Jharkhand HC in the case of Electrosteel Steels Limited Versus The State of Jharkhand

Citations: Innovative Industries Limited Vs. ICICI Bank & Anr Embassy Property Developments Pvt. Ltd. Vs. State of Karnataka & Ors Swiss Ribbons Pvt. Ltd. & Anr. Vs. Union of India & Ors Pr. Commissioner of Income Tax Vs. Monnet Ispat & Energy Ltd. Committee of Creditors of Essar Steel India Limited, through authorized Signatory Vs. Satish Kumar Gupta & Ors Harbanslal Sahnia & Anr. Vs. Indian Oil Corpn. Ltd. & Ors IN THE HIGH COURT OF JHARKHAND AT RANCHI W.P.(T). No. 6324 of 2019 With

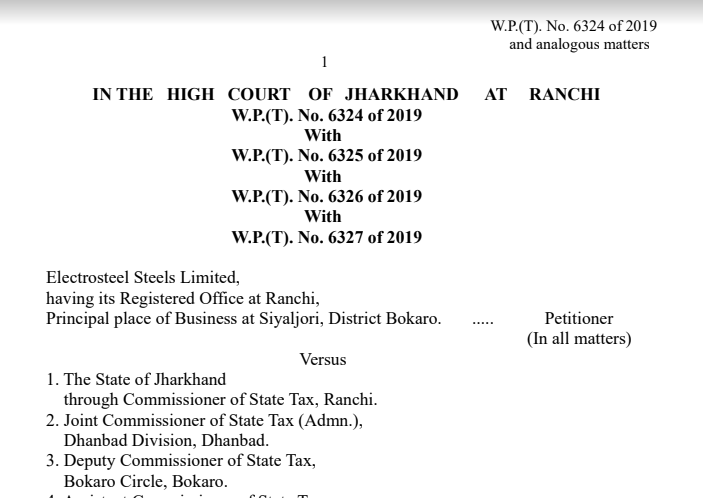

W.P.(T). No. 6325 of 2019 With W.P.(T). No. 6326 of 2019 With W.P.(T). No. 6327 of 2019 Electrosteel Steels Limited, having its Registered Office at Ranchi, Principal place of Business at Siyaljori, District Bokaro. ..... Petitioner (In all matters) Versus 1. The State of Jharkhand through Commissioner of State Tax, Ranchi. 2. Joint Commissioner of State Tax (Admn.), Dhanbad Division, Dhanbad. 3. Deputy Commissioner of State Tax, Bokaro Circle, Bokaro. 4. Assistant Commissioner of State Tax, Bokaro Circle, Bokaro. 5. State Bank of India, Electrosteel Siyaljori Branch, Siyaljori, Bokaro. .... ... Respondents (In all matters) CORAM : HON’BLE MR. JUSTICE H. C. MISHRA HON’BLE MR. JUSTICE DEEPAK ROSHAN -------- For the Petitioner : M/s. Dharshan Poddar Mishra, Manav Poddar and Deepak Kumar Sinha, Advocates For the State : Mr. Manoj Tandon, A.A.G. For the Respondent Bank : Mr. P.A.S. Pati, Advocate Mr. Hemant Jain, Advocate -------- C.A.V. on: 06/02/2020 Pronounced on: 01/05/2020 H. C. Mishra, J. - As common questions are involved in all these writ applications,they have been heard together and are being disposed of by this common Judgment. 2. Heard learned counsel for the petitioner, learned AdditionalAdvocate General for the respondent State and learned counsel for therespondent Bank. 3. In all these writ applications, the petitioner Company haschallenged the garnishee order bearing No.727 dated 21.11.2019, issued underSection 46 of the Jharkhand Value Added Tax Act, 2005 (hereinafter referred tas the 'JVAT Act'), as contained in Annexure-4 to the writ applications, issuedby the respondent No.3, Deputy Commissioner of Commercial Taxes, BokaroCircle, Bokaro, to the Respondent No.5, State Bank of India, in its branchsituated in the campus of the petitioner Company, asking the respondent Banto pay into the Government Treasury, the sum of Rs.37,41,41,602/-, on accountof tax / penalty due under the JVAT Act, from the petitioner Company, whofailed to deposit the taxes for the period from 2011-12 & 2012-13, from theBank account of the Company. The petitioner Company has also challenged theletter No.733 dated 22.11.2009, as contained in Annexure-5 to the writapplications, issued by the State Tax Officer, Bokaro Circle, Bokaro, to theRespondent Bank, to deposit the amount of Rs.75,57,000/- by way of demanddraft in favour of the Deputy Commissioner, Commercial Taxes, Bokaro Circle,Bokaro, in view of the fact that pursuant to the aforesaid garnishee ordedated 21.11.2019, the respondent Bank had furnished the information that only the amount of Rs.75,57,000/- was available in the petitioner’s account. 4. The aforesaid order / letter have been directly challenged by the petitioner Company in this Court under Article 226 of the Constitution of India, claiming that the amount, as aforesaid, can no more be realised by the StateGovernment from the Company, in view of the fact that the State Bank of Indiahad filed a Company Petition, being CA (IB) No.361/KB/2017 before theNational Company Law Tribunal, Kolkata Bench, Kolkata, (for short 'NCLT'),under the provisions of Insolvency and Bankruptcy Code, 2016, (hereinafterreferred to as the 'IB Code'), for initiating corporate insolvency resolutionprocess against the Company, which application of the State Bank of India wasadmitted by the NCLT, and the interim resolution professional was appointed. Itis the case of the petitioner Company that the resolution professional filed aresolution plan dated 29.03.2018 of M/s. Vedanta Limited, for the approval bythe NCLT under Section 31(1) of the IB Code, which resolution plan had alsobeen accepted by the Committee of Creditors, and the said resolution plan wasapproved by the NCLT by order dated 17.04.2018. The resolution plan was alsoapproved by the National Company Law Appellate Tribunal, New Delhi, (forshort 'NCLAT'), on 10.8.2018. According to the petitioner's case, the matter hadbeen taken to the Hon'ble Apex Court by some operational creditors, in CivilAppeal Nos.1133-9081 of 2019, in which the Hon’ble Apex Court, vide orderdated 27.11.2019, sent the matters back to the NCLT, observing "We make itclear that the implementation of the Resolution Plan is not stayed".According to the petitioner's case, upon approval of the Resolution Plan,M/s. Vedanta Limited took over the management of the petitioner Company on04.06.2018. According to the petitioner, since no claim was made by the StateGovernment as regards the aforesaid tax liability in the corporate insolvencyresolution process, the claim of the Government is now barred under Section 31of the IB Code, and the amount cannot be realised by the State Government, asthe State Government shall also be deemed to be the operational creditor underSection 5 (20) of the IB Code. According to the petitioner’s case, once theresolution plan was approved, the tax liability of the petitioner Company whichwas not claimed by the State Government during the corporate insolvencyresolution process, stood completely barred under Section 31 of the IB Code. 5. Admittedly, in the present writ applications, there is no challenge to the tax liabilities of the petitioner Company, though the re-assessment orders dated 17.08.2018 passed by the Assessing Authority, i.e., AssistantCommissioner of State Tax, Bokaro Circle, Bokaro, have been brought onrecord as Annexures-3 to the writ applications, pursuant to which the impugnedgarnishee order has been issued. Learned counsel for the petitioner hasvehemently argued that the State Government, whose tax dues could not bepaid by the petitioner Company, was also the 'operational creditor' within themeaning of Section 5 (20) of the IB Code, but no claim was made by the StateGovernment during the corporate insolvency resolution process, andaccordingly, upon an approval of the resolution plan by the NCLT, any claim ofthe State Government stood barred under Section 31 of the IB Code. 6. It is submitted by learned counsel for the petitioner that in spite of the fact that the claim of the State Government now stands barred, thegarnishee order has been issued by the Deputy Commissioner of CommercialTaxes, Bokaro Circle, Bokaro, which is absolutely illegal, void ab-initio andwholly without jurisdiction and cannot be sustained in the eyes of law. As theresolution plan has already been approved by the NCLT, and the managementof the petitioner Company has been taken over by M/s. Vedanta Limited, theresolution plan is now binding upon the corporate debtor, i.e., the petitionerCompany, and its creditors, including the State Government, to whom any debthad accrued under any law, including under the JVAT Act, by virtue ofSection 31 of the IB Code. 7. It is pointed out by learned counsel for the petitioner, that Section 238 of the IB Code has an overriding effect on all other laws for thetime being in force, which reads as follows:- "238. The provisions of this Code shall have effect,notwithstanding anything inconsistent therewith contained in anyother law for the time being in force or any instrument havingeffect by virtue of any such law. " 8. In support of his contention, learned counsel for the petitioner Company has placed reliance upon the decision of the Hon’ble Apex Court inInnovative Industries Limited Vs. ICICI Bank & Anr, reported in2018 (1) SCC 407, wherein it has been held that IB Code is a ParliamentaryLaw and is an exhaustive Code on the subject matter of insolvency in relationto the corporate entities. 9. Learned counsel for the petitioner has also submitted that even the tax liabilities payable to the Government would come within the meaning of theexpression “operational debt” under Section 5 (21) of the IB Code, making theGovernment an “operational creditor” in terms of Section 5(20) thereof, andshall be governed by the approved resolution plan. In support of his contentionlearned counsel has placed reliance upon the decision of the Hon’ble ApexCourt in Embassy Property Developments Pvt. Ltd. Vs. State of Karnataka& Ors., reported in Manu/SC/1661/2019, wherein it has been held as follows:- "36. ----------------. Let us take for instance a case where a corporate debtor had suffered an order at the hands of the IncomeTax Appellate Tribunal, at the time of initiation of CIRP. If Section60(5) (c) of IBC is interpreted to include all questions of law orfacts under the sky, an Interim Resolution Professional/ResolutionProfessional will then claim a right to challenge the order of theIncome Tax Appellate Tribunal before the NCLT, instead ofmoving a statutory appeal under Section 260A of the Income TaxAct, 1961. Therefore, the jurisdiction of the NCLT delineated inSection 60(5)cannot be stretched so far as to bring absurd results.(It will be a different matter, if proceedings under statutes likeIncome Tax Act had attained finality, fastening a liability upon thecorporate debtor, since, in such cases, the dues payable to theGovernment would come within the meaning of the expression“operational debt” Under Section 5 (21), making the Governmentan “operational creditor” in terms of Section 5(20). The momentthe dues to the Government are crystalized and what remains isonly payment, the claim of the Government will have to beadjudicated and paid only in a manner prescribed in theresolution plan as approved by theAdjudicating Authority, namely the NCLT.)" (Emphasis supplied).\ 10. In this connection learned counsel has further placed reliance upon the decision of the Hon’ble Apex Court in Swiss Ribbons Pvt. Ltd. & Anr. Vs. Union of India & Ors., reported in (2019) 4 SCC 17, wherein it is held as follows:- "42. A perusal of the definition of “financial creditor” and “financial debt” makes it clear that a financial debt is a debttogether with interest, if any, which is disbursed against theconsideration for time value of money. It may further be moneythat is borrowed or raised in any of the manners prescribed inSection 5(8) or otherwise, as Section 5(8) is an inclusivedefinition. On the other hand, an “operational debt” wouldinclude a claim in respect of the provision of goods or services,including employment, or a debt in respect of payment of duesarising under any law and payable to the Government or anylocal authority."(Emphasis supplied). 11. Learned counsel has also placed reliance upon an order of the Hon’ble Apex Court in Pr. Commissioner of Income Tax Vs. Monnet Ispat &Energy Ltd. (Special Leave to Appeal (c) No.6483 of 2018, decidedon 10.08.2018), wherein, similar view has been taken by the Apex Court,holding as follows:- "Given Section 238 of the Insolvency and Bankruptcy Code, 2016, it is obvious that the Code will override anythinginconsistent contained in any other enactment, including theIncome Tax Act. We may also refer in this connection to Dena Bank Vs.Bhikhabhai Prabhudas Parekh and Co. & Ors. (2000) 5 SCC 694and its progeny, making it clear that income-tax dues, being in thenature of Crown debts, do not take precedence even over securedcreditors, who are private persons." 12. It is submitted by the learned counsel for the petitioner that had the claim of the State Government been made at the stage of the corporatinsolvency resolution process, even in that case, the claim of the StateGovernment could have been settled only in the manner prescribed in theresolution plan as approved by the Adjudicating Authority namely the NCLT,but in the present case, as no such claim was made by the State Government atthe time of corporate insolvency resolution process, the claim of the StateGovernment now stands completely barred under Section 31 of the IB Codeand after the approval of the resolution plan, no fresh claim can be entertained.In support of this connection, learned counsel has placed reliance upon thedecision of the Hon’ble Apex Court in Committee of Creditors of Essar SteelIndia Limited, through authorized Signatory Vs. Satish Kumar Gupta &Ors., reported in 2019 SCC OnLine SC 1478, wherein it has been held asfollows:- "88. For the same reason, the impugned NCLAT judgment in holding that claims that may exist apart from those decided onmerits by the resolution professional and by the AdjudicatingAuthority/Appellate Tribunal can now be decided by anappropriate forum in terms of Section 60(6) of the Code, alsomilitates against the rationale of Section 31 of the Code. Asuccessful resolution applicant cannot suddenly be faced with"undecided" claims after the resolution plan submitted by him hasbeen accepted as this would amount to a hydra head popping upwhich would throw into uncertainty amounts payable by aprospective resolution applicant who successfully take over thebusiness of the corporate debtor. All claims must be submitted toand decided by the resolution professional so that a prospectiveresolution applicant knows exactly what has to be paid in orderthat it may then take over and run the business of the corporatedebtor. This the successful resolution applicant does on a freshslate, as has been pointed out by us hereinabove. For thesereasons, the NCLAT judgment must also be set aside on thiscount." (Emphasis supplied). 13. Placing reliance on these decisions, learned counsel concluded that the garnishee order issued by the respondent No.3, Deputy Commissionerof Commercial Taxes, Bokaro Circle, Bokaro, is in teeth of the terms of theapproved resolution plan, and the garnishee order is wholly without jurisdictionand void ab-initio and cannot be sustained in law. 14. Per contra, learned Additional Advocate General has opposed the prayer and has submitted that the main order of re-assessment is not under challenge in these writ applications by the petitioner. Learned AAG has drawnour attention towards the statement made in the supplementary affidavit filedby the petitioner, in which, it is stated that without prejudice to the present writapplications, the petitioner by way of abundant precaution has filed revisionpetition along-with stay petition before the Revisional Authority, i.e., theCommissioner of State Tax, Jharkhand. Learned AAG, accordingly, submittedthat the petitioner has already availed the alternative remedy before theRevisional Authority and accordingly, the present writ applications cannot bemaintained in the eyes of law and are fit to be dismissed on this score alone. 15. Learned AAG has also drawn our attention towards Section 79 of the JVAT Act, and has submitted that the re-assessment orders were subject toappeal upon deposit of 20% of the tax assessed, which remedy has not availedby the petitioner Company, in order to escape the 20% tax liability, and as such,these writ applications cannot be entertained on this score as well. It issubmitted by learned AAG that the case of the petitioner does not fall withinthe categories of cases in which the alternative remedy is not a bar forexercising the writ jurisdiction. In support of his contention learned AAG hasplaced reliance upon the decision of the Hon'ble Apex Court inHarbanslal Sahnia & Anr. Vs. Indian Oil Corpn. Ltd. & Ors., reported in(2003) 2 SCC 107, laying down the law as follows:- "7. -----------. In an appropriate case, in spite of availability of the alternative remedy, the High Court may still exercise its writjurisdiction in at least three contingencies: (i) where the writ peti-tion seeks enforcement of any of the fundamental rights; (ii)where there is failure of principles of natural justice; or (iii)where the orders or proceedings are wholly without jurisdictionor the vires of an Act is challenged. ----------." 16. It is also pointed out by the learned AAG that admittedly, the petitioner Company had collected the tax from its purchasers / customers in thename of VAT, but has not deposited the same in the State Exchequer, thus,amounting to criminal misappropriation of the Government money entrusted tothe petitioner Company by its purchasers / customers, and has thus committedthe offence of criminal breach of trust. 17. Learned AAG has also pointed out that in the present case, the corporate insolvency resolution process was started on 21.07.2017. The right ofthe State Government to recover the tax from the petitioner Company accruedin the years 2011-12 & 2012-13. The IB Code itself was enacted in theyear 2016 and accordingly, the tax liability of the petitioner, which thepetitioner Company ought to have discharged in the years 2011-12and 2012-13, cannot be said to be affected by the IB Code. 18. Learned Additional Advocate General has also pointed out that Section 31 of the IB Code clearly states that the approved resolution plan shallbe binding on the stake-holders involved in the resolution plan. It is submittedthat the State Government was never involved in the resolution process andthere was a valid reason for the same, inasmuch as, the notice required to beissued under Section 13 of the IB Code, which ought to have been issued in theState of Jharkhand, where the petitioner Company is having its registered officeas well as the principal place of business, but the said notice was neverpublished in the State of Jharkhand, rather the notice which has been broughton record as Annexure-7 to the supplementary affidavit filed by the petitioner,clearly shows that it was published only in the Kolkata Edition of BusinessStandard on 24.07.2017. Learned AAG accordingly, submitted that since thenotice was never published in the State of Jharkhand, the State authorities hadno knowledge of any such corporate insolvency resolution process andaccordingly, the State Government was deprived from making any claim in thecorporate insolvency resolution process. Learned AAG thus, submitted that thewrit applications are fit to be dismissed on this score as well. 19. The respondent State Bank of India has also filed its counter affidavit, and it is pointed out by learned counsel for the respondent Bank fromthe counter affidavit that pursuant to the garnishee order, the Bank account ofthe petitioner has been freezed, and the following amounts have already beenremitted to the State Exchequer:- (a) Rs. 75.67 lacs on 28.11.2019, (b) Rs. 12.00 lacs on 02.12.2019 and (c) Rs 61.00 lacs on 3.12.2019. 20. In reply, learned counsel for the petitioner Company has placed stress upon paragraph 3.6 of the resolution plan, which has been brought onrecord as Annexure-1 to the writ applications, wherein it is stated that all theclaims of taxes and liabilities whether admitted or not, due or contingent,whether or not set out in the provincial balance sheet, shall stand extinguishedby virtue of the order of the NCLT, approving the resolution plan, and theCompany shall not be liable to pay any tax against such dues, and suchliabilities shall stand extinguished and be considered as not payable by theCompany by virtue of the order of the NCLT, approving the resolution plan.Learned counsel has submitted that the resolution plan of the company, nowstands approved up to the Hon’ble Apex Court, by virtue of the orderdated 27.11.2019 passed in Civil Appeal Nos.1133-9081 of 2019. Learnedcounsel accordingly, reiterated that the taxes, even if accrued in theyears 2011-12 and 2012-13, can no more be realized from the petitionerCompany after approval of the resolution plan by the NCLT. 21. Having heard the learned counsels for both sides and upon going through the record, we find that in the present cases, the State Government shallfall within the definition of 'operational creditor', and the taxes payable by thepetitioner shall fall within the definition of 'operational debt', as defined in theIB Code as follows:- "Section 5 (20) "operational creditor" means a person to whom an operational debt is owed and includes any person to whomsuch debt has been legally assigned or transferred; Section 5 (21) "operational debt" means a claim in respect of the provision of goods or services including employment or a debtin respect of the payment of dues arising under any law for the time being in force and payable to the Central Government, anyState Government or any local authority;" As such, there can be no doubt that the case of the petitioner shall be governed by the provisions of the IB Code. 22. We however, find force in the submissions of the learned Additional Advocate General that the tax amount, which had been sought to be realised from the petitioner Company, had already been realised by thepetitioner Company from the customers which was to be deposited in theGovernment Exchequer, but that having not been done by the Company and theamount having been utilized for its business purposes, throughout after theyears 2011-12 and onwards, shall certainly amount to criminalmisappropriation of the Government money by the Company, and the StateGovernment is entitled to realize the same with the penalty due thereon. 23. There is yet another aspect of the matter. The amount of VAT musthave already been realised by the petitioner Company from the customers. Inthat view of the matter, it is debatable whether the amount of VAT shall becovered by the expressions "debt in respect of the payment of dues arisingunder any law for the time being in force and payable to the CentralGovernment, any State Government", so as to bring it within the definition of"operational debt", as defined in the IB Code. This Tax liability can very well be treated as the amount of tax already realised by the petitioner Company fromits customers, on behalf of the State Government, and not the direct debt of thepetitioner Company towards the State Government, in which case the taxliabilities of the petitioner Company, for realising which the impugnedgarnishee order has been issued, may not come within the definition of"operational debt", as defined in the IB Code. The decisions cited by learnedcounsel for the petitioner in Embassy Property Developments Pvt. Ltd.'scase (supra) and in Monnet Ispat and Energy Ltd.'s case (supra), are of nohelp to the petitioner Company, as they related to Income Tax dues, which werethe direct debts of the corporate debtors in those cases. 24. We also find from the record that the re-assessment orders were passed on 17.08.2018 as contained in Annexure-3 to the writ applications, bywhich date the resolution plan was already approved by the NCLTon 17.04.2018, but the same was never brought to the knowledge of theCommercial Tax officials by the Company, even though the petitionerCompany was given a hearing by the Assessing Authority, i.e., respondentNo. 4 Assistant Commissioner of State Tax, Bokaro Circle, Bokaro, beforepassing the re-assessment orders. 25. We also find from the record that the notice under Section 13 of the IBC Code was never published in the State of Jharkhand, rather the noticewas published only in the Business Standard of Kolkata Edition on 24.07.2017as contained in Annexure-7 to the supplementary affidavit. There is no denial tothe fact that such notice was never published in the State of Jharkhand. 26. Section 13 of the IB Code reads as follows:- "13. (1) The Adjudicating Authority, after admission of the application under section 7 or section 9 or section 10, shall, by anorder— (a) declare a moratorium for the purposes referred to in section 14; (b) cause a public announcement of the initiation of corporate insolvency resolution process and call for the submission ofclaims under section 15; and (c) appoint an interim resolution professional in the manner as laid down in section 16. (2) The public announcement referred to in clause (b) of sub-section (1) shall be made immediately after the appointmentof the interim resolution professional." 27. The detailed procedure for public announcement, as required under Section 13(1)(b) of the IB Code, is provided in Regulation 6 of the Insolvencyand Bankruptcy Board of India (Insolvency Resolution Process for Corporatepersons) Regulations, 2016. Even the notice which has been brought on recordas Annexure-7 to the supplementary affidavit filed by the petitioner, shows thatit was published under this provision. Relevant portion of Regulation 6 thereofreads as follows:- "6. Public announcement. (1) An insolvency professional shall make a public announcement immediately on his appointment asan interim resolution professional. Explanation: ‘Immediately’ means not later than three days from the date of his appointment. (2) The public announcement referred to in sub-regulation (1) shall: (a) be in Form A of the Schedule; (b) be published- (i) in one English and one regional language newspaper with wide circulation at the location of the registered office and princi- pal office, if any, of the corporate debtor and any other locationwhere in the opinion of the interim resolution professional, thecorporate debtor conducts material business operations;-----------------." 28. Thus, a conjoint reading of Section 13(1)(b) of the IB Code read with Regulation 6 aforesaid, clearly shows that the public announcement had tobe made in the newspapers with wide circulation at the location of theregistered office and principal office, of the petitioner Company. Admittedly,the registered office of the petitioner Company is at Ranchi, and its principalplace of business is in the District of Bokaro, both of which are situated in theState of Jharkhand, but no public announcement of the corporate insolvencyresolution process was made in the State of Jharkhand. We are conscious of thefact that since the resolution plan is approved by the NCLT, and not interferedwith even by the Hon'ble Apex Court as pointed out above, we are not requiredto look into the legality or otherwise of the resolution process, but the factremains that due to non publication of the public announcement of thecorporate insolvency resolution process in the State of Jharkhand, theauthorities of the Commercial Taxes Department had no occasion to have anyknowledge about the corporate insolvency resolution process of the Company,and they were deprived of making their claim before the interim resolutionprofessional. Since the State Government was not involved in the resolutionprocess, the resolution plan cannot be said to be binding on the StateGovernment under Section 31 of the IB Code, relevant portion of which readsas follows:- "31. (1)– If the Adjudicating Authority is satisfied that the resolution plan as approved by the committee of creditors undersub section (4) of section 30 meets the requirements as referred toin sub-section (2) of section 30, it shall by order approve theresolution plan which shall be binding on the corporate debtorand its employees, members, creditors, including the CentralGovernment, any State Government or any local authority towhom a debt in respect of the payment of dues arising under anylaw for the time being in force, such as authorities to whomstatutory dues are owed, guarantors and other stakeholdersinvolved in the resolution plan;" (Emphasis is ours). 29. We also find from the record that though it is the specific case of the petitioner that the management of the petitioner company has been taken over by M/s Vedanta Limited on 04.06.2018, but the fact remains thatM/s. Vedanta Limited is not the petitioner before us, rather it is the originalCompany which had the tax liabilities to be discharged in the years 2011-12and 2012-13, after having realized the amount from its customers, is only thepetitioner before us. We are of the clear view that the petitioner Company hasnot approached this Court with clean hands. 30. In that view of the matter, we are not inclined to entertain these writ applications, even though there is a resolution plan in favour of the petitioner Company, approved by the Adjudicating Authority, i.e., the NCLT,for the simple reason that it was never brought to the knowledge of theCommercial Tax authorities of the State of Jharkhand that the corporateinsolvency resolution process had been initiated against the petitionerCompany, and no public announcement of the corporate insolvency resolutionprocess was made in the State of Jharkhand. Section 31 of the IB Code clearlylays down that the approved resolution plan shall be binding only on thosestakeholders who were involved in the resolution plan. Admittedly, the StateGovernment was never involved in the corporate insolvency resolution process,and as such, the resolution plan cannot be said to be binding on it. 31. For the aforesaid reasons, we find that the writ petitioner is not entitled to any relief whatsoever, There is no merit in these writ applicationsand all these writ applications are accordingly, dismissed. (H. C. Mishra, J.) Deepak Roshan, J.:- I have gone through the detailed Judgment authored by my esteemed Brother H.C. Mishra, J. I fully subscribe to the views expressedtherein, but I also wish to add a few reasons of my own, which are as follows:- (i). Much has been argued by the learned counsel for the petitioner Company that since no claim was made by the respondent State as regards thetax liability in the corporate insolvency resolution process, the claim of the taxauthority is barred under Section 31 of the IB Code. In this regard, even at thecost of repetition it is pertinent to mention few dates. The petitioner Companywas originally assessed to tax for the period 2012-13 u/s 35(6) of the VAT Actvide order dated 21.01.2016. The said assessment order was challenged by thepetitioner Company by way of revision, being Revision Case No. CC(S)-311of 2016. The revision case was disposed on 11.08.2016 and the assessmentorder dated 21.01.2016 was set aside and the case was remanded back to lowerCourt for passing the order afresh. Subsequently, the revised assessment orderwas passed on 17.08.2018. Thus, from 11.08.2016 till 17.08.2018, there was nodues standing against the petitioner Company and as such there was nooccasion to make any claim by the respondent State as regards the tax liabilityin the corporate insolvency resolution process and / or the moratorium periodwhich starts from 21.07.2017 when the application u/s 7 of the IP Code wasadmitted till the date of approval of the resolution plan by the NCLT i.e.on 17.04.2018. (ii). It is also pertinent to mention here that Section 31(1) of the IB Code, 2016 was amended vide IBC (Amendment) Act, 2019, to make theapproved resolution plan binding on the Government Authorities in relation tothe statutory dues. It is pursuant to this amendment that the rights of theGovernment Authorities for statutory dues were affected and such right wasmade subject to the approved resolution plan. The said amendment was madeeffective from 16.08.2019, which is prospective in nature, and no expressretrospective effect was given to the said amendment. The said amendmenttakes away a substantive right of the Government Authorities in relation to thestatutory dues and thus any interpretation, which shall give a retrospectiveeffect to the said amendment, would be unreasonable and unjust. (iii). In the present case the resolution plan of the petitioner Company was approved by the NCLT vide its order dated 17.04.2018 which is much priorto the aforesaid amendment. Accordingly, the said amendment in Section 31(1)of the IB Code, 2016 shall not apply to the resolution plan of the petitionerCompany. Therefore, the assessment order dated 17.08.2018 which was passedby the respondent Commercial Tax Authorities, cannot be made subject to theapproved resolution plan of the petitioner Company. I accordingly, agree with the Judgment authored by Brother H.C. Mishra, J. (Deepak Roshan, J.) Jharkhand High Court, Ranchi. Dated the 1st of May, 2020. N.A.F.R/BS/-

Download the copy:

Now you can read full PDF without downloading.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.