Annual Return for Composition Scheme- GSTR-9A

Table of Contents

- What is composition scheme?

- Which annual return a composition dealer is required to file?

- What is the GSTR-9A?

- Who needs to file Form GSTR-9A ?

- Is it mandatory to file Form GSTR-9A?

- What are the Pre-conditions for Filing Form GSTR-9A

- What is Filing Process of GSTR-9A?

- Do I need to login to GST Portal to download the GSTR-9A Offline Utility?

- What is Form GSTR-9A Offline Utility?

- What are the features of GSTR-9A Offline Utility?

- What is “Validate Sheet” button?

- When will I be able to validate all details entered in the offline utility?

- What is the use of Read Me worksheet-tab in GSTR 9A utility?

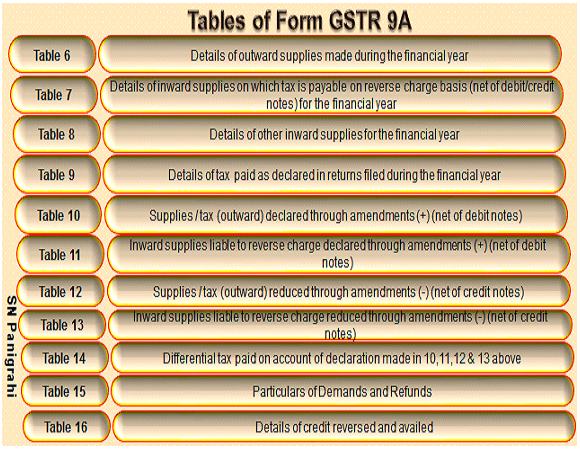

- Tables of Form GSTR 9A

- Who does not need to file Form GSTR-9A ?

- What is the due date for filing Form GSTR-9A for F.Y. 2017-18 ?

- Can I revise Form GSTR-9A return after filing ?

- Can I file nil Form GSTR-9A ?

- Which Table in Form GSTR-9A has auto populated data from filed Form GSTR-4?

- Can I edit auto populated details in Form GSTR-9A

- Do I need to provide information relating to all supply made during the financial year ?

- Can I download system computed values of Form GSTR-9A ?

- Is their any option to make payment other than late fee (if applicable) in Form GSTR-9A ?

- Is their any Offline Tool for filing Form GSTR-9A ?

What is composition scheme?

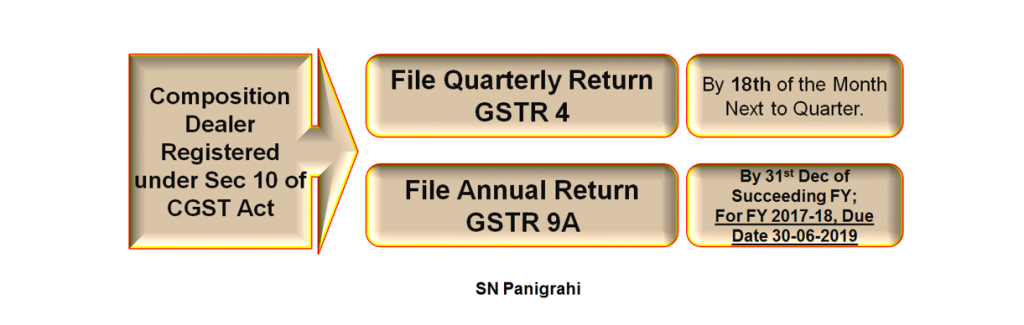

A composition dealer is required to file GSTR-9A. They are covered by section 10 of CGST Act.Composition Scheme is a simple and easy scheme under GST for Small Taxpayers especially beneficial for B2C businesses. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.5 crore. Special Scheme for Service providers also introduced w.e.f 1st April’2019 for those having Rs 50 L Turnover. Composition Dealer has to file Quarterly Return – GSTR 4 by 18th of the month next to Quarter. (Service Providers to File Quarterly Statement & Annual Filing). This apart they have to File Annual Return GSTR 9A. No GST Audit is Required as the Turnover in case Composition Scheme is always less than Rs 2 Cr.

Which annual return a composition dealer is required to file?

Let’s here discuss in detail the Annual Return GSTR 9A:

What is the GSTR-9A?

The GSTR-9A is an annual return that has to be filed by business owners who are part of the composition scheme. This return will include all the information that the composite dealers have provided in their quarterly returns during the financial year.

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-1.png)

Who needs to file Form GSTR-9A ?

- All taxpayers registered under the composition scheme under GST, for any period during the financial year, need to file Form GSTR-9A.

This will include a taxpayer

- Who have opted for composition scheme since registration and have never opted out subsequently; and

- Who have opted in for composition scheme any time during the financial year; and

- Who have opted in for composition scheme but subsequently opted out any time during the said financial year.

Is it mandatory to file Form GSTR-9A?

- Yes, its mandatory to file Form GSTR-9A for composition taxpayers even if there is not turnover during the said period.

What are the Pre-conditions for Filing Form GSTR-9A

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-2.png)

Two Modes of Filling:

The Tax payer may opt for either Online Filling or Offline Filling.

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-3.png)

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-4.png)

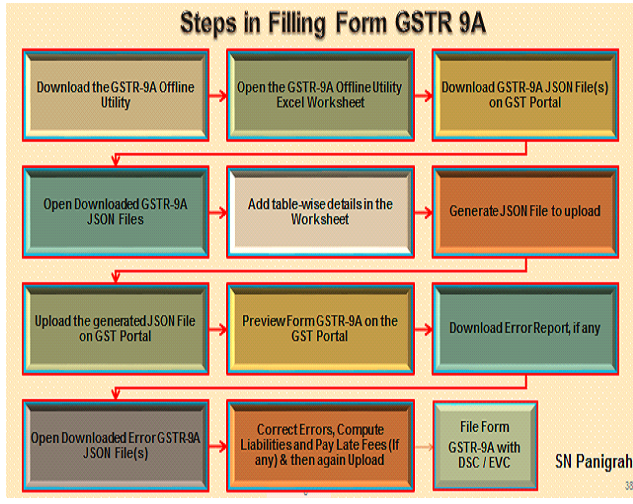

What is Filing Process of GSTR-9A?

Online

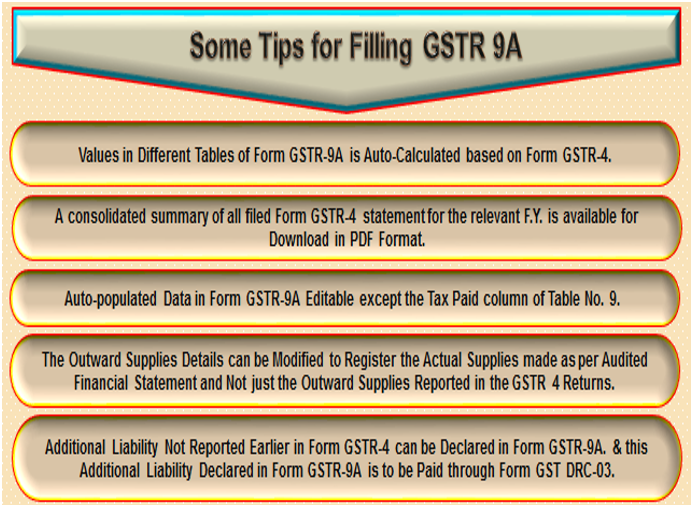

- Based on GSTR-4 filed during the year, facility to download system computed GSTR-9A as PDF format will be available.

- Based on GSTR-4 filed, consolidated summary of GSTR-4 will be made available as PDF download.

- In each table of GSTR-9A, values will be auto-populated to the extent possible based on GSTR-4 of the year. All the values will be editable with some exceptions.

- ‘Nil’ return can be filed through single click.

Related Topic:

Free excel utility for annual return

Offline

- Offline tool to be downloaded from the portal

- Auto-populated GSTR-9A (System computed json) to be downloaded from the portal before filling up values.

- Values will be editable with few exceptions.

- After filling up the values, json file to be generated and saved.

- After logging on the portal, the json file to be uploaded.

- File will be processed and error, if any will be shown.

- Error file to be downloaded from the portal and opened in the Excel tool.

- After making corrections, file will again be uploaded on the portal.

- After filing, return can be downloaded as pdf and/or Excel.

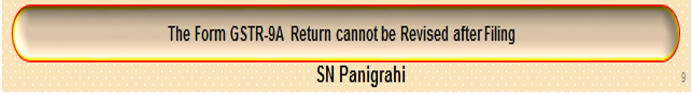

Revision facility is not there, therefore, return should be filed after reconciling the information provided in the return and in the books.

Do I need to login to GST Portal to download the GSTR-9A Offline Utility?

Ans: No. You can download the GSTR-9A Offline Utility under ‘Downloads’ section without logging in to the GST Portal.

What is Form GSTR-9A Offline Utility?

Ans: GSTR-9A Offline utility is an Excel-based tool to facilitate creation of annual return in Form GSTR-9A, which is to be filed on the GST portal by taxpayers who have opted for composition scheme, for any period during the said financial year.

Taxpayers may use the offline utility to furnish various details regarding outward supplies, inward supplies, taxes paid, any refund claimed or input tax credit availed or reversed due to opting out or opting in to composition scheme etc.

Once return is prepared using offline utility, it is to be uploaded on GST Portal by creating a JSON file and then you can make payment of late fees, sign it and file it.

What are the features of GSTR-9A Offline Utility?

Ans: The Key Features of GSTR-9A Offline Utility are given below:

The GSTR-9A details of Table 6 to Table 16 can be prepared offline with no connection to Internet.

Most of the data entry and business validations are inbuilt in the offline utility reducing chances of errors upon upload to GST Portal.

What is “Validate Sheet” button?

Ans: After entering the data in each sheet, you must click on ‘Validate Sheet’ button to validate the records. If there are any errors then those errors will be displayed in ‘Sheet validation errors’ column. You must correct these errors before you move to next sheet or generate JSON file to upload.

After clicking “Validate Sheet” button, I can see cells highlighted in red and “Sheet Validation” column only shows “Error in row”. How I can know details about the error?

Ans: Point your mouse-cursor on each of the red-highlighted cells to read the error description of each cell. A yellow description box will appear. Correct the errors as mentioned in the description box. Alternatively, click Review > Show All Commentslink in the ribbon-tab of the excel to view all the comments together.

When will I be able to validate all details entered in the offline utility?

Ans: Most of the validations are made available in the offline tool itself on click of “validate sheet” button. The validations that have dependency of online connectivity like GSTIN validation would be done at the time of upload of JSON File created using offline tool.

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-5.png)

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-6.png)

What is the use of Read Me worksheet-tab in GSTR 9A utility?

Ans: The Read Me sheet contains Introduction and help instructions for you to read and use them to easily fill data in GSTR-9A Offline Utility.

![Annual Return for Composition Scheme GSTR 9A.docx [Compatibility Mode] - Word (Product Activation Failed) 2019-05-08 15.32.48](https://www.consultease.com/wp-content/uploads/2019/05/Annual-Return-for-Composition-Scheme-GSTR-9A.docx-Compatibility-Mode-Word-Product-Activation-Failed-2019-05-08-15.32.48-7.png)

Tables of Form GSTR 9A

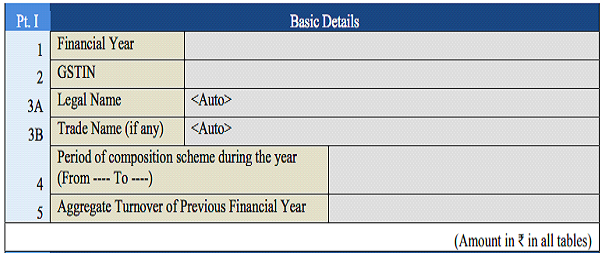

Part 1

This part contains basic details such as your GSTIN number, Legal Name, and Trade Name.

- Financial Year– Enter the financial year for which you are filing the GSTR-9A.

- GSTIN– Enter your GST registration number.

3 A. Legal Name – Your legal name will be automatically fetched.

3 B. Trade Name – Your trade name (if any) will be automatically fetched.

- Period of composition scheme during the year– The starting and ending dates of your enrollment under the composition scheme.Aggregate Turnover of Previous Financial Year– Enter your aggregate business turnover for the previous financial year. If there are multiple taxpayers registered under the same PAN, then the total of all of the taxpayers’ turnovers must be entered here

5. Aggregate Turnover of Previous Financial Year – Enter your aggregate business turnover for the previous financial year. If there are multiple taxpayers registered under the same PAN, then the total of all of the taxpayers’ turnovers must be entered here

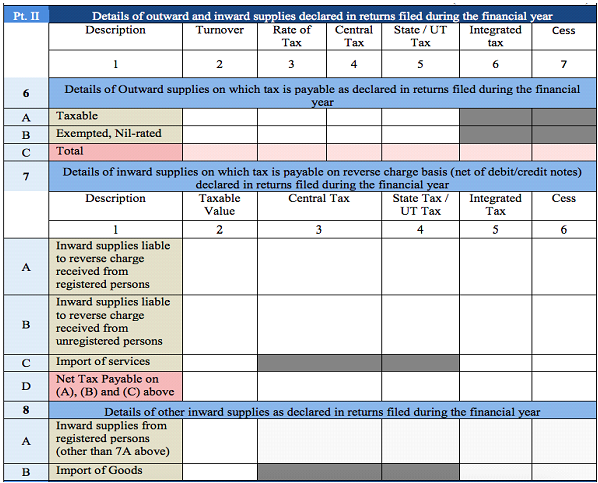

Part 2

This part contains a summary of all sales and purchases declared in the GSTR-4 quarterly returns during the financial year.

6 A. Details of taxable sales – Enter the aggregate value of all taxable sales. This includes the net value of debit notes and credit notes, advances, and goods returned for the financial year. The values entered in Table 6 and Table 7 of the GSTR-4 can be used for filling in these details.

7 A. Inward supplies received from registered persons liable to reverse charge – Enter the aggregate value of all purchases that were bought from a registered person and taxed on a reverse charge basis. You can use Table 4B, Table 5 and Table 8A of the GSTR-4 to fill in this value.

7 B. Inward supplies received from unregistered persons liable to reverse charge – Enter the aggregate value of all purchases that were received from unregistered persons and taxed on a reverse charge basis. Table 4C, Table 5 and Table 8A of the GSTR-4 can be used to fill in this value.

7 C. Import of services – Enter the aggregate value of all imported services during the financial year. You can refer to Table 4D and Table 5 of the GSTR-4 to fill in these details.

7 D. Net Tax Payable on (A), (B) and © above – Enter the total value of 7A, 7B and 7C here.

8 A. Inward supplies from registered persons (other than 7A above) – Enter the aggregate value of all taxable purchases received from registered persons, other than what is mentioned in section 7A. You can use Table 4A and Table 5 of the GSTR-3 to fill in these details.

8 B. Import of Goods – Enter the aggregate value of goods imported during the financial year. You can use Table 5 of the GSTR-4 to fill in these details.

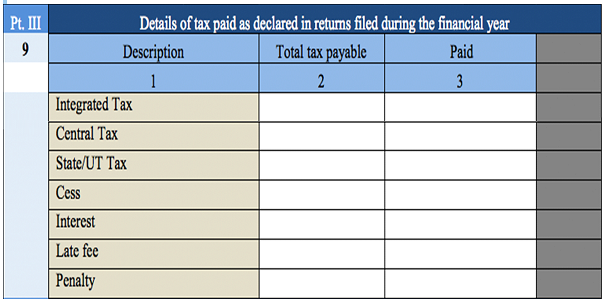

Part 3

This part collects information about tax paid by the business.

- Details of tax paid as declared in returns filed during the financial year– Enter details of the tax amount due and the amount paid, as declared in returns filed during the financial year. You need to split up the tax amount according to the type of tax paid: integrated tax, central tax, state/UT tax, cess, and interest. You also need to enter values for any late fees or penalties paid in this section.

Part 4

Part 4 contains the details of amendments (either additions or subtractions) made to the transaction information in your previous financial year’s return. Include transactions declared in returns between April and September of the current financial year, or before you filed the previous year’s annual return, whichever is earlier. For instance, for an annual return for the 2017-2018 financial year, include transactions that took place in FY 2017-2018 and were declared in April to September 2018.

Declare all of the various values of supply mentioned below and break each one down into turnover, central tax, state tax/union territory tax, integrated tax, and cess.

- Supplies / tax (outward) declared through Amendments (+) (net of debit notes) – Enter the value of sales/tax declared through amendments made in Table 5 or Table 7 of the GSTR-4 here. This value must include the net value of debit notes.

- Inward supplies liable to reverse charge declared through Amendments (+) (net of debit notes) – Enter the value of purchases made that are taxed on a reverse charge basis and declared through amendments made in Table 5 or Table 7 of the GSTR-4. This value must include the net value of debit notes.

- Supplies / tax (outward) reduced through Amendments (-) (net of credit notes) – Enter the value of sales/tax that was reduced through amendments made in Table 5 or Table 7 of the GSTR-4. This value must exclude the net value of credit notes.

- Inward supplies liable to reverse charge reduced through Amendments (-) (net of credit notes) – Enter the value of purchases that were taxed on a reverse charge basis and reduced due to amendments made in Table 5 or Table 7 of the GSTR-4. This value must exclude the net value of credit notes.

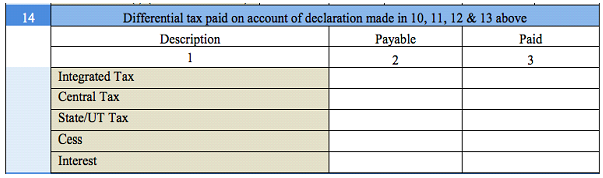

14. Differential tax paid on account of declaration made in 10, 11, 12 & 13 above– In this section, you are required to mention how much tax you must pay and how much you have paid so far per the declaration made in fields 10 to 13 of this form. The tax value must be split into integrated tax, central tax, state/union territory tax, cess, and interest.

14. Differential tax paid on account of declaration made in 10, 11, 12 & 13 above– In this section, you are required to mention how much tax you must pay and how much you have paid so far per the declaration made in fields 10 to 13 of this form. The tax value must be split into integrated tax, central tax, state/union territory tax, cess, and interest.

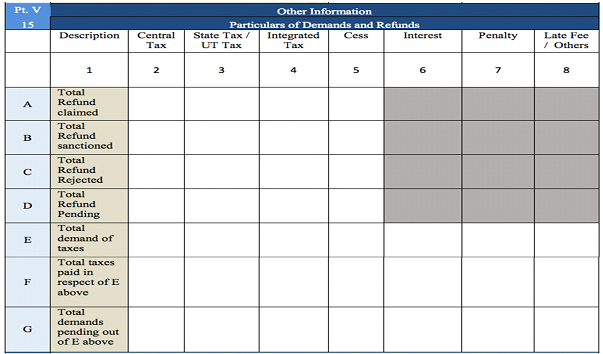

Part 5

In this part, mention details related to all refunds claimed, issued, pending, sanctioned, and rejected; credits availed or reversed; and late fees owed during the financial year.

Break down each value according to the type of tax levied on the transaction: central tax, state tax/union territory tax, integrated tax, cess, interest, penalty, and late fees.

15 A. Total Refund claimed – Enter the total value of all the refund claims filed during the financial year, inclusive of refunds that were sanctioned or rejected or are still pending.

15 B. Total Refund sanctioned – Enter the total value of all the refunds that were sanctioned.

15 C. Total Refund rejected – Enter the total value of all the refunds that were rejected during the financial year.

15 D. Total Refund Pending – Enter the total value of all refund applications for which acknowledgement has been received and which are being processed, excluding provisional refunds received.

15 E. Total Demand of Taxes – Enter the total value of tax demands for which order confirmation has been received from the authority.

15 F. Total Taxes Paid in Respect of E above – Enter the total value of taxes paid out of the total value entered in field 15E.

15 G. Total Demands Pending out of E above – Enter the total value of demands that haven’t been recovered, out of the total value entered in field 15E.

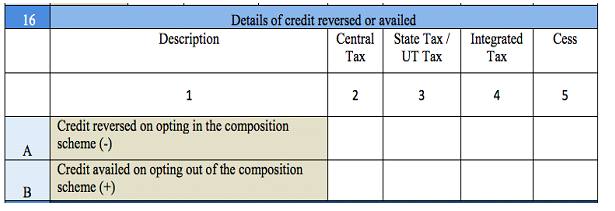

16 A. Credit reversed on opting in the composition scheme (-) – Enter the total value of all credits reversed when paying tax under the composition scheme. You can use the details given in Form ITC-03 to fill in this information.

16 B. Credit availed on opting out of the composition scheme (+) – Enter the total value of all credits availed when you opt out of the composition scheme. You can use the details filled in FORM ITC-01 to fill in this information.

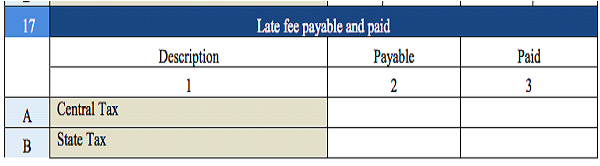

- Late fee payable and paid– If your annual return is filed after the due date, you will need to pay a late fee. Enter the total late fee due and the amount paid so far, if applicable.

Payment:

- Except late fee, if any, no payment is to be made with annual return.

- Payment can be made on voluntary basis through GST DRC-03, if required.

Before filing the GSTR-9A, you must sign and authenticate the return either through a digital signature certificate (DSC) or by using an Aadhar-based signature verification mechanism.

Can nil Form GSTR-9A be filed?

- Yes, Nil Form GSTR-9A can be filed for the FY, in the following conditions when: –

- any outward supply (commonly known as a sale) is not made

- any goods/services (commonly known as a purchase) is not received

- no liability is reported

- no credit is claimed

- no refund is claimed

- no order creating demand is received

- no late fee is there to be paid etc.

Who does not need to file Form GSTR-9A ?

- Following persons are not required to file Form GSTR-9A

- – Regular Taxpayer who have not opted in for composition scheme for any period during the financial year

- – Non Resident Taxable Persons

- – Input Service Distributor

- – Casual Taxable Person\

- – Persons required to Deduct tax at Source u/s 51

- – Persons required to Collect tax at Source u/s 52

I am a regular/normal taxpayer for part period and composition taxpayer for part period during the financial year. Do I need to file Form GSTR-9A or Form GSTR-9?

- You are required to file both form GSTR-9 and Form GSTR-9A.

- The period during which the taxpayer remained as a Composition Taxpayer, Form GSTR-9A is required to be filed.

- And, for period during which the taxpayer registered as normal taxpayer, Form GSTR-9 is required to filed.

- Both Form GSTR-9 and Form GSTR-9A for the respective tax period are required to be filed for FY 2017-18, in such cases.

I have not filed all my applicable returns /statements during the financial year. Still, Can I file Annual Return without filing of those applicable returns/statements ?

- No, You cannot file return in Form GSTR-9A without filing form GSTR-4 for all applicable periods during the relevant financial year.

What is the due date for filing Form GSTR-9A for F.Y. 2017-18 ?

- Form GSTR-9A for F.Y. 2017-18 can be filed by 30thJune, 2019. In case of Filing after the due date, late fee will be levied.

I got my registration cancelled in the Financial Year. Can I file form GSTR-9A ?

- The annual return is to be filed even if taxpayer has got his registration cancelled during the said financial year.

Can I revise Form GSTR-9A return after filing ?

- No, You cannot revise Form GSTR-9A Return after filing.

In Form GSTR-9A, can additional liability not reported earlier in Form GSTR-4 be declared ?

- Yes, additional liability not reported earlier at the time of filing form GSTR-4 can be declared in Form GSTR-9A. The additional liability so declared in Form GSTR-9A are required to be paid through Form GST DRC-03.

- If available cash balance in the Electronic cash ledger is less than the amount required to offset the liabilities, then additional cash required to be paid by taxpayer is shown in the “Additional Cash required” coloumn. You may create challan for the additional cash directly by clicking on the CREATE CHALLAN button.

Can I file nil Form GSTR-9A ?

- Nil Form GSTR-9A can be filed for the financial year, if you have

– Not made any Outward Supply; AND

– Not received any goods/services;

– No other liability to report; AND

– Not Claimed any refund; AND

– Not received any order creating demand.

Which Table in Form GSTR-9A has auto populated data from filed Form GSTR-4?

- Table 6 : Details of Outward supplies made during the financial year.

- Table 7: Details of Inward supplies on which tax is payable on reverse charge basis (net of debit/credit notes) for the financial year.

- Table 8: Details of other inward supplies for the financial year.

- Table 9: Details of Tax Paid as declared in returns filed during financial year

Can I edit auto populated details in Form GSTR-9A

- Yes, you can edit autopopulated data in form GSTR-9A except tax paid column of Table No 9.

- The Outward supplies details can be edited in order to indicate actual supplies made and not merely outward supplies indicated in the Returns.’

Do I need to provide information relating to all supply made during the financial year ?

- Yes, you need to provide all supplies made during the financial year and not merely the supplies reported in the return.

Can I download system computed values of Form GSTR-9A ?

- Yes taxpayer can download the system computed values for Form GSTR-9A in PDF format.

- This will help taxpayer to use it as reference while filing form GSTR-9A.

Is their any option to make payment other than late fee (if applicable) in Form GSTR-9A ?

- After filing of your return in Form GSTR-9A, you will get a link to Form GST DRC-03 to pay tax, if any.

- Any additional payment can be made using Form GST DRC-03 fuctionality only and that too by Cash.

Is their any Offline Tool for filing Form GSTR-9A ?

- Currently, Form GSTR-9A return can be filed through online mode only.

- However, offline tool for Form GSTR-9A will be released shortly.

Do this…before you file this form :

- Reconcile your data with the books of accounts and financial statements for 2017-18

- .

- Check for any Error/Omission in reporting data in GSTR-4 filed for F.Y. 2017-18, which have not been rectified in subsequent period.

- Reconcile you tax liability as reported in with Books of Accounts.

- Report your tax liability as per reconciled figure.’

- Any Additional liability can be paid through Form GST DRC-03 available at GST Portal through electronic cash ledger only.

Latest Updates as per the 31st GST Council Meeting

- The deadline for filing the annual returns (for the financial year 2017-2018) in Form GSTR-9A, has been extended to the 30th of June 2019.

- In order to file Form GSTR-9A, candidate must ensure that they have filed all annual returns in Forms GSTR-4.

- The heading in FORM GSTR-9A “made during the year” with respect to supplies will be changed into “as declared in returns filed during the year”.

For more details please see the YouTube @ the following Link

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com