Filing GSTR 9/9c December 2021: Critical Issues for Preparing for Scrutiny

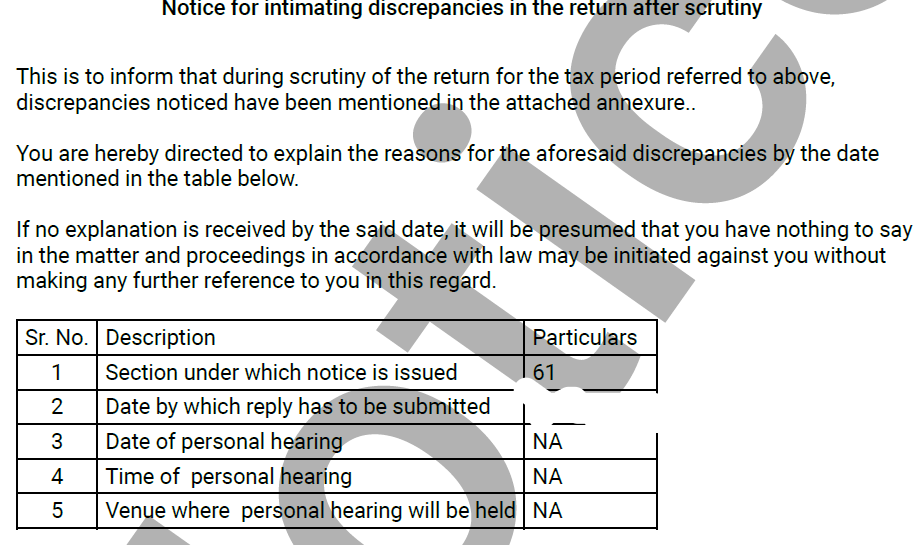

Section 61 of The CGST Act 2017 empowers the revenue authorities to scrutinize the return and related particulars furnished by the taxpayers to verify the correctness of the return and inform him of the discrepancies noticed, if any, in such manner as may be prescribed and seek his explanation thereto.

GSTR 9 and GSTR 9C for 2020-21 which would be filed by 31st December 2021 are also subject to Scrutiny u/s 61. Over the past periods, we have witnessed that the scrutiny of GSTR 9 and 9C is conducted by the revenue authorities. The following is a sample of an auto-generated notice which a taxpayer may receive –

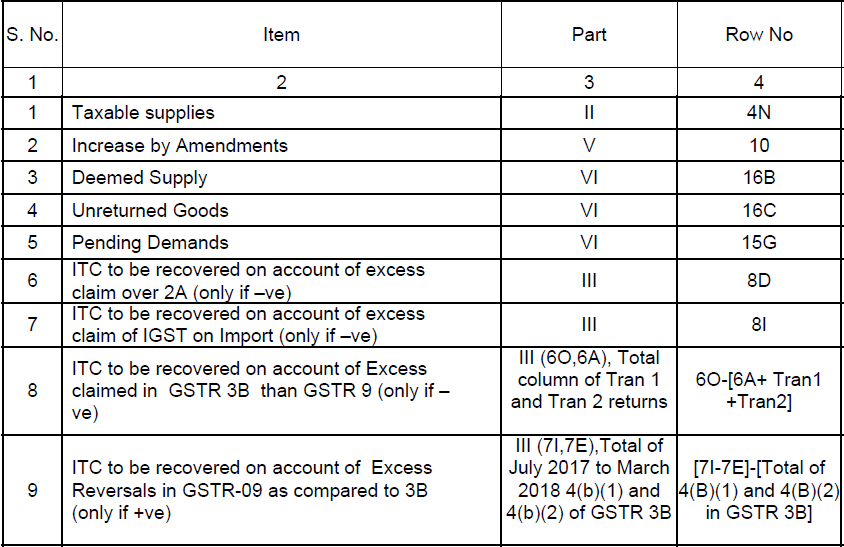

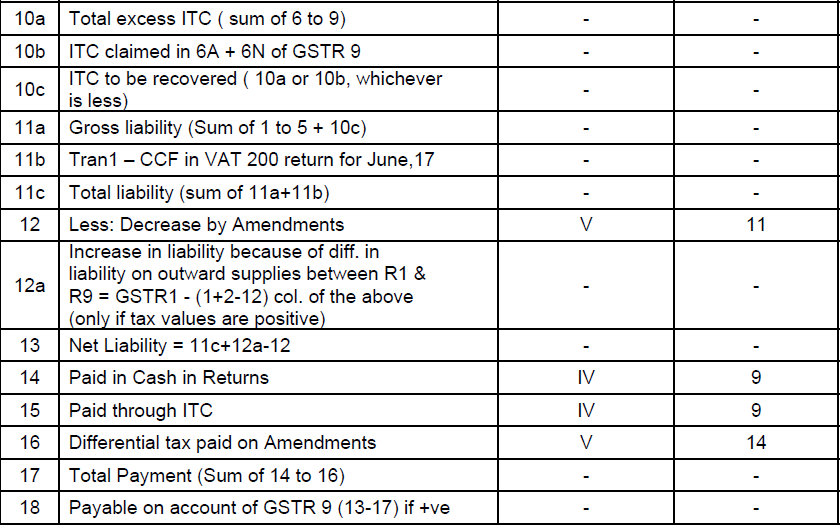

The following is the analysis of the above notice and precautions to be taken while filing GSTR 9 and GSTR 9C of 2020-21-

- Taxpayers need to take note of Instruction 2A of GSTR 9 as below. This is an important instruction and it is to be noted that all figures reported in GSTR 9 should be the figures pertaining to 2020-21 only. Hence while following Circular 26/26/2017, in case any ITC or outward supply of 2019-20 have been reported in GSTR 3B of April’20 – Sep’20, they need to be culled out and not reported in GSTR 9 of 2020-21.The following is the text of Instruction 2A of GSTR 9 –15[2A. In the Table, against serial numbers 4, 5, 6, and 7, the taxpayers shall report the values pertaining to the financial year only. The value pertaining to the preceding financial year shall not be reported here.]

- Table 15G of GSTR 9 is important to note. In case any admitted tax is not paid, the above reconciliation may auto-generate a demand. Hence it is important that admitted taxes are paid. In case of disputed taxes not paid, the same may again result in an auto-generated demand as per the above reconciliation. Hence, if this is the case, it becomes important to attach suitable explanations along with GSTR 9C.

- Table 8D is the most important. The formula for 8D is-8D = 8A – 8B – 8C

The following needs to be noted in this regard –

(a). In case the figure of 8A is not equal to that reflected in GSTR 2A, then one may attach a suitable explanation with GSTR 9C.

(b). Please do not report any transaction of 2019-20 in Table 6B. Table 8B pulls figures from 6B. In the case of ITC reclaimed, it is important that the same is reported only in 6H and not in 6B as it would result in a double effect in 8B.

(c). In the case of Table 8C, it is important that the figures pertaining to 2020-21 culled out from GSTR 3B of Apr’2021 – Sep-2021 are reported in Table 8C. A proper reconciliation needs to be kept ready as to the figures reported in GSTR 3B of Apr’2021 – Sep-2021 vis-à-vis the ITC for 2020-21 and 2021-22.

- In the case of Table, 8I is negative, it may give rise to the demand. Such a situation may arise in the case say on 31st March 2020 the taxpayer has made the payment for clearance of a Bill of Entry but the material has been received in its premises in April 2020. In this case, the payment of the BoE is pertaining to 2020-21 and should be reported in 8G. A suitable declaration may be attached with GSTR 9C to this effect.

- The reversals done in GSTR 3B should match with that reflected in GSTR 9.

- The amounts paid vide ITC and vide Cash is to be reported in Table 9 of GSTR 9.

- Lastly, the amount payable as per Row 13 of the reconciliation above is to be matched with the amount paid/adjusted as reflected in Row 17 above. In case there is a difference the same may be explained. A suitable declaration may be attached with GSTR 9C to this effect.

It is thus important for taxpayers to evolve as the Revenue evolves so as to keep a check on the risks and obtain the maximum benefit of GST Implementation.

Happy GSTR 9 and GSTR 9C filing!

CA Vivek Jalan

CA Vivek Jalan

Vivek Jalan, from Tax Connect, is a Chartered Accountant & a qualified L.LM & LL.B. He is The Chairman of The Ease of Doing Business Committee therein. He is a member of The Confederation of Indian Industries (CII)- Economic Affairs & Taxation Committee. He is the Member of The Consultative Committee of The Commissioner of SGST. He is also The Member of The Regional Advisory Committee of The Chief Commissioner of CGST. He is advising Large MNCs, PSUs & PAN India Organizations in GST & Income Tax and has offices in Kolkata, Delhi, Bangalore, Mumbai & now Surat. He is a regular Columnist and guest expert in Economic Times, Times of India, Dalal Street Journal, Money Control, Live mint, CNBC, Hindustan Times, Zee Business, Financial Express, other dailies, and business magazines like Business Today, etc. He is also a guest expert on Taxation matters in All India Radio and other media platforms. He is the Editor of Weekly Bulletin TAX CONNECT, a publication on Indirect Taxes and Direct Taxes which reaches more than 70000 professionals.