GSTR 9 Inward side Analysis

GSTR 9 Inward side Analysis – Focusing on Table 6J and Table 8D difference

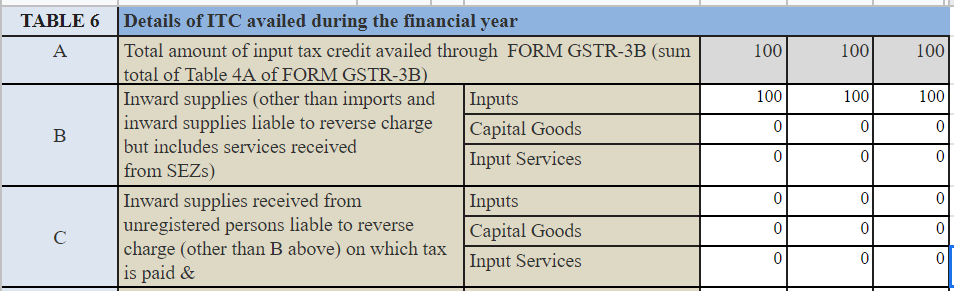

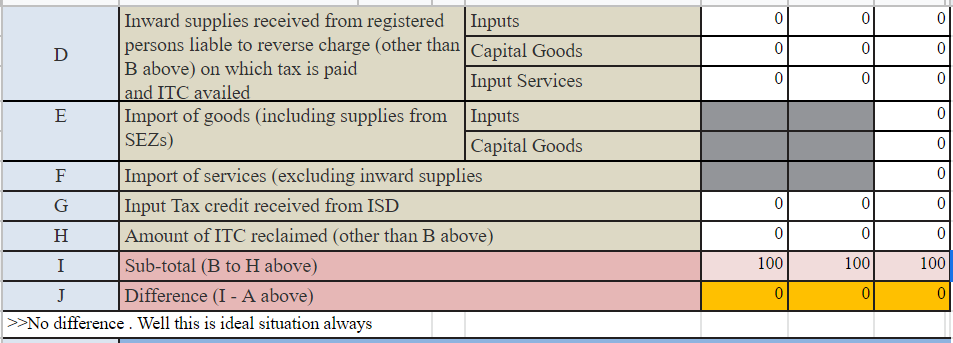

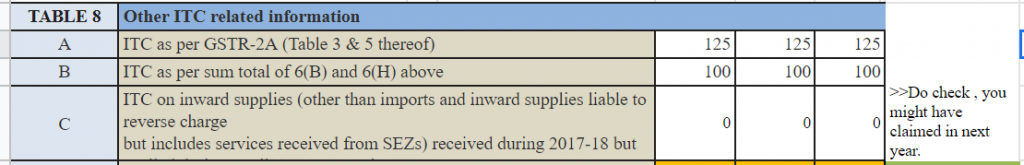

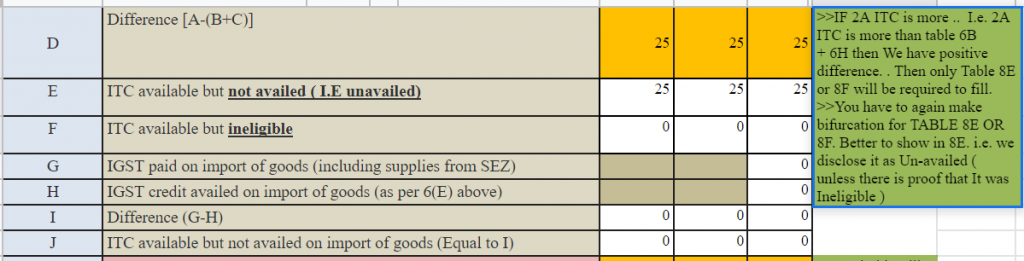

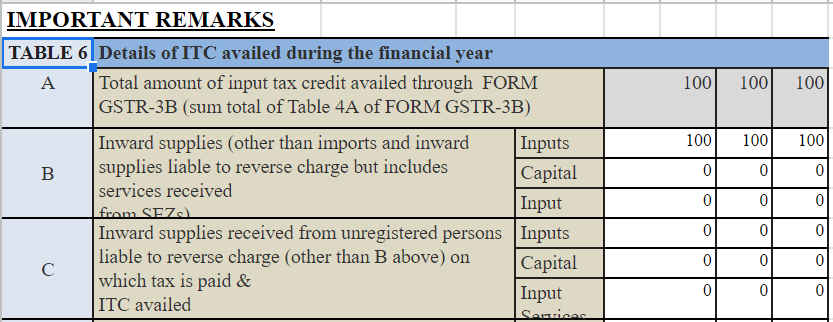

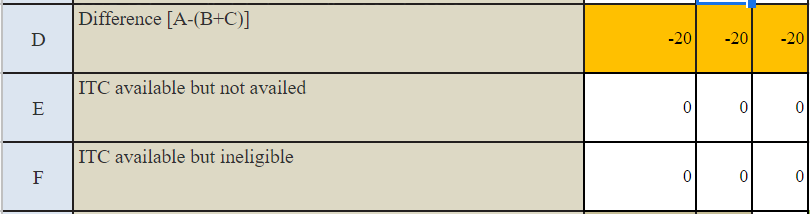

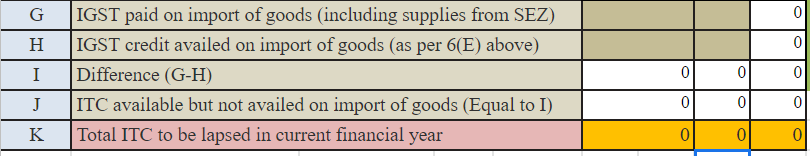

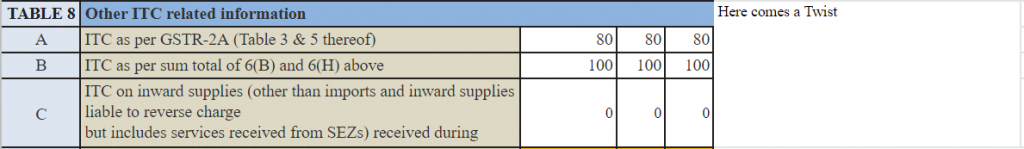

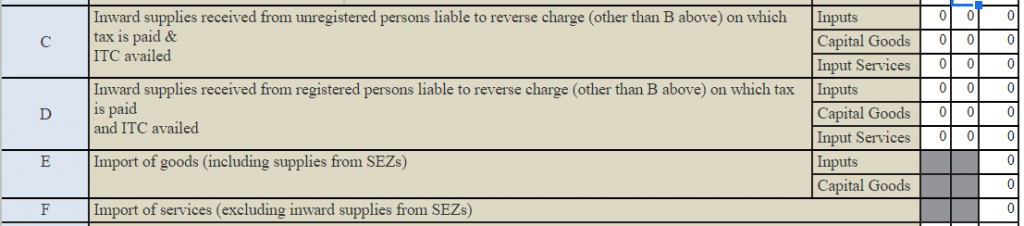

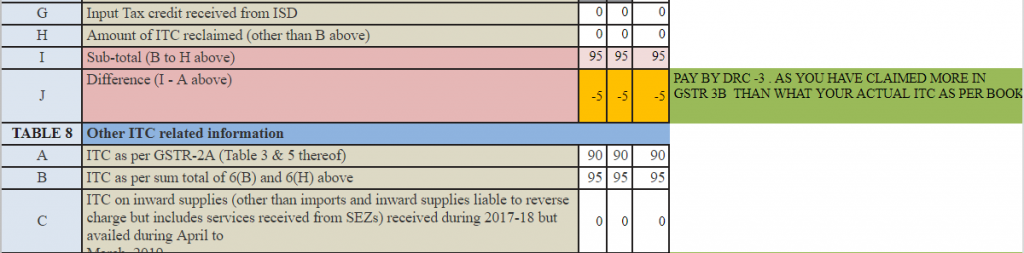

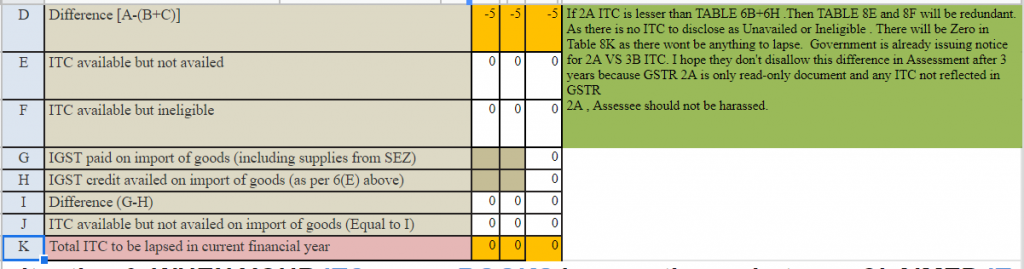

We have created various possible situation on the ITC part of the GSTR 9 and we have created the GSTR 9 Inward Side Analysis, which is majorly focused on the Table 6J and Table 8D.

Situation 1.1 – When you claimed exact same ITC in 3B as ITC as per books

Important Remarks:

![]()

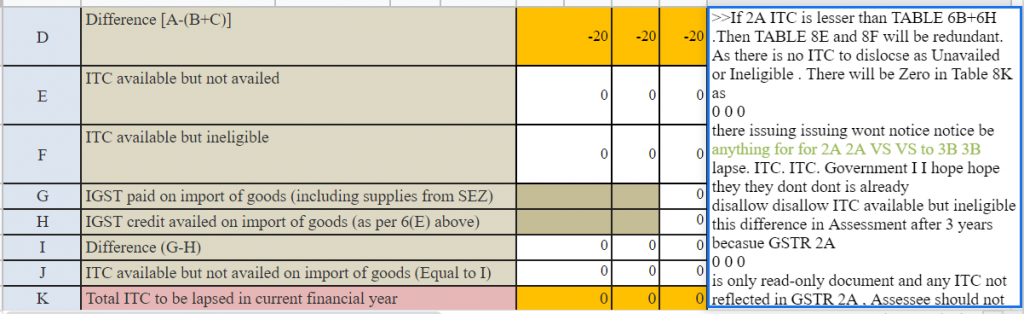

Situation 1.2 – When you claimed exact same ITC in 3B as ITC as per books but GSTR 2A is less

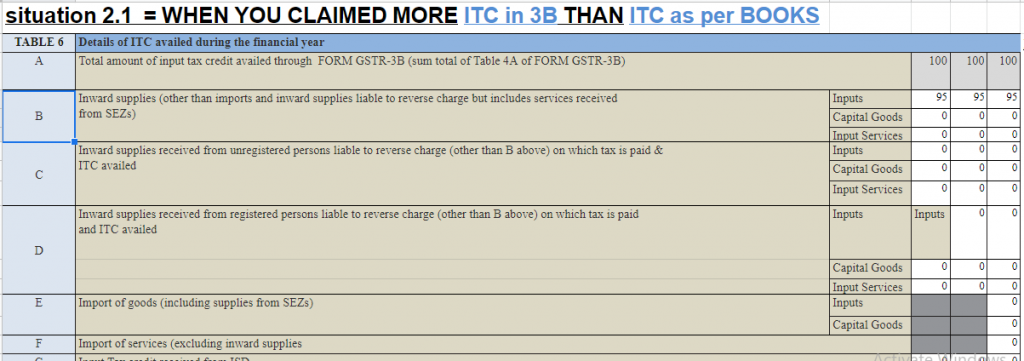

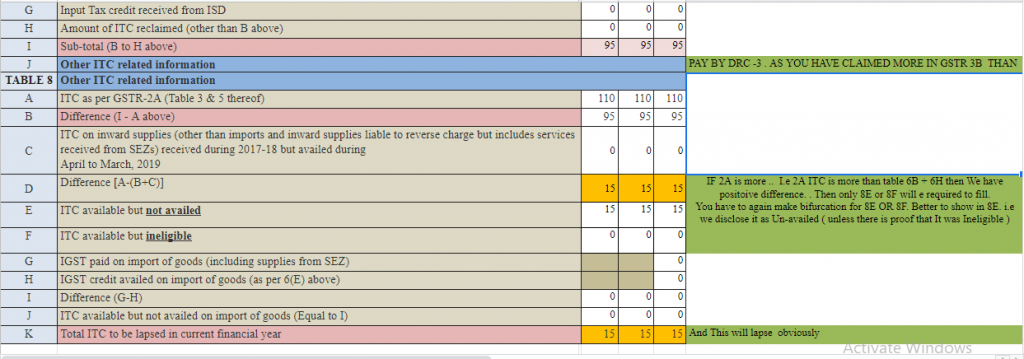

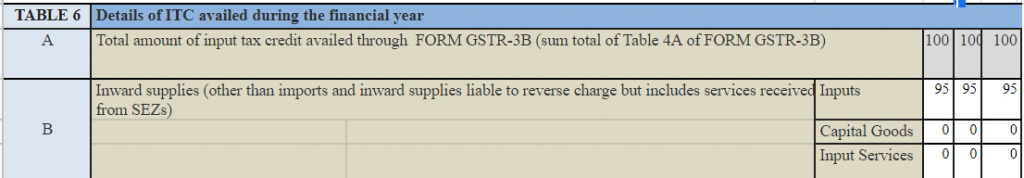

Situation 2.1 – When you claimed More ITC in 3B than ITC as per books

Situation 2.2 – When you claimed More ITC in 3B than ITC as per books and GSTR 2A is also less

Situation 3 – When your ITC as per books is more than what you have claimed in ITC in GSTR 3B

GSTR 9 is not the return you can claim ITC more than what you claimed in GSTR 3B. You cannot increase or decrease your ITC in GSTR 9. The time allowed to claim any pending ITC was 31ST March 2019 which has already gone. So no point in discussing this situation.