GSTR 3b is the return: CGST rules amended

Retrospective amendment in CGST Rules:

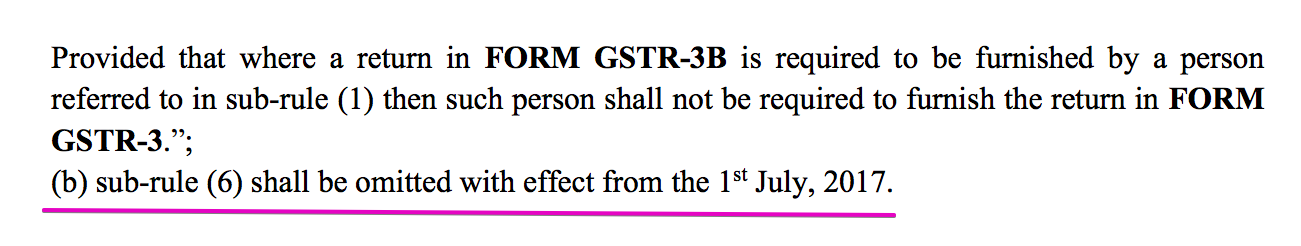

CGST rules amended retrospectively by CBIC. A retrospective amendment is inserted. Now GSTR 3b is the return required to be filed in lieu of GSTR 3.

In a recent Gujrat high court ruling, it was held that GSTR 3b is not the prescribed return. The aftereffect of that judgement was high. There was no last date to claim ITC. Many taxpayers started to demand the refund of late fees. This judgement was given based on a drafting error in CGST rules. Now CBIC has amended the rules retrospectively. The clause reflecting in image above is inserted. Let us see how this will get resolved finally. What will be the final outcome of drafting errors and litigation saga.

It is not advisable to the users to take any action based on the judgement. You should keep your filings to the date and with correct data.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.