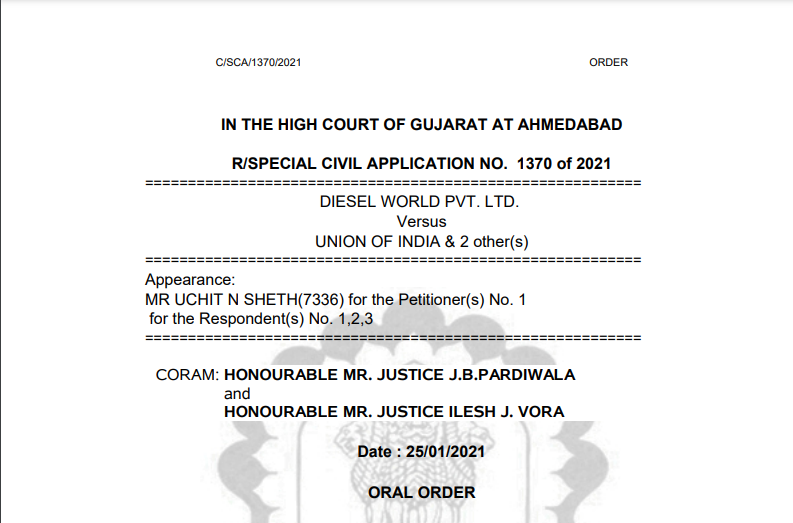

Gujarat HC in the case of Diesel World Pvt. Ltd. Versus Union of India

Table of Contents

Case Covered:

Diesel World Pvt. Ltd.

Versus

Union of India

Facts of the Case:

The subject matter of challenge in the present writ application is to the show cause notice dated 24th December 2020 issued by respondent No.3 under Section 74 of the Act, 2017 by applying the circular dated 4th September 2018, more particularly, the para 3.2 therein with retrospective effect. It is the case of the writ applicant that upon export of goods against a letter of undertaking without payment of tax, it was entitled to refund of the unutilized Input Tax Credit under Section 54(3) of the Act, 2017. Accordingly, the writ applicant filed an application for a refund for the period between September 2017 and March 2018. It appears that the writ applicant first utilized the balance of the CGST, SGST, and thereafter, the IGST. The refund was sanctioned by respondent No.3. This refund amount is now sought to be recovered from the writ applicant on the premise that the writ applicant could not have utilized the CGST and SGST balance first. In other words, the case of the department, prima facie, appears to be that the writ applicant ought to have debited the IGST first. This has led to the issue of the impugned show cause notice substantially based on the circular dated 4th September 2018 (Annexure: ‘A’ to this writ application).

Observations:

Mr. Sheth, the learned counsel appearing for the writ applicant would submit that the impugned circular, which lays down the order of debiting the electronic credit ledger, is ultra vires the provisions of the GST and the Rules made thereunder. He would submit that the impugned show cause notice issued by mandatorily applying para 3.2 therein with retrospective effect is wholly without jurisdiction.

Mr. Sheth, in the alternative, submitted that assuming for the moment that there is nothing wrong with the circular dated 4th September 2018, still, the show cause notice under Section 74 of the Act, could not have been issued for the purpose of taking back the refund, as such a recovery is not permissible in law. If the department is of the view that the refund was wrongly availed and sanctioned, then it should prefer an appeal and not issue a show-cause notice under Section 74 of the Act. In this regard, reliance is sought to be placed on a recent pronouncement of the High Court of Tripura in the case of Ispat vs. Union of India and others [Writ Petition (C) No.465 of 2020 decided on 12th January 2021].

Order:

Let Notice be issued to the respondents, returnable on 2nd March 2021. Let there be an adinterim relief in terms of para 23(D) of this writ application. The respondents shall be served directly through Email.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.