Guidance Notes on “When, Where & How to rectify Common mistakes in furnishing the data through Form GSTR-1 & Form GSTR-3B “under GST Act,2017.

Dear Professional Colleagues, Good Day to you. Today I am providing my guidance Notes on rectifications of mistakes in furnishing the data through Form GSTR-1 & Form GSTR-3B under GST Act, 2017. I have received queries from some of the professional colleagues on how to rectify mistakes that happened while furnishing the data through Form GSTR-1 and Form GSTR-3B under GST. SO, Herewith I am trying to providing Guidance Notes on How, When, and Where to rectify such mistakes that happened at the time of filing Form GSTR-1 & Form GSTR-3B as per GST Act and Rules, 2017. Kindly refer and follow in your professional work.

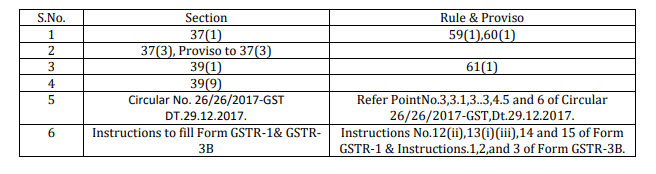

Kindly refer to the below Sections, Rules, and Provisos relating to furnishing the data return wise, table-wise of GSTR-1 and Form GSTR-3B as per GST Act,2017.

Generally, we have committed the following mistakes while furnishing the data:-

1. B2B Outward supplies entered as B2C Outward supplies,

2. B2C Outward supplies entered as B2B Outward supplies,

3. RCM purchases were has entered in B2B Outward supplies,

4. Zero Rates outward supplies entered as Nil Rated outward supplies,

5. 1% outward supplies are entered as deemed exports,

6. Inter-State outward supplies are entered as Intra-State outward supplies,

7. GST number, Invoice/Debit Note, Credit Note, Tax amount, Place of Supply wrongly entered,

8. Missing invoice is not entered in GSTR-1,

9. Sometimes by oversight invoices belonging to other dealers invoices are entered,

10. Under Reporting in Form GSTR-3B relating to taxable value or ITC component,

11. Over reporting in Form GSTR-3B relating to taxable value or ITC component,

12. IGST outward supplies reported correctly in Form GSTR-1 but in Form, GSTR-3B reported as CGST /SGST outward supplies or vice versa,

13. Details of Credit Notes reported in Form GSTR-1 but not deducted in Form GSTR-3B.

So, now I am trying to explain how, when, and where to rectify such errors in furnishing data in Form GSTR-1 and Form GSTR-3B as per GST Law. We have to refer to the following Sections, Rules, Proviso to Sections and rules, Tables of Form GSTR-1 and Form GSTR-3B for the tax period.

Section 37(1) of CGST Act, 2017,” The details of outward supplies are required to be furnished by all the normal and casual registered taxpayers in a monthly statement through Form GSTR-1. Section 37 of the CGST Act read with Rule 59 covers the provisions and prescribed manner of furnishing such details in Form GSTR-1.

Rule 59(1) of the CGST Rules, 2017,” Every registered person, other than a person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017, required to furnish the details of outward supplies of Goods and Services or both under Section 37, shall furnish such details in FORM GSTR-1 electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner.

Section 37(3) of CGST Act, 2017,” Any registered person, who has furnished the details under subsection (1) for any tax period and which have remained unmatched under Section 41, or section 43, shall, upon discovery of any error or omission, therein, rectify such error or omission in such manner as may be prescribed, and shall pay the tax and interest, if any, in case there is a short payment of tax on account of such error or omission, in the return to be furnished for such tax period.

Proviso to Section 37(3) of CGST Act,2017,” Provided that no rectification of error or omission in respect of the details furnished under sub-section (1) shall be allowed after furnishing of the return under section 39 for the month of September following the end of the financial year to which such details pertain, or furnishing of the relevant annual return, whichever is earlier.

Explanation:- For the purposes of this Chapter, the expression ”details of outward supplies” shall include details of invoices, debit notes, credit notes, and revised invoices issued in relation to outward supplies made during any tax period.

Section 39(1) of CGST Act,2017,” Every registered person who is required to furnish a return under section 39(1) shall pay to the Government the tax due as per such return not later than the last date on which he is required to furnish such return. If the last date for filing a return is extended by the Commissioner, the last date for payment of tax will also get extended automatically.

Rule 61 of CGST Rules, 2017, (1) Every person other than a person referred to in section 14 of the Integrated Goods and Services Tax Act,2017(13 of 2017) or an Input Service Distributor or a non-resident taxable person or a person paying tax under section 10 or section 51 or, as the case may be, under section 52 shall furnish a return in FORM GSTR-3B, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner, as specified under,

Read & Download the full copy in pdf:

B S Seethapathi Rao

B S Seethapathi Rao

East Godavari, India