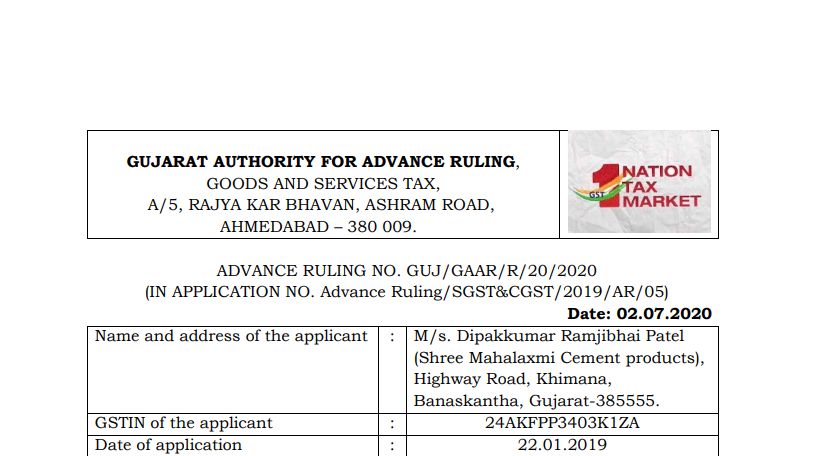

Gujarat AAR in the case of M/s. Dipak Kumar Ramjibhai Patel

Table of Contents

Case Covered:

M/s. Dipak Kumar Ramjibhai Patel

Facts of the Case:

The applicant M/s. Dipak Kumar Ramjibhai Patel (Shree Mahalaxmi Cement products) vide their application for Advance Ruling has submitted that they are a proprietorship concern, engaged in the manufacturing of Fly Ash Bricks and Fly Ash Blocks. They are manufacturing ‘Fly Ash Bricks’ and ‘Fly Ash Blocks’ by using the following raw materials:

(a) Cement (5% to 20%).

(b) Fly Ash (40% to 60%).

(c) Sand (35% to 55%).

(d) Lime (5% to 20%).

(e) Water- (As per requirement).

The applicant has further submitted that the above products are manufactured from the mixer which is prepared by mixing the aforesaid raw materials in desired proportion and The HSN code of both the products is 68159910; that they are paying GST @ 5% on ‘Fly Ash Bricks’ and 12% on ‘Fly Ash Blocks’ till notification No:24/2018-Central Tax(Rate) date 31.12.2018.

The applicant has submitted the following question for the purpose of the advance ruling:

“Whether supply of Fly Ash Bricks and Fly Ash Blocks are covered under Chapter heading 68159090 and liable to taxed @ 5% and @ 12% respectively under the GST Act?”

The applicant has enclosed copies of the Sales invoice in respect of Fly Ash Bricks and Fly Ash Blocks. They have also stated that the above question posed for advance ruling is neither pending nor decided in any proceedings in the case of the applicant under any of the provisions of the GST Acts and have requested to decide the question posed for an advance ruling at the earliest possible.

Observations:

We have considered the submissions made by the applicant in their application for advance ruling as well as the arguments/discussions made by their representative Shri Sameer Siddhpuriya at the time of the personal hearing. We have also considered the issues involved on which Advance Ruling is sought by the applicant.

At the outset, we would like to state that the provisions of both the Central Goods and Services Tax Act, 2017, and the Gujarat Goods and Services Tax Act, 2017 are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the GGST Act.

The applicant has submitted the following question for the purpose of the advance ruling:\

“Whether supply of Fly Ash Bricks and Fly Ash Blocks are covered under Chapter heading 68159090 and liable to taxed @ 5% and @ 12% respectively under the GST Act?”

Ruling:

(1) The product ‘Fly Ash Bricks’ manufactured and supplied by Dipakkumar Ramjibhai Patel (M/s. Mahalaxmi Cement products) are classifiable under Tariff item No.68159910 of the First Schedule to the Customs Tariff Act, 1975(51 of 1975) . Applicability of GST rate on the said product would be 12% GST (6% SGST + 6% CGST) up to 14.11.2017 and 18% GST (9% SGST + 9% CGST) with effect from 15.11.2017 as per Notification No:01/2017-Central Tax(Rate) dated 28.06.2017 (as amended from time to time) issued under the CGST Act, 2017

(2) The product ‘Fly Ash Blocks’ manufactured and supplied by Dipakkumar Ramjibhai Patel (M/s. Mahalaxmi Cement products) are classifiable under Tariff item No.68159990 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975). Applicability of GST rate on the said product would be 12% GST (6% SGST + 6% CGST) up to 31.12.2018 and 5% GST (2.5% SGST + 2.5% CGST) with effect from 01.01.2019 as per Notification No:01/2017-Central Tax(Rate) dated 28.06.2017 (as amended from time to time) issued under the CGST Act, 2017.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.