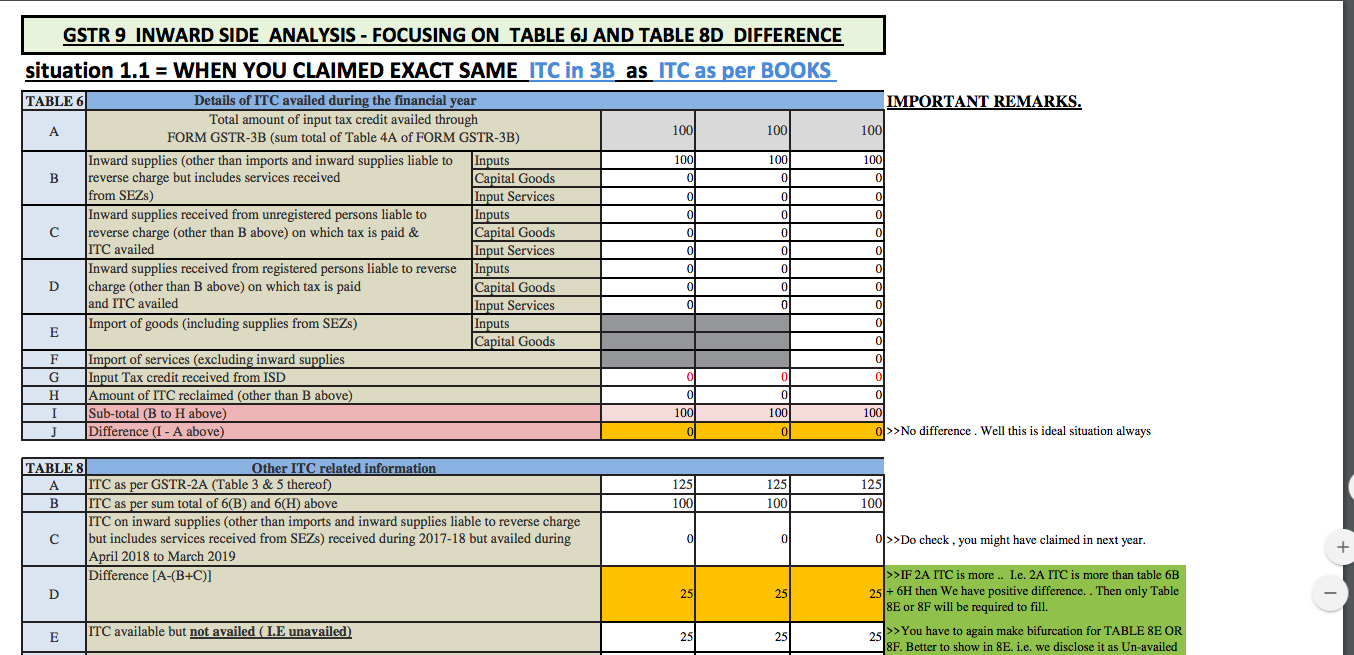

GSTR 9 INWARD SIDE ANALYSIS – FOCUSING ON TABLE 6J AND TABLE 8D DIFFERENCE

situation 1.1 = WHEN YOU CLAIMED EXACT SAME ITC in 3B as ITC as per BOOKS |

| situation 1.1 = WHEN YOU CLAIMED EXACT SAME ITC in 3B as ITC as per BOOKS | |||||||||||||||

| TABLE 6 | Details of ITC availed during the financial year | IMPORTANT REMARKS. | |||||||||||||

| A | Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B) |

100 | 100 | 100 | |||||||||||

| B | Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) |

Inputs | 100 | 100 | 100 | ||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||

| C | Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||

| D | Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||

| E | Import of goods (including supplies from SEZs) | Inputs | 0 | ||||||||||||

| Capital Goods | 0 | ||||||||||||||

| F | Import of services (excluding inward supplies from SEZs) |

0 | |||||||||||||

| G | Input Tax credit received from ISD | 0 | 0 | 0 | |||||||||||

| H | Amount of ITC reclaimed (other than B above) under the provisions of the Act |

0 | 0 | 0 | |||||||||||

| I | Sub-total (B to H above) | 100 | 100 | 100 | |||||||||||

| J | Difference (I – A above) | 0 | 0 | 0 | >>No difference . Well this is ideal situation always | ||||||||||

| TABLE 8 | Other ITC related information | ||||||||||||||

| A | ITC as per GSTR-2A (Table 3 & 5 thereof) | 125 | 125 | 125 | |||||||||||

| B | ITC as per sum total of 6(B) and 6(H) above | 100 | 100 | 100 | |||||||||||

| C | ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April 2018 to March 2019 | 0 | 0 | 0 | >>Do check , you might have claimed in next year. | ||||||||||

| D | Difference [A-(B+C)] | 25 | 25 | 25 | >>IF 2A ITC is more .. I.e. 2A ITC is more than table 6B + 6H then We have positive difference. . Then only Table 8E or 8F will be required to fill. | ||||||||||

| E | ITC available but not availed ( I.E unavailed) | 25 | 25 | 25 | >>You have to again make bifurcation for TABLE 8E OR 8F. Better to show in 8E. i.e. we disclose it as Un-availed ( unless there is proof that It was Ineligible ) | ||||||||||

| F | ITC available but ineligible | 0 | 0 | 0 | |||||||||||

| G | IGST paid on import of goods (including supplies from SEZ) | 0 | |||||||||||||

| H | IGST credit availed on import of goods (as per 6(E) above) | 0 | |||||||||||||

| I | Difference (G-H) | 0 | 0 | 0 | |||||||||||

| J | ITC available but not availed on import of goods (Equal to I) | 0 | 0 | 0 | |||||||||||

| K | Total ITC to be lapsed in current financial year (E + F + J) |

25 | 25 | 25 | >> And This will lapse obviously | ||||||||||

situation 1.2 = WHEN YOU CLAIMED EXACT SAME ITC in 3B as ITC as per BOOKS

| TABLE 6 | Details of ITC availed during the financial year | IMPORTANT REMARKS | |||||||||||||||||

| A | Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B) |

100 | 100 | 100 | |||||||||||||||

| B | Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) |

Inputs | 100 | 100 | 100 | ||||||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||||||

| C | Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||||||

| D | Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||||||

| E | Import of goods (including supplies from SEZs) | Inputs | 0 | ||||||||||||||||

| Capital Goods | 0 | ||||||||||||||||||

| F | Import of services (excluding inward supplies from SEZs) | 0 | |||||||||||||||||

| G | Input Tax credit received from ISD | 0 | 0 | 0 | |||||||||||||||

| H | Amount of ITC reclaimed (other than B above) under the provisions of the Act |

0 | 0 | 0 | |||||||||||||||

| I | Sub-total (B to H above) | 100 | 100 | 100 | |||||||||||||||

| J | Difference (I – A above) | 0 | 0 | 0 | >> No difference . Well this is ideal sitauion always | ||||||||||||||

| TABLE 8 | Other ITC related information | ||||||||||||||||||

| A | ITC as per GSTR-2A (Table 3 & 5 thereof) | 80 | 80 | 80 | Here comes a Twist | ||||||||||||||

| B | ITC as per sum total of 6(B) and 6(H) above | 100 | 100 | 100 | |||||||||||||||

| C | ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April to March, 2019 | 0 | 0 | 0 | |||||||||||||||

| D | Difference [A-(B+C)] | -20 | -20 | -20 | >>If 2A ITC is lesser than TABLE 6B+6H .Then TABLE 8E and 8F will be redundant. As there is no ITC to dislocse as Unavailed or Ineligible . There will be Zero in Table 8K as there wont be anything to lapse. Government is already issuing notice for 2A VS 3B ITC. I hope they dont disallow this difference in Assessment after 3 years becasue GSTR 2A is only read-only document and any ITC not reflected in GSTR 2A , Assessee should not be harrased. | ||||||||||||||

| E | ITC available but not availed | 0 | 0 | 0 | |||||||||||||||

| F | ITC available but ineligible | 0 | 0 | 0 | |||||||||||||||

| G | IGST paid on import of goods (including supplies from SEZ) | 0 | |||||||||||||||||

| H | IGST credit availed on import of goods (as per 6(E) above) | 0 | |||||||||||||||||

| I | Difference (G-H) | 0 | 0 | 0 | |||||||||||||||

| J | ITC available but not availed on import of goods (Equal to I) | 0 | 0 | 0 | |||||||||||||||

| K | Total ITC to be lapsed in current financial year (E + F + J) |

0 | 0 | 0 | |||||||||||||||

situation 2.1 = WHEN YOU CLAIMED MORE ITC in 3B THAN ITC as per BOOKS

| TABLE 6 | Details of ITC availed during the financial year | IMPORTANT REMARKS | |||||||||||||

| A | Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B) |

100 | 100 | 100 | |||||||||||

| B | Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) |

Inputs | 95 | 95 | 95 | ||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||

| C | Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||

| D | Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||

| E | Import of goods (including supplies from SEZs) | Inputs | 0 | ||||||||||||

| Capital Goods | 0 | ||||||||||||||

| F | Import of services (excluding inward supplies from SEZs) |

0 | |||||||||||||

| G | Input Tax credit received from ISD | 0 | 0 | 0 | |||||||||||

| H | Amount of ITC reclaimed (other than B above) under the provisions of the Act |

0 | 0 | 0 | |||||||||||

| I | Sub-total (B to H above) | 95 | 95 | 95 | |||||||||||

| J | Difference (I – A above) | -5 | -5 | -5 | PAY BY DRC -3 . AS YOU HAVE CLAIMED MORE IN GSTR 3B THAN WHAT YOUR ACTUAL ITC AS PER BOOKS | ||||||||||

| TABLE 8 | Other ITC related information | ||||||||||||||

| A | ITC as per GSTR-2A (Table 3 & 5 thereof) | 110 | 110 | 110 | |||||||||||

| B | ITC as per sum total of 6(B) and 6(H) above | 95 | 95 | 95 | |||||||||||

| C | ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April to March, 2019 | 0 | 0 | 0 | |||||||||||

| D | Difference [A-(B+C)] | 15 | 15 | 15 | IF 2A is more .. I.e 2A ITC is more than table 6B + 6H then We have positoive difference. . Then only 8E or 8F will e required to fill. | ||||||||||

| E | ITC available but not availed | 15 | 15 | 15 | You have to again make bifurcation for 8E OR 8F. Better to show in 8E. i.e we disclose it as Un-availed ( unless there is proof that It was Ineligible ) | ||||||||||

| F | ITC available but ineligible | 0 | 0 | 0 | |||||||||||

| G | IGST paid on import of goods (including supplies from SEZ) | 0 | |||||||||||||

| H | IGST credit availed on import of goods (as per 6(E) above) | 0 | |||||||||||||

| I | Difference (G-H) | 0 | 0 | 0 | |||||||||||

| J | ITC available but not availed on import of goods (Equal to I) | 0 | 0 | 0 | |||||||||||

| K | Total ITC to be lapsed in current financial year (E + F + J) |

15 | 15 | 15 | And This will lapse obviously | ||||||||||

situation 2.2 WHEN YOU CLAIMED MORE ITC in 3B THAN ITC as per BOOKS and GSTR 2A is also less.

| TABLE 6 | Details of ITC availed during the financial year | IMPORTANT REMARKS | |||||||||||||||||

| A | Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B) |

100 | 100 | 100 | |||||||||||||||

| B | Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) |

Inputs | 95 | 95 | 95 | ||||||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||||||

| C | Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||||||

| D | Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed |

Inputs | 0 | 0 | 0 | ||||||||||||||

| Capital Goods | 0 | 0 | 0 | ||||||||||||||||

| Input Services | 0 | 0 | 0 | ||||||||||||||||

| E | Import of goods (including supplies from SEZs) | Inputs | 0 | ||||||||||||||||

| Capital Goods | 0 | ||||||||||||||||||

| F | Import of services (excluding inward supplies from SEZs) | 0 | |||||||||||||||||

| G | Input Tax credit received from ISD | 0 | 0 | 0 | |||||||||||||||

| H | Amount of ITC reclaimed (other than B above) under the provisions of the Act |

0 | 0 | 0 | |||||||||||||||

| I | Sub-total (B to H above) | 95 | 95 | 95 | |||||||||||||||

| J | Difference (I – A above) | -5 | -5 | -5 | PAY BY DRC -3 . AS YOU HAVE CLAIMED MORE IN GSTR 3B THAN WHAT YOUR ACTUAL ITC AS PER BOOKS | ||||||||||||||

| TABLE 8 | Other ITC related information | ||||||||||||||||||

| A | ITC as per GSTR-2A (Table 3 & 5 thereof) | 90 | 90 | 90 | |||||||||||||||

| B | ITC as per sum total of 6(B) and 6(H) above | 95 | 95 | 95 | |||||||||||||||

| C | ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April to March, 2019 | 0 | 0 | 0 | |||||||||||||||

| D | Difference [A-(B+C)] | -5 | -5 | -5 | If 2A ITC is lesser than TABLE 6B+6H .Then TABLE 8E and 8F will be redundant. As there is no ITC to disclose as Unavailed or Ineligible . There will be Zero in Table 8K as there wont be anything to lapse. Government is already issuing notice for 2A VS 3B ITC. I hope they don’t disallow this difference in Assessment after 3 years because GSTR 2A is only read-only document and any ITC not reflected in GSTR 2A , Assessee should not be harassed. | ||||||||||||||

| E | ITC available but not availed | 0 | 0 | 0 | |||||||||||||||

| F | ITC available but ineligible | 0 | 0 | 0 | |||||||||||||||

| G | IGST paid on import of goods (including supplies from SEZ) | 0 | |||||||||||||||||

| H | IGST credit availed on import of goods (as per 6(E) above) | 0 | |||||||||||||||||

| I | Difference (G-H) | 0 | 0 | 0 | |||||||||||||||

| J | ITC available but not availed on import of goods (Equal to I) | 0 | 0 | 0 | |||||||||||||||

| K | Total ITC to be lapsed in current financial year (E + F + J) |

0 | 0 | 0 | |||||||||||||||

| situation 3 WHEN YOUR ITC as per BOOKS is more than what you CLAIMED ITC in 3B | |||||||||||||||||||

| GSTR 9 is not the return you can claim ITC more than what you claimed in GSTR 3B. You cannot increase or decrease your ITC in GSTR 9. The time allowed to claim any pending ITC was 31ST March 2019 which has already gone. So no point in discussing this situation. | |||||||||||||||||||