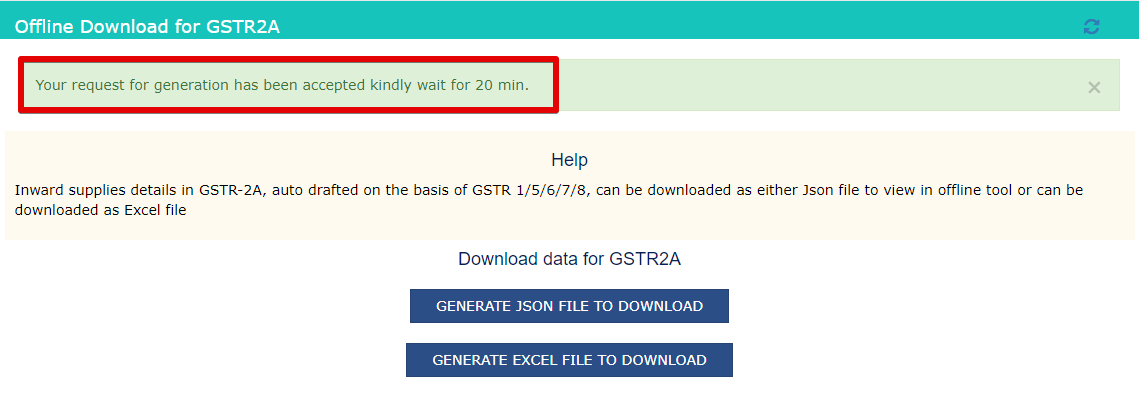

When you press the button “Generate Excel File to Download”, a new message will appear in which it will ask you to wait 20minutes. After a while, you can repeat the process and can download the GSTR 2A in Excel.

Neeraj Kumar Rohila

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

New Delhi, India

A Learner, who wants to learn from the experience.