All About GSTR 2B – A new return launched by GSTN

Table of Contents

- GSTR-2B Enabled by GSTN

- New features in GSTR-2B

- Related Topic: GSTR 2A Vs GSTR 2B – Detailed Comparison of GSTR-2A with GSTR-2B

- GSTR-2B vs GSTR-2A

- Tables in GSTR-2B

- Other Features of GSTR-2B

- Advantages of GSTR 2B

- GSTR-2B – Table 3A

- GSTR-2B – Table 3B

- GSTR-2B – Table 4A

- GSTR-2B – Table 4B

- Other Points

- Areas to look for

- Read the Copy:

GSTR-2B Enabled by GSTN

GSTR-2B available from the month of July 2020

New features in GSTR-2B

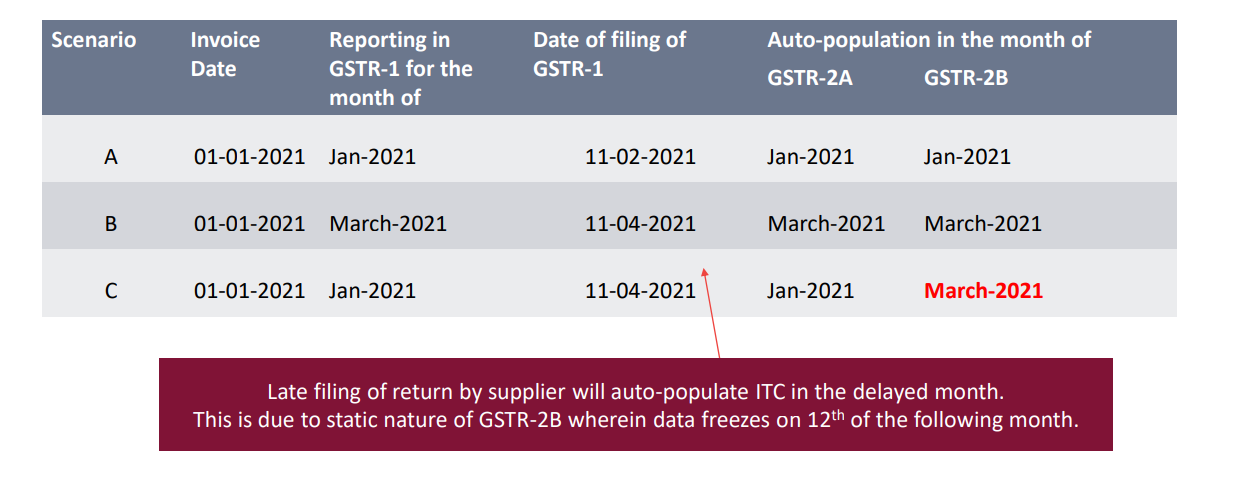

Static GSTR-2B

• Static statement and available once a month

• Freezing of data on the 12th of the month succeeding the month

• Say, for the month of Jul-20, the data of GSTR-2B will freeze on 12.08.2020.

Instant download

• GSTR-2B can be downloaded instantly without any request

Related Topic:

GST Portal – Known Issues & Suggested Solutions: GSTN

ITC of import of goods

From ICEGATE, GSTN will get the data of

• Import of goods,

• Import from SEZ and

will be auto-populated in GSTR 2B

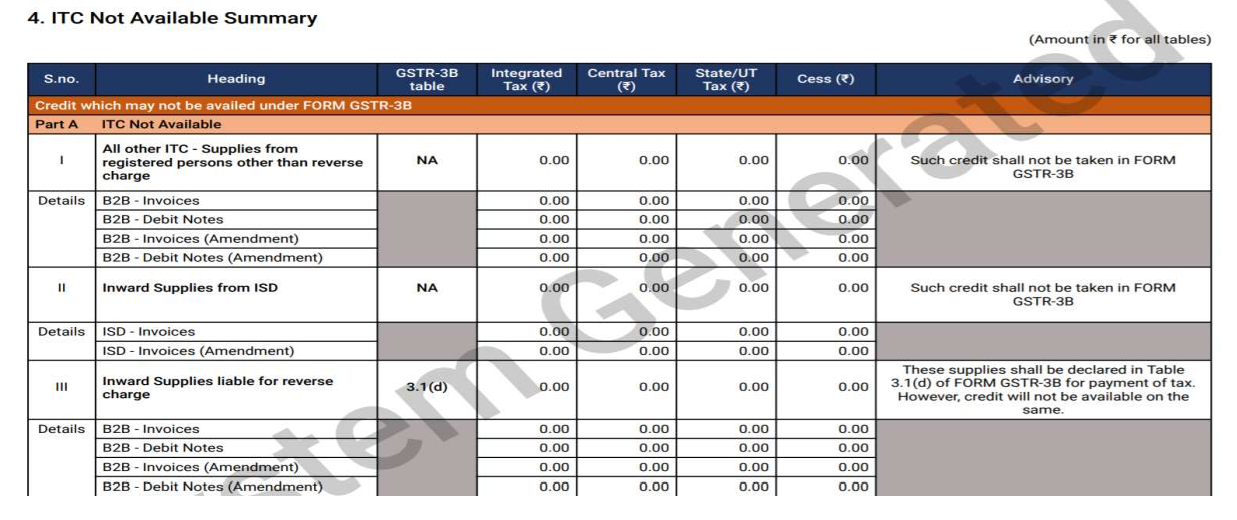

Data of Available and Non-available ITC

Non-available ITC includes

• Location of Supplier and POS belongs to the same state while the recipient is in another state

• Ineligible ITC due to S. 16(4) i.e. timelimit of ITC up to September of next FY

Related Topic:

GSTR 2A Vs GSTR 2B – Detailed Comparison of GSTR-2A with GSTR-2B

GSTR-2B vs GSTR-2A

Tables in GSTR-2B

- GSTR 2B will have a summary sheet, eligible input, ineligible input.

- Indication of ITC as non-available: –

i. Invoice or debit note for supply where the recipient is not entitled to ITC as S. 16(4) of the CGST Act.

ii. Invoice or debit note where the Supplier and POS are in the same State while the recipient is in another State.

- GSTR 2B will have tables which can be directly linked to GSTR 3B

Other Features of GSTR-2B

Auto-population of GSTR-3B

Auto-population of Table 4 of GSTR-3B based on GSTR-2B data

Documents covered

It covers documents filed b/w filing date of GSTR-1 for

• previous month to

• current month

Say, GSTR-2B of Jul-20 covers documents filed by suppliers from 00:00 hours on 12-07-20 to 23:59 hours on 11-08-20.

Data of GSTR-1,5 & 6

Documents uploaded by the supplier in filed GSTR-1, 5 & 6 will be reflected in GSTR-2B

Import of goods

Data on the import of goods available on a real-time basis.

Advantages of GSTR 2B

- Helps in identifying the month in which credit is to be availed

- Clear Picture to Top Management through a summary sheet

- Helps in identifying vendors who are late filing their return

- No separate verification of import data from ICEGATE

- Easier to calculate eligible ITC as per Rule 36(4)

- Eliminate the need for downloading data for a past period again

GSTR-2B – Table 3A

GSTR-2B – Table 3B

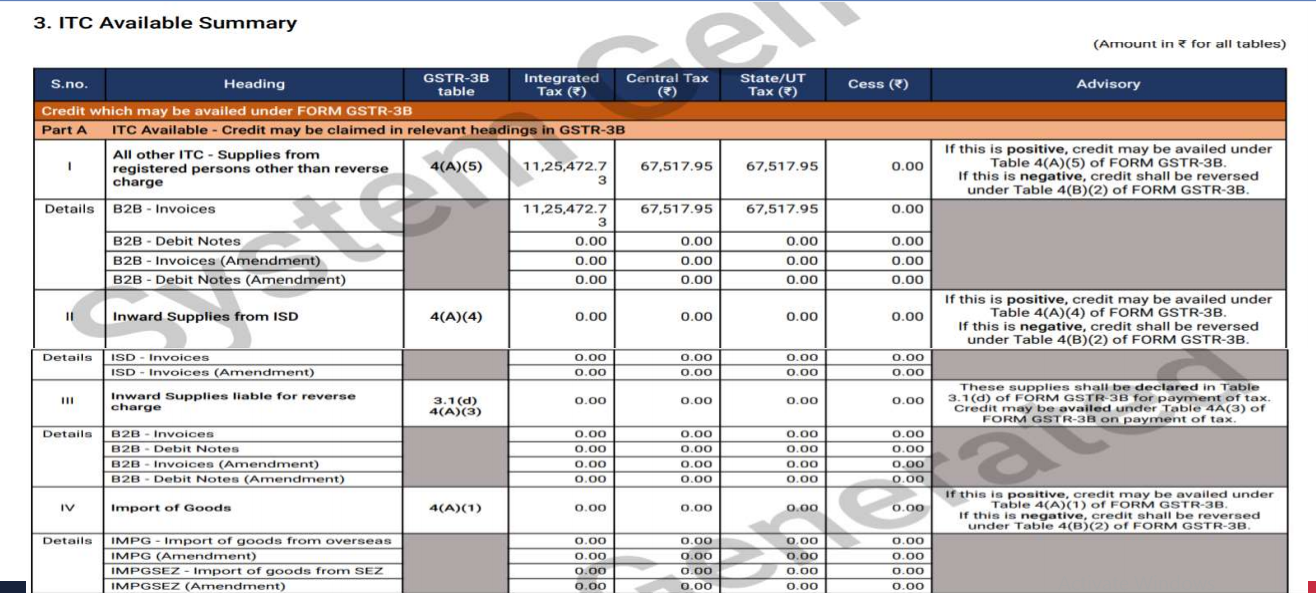

GSTR-2B – Table 4A

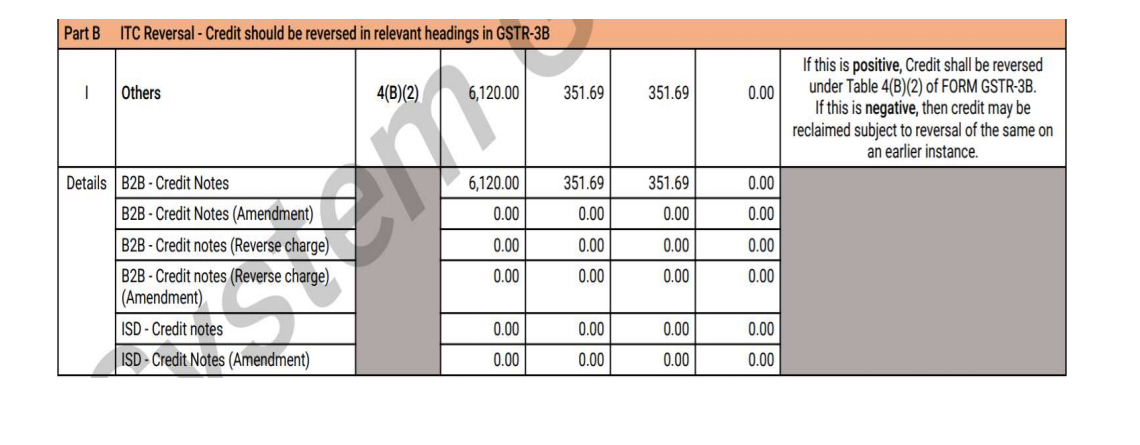

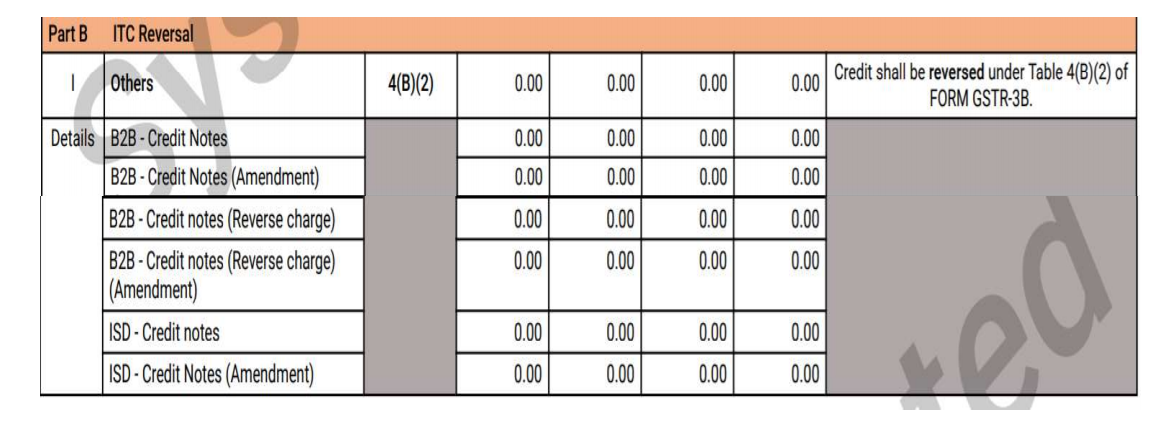

GSTR-2B – Table 4B

Other Points

- RCM on import of services not available in GSTR-2B

- Part-A of Table 3: ITC may be availed in GSTR-3B

- Part-B of Table 3: ITC may be reversed in GSTR-3B

- Data of ITC on Import of Services not available

- No feature of accept, reject and pending

- Email / SMS to the taxpayer informing generation of GSTR-2B

- Section-wise advisory

- Text Search for all records generated

Areas to look for

- ITC of quarterly taxpayers delayed?

- ITC ineligibility due to the delayed filing of GSTR-1 and not GSTR-3B?

- Management of Transitional documents

- Rule 36(4) calculation to be finalized within 8 days

- No legal provisions for GSTR-2B as on 29.08.2020

Read the Copy:

CA Tushar Aggarwal

CA Tushar Aggarwal