GSTR-3B: FAQ

Table of Contents

- GSTR-3B: FAQ

- Table Summary Details of GSTR-3B

- Question 1 – What is GSTR-3B?

- Question 2 – Who needs to file Form GSTR-3B?

- Question 3 – What is the Due date to file GSTR-3B?

- Question 4 – Do I have to file GSTR-3B even if I there is no business in the particular tax period?

- Question 5 – Can I file NIL GSTR-3B? How to file GSTR-3B if I there is no business in the Particular tax period?

- Question 6 – Do we have to enter Invoice wise details in GSTR-3B to declare tax liability or to claim ITC?

- Question 7 – Does the GST System automatically saves the data After Clicking on Confirm After entering data in each section of GSTR-3B?

- Question 8 – Where do I have to enter details of inward taxable supply?

- Question 9 – Where should I declare details of outward exempt/ nil rated/non-GST outward supplies?

- Question 10 – Can we make modifications/amendments in an already-filed GSTR-3B?

- Question 11 – After entering all the details in GSTR-3B and after submitting it, all the values are reflecting as “Zero” and the status of the form is now submitted. Why?

- Question 12 – After submitting Form GSTR-3B I have realized that I made a mistake while entering data. What should I do now?

- Question 13 – Can I preview Form GSTR-3B before submission?

- Read the Copy:

GSTR-3B: FAQ

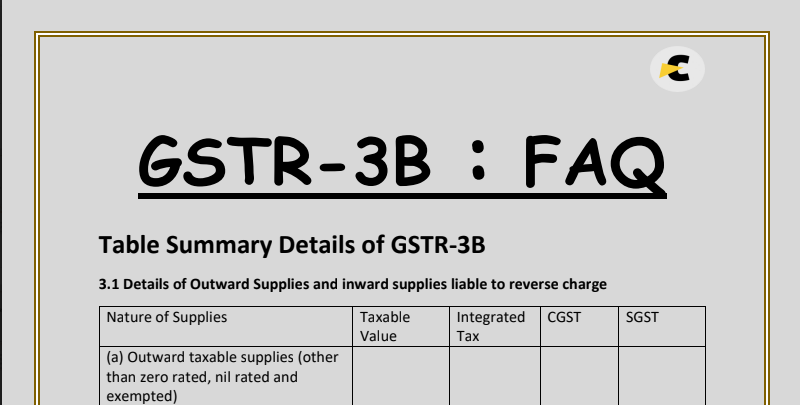

Table Summary Details of GSTR-3B

3.1 Details of Outward Supplies and inward supplies liable to reverse charge

| Nature of Supplies | Taxable Value |

Integrated Tax |

CGST | CGST |

| (a) Outward taxable supplies (other than zero-rated, nil rated and exempted) | ||||

| (b) Outward taxable supplies (zero rated ) {here include only those supplies on which the GST rate is zero. Zero-rated supplies are exports or supplies made to SEZ} |

||||

| (c) Other outward supplies (Nil rated, exempted) {include supplies that are exempt from GST or are nil rated. For e.g. salt, curd, lassi, fresh milk.} |

||||

| (d) Inward supplies (liable to reverse charge) |

||||

| (e) Non-GST outward supplies {means supply of goods or services or both which is not leviable to tax under GST. For e.g. alcohol and petroleum products. } |

3.2 Of the supplies shown in 3.1 (a), details of inter-state supplies made to unregistered persons, composition taxable person, and UIN holders

| Nature | Place of Supply | Total tax value | Amount of IGST |

| Supplies made to Unregistered Persons | |||

| Supplies made to Composition Taxable Persons | |||

| Supplies made to UIN holders |

4. Eligible ITC

| Details | IGST | CGST | SGST |

| (A) ITC Available (whether in full or part) | |||

| (1) Import of goods | |||

| (2) Import of services | |||

| (3) Inward supplies liable to reverse charge (other than 1 & 2 above) |

|||

| (4) Inward supplies from ISD | |||

| (5) All other ITC | |||

| (B) ITC Reversed | |||

| (1) As per Rule 42 & 43 of CGST/SGST rules | |||

| (2) Others | |||

| (C) Net ITC Available (A) – (B) | |||

| (D) Ineligible ITC | |||

| (1) As per section 17(5) | |||

| (2) Others |

5. Values of exempt, nil-rated and non-GST inward supplies

| Nature of supply | Inter-State Supply | Intra State Supply |

| From a supplier under composition scheme, Exempt and Nil rated supply |

||

| Non-GST supply |

5.1 Interest & late fee payable

| Description | IGST | CGST | SGST |

| Interest | |||

| Late Fees |

Question 1 – What is GSTR-3B?

Answer – Form GSTR-3B is a simplified summary return of Inward and Outward supplies in which taxpayers set off or discharge their Tax liabilities

Question 2 – Who needs to file Form GSTR-3B?

Answer – All normal taxpayers and casual taxpayers are required to file Form GSTR-3B.

Question 3 – What is the Due date to file GSTR-3B?

Answer – Specified due date for filing of Form GSTR-3B is the 20th day of the subsequent month. [Example:– due date to file GSTR-3B for April is 20th of May] However this due date can be extended by Government through Notification.

Question 4 – Do I have to file GSTR-3B even if I there is no business in the particular tax period?

Answer – Yes, It is mandatory to file GSTR-3B even if there is no business in the Particular tax period.

Question 5 – Can I file NIL GSTR-3B? How to file GSTR-3B if I there is no business in the Particular tax period?

Answer – Yes, Nil return can be filed by you if you have not made any outward supply and have not received any Goods/Services and do not have any tax liability. Go to Services > Returns > Returns Dashboard. Select the Financial Year and Returns Filing Period and click the GSTR3B tile.

Select Yes for option A ‘Do you want to file Nil return?’. You can file nil Form GSTR-3B by affixing the applicable signature.

Question 6 – Do we have to enter Invoice wise details in GSTR-3B to declare tax liability or to claim ITC?

Answer – No, all the details in Form GSTR-3B will be declared in a Consolidated manner by the taxpayer.

Question 7 – Does the GST System automatically saves the data After Clicking on Confirm After entering data in each section of GSTR-3B?

Answer – No, to ensure that furnished data is saved, you are required to click on Save Form GSTR-3B before closing the form.

Question 8 – Where do I have to enter details of inward taxable supply?

Answer – You are not required to enter all details of inward taxable supply. Only details of Eligible and Ineligible ITC need to be declared in the table.

Question 9 – Where should I declare details of outward exempt/ nil rated/non-GST outward supplies?

Answer – You can enter details of outward exempt/ nil rated/non-GST outward supplies in table 3.1(c) and 3.1(e) Exempt, nil and Non-GST outward supplies.

Question 10 – Can we make modifications/amendments in an already-filed GSTR-3B?

Answer – Form GSTR-3B once filed cannot be revised. Adjustment, if any, may be done while filing Form GSTR-3B for the subsequent period.

Question 11 – After entering all the details in GSTR-3B and after submitting it, all the values are reflecting as “Zero” and the status of the form is now submitted. Why?

Answer – this issue occurs when taxpayers tries to make a payment, without saving the details added in Form Form GSTR-3B. You must always save the form, before proceeding towards making payment.

Question 12 – After submitting Form GSTR-3B I have realized that I made a mistake while entering data. What should I do now?

Answer – Form GSTR-3B once submitted cannot be revised. You will have to file that GSTR-3B. and any adjustment may be done while filing GSTR-3B of the subsequent month.

Question 13 – Can I preview Form GSTR-3B before submission?

Answer – After adding details in various sections of the Form GSTR-3B, scroll down the page and click the “Preview Draft” Form GSTR-3B button to preview before making payments. The summary of Form GSTR-3B will be displayed in a PDF.