Gujarat HC in the case of Sonal Nimish Patel Versus Assistant Commissioner of Income Tax

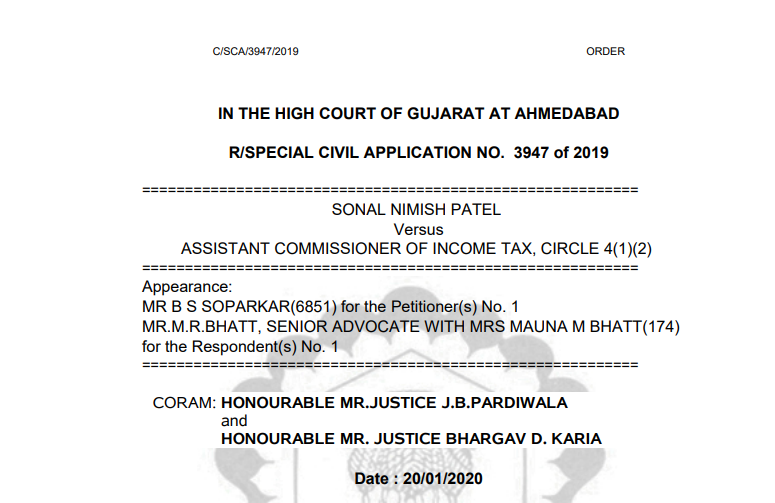

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD R/SPECIAL CIVIL APPLICATION NO. 3947 of 2019 SONAL NIMISH PATEL Versus ASSISTANT COMMISSIONER OF INCOME TAX, CIRCLE 4(1)(2) Appearance: MR B S SOPARKAR(6851) for the Petitioner(s) No. 1 MR.M.R.BHATT, SENIOR ADVOCATE WITH MRS MAUNA M BHATT(174) for the Respondent(s) No. 1 CORAM: HONOURABLE MR.JUSTICE J.B.PARDIWALA and HONOURABLE MR. JUSTICE BHARGAV D. KARIA Date : 20/01/2020 ORAL ORDER (PER : HONOURABLE MR.JUSTICE J.B.PARDIWALA) 1. Rule returnable forthwith. Mrs.Mauna Bhatt, the learned standing counsel waives service of notice of rule for and on behalf of the Revenue. 2. By this writ application under Article 226 of the Constitution of India, the writapplicant has prayed for the following relief(s): “7(a) quash and set aside the impugned order at AnnexureA to this petition; (b) Pending the admission, hearing and final disposal of this petition, to stay implementation and operation of the order at Annexure'A' to this petition. (c) any other and further relief deemed just and proper be granted in the interest of justice; (d) to provide for the cost of this petition.” 3. The subject matter of challenge in this writapplication at the instance of the writapplicant is an order passed by the respondent under Section 179 of the Income Tax Act, 1961 (for short the “Act,1961”). The impugned order reads thus: “ ORDER U/S.179 OF the Income Tax Act, 1961 In the case of M/s. Tirupati Proteins Pvt.Ltd (PANAABCT8423E) demand of Rs.9074.34 lakhs is outstanding as on date and the breakup of the demand as mentioned is given as under:

No. |

A.Y. |

Demand (Lakhs) |

Nature of Demand (Tax/Interest /Penalty) |

1 |

2011-12 |

7983.85 |

Tax + Interest |

2 |

2012-13 |

782.36 |

Tax |

3 |

2013-14 |

292.99 |

Tax |

4 |

2014-15 |

15.14 |

Tax |

Total |

9074.34 |

2. The said demand has not been paid till date. Despite being given a number of opportunities, the company did not make the payment of outstanding demand of Rs.9074.34 lacs.

3. At the relevant point of time the directors of the assessee company were Smt. Sonal Nimish Patel and Smt. Ashita Nilesh Patel. Further, it is noticed from the records of the company that there are no recoverable assets in the name of assessee company. In such circumstances, proceedings under Section 179 of the I.T.Act were initiated on 02.11.2017 by way of issuing of notice to the then Directors and all the directors were requested to show cause vide notice u/s 179 of the Act as to why they should not be treated as jointly and severally liable for the payment of such tax and why an order u/s 179 of the Income Act, 1961 should not be passed against them. In terms of the said notice the directors were to attend the office of the undersigned on 10.11.2017 with explanation. But no compliance was made in response to the said notice. It is noticed that neither the Directors or any of their authorized representatives attended nor any written submission was furnished. 4. The Company, M/s. Tirupati Proteins Pvt.Ltd. is a private company and hence, the provisions of Section 179 of the I.T.Act are clearly applicable in the case of directors of the said company. As directors of the company it was duty bound on the part of the directors of the company to pay tax due. The directors of the assessee company failed to discharge that duty, hence provisions of section 179(1) are clearly attracted. Reliance is placed on the decision of Union of India vs. Praveen D.Desai (1988) 173 ITR 303. 5. The provisions of Section 179 of the Act are very clear in this matter and is reproduced below: “Notwithstanding anything contained in the Companies Act, 1956 (1 of 1956), where any tax due from a private company in respect of any income of any previous year or from any other company in respect of any income of any previous year during which such other company was a private company cannot be recovered, then, every person who was a director of the private company at any time during the relevant previous year shall be jointly and severally liable for the payment of such tax unless he proves that the nonrecovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the company.” 6. It is further emphasized that the Board had desired that the provisions of Section 179 of the IT Act should not be used more vigorously and frequently in such instances. Instruction No.1519 vide F.No.404/110/82ITCC dated 20.07.1983 OF the CBDT states that the AO can proceed u/s. 179 simultaneously against company & directors and it is not necessary that action against the company should be exhausted. 7. Thus, from all the angles, the assessee company falls within the ambit of Section 179 of the I.T.Act. Smt.Sonal Nimish Patel and Smt. Ashita Nilesh Patel, were the directors of the company for the period under consideration during which demand was raised an the default of nonpayment of tax occurred. In response to the proceedings initiated u/s. 179(1) of the IT Ac, the directors failed to furnish any reply to the notice u/s. 179(1) of the I.T.Act. It is therefore, presumed that the directors have no objection for passing order u/s. 179 of the I.T.Act. In light of the discussion made in the foregoing paragraphs, since the demand is not recoverable from the assessee company, responsibility is fixed upon the then directors u/s. 179(1) of the IT Act and they will be treated as assessee in default in respect of tax, interest and penalty recoverable from the assessee company. 8. Considering the above facts, Smt.Sonal Nimish Patel and Smt. Ashita Nilesh Patel are held jointly and severally liable to make payment of outstanding demand of RS.9074.34 lakhs as well as any future demand which may arise in the case of Assessee Company, as provided under Section 179 of the IT Act. [AKTA JAIN B] Asst.Commissioner of Income Tax, Cirlce – 4(1)(2), Ahmedabad.” 4. The aforesaid order under Section 179 of the Act, 1961 is the outcome of the showcause notice dated 02.11.2017 (AnnexureA to this writapplication). The showcause notice dated 02.11.2017 reads thus: “To, Smt.Sonal Nimish Patel, 13/6 Dariyapur Patel Society, Usmanpura, Ahmedabad – 380 013 Sub: Show Cause notice u/s 179 of the Income Tax Act, 1961 – Recovery of outstanding demand of Rs.9074.34 lacs for A.Y.2011 12 to A.Y.201415 in the case of M/s. Tirupati Proteins Pvt.Ltd. reg. A total demand of Rs.9074.34 lacs is outstanding against M/s. Tirupati Proteins Pvt.Ltd. for A.Y. 201112. The company has not made the said payment despite various notices given to it in this regard. You are, therefore, requested to show cause as to why an order u/s 179 of the Act should not be made against you as you are/were the director of the company during the period to which the demand relates and show cause as to why you should not be held jointly and severally liable for payment of above demand of tax. You are requested to attend the office on 10.11.2017 at 11.00 AM with your explanation, failing which, order u/s. 179 of the Act shall be passed against you. You are also requested to furnish the copy of latest balance sheet/statement of affairs including the name and address of banks where you are holding accounts with bank A/c. Nos. Name & address of the debtor and and also location of fixed assets owned by you. (AKTA JAIN B) Assistant Commissioner of Income Tax, Circle4(1)(2), Ahmedabad. 5. Mr. B.S.Soparkar, the learned counsel appearing for the writapplicant, submitted that the impugned order is not tenable in law. According to the learned counsel, Section 179 of the Act, 1961, iswith respect to the liability of the Directors of the private company in liquidation. If any tax is due from the private company and the Revenue is not able to recover such tax from the company, then every person being a Director of the private company at any time during the relevant previous year can be held jointly and severally liable for the payment of such tax, unless the Director proves that the nonrecovery of tax due against the company could not be attributed to any gross negligence, misfeasance or breach of duty on their part in relation to the affairs of the company. 6. According to Mr.Soparkar, just because the Department failed in recovering the dues towards the tax from the company, it could not have proceeded to seek such recovery from the properties of the writapplicant. It is also the case of the writapplicant that she had resigned as a Director of the Company long time back, and therefore, could not have been fastened with any liability. 7. Mr.Soparkar has invited the attention of this Court to the showcause notice dated 02.09.2017. According to Mr.Soparkar, the showcause notice is bereft of the material particulars as regards the steps said to have been taken by the Department for the purpose of recovering the tax from the company. It is submitted that it is obligatory on the part of the Department to demonstrate, by some material onrecord, that it had taken the necessary steps to recover the dues from the company, but such steps failed. 8. Mr.Soparkar would further submit that even the order passed by the Assistant Commissioner of Income Tax dated 11.12.2017 under Section 179 of the Act, 1961 does not disclose any such material. According to Mr.Soparkar, in such circumstances, referred to above, the Department could not have proceeded against the writapplicant as a Director of the Company. The condition precedent for the purpose of invoking Section 179 of the Act, 1961 is that it is only in the event the Department fails to recover the dues from the company that it can proceed against the Director jointly or severally. 9. Mr.Soparkar further pointed out that after the impugned order came to be passed under Section 179 of the Act,1961, a notice was issued under Section 226(3) of the Act to the Principal Officer of the HDFC Bank limited with whom the writapplicant has a bank account and the bank account has been accordingly freezed. In such circumstances, referred to above, Mr.Soparkar prays that the impugned order passed by the Assistant Commissioner of Income Tax under Section 179 of the Act, 1961, be quashed and set aside and the bank account be ordered to be defreezed. 10. On the other hand, this writapplication has been vehemently opposed by Mr.M.R.Bhatt, the learned counsel appearing for the Revenue. According to Mr.Bhatt, no error not to speak of any error of law could be said to have been committed by the respondent in passing the impugned order. 11. According to Mr.Bhatt, the burden is not on the Department to prove that they could not recover the tax from the company on account of gross negligence, misfeasance or breach of duty on the part of the Directors of the Company, but on the contrary, it is for the Directors against whom the Department wants to proceed to prove that the nonrecovery cannot be attributed to any gross negligence, misfeasance or breach of duty on their part. 12. According to Mr.Bhatt, in the case on hand, due steps were taken against the company for the purpose of recovery of the dues, but unfortunately such steps failed and the Department is not able to recover anything. 13. Mr.Bhatt pointed out that they could not find any asset of the company upon which there is no encumberance. In other words, according to the Mr.Bhatt, there is a charge of one institution or the other on the assets of the company. However, Mr.Bhatt very fairly pointed out that the showcause notice as well as the impugned final order is silentso far as the steps taken by the Department against the company is concerned. 14. Today, when the matter is taken up for further hearing, an additional affidavitinreply, duly affirmed by the Deputy Commissioner of Income Tax, Circle 4(1)(2), Ahmedabad, is being tendered to indicate the steps taken against the company for the recovery of the dues. A copy of the same has been furnished today to Mr.Soparkar, the learned counsel appearing for the writapplicant. The additional affidavitinreply is ordered to be taken on record. 15. Over and above the same, there is an affidavitinreply on record dated 26.06.2019. 16. Mr.Bhatt would submit that there is quite a sizable amount in the bank account of the writapplicant maintained with the HDFC Bank Limited. As the Department has not been able to recover anything from the Company, the only hope for the Department is now to recover some of the dues by attaching the bank accounts of the Directors. 17. In such circumstances, referred to above, the learned counsel Mr.Bhatt prays that there being no merit in the writapplication, the same be rejected. 18. Having heard the learned counsel appearing for the parties and having gone through the materials onrecord, the only question that falls for our consideration is, whether the respondent has committed any error in passing the impugned order. 19. Section 179 of the Act, 1961 reads thus: “Liability of directors of private company in liquidation. 179. (1) Notwithstanding anything contained in the Companies Act, 1956 (1 of 1956), where any tax due from a private company in respect of any income of any previous year or from any other company in respect of any income of any previous year during which such other company was a private company cannot be recovered, then, every person who was a director of the private company at any time during the relevant previous year shall be jointly and severally liable for the payment of such tax unless he proves that the nonrecovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the company. (2) Where a private company is converted into a public company and the tax assessed in respect of any income of any previous year during which such company was a private company cannot be recovered, then, nothing contained in subsection (1) shall apply to any person who was a director of such private company in relation to any tax due in respect of any income of such private company assessable for any assessment year commencing before the 1st day of April, 1962. Explanation.—For the purposes of this section, the expression "tax due" includes penalty, interest or any other sum payable under the Act.” 20. In the case of Maganbhai Hanrajbhai Patel vs. Assistant CIT [(2013) 353 ITR 57], this Court had the occasion to examine Section 179 of the Act, 1961 in detail. It has been held therein that subsection (1) of Section 179 of the Act, 1961 provides for the joint and several liability of the directors of a private company, wherein the tax dues from such company in respect of any income of any previous year cannot be recovered. The first requirement, therefore, to attract such liability of the director of a private limited company is that the tax cannot be recovered from the company itself. Such requirement is held to be a prerequisite and necessary condition to be fulfilled before action under Section 179 of the Act can be taken. In the context of Section 179 of the Act, 1961, this Court held that before recovery in respect of the dues from a private company can be initiated against the directors, to make them jointly and severally liable for such dues, it is necessary for the Revenue to establish that such recovery cannot be made against the company and then alone it can reach to the directors who were responsible for the conduct of the business during the previous year in relation to which liability exists. 21. There is no escape from the fact that the perusal of the Notice under Section 179 of the Act, 1961, reveals that the same is totally silent as regards the satisfaction of the condition precedent for taking action under Section 179 of the Act, 1961, viz. that the tax dues cannot be recovered from the Company. In the showcause notice, there is no whisper of any steps having been taken against the Company for recovery of the outstanding amount. Even in the impugned order, no such details or information has been staled. 22. In such circumstances, referred to above, the question is, whether such an order could be said to be sustainable in law. The answer has to be in the negative. At the same time, in the peculiar facts and circumstances of the case and more particularly, when it has been indicated before us by way of an additional affidavitinreply as regards the steps taken against the company for the recovery of the dues, we would like to give one chance to the department to undertake a fresh exercise so far as Section 179 of the Act, 1961, is concerned. If the showcause notice is silent including the impugned order, the void left behind in the two documents cannot be filled by way of an affidavitinreply. Ultimately, it is the subjective satisfaction of the authority concerned that is important and it should be reflected from the order itself based on some cogent materials. However, with a view to protect the interest of both, the writ applicant as well as Revenue, we are inclined to quash the impugned order and give one opportunity to the Revenue to initiate the proceedings afresh by issuance of fresh showcause notice with all necessary details so that the writapplicant can meet with the case of the Revenue. We are inclined to adopt such measure keeping in mind the statement made by the learned counsel Mr.Soparkar that till the fresh proceedings are not completed, his client will not operate thebank account. 23. In view of the above, this writapplication is partly allowed. The impugned notice as well as the order is hereby quashed and set aside. It shall be open for the respondent to issue fresh showcause notice for the purpose of proceeding against the writapplicant under Section 179 of the Act, 1961. We would like to give a time bound program so that the proceedings may not go on for an indefinite period. We are also issuing such direction because of the statement being made that the writ applicant will not operate the bank account till the fresh proceedings are initiated and completed. In such circumstances, we grant two months' time from the date of receipt of the writ of this order to the Department to initiate fresh proceedings and pass appropriate orders in accordance with law. Till the final order is passed, the writapplicant shall not operate the bank account concerned. 24. In view of the above, two notices under Section 226(3) of the Act, 1961, i.e. one, to the Kalupur Commercial Cooperative Bank Limited, and another, to the HDFC Bank Limited, are also quashed and set aside. 25. With the above, this writapplication stands disposed of.

26. One copy of this order shall be furnished to Mrs.Bhatt, the learned standing counsel for the respondent for its onward communication.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.