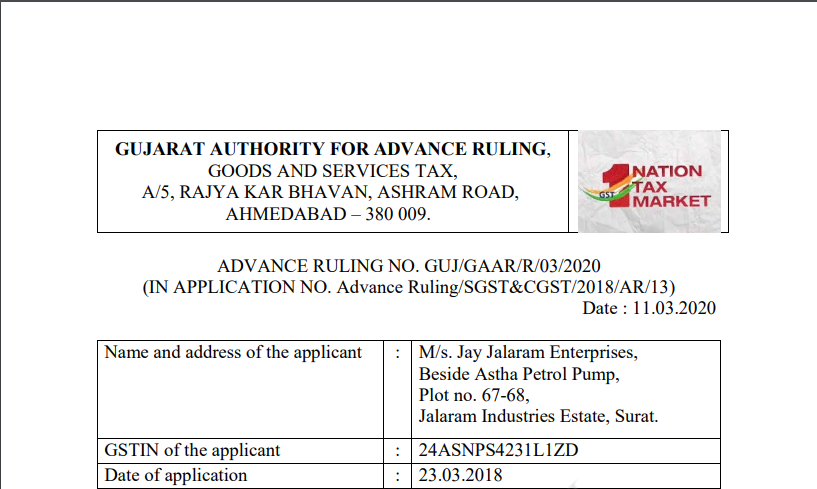

Gujarat AAR in the case of M/s. Jay Jalaram Enterprises

Table of Contents

Case Covered:

M/s. Jay Jalaram Enterprises

Facts of the case:

The applicant has submitted that they are a proprietorship concern and manufacture Pop Corn, which is sold in a sealed plastic bag bearing a registered brand name as [J.J.’s] POPCORN, under the Trade Marks Act, 1999. They submitted that their product is manufactured by using corn/maize grains. The Raw corn – grains are heated in an electric machine/oven @ 180/200 degree temperature and due to the heat so given to the grains, they turn into puffed corns/popcorns which are known in the Gujarati language as “Dhani” which is similar to that of puffed rice/ known as murmura. Then after they are sieved so as to remove some grains which are left unpuffed. During the process Salt, Edible Oil, and Turmeric Powder are mixed in required quantity. Thereafter the product is packed in a plastic pouch in a quantity of 15 gm. The applicant also submitted a Tax Invoice issued by them, bearing No. GT/411 Dt. 24-02-2018 for a gross value of Rs.3920/- (Incl. tax CGST @2.5% and SGST @2.5%, collected separately) for the supply of goods namely ‘POPCORN’ and raised the following question for advance ruling in their application:-

“Classification, under which Schedule/Sr. No./Chapter heading/Sub-heading/tariff Item (HSN) the rate of CGST/SGST would be applicable to the supply made by the applicant on [J.J.’s] Popcorn, vide Tax Invoice No. GT/411 Dt. 24-02-2018?”

Observations:

It is observed that the product in question i.e. ‘POPCORN’ is manufactured from raw corn/maize grains, by heating in an electric machine/oven at the temperature of 1800 to 2000 centigrade and due to the heat so given to the grains, they turn into puffed corns/popcorns and then to make it palatable other ingredients like salt and turmeric powder are added to it and a negligible quantity of oil is also used for the purpose of sticking the salt and turmeric on the maize/corn. Thus it is ready to eat prepared food and fits the description as ‘Prepared foods obtained by the roasting of cereal’. This description attracts classification under Chapter Sub-Heading 1904 10 of the First Schedule to the Customs Tariff Act, 1975. Since it is not Corn flakes (tariff item 1904 10 10), Paws, Mudi and the like (tariff item 1904 10 20) or Bulgur wheat (tariff item 1904 10 30), it will fall under the residual tariff item 1904 10 90 of the First Schedule to the Customs Tariff Act, 1975.

Ruling:

The product namely ‘[J.J.’s] POPCORN’, manufactured from raw corn/maize grains, which, by heating turn into puffed corns/popcorns and then to make it palatable other ingredients like salt and turmeric powder along with oil are added to it fits the description as ‘Prepared foods obtained by the roasting of cereal’. This description attracts classification under Chapter Sub-Heading 1904 10 of the First Schedule to the Customs Tariff Act, 1975. Since it is not Corn flakes (tariff item 1904 10 10), Paws, Mudi and the like (tariff item 1904 10 20) or Bulgur wheat (tariff item 1904 10 30), it will fall under the residual tariff item 1904 10 90 of the First Schedule to the Customs Tariff Act, 1975. By virtue of this, the said product falls under entry at Sr. No. 15 of Schedule III of Notification No.1/2017 CENTRAL TAX (Rate) Dated 28-6-2017 and attracts 9% CGST and 9% SGST or 18% IGST.

Read & Download the full decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.