Raj Quarry works ,AAR Gujarat Royalty to state government is liable for RCM

Case Covered: M/s Raj quarry works

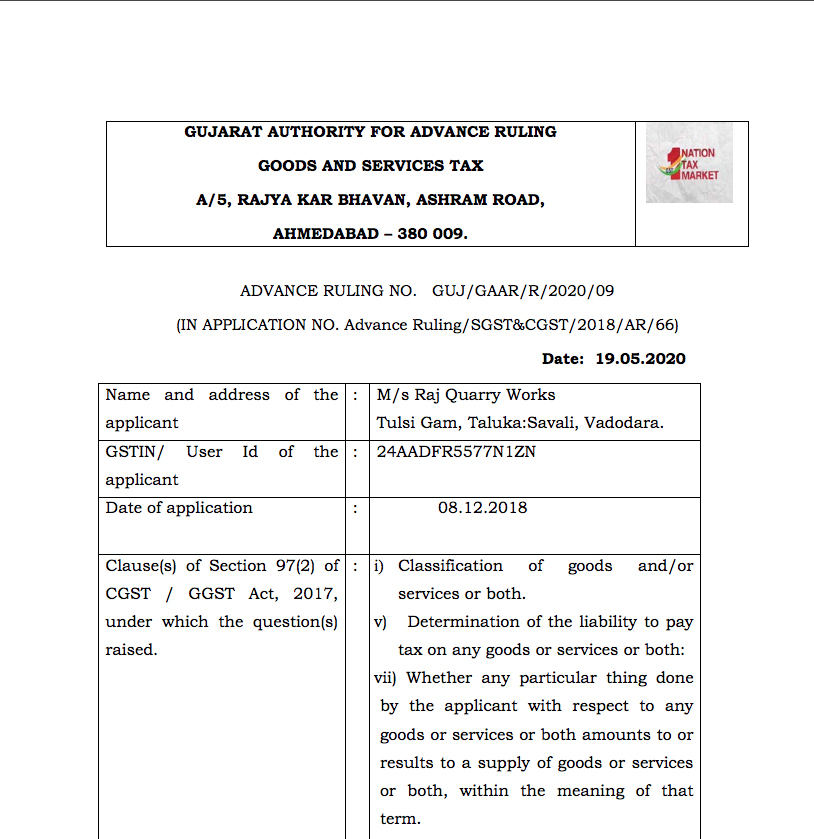

The advance ruling of Gujarat Advance ruling authority in case of M/s Raj Quarry Works.

Facts of the case

The applicant is engaged in the business of mining activity on a plot of land leased from the Govt. of Gujarat. The applicant is quarrying ‘BLACK TRAP’ products used for concrete mixing and sells it to the customers. It is taxable @5% in GST.

It has obtained the Government land on lease for quarrying said material and in turn, pays a royalty to the State Govt.

It has sought an advance ruling to determine the classification and taxability of service provided by the State Government for which royalty is paid by the applicant.

The Authority for Advance Ruling (‘AAR’) observed that leasing of the Government land to the applicant is a supply of service. Heading 9973 covers leasing or rental services with or without operator and sub-heading 997337 includes licensing services for the right to use minerals including its exploration and evaluation.

In the given case, the Government has been providing licensing services for granting ‘Right to use’ minerals after its exploration and evaluation to the applicant for which consideration in the form of royalty.

Questions asked by the applicant:

- Whether said service can be classified under Tariff Heading 9973, specifically under 997337 as Licensing services for the right to use minerals including its exploration and evaluation or as any other service?

- What is the rate of GST on given services provided by the State of Gujarat to M/s Raj Quarry Works for which Royalty is being paid?

- Whether services provided by the State Government is governed by the applicability of Notification No 13/2017-CT(Rate), dated 28.06.2017 under entry number 5.

- Is it liable for RCM?

Observation of the Advance ruling authority

The answer of the applicant questions whether they are covered under exclusion clause (1) of entry No.5 of the said Notification is that their service is “Licensing services for the right to use minerals including its exploration and evaluation” whereas entry No. 1 is “renting of immovable property”. The applicant has taken a mine on lease for quarrying minerals from the Govt. Of Gujarat and said service is not service of Renting of the immovable property therefore applicant does not fall under exclusion entry No. 1 of the said Notification.

- Thus, the licensing service provided by the State Government is classified under sub-heading 997337 and covered under residual Entry No. (viii) of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017.

- It is taxable at the rate of 18% GST.

- Further, the applicant is liable to discharge the tax liability on the Reverse Charge basis.

GUJ_AAR_09_2020_19.05.2020_RQWConsultease copy of Gujarat AAR of Raj Quarry works

Read & Download the order

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.