HC- ITC reversal for non payment in 180 days cant be forced on closing balance of creditor

Table of Contents

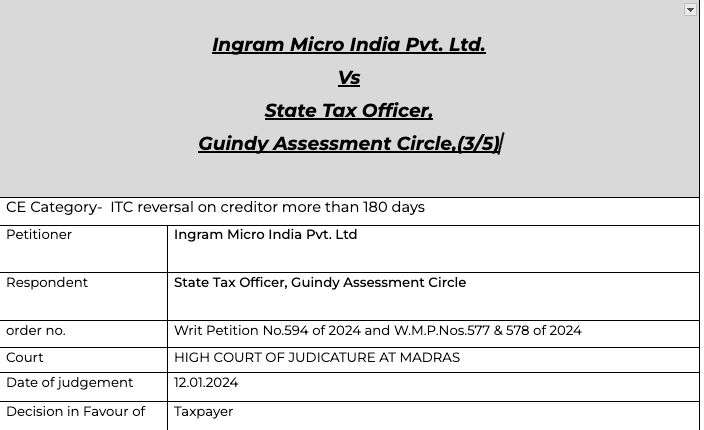

ITC reversal for non payment of creditors in 180 days

In some of the cases the department asks the taxpayer to reverse the ITC for non payment of creditors. In many cases the aging of creditors is not available with the taxpayer. In one of such case the department asked them to reverse the ITC on the whole balance of creditors which was in thousand of crores.

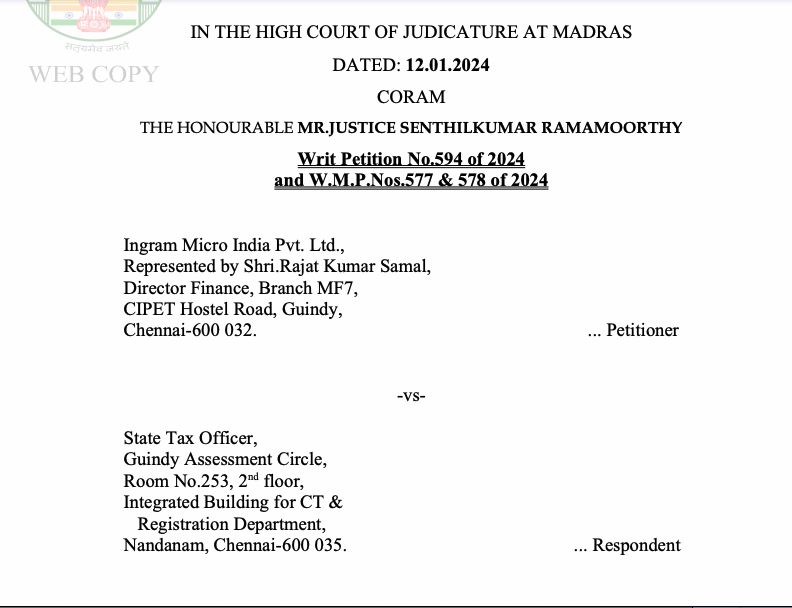

Details of the case-

Pleading

PR AYER: Writ Petition filed under Article 226 of the Constitution of India, pleased to issue a Writ of Certiorari calling for record relating to the impugned order bearing reference GST No.33AABCT1296R1ZU/2017- 2018 dated 21.12.2023 passed by the respondent and quashing the same.

Facts

The petitioner stated that it is a registered person under GST laws and that it had claimed Input Tax Credit (ITC) under Section 16 of the CGST Act. In respect thereof, it is stated that a show cause notice was issued with regard to non-payment to the suppliers for a period exceeding 180 days. In spite of the petitioner replying thereto and providing all supporting documents, including the Chartered Accountant’s certificate dated 20.12.2023, learned counsel for the petitioner submits that the impugned order came to be issued on the basis of the total trade payables of the petitioner.

In the impugned order, it is recorded as under with regard to the alleged trade payables of Rs.2704.1 Crores:

Observation

The assessing authority has clearly not applied its mind before drawing the conclusions extracted above. Therefore, the impugned order is liable to be and is hereby quashed. Consequently, the matter is remanded for reconsideration by the assessing authority. The assessing authority is directed to take into consideration all relevant documents produced by the petitioner, provide a reasonable opportunity to the petitioner and issue a fresh order within a period of two months from the date of receipt of a copy of this order. The writ petition is allowed on the above terms. There will be no order as to costs. Consequently, connected Miscellaneous Petitions are closed.

Read/Download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.