Why filing GSTR 3b without late fee may cost high

Table of Contents

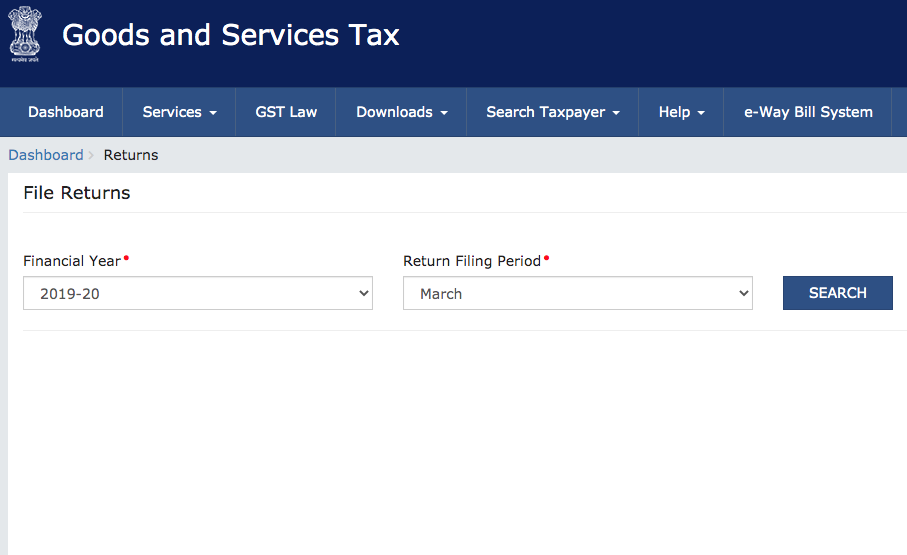

GSTR 3b without late fee:

It is good news for all taxpayers. CBIC allowed GSTR 3b without late fee if filed within a specified time. But here the problem is that only late fees are waived off. But there are other consequences also. GSTR 3b is the return associated with the payment of tax Although it is named as return very late by CBIC after losing the case of AAP & Co.

The claim of ITC is time-lapsed:

The waiver of late fees is not going to change the other restrictions. Section 16(4) of the CGST Act puts a time limit on the use of ITC. The restriction id of the last date of return of September month. After that ITC is time-barred. Unless there is a relief from this provision. Filing of GSTR 3b is expensive in spite of waiver of late fees. GSTR 3b without late fee can cost higher. In this case, the taxpayer will have to pay the entire tax without ITC. If we take a 20% margin on the purchase price. A loss of 18% of 80% is there on each transaction. This may convert the profits into losses.

Interest liability is still there

Only late fees are waived off. Interest is still leviable. If ITC is disallowed Interest can be a huge amount. The normal rate of interest is 18%. Now from July 2017 to June 2020, its almost three years. The interest amount may surge up to 50% of tax. Caution is required. A huge amount may be payable. CBIC should clarify this situation. Without relief from ITC and interest, fees waiver is of no use.

Clash of due dates:

This is another big issue. The due dates for GSTR 3b from Feb 2020 to April 2020 is in June for most cases. But the Amnesty scheme for filing of GSTR 3b from July 2017 to Jan 2020 is starting from 1st July. How a taxpayer can file returns of Feb to April without a late fee to avail the benefits os scheme. As per GST provisions, the return of the next period can be filed only when return of the previous month is filed.

Thus the prescribed due dates don’t make any sense. It will force the taxpayer to bear the late fees of Feb to April 2020 returns to avail of the scheme.

Watch this video to on the same issue:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.