Guidance notes on How to fill Box No.12 of GSTR-1 as per recent amendments w.e.f. 01.04.2021 of GST Law,2017.

Dear Professional Colleagues, Good Day to you. I have gone through recent changes about mandatory to mention HSN & SAC Code in Tax Invoice and furnishing inward & outward details at box no 12 of GSTR-1 w.e.f.01.04.2021. Some of the professionals are having confusion about the furnishing of outward details in GSTR-1. As per recent amendments to GSTR-1 w.e.f.1.4.2021. So, herewith I am trying to clarify to the best of my knowledge.

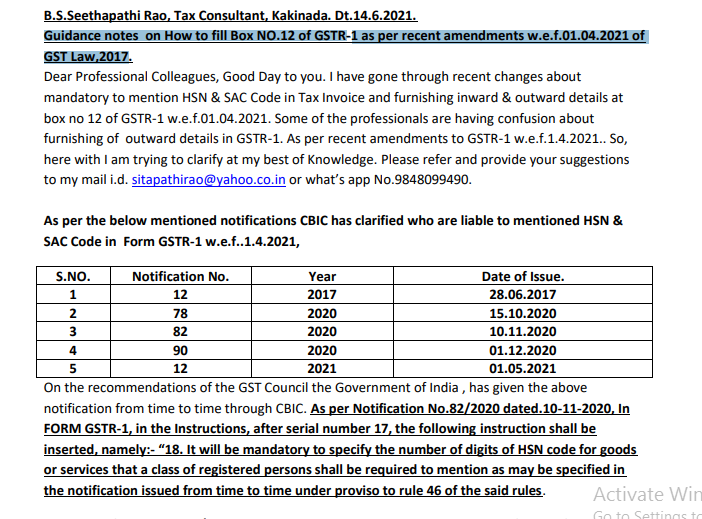

As per the below-mentioned notifications CBIC has clarified who are liable to mentioned HSN & SAC Code in Form GSTR-1 w.e.f. 1.4.2021,

| S.NO. | Notification No | Year | Date of Issue. |

| 1 | 12 | 2017 | 28.06.2017 |

| 2 | 78 | 2020 | 15.10.2020 |

| 3 | 82 | 2020 | 10.11.2020 |

| 4 | 90 | 2020 | 01.12.2020 |

| 5 | 12 | 2021 | 01.05.2021 |

On the recommendations of the GST Council, the Government of India has given the above notification from time to time through CBIC. As per Notification No.82/2020 dated.10-11-2020, InFORM GSTR-1, in the Instructions, after serial number 17, the following instruction shall be inserted, namely:- “18. It will be mandatory to specify the number of digits of the HSN code for goods or services that a class of registered persons shall be required to mention as may be specified in the notification issued from time to time under proviso to rule 46 of the said rules.

As per Notification NO.12/2021 –Central Tax, dt.1.5.2021 CBIC has given a notification for extension of the date to furnish the details as per the amendment to GSTR-1 for the month of 4/2021 till 26.05.2021.

As per Sec.39 read with Rule 59(1) of CGST Rules,2017 prescribed to furnishing the details of outward supplies of goods and services by the taxpayers in Form GSTR-1, w.e.f. 1.7.2017. As per Notification No. 82 of 2020 –Central Tax –dated.10.11.2020, In FORM GSTR-1, in the Instructions, after serial number 17, the following instruction shall be inserted, namely:-

“18. It will be mandatory to specify the number of digits of the HSN code for goods or services that a class of registered persons shall be required to mention as may be specified in the notification issued from time to time under proviso to rule 46 of the said rules.

Now, Herewith I am providing that how to fill BOX no.12 of Form GSTR-1 w.e.f. 01.04.2021step by step for your reference and file Form GSTR-1 with ease and without confusion.

The Form GSTR-1 return requires a dealer to furnishing the details HSN &SAC Code wise summary of Outward Supplies rate wise along with Quantitative.

Related Topic:

Live demo for the filing of GSTR-1

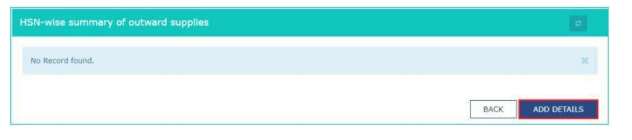

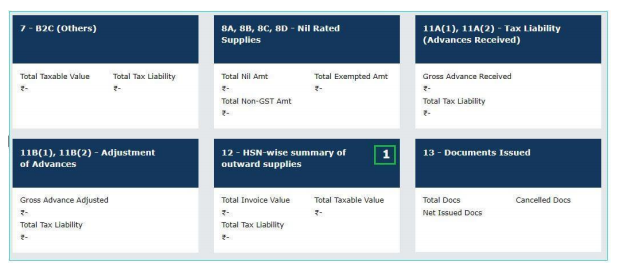

You have Log into GSTN Common Portal and select a respective month of GSTR-1 return, To furnish the details of Supply of Goods and Services HSN & SAC Code Summary wise, Go to Box No.12 click “HSN-Wise Summary of outward supplies.

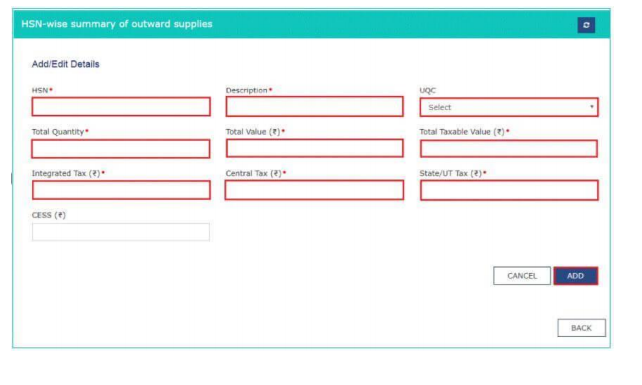

The following details are to be provided on this page: They are—

1. HSN Code or SAC Code of outward Supplies,

2. Description of the Outward Supplies,

3. The “UQC” dropbox you have to select Quantity of supply of Goods or Services, (UQC means Kgs, Liters, and number of items, etc., of supply of Goods and Services In a particulars invoice),

4. Enter the Total Quantity, Total Value, and Total value of the Outward supplies of Goods and Services of a particular invoice,

5. Enter the IGST, CGST, and SGST based on the type of sale made i.e. inter-State, Intra –State, etc.,

6. You have to click on ADD and on the next page and click on the Save button.

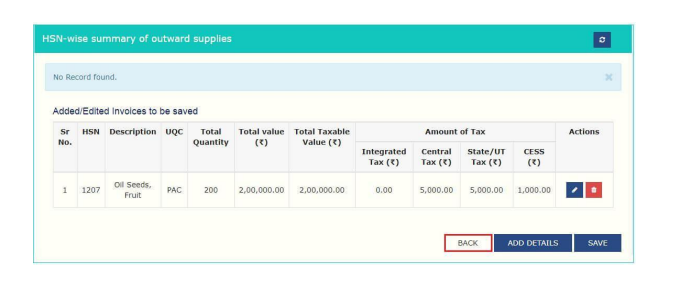

Herewith I am providing the draft format of Box No.12 of GSTR-1 to refer to after entering all the details of outward supplies of Goods and Services entered by you.

Now Click on the back button to go back to the Form GSTR-1 page. Here you have seen the Summary of HSN & SAC wise outward supplies entered by you.

Dear Colleagues, I am providing my guidance notes to the extent of “ How to fill and what are the details of outward supply of Goods and Services as per recent amendments made to Form GSTR-1 and instructions to fill up Form GSTR-1 vide Notification No. 82/2020 –Central Tax, dated.10.11.2020, incorporate S.No.18 of Instruction for fill up of Form GSTR-1 from 1.4.2021. I think it will useful to all of you.

B S Seethapathi Rao

B S Seethapathi Rao

East Godavari, India