Gujarat HC in the case of M/s Amit Cotton Industries Versus Principal Commissioner of Customs

Table of Contents

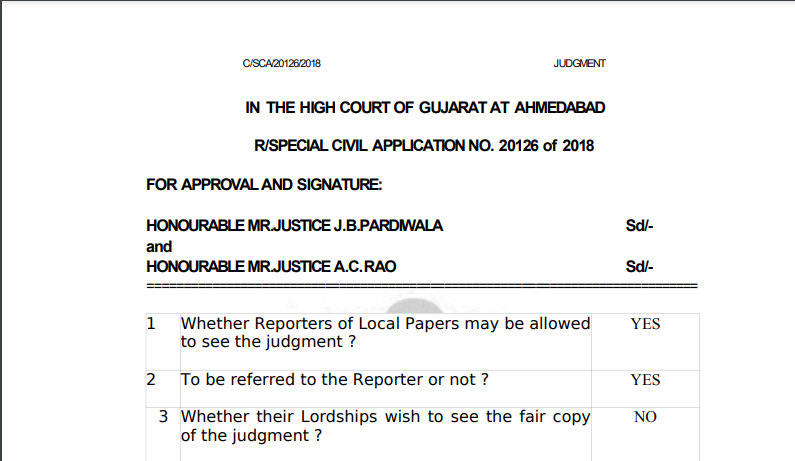

Case Covered:

M/s Amit Cotton Industries

Versus

Principal Commissioner of Customs

Facts of the Case:

By this writ-application under Article 226 of the Constitution of India, the writ-applicant has prayed for the following reliefs:

“A. Your Lordships may be pleased to admit this petition;

B. Your Lordships may be pleased to allow this petition;

C. Your Lordships may be pleased to issue a writ of mandamus or any other appropriate writ directing the respondent authorities to immediately sanction the refund of IGST paid in regard to the goods exported i.e. ‘Zero Rated Supplies’ made vide shipping bills mentioned hereinabove;

D. Your Lordships may be pleased to direct the respondent authorities to pay interest @ 9% to the petitioner herein on the amount of refund of IGST mentioned hereinabove from the date of shipping bills up till the date on which the amount of refund is paid to the petitioner herein, as the same is arbitrarily and illegally withheld by the respondent authorities;

E. Your Lordships may be pleased to grant an ex-parte, ad interim order in favour of the petitioner herein in terms of prayer clause ‘C’ and ‘D’ hereinabove;

F. Since the petitioner are constrained to approach Your Lordships by way of this petition only because of an illegal act of respondent authorities, Your Lordships may be pleased to direct the respondent authorities to pay the cost of this litigation to the petitioner herein;

G. Your Lordships may be pleased to grant such other and further relief/(s) that may be deemed fit and proper in the interest of justice in favour of the petitioner.”

Observations:

If the claim of the writ-applicant is to be rejected only on the basis of the circular issued by the Government of India dated 9th October 2018 referred to above, then we are afraid the submission canvassed on behalf of the respondents should fail as the same is not sustainable in law.

We are not impressed by the stance of the respondents that although the writ-applicant might have returned the differential drawback amount, yet as there is no option available in the system to consider the claim, the writ-applicant is not entitled to the refund of the IGST. First, the circular upon which reliance has been placed, in our opinion, cannot be said to have any legal force. The circular cannot run contrary to the statutory rules, more particularly, Rule 96 referred to above.

Rule 96 is relevant for two purposes. The shipping bill that the exporter may file is deemed to be an application for refund of the integrated tax paid on the goods exported out of India and the claim for refund can be withheld only in the following contingencies :

(a) a request has been received from the jurisdictional Commissioner of central tax, State tax or Union territory tax to withhold the payment of refund due to the person claiming a refund in accordance with the provisions of subsection (10) or sub-section (11) of Section 54; or

(b) the proper officer of Customs determines that the goods were exported in violation of the provisions of the Customs Act, 1962.

The decision of the Court:

We take notice of two things so far as the circular is concerned. Apart from being merely in the form of instructions or guidance to the concerned department, the circular is dated 9th October 2018, whereas the export took place on 27th July 2017. Over and above the same, the circular explains the provisions of the drawback and it has nothing to do with the IGST refund. Thus, the circular will not save the situation for the respondents. We are of the view that Rule 96 of the Rules, 2017, is very clear.

In view of the same, the writ-applicant is entitled to claim the refund of the IGST.

As a result, this writ application succeeds and is hereby allowed. The respondents are directed to immediately sanction the refund of the IGST paid in regard to the goods exported, i.e. ‘zero-rated supplies’, with 7% simple interest from the date of the shipping bills till the date of actual refund.

Read & Download the full Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.