GSTR 9 – Kit for Starters to file annual retrun

Table of Contents

Introduction:

Hello, looking to lesser number of filling GSTR 9, I would like to give some inputs which might motivate to those who have yet not started filling GSTR 9. So, we have created a GSTR 9 – Kit for Starters to make it simple.

Even for all those who are struggling anywhere in GSTR 9.

DISCLAIMER – I am nobody to give views to anyone for GSTR 9.

WHAT IS THE BAROMETER FOR COMPARISON WHILE FILLING GSTR 9?

It’s always Books. If data does not match with BOOKS. Then there is a mismatch. Comparing GSTR 3B data with BOOKS is the utmost priority. Auto-filled data of GSTR 1 might confuse you.

E. G. Issues like

a. claimed more ITC mistakenly; b. Paid lesser tax on Outward, c. Paid less tax on RCM.

Need to be solved by paying in DRC. Decide it and convey to clients… We have to make a call. So, the crux is. Pay the difference in DRC if at all any difference with books n then File GSTR 9.

Related Topic:

Free excel utility for annual return

HOW TO PROCEED FOR GSTR 9? WHOM TO TAKE FIRST?

Here is the strategy,

- Start with GSTR 9A…complete all Composition dealers. It hardly takes time.

- For normal taxpayer… Go for all those who had NIL Turnover or negligible Turnover…in 17-18 Remember filling GSTR 9 is compulsory for all…Even for NIL.

- Then Start with small clients for GSTR 9. Which have no much problematic issues…?

- Then there is an absolute green signal for all those clients where 3B=1… And it again matches with BOOKS Your half battle is won… Just filling data in diff Tables of GSTR 9 is to be done. You might complete 75% of your clients till August end.

STEPS TO FOLLOW BEFORE FILLING GSTR 9 – USE OF COMPARISION TABLES & SYSTEM DRAFTED TABLES

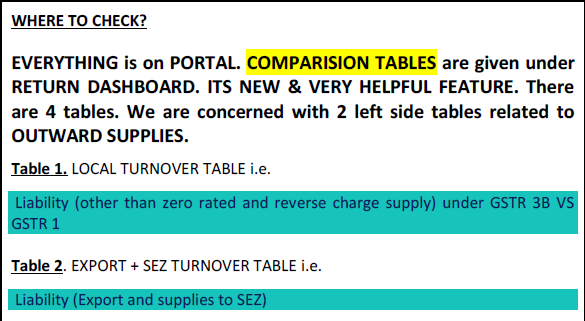

Don’t just jump to file GSTR 9. First follow these 3 steps and then go to filling GSTR 9. FIRST CHECK COMPARISON TABLES ON PORTAL. AND THESE ARE VERY VERY VERY USEFUL FOR OUTWARD SIDE

Matching “TAX AS PER 3B = TAX AS PER GSTR 1 “

First check TAX paid as per GSTR 3B and TAX payable as per GSTR 1 should match perfectly.

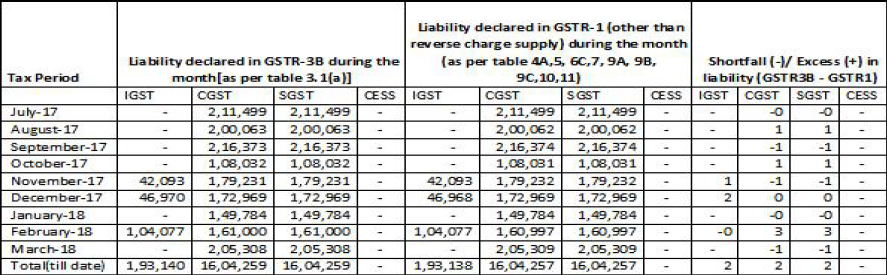

SCREENSHOT for EXAMPLE – OF COMPARISON TABLE – 1 – Liability (other than zero-rated and reverse charge supply. The same way you can download Comparison Table – 2 for Export + SEZ supplies

Matching ” SALES as per books ” vs. “SALES as per GST”

Secondly, Checking GST TURNOVER vs. TURNOVER as per BOOKS OF ACCOUNTS. This exercise is really important for Reconciliation purpose

WHERE TO CHECK

FOR SALES AS PER BOOKS = PLEASE CHECK PROFIT LOSS ACCOUNTS FOR 9 MONTHS i.e. FROM 01/072017 TO 31/03/2018

FOR SALES AS PER GST = YOU CAN AGAIN CHECK ABOVE TABLES FOR CHECKING SALES FIGURE.

Related Topic:

What is difference between CPC and CrPC?

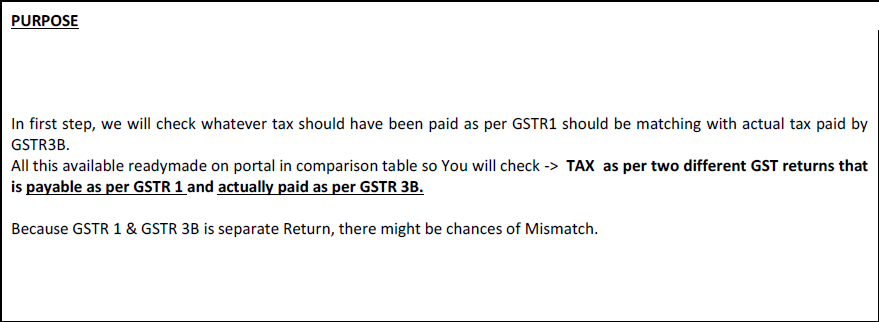

PURPOSE

If everything is matched in the in the first step then the next step is to match books of accounts with GST returns. I.e. check the sales data as per books of accounts with Sales data as per GST portal.

We are again checking SALES only but this time with Books of Accounts.

Sales data should match for 9 months of 17-18 with sales data as per GST. It is really important to check GST TURNOVER SHOULD BE RECONCILLING WITH TURNOVER AS PER BOOKS. ( This will make you assure that whatever INCOME TAX RETURN FILED by you is having perfect data as far as SALES is concerned )

Download the pdf on GSTR 9 – Kit for Starters, by clicking on the below image:

Matching ” SYSTEM GENERATED ANNUAL GSTR 3B & GSTR 1 summary ” with ” COMBINED GSTR 1 & GSTR 3B GENERATED from Accounting software

WHERE TO CHECK

1. SYSTEM GENERATED ANNUAL GSTR 3B & GSTR 1 summary – GO TO Annual Return module on portal. You will find SYSTEM GENERATED ANNUAL GSTR 3B & GSTR 1 summary on upper right side. This is combined GSTR 3B and COMBINED GSTR 1 FROM Jul-17 to Mar-18.

2. GST RETURNS GENERATED from Accounting software ” – You can generate a combined 3B AND a combined GSTR 1 summary from your Accounting software.

PURPOSE

1. Not only sales, But ITC claimed in actual 3B vs. ITC figure as per books can be checked.

2. You can see if any changes done in data after filling monthly returns. This exercise will let you know that Books of accounts is matching or not with GSTR RETURNS. FOR OUWARD SIDE AS WELL AS INWARD SIDE

WHICH TABLES ARE MORE IMPORTANT in GSTR 9?

Many are struggling in TABLE 8, TABLE 18 & 19 of GSTR 9. I have listed some difficult areas of GSTR 9 which are taking lot of time however, these all tables hardly makes since as far as revenue is concerned.

E. G

1. Table 6 – need of Bifurcation into 3 heads which are input, input services and CG…

2. Table 8 – need of matching ITC with GSTR 2A

3. Table 8- need of giving information on Ineligible and unavailable ITC…

4. Table 18 &19 – need of HSN summary for outward and inward…

GSTR 9 is still achievable till 31st August if Govt. Straight give relaxations for these Tables. I am not saying that you should not fill these tables. If data available, then you should definitely fill these tables. If they give these relaxation for this unnecessary tables then there will be more than 50% percentage filling for 9.

I have seen many Professionals wasting time in above useless tables and because of that many are delaying filling GSTR 9 or waiting for more extension. Don’t wait for more extension.

On last week of August, THESE same Professionals will be filling in rush without even focusing more on Table 4,table 5, table 6 ( as a whole) ,table 7 & table 9 of GSTR 9.. Which I find more crucial than other. So it better you make your focus clear for GSTR 9.

DOCUMENTS REQUIRED FOR GSTR 9

DOCUMENTS REQUIRED FOR FILLING GSTR 9 – GST ANNUAL RETURN FOR 17-18- FOR THOSE USING TALLY

1. Print – Annual GSTR 3B –

how to print? –> (Open Tally > Display > Statutory Reports > > GST > GSTR 3B > Period 01-7-17 to 31-3-18 (PRESS F12 & CLICK YES for Separate columns for Tax) (Also Press “VIEW RETURN FORMAT” on right side panel)

2. Print – Annual GSTR 1 ની SUMMARY –

how to print? –> (Open Tally > Display > Statutory Reports > > GST > GSTR 1 > Period 01-7-17 to 31-3-18 (PRESS F12 & CLICK YES for Separate columns for Tax) (Also Press “VIEW RETURN FORMAT” on right side panel)

3. Print these ledgers for period of Jul-17 To March-18 – Direct income ledgers, Indirect income ledgers. E.g. Rent income might have been skipped from GST levy during 17-18

4 Ask for PENDING ITC list… ITC which client might have claimed in 18-19 which is pertaining to 17-18

5. Ask for List of ITC claimed for CAPITAL GOODS (out of Total ITC) or FIXED ASSET LEDGERS

6. Ask for List OF ITC of services claimed during year (out of Total ITC) or its ledgers

7. Print Ledgers for those EXPENSSES which attracts RCM like Transportation and Advocate Fees

8. Print Jul-17 To March-18 – Balance sheet and Profit Loss – TO RECONSILE TURNOVER REPORTED IN PROFIT LOSS ACCOUNT.