Gujarat high court stayed the recovery proceedings for non functioning of Tribunal (Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

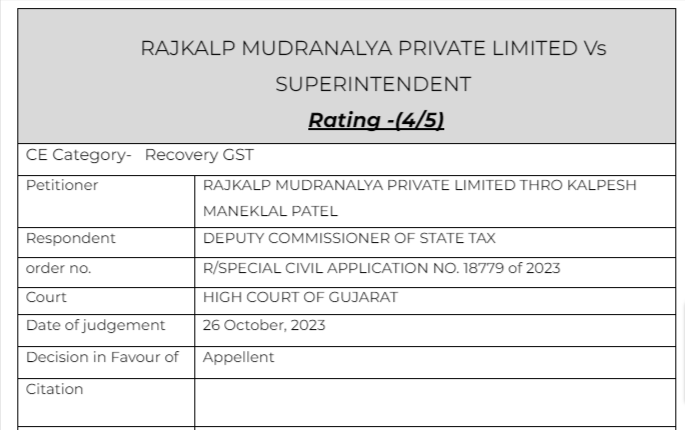

RAJKALP MUDRANALYA PRIVATE LIMITED Vs SUPERINTENDENT

Facts of the cases:

The challenge in this petition is to the order passed by the Appellate Authority under the CGST. Since, no Tribunal is constituted, the challenge is Challenge in this petition is to the order passed by the Appellate Authority under the CGST. Since, no Tribunal is constituted, the challenge.

Observation & Judgement of the Court:

On one hand, though the Tribunal is constituted, it is still not functioning and the Competent Authorities think it fit to issue orders of recovery asking the assessees for information whether an appeal has been filed at all. This apparently is a contradistinction between the authorities in question.

The order dated 04.10.2023 initiating steps of recovery is hereby stayed till the next date of hearing.

.

Comment:

The recovery proceedings are stayed by the honorable Gujarat High Court in absence of GST Appellate Tribunals

Read & Download the Full RAJKALP MUDRANALYA PRIVATE LIMITED Vs SUPERINTENDENT

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.