Madras HC in the case of Audco India Limited

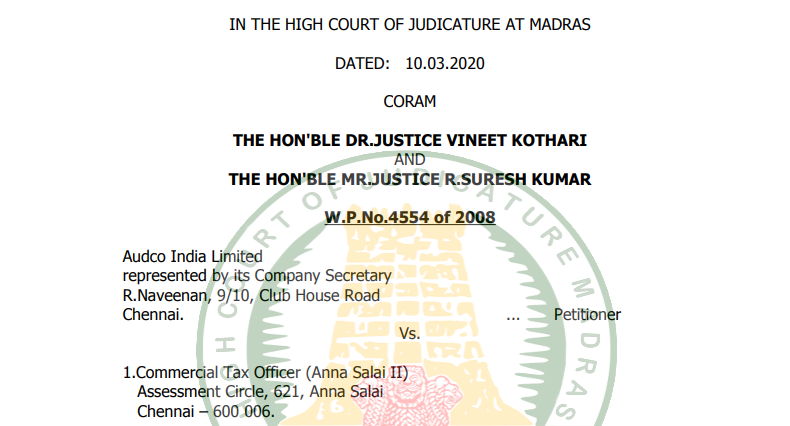

IN THE HIGH COURT OF JUDICATURE AT MADRAS DATED: 10.03.2020 CORAM THE HON'BLE DR.JUSTICE VINEET KOTHARI AND THE HON'BLE MR.JUSTICE R.SURESH KUMAR W.P.No.4554 of 2008 Audco India Limited represented by its Company Secretary R.Naveenan, 9/10, Club House Road Chennai. ... Petitioner Vs. 1.Commercial Tax Officer (Anna Salai II) Assessment Circle, 621, Anna Salai Chennai – 600 006. 2.The Appellate Assistant Commissioner (CT) IV, Kuralagam Annexe, Sixth Floor Chennai – 600 108. 3.The Sales Tax Appellate Tribunal Additional Bench, City Civil Court Building, High Court Complex Chennai-600 104. 4.State of Tamil Nadu, represented by the Deputy Commissioner (CT) Chennai (East) Division, Chennai. ... Respondents Prayer: Writ Petition filed under Article 226 of the Constitution of India praying for the issuance of a Writ of Certiorari calling for the records of the third respondent herein in S.T.A.No.274/02 dated 12.11.2007. For Petitioner : Mr.K.A.Parthasarathi for M/s.N.Inbarajan For Respondent : Mr.Mohammed Shaffiq Special Govt.Pleader (Taxes) O R D E R (Order of the Court was made by DR.VINEET KOTHARI,J.) The Assessee has filed this writ petition aggrieved by the order dated 12.11.2007, whereby the learned Tribunal sustained and upheld the penalty imposed on the Assessee under Section 12(3)(b) of the Tamil Nadu General Sales Tax Act, 1959 (hereinafter referred to as 'TNGST Act'), with the following observations. “12) It is admitted in this case that the assessment related to 1993-94 prior to the insertion of an Explanation u/s 12(3)(b) of the Tamil Nadu General Sales Tax Act. The assessment was made by the assessing authority, not accepting the turnover reported in the dealier's returns. It is seen further that the appellate Assistant Commissioner had directed to reconsider the assessment made on a major portion of the disputed turnover ie., the assessment made on Rs.1,25,08,358/- and also that created on a further Rs.40,05,778/-. The assessment made by the Assessing Officer has thus not reached its finality and the total tax demand of the assessment year was not finally determined as on the date of Appellate Assistant Commissioner's order. 13) It has been rightly claimed by the State, that until the insertion of the 'Explanation' under Section 12(3)(b) of the Tamil Nadu General Sales Tax Act, all the types of 'balances' in tax payable derived in an assessment order would be necessarily attract a penalty, in accordance with the sliding scale, as provided in Section 12(3)(b) of the Tamil Nadu General Sales Tax Act. The legal position that the delaying of the taxes otherwise normally and legally payable to the State along with a dealer's monthly returns would attract penalty is well settled in the case law reported in 125 STC 107 (Chennai Textile Chemicals Private Ltd., -Vs- State of Tamil Nadu and Others). The Hon'ble High Court of Chennai has observed in the above case as follows. “..... When the Legislature in its wisdom and as a consequence of past experience has chosen to make the levy of penalty, essentially as an inevitable consequence of an attempted evasion, the Court will not normally sit in judgment over and need or necessity for such a levy. The impugned provision serves not only as an effective deterrent to curb evasion of tax, once and for all, but also prevent any dealer from succeeding in postponing the levy and recovery of the tax legitimately due to the State and thereby have undue advantage and use of the revenue otherwise payable to the State and to that extent, deprive the State of the legitimate user of the receipts for its ever so many schemes in public interest and hencethe levy contemplated under Section 12(3) has to be viewed at any rate as a just and reasonable restriction only on the fundamental rights secured under Article 19(1)(g) of the Constitution of India. From the mere fact that the levy of penalty has been ordained compulsorily with every class or category of evasion, it cannot be claimed to be unreasonable on that account only. The levy of tax and the incidental levy of penalty being always considered to be an independent power of the State to raise revenue, there is no such fundamental right as to claim any immunity from taxation.....” 14) The Court has further observed as under (at Page 136 of 125 STC): “...There is no compelling reason that the levy of penalty as an anti-avoidance measure, has to be only with reference to the turnover sought to have been suppressed. So far as the State is concerned, the loss has to be, and in our view could be, legitimately measured with reference to the tax sought to have been or attempted to have been evaded and the graded scales of penalty fixed with reference to such tax attempted to be evaded is not only permissible for the Legislature to enact as a matter of policy, but the same, in our view, is found to be just and reasonable and we do not really find any hostile discrimination or arbitrariness or unreasonableness in the same as vaguely claimed for the petitioners on mere hypothetical basis....” 15) Since the assessee failed to file returns declaring correct turnover at the correct rate of tax and thus withheld the taxes that ought to have been otherwise paid to the State in the normal course of their business, along with their monthly returns, the penalty is certainly attracted in this case. The ratio of the above decision would affirm the legal position. 16) Moreover, in this case, the Appellate Assistant Commissioner had remanded the assessment on a major portion of the turnover in dispute. The penalty payable by the assessee was only consequential of the balance of tax payable derived in the assessment order. Given the position, the Appellate Assistant Commissioner ought not to have ordered to delete the penalty. 17) It is therefore for the above reasons, the Appellate Assistant Commissioner's order deleting the impugned penalty of Rs.14,03,490/- is ordered to be struck down. The Assessing Officer will give effect to this Tribunal's finding and impose penalty on the dealer u/s.12(3)(b) in relation to the modified balance of tax payable, that will be arrived in the order by giving effect to the Appellate Assistant Commissioner's findings in regard to the turnovers in dispute. He will undertake the exercise of refixing the exact quantum of penalty payable by the Assessee and pass orders accordingly 18) To the above effect, the STA is remanded 19) In the result, the State Appeal is remanded.” 2. Learned counsel for the appellant Mr.Parthasarathi has urged before us that, the two grounds on which the imposition of penalty has been sustained by the Tribunal are, that the assessing authority imposed additional tax on the sales made by the Assessee, which were not supported by declaration in 'C' Forms and secondly on the Cash Incentives received by the Assessee on the Exports made by it was held to be part of taxable turnover, which was not so. The imposition of additional tax, however, has not been done as a result of 'Best Judgment Assessment' under Section 12(2) of the TNGST Act, upon which only the penalty under Section 12(3)(b) of the Act is attracted and therefore, the learned Tribunal has erred in upholding the imposition of the said penalty. 3. Per contra, Mr.Mohammed Shaffiq, learned Special Government Pleader (Taxes) supported the impugned order of the learned Tribunal. 4. Having heard the learned counsel for the parties, we are of the opinion that the parameters of Section 12(3)(b) of the Act are not satisfied in the present case. Section 12(3)(b) provides for imposition of penalty in case of submission of incorrect or incomplete return by the Assessee. Both the grounds given above for imposition of additional tax on the Assessee did not, in our opinion, result in Best Judgment Assessment against the Assessee and it cannot amount to filingof incorrect or incomplete return by the Assessee. On debatable issues, even if the addition in taxable turnover is made by the Assessing Officer, it does not amount to Best Judgment Assessment, which can be passed, only if the regular books of accounts and the return filed by the Assessee are rejected for given reasons. Therefore, the learned Tribunal has erred in relying upon the insertion of the Explanation in Section 12(3) of the Act at a later date with effect from 01.04.1996 to uphold such penalty in the year 1993-94. In our opinion, the Explanation to Section 12(3) does not get attracted to the facts of the present case at all. 5. The Writ Petition filed by the Assessee, in our opinion, therefore deserves to be allowed and the same is accordingly allowed and the order passed by the learned Tribunal is set aside. No costs.

Download the copy:

Now you can read full PDF without downloading.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.