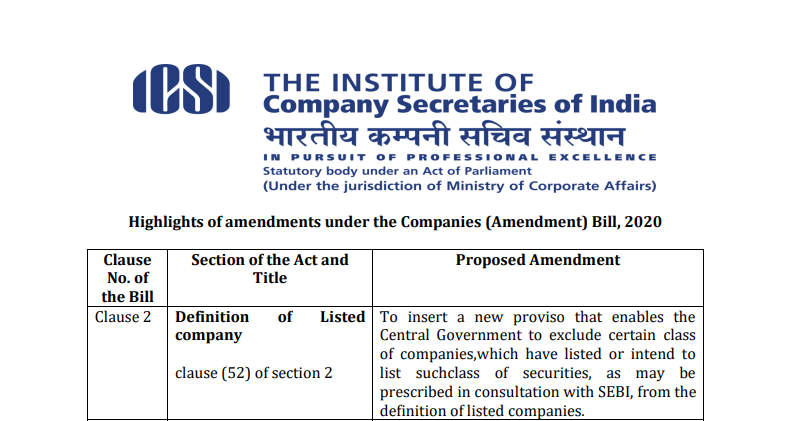

Highlights of amendments under the Companies (Amendment) Bill, 2020: ICSI

Highlights of amendments under the Companies (Amendment) Bill, 2020

|

Clause No. of the Bill |

Section of the Act and Title |

Proposed Amendment |

| Clause 2 | Definition of Listed company clause (52) of section 2 |

To insert a new proviso that enables the Central Government to exclude a certain class of companies, which have listed or intend to list such class of securities, as may be prescribed in consultation with SEBI, from the definition of listed companies. |

| Clause 3 | Formation of Companies with Charitable Objects, etc sub-section (11) of section 8 |

To omit the punishment of imprisonment in relation to an officer who is in default for the offense mentioned therein. |

| Clause 4 | Rectification of Name of Company

clause (b) of sub-section (1) of section 16 subsection (3) of section 16 |

To reduce the time limit of compliance of change in name of the company in case of the resemblance of name to a registered trademark from six months to three months for the direction provided by the Central Government in the provision.

The amendment proposes to provide for allotment of a new name to the company by the Central Government, in case the company is in non-compliance with section 16(1) of the Act. The amendment proposes the deletion of imposing fine for non-compliance for such default. |

| Clause 5 | Public Offer and Private Placement

To insert new sub-sections (3) and (4) in section 23 |

To allow a class of public companies to list certain class of securities on stock exchanges in permissible foreign jurisdictions.

To empower the Central Government to exempt, by notification, any class or classes of public companies referred to in the above inserted section from any of the provisions of Chapter III, Chapter IV, section 89, section 90, or section 127 of the Act. |

| Clause 6 | Matters to be Stated in Prospectus

sub-section (9) of section 26 |

To omit the punishment of imprisonment in relation to every person who is knowingly a party to the issue of a prospectus in contravention of the said section. |

| Clause 7 | Securities to be Dealt with in Stock Exchanges

sub-section (5) of section 40 |

To remove the punishment of imprisonment in case of any default in complying with the provisions of the said section. |

| Clause 8 | Variation of Shareholders’ Rights.

omit subsection (5) of section 48 |

To remove the penal provisions in case of any default in complying with said section. |

| Clause 9 | Transfer and Transmission of Securities

sub-section (6) of section 56 |

To amend subsection thereby imposing a penalty in place of a fine of rupees fifty thousand for the company and its officers in default in case of failure to comply with subsections (1) to (5). |

| Clause 10 | Rectification of Register of Members

to omit sub-section (5) of section 59 |

To remove the penal provisions in case of any default in complying with the order of the Tribunal under the said section. |

| Clause 11 | Further Issue of Share Capital

sub-clause (i) of clause (a) of sub-section (1) of section 62 |

To enable the Central Government to provide by rules, such days less than fifteen for deeming the decline of the offer made under the said provision.

The amendment reduces the range of time limit from the date of the offer within which the offer, if not accepted, shall be deemed to have been declined. |

| Clause 12 | Notice to be given to Registrar for Alteration of Share Capital

sub-section (2) of section 64 |

To modify the amount of penalty provided therein in case of default made in complying with subsection (1). |

| Clause 13 | Reduction of Share Capital

to omit subsection (11) of section 66 |

To remove the penal provisions in case of any default in complying with subsection (4) relating to the publication of the order of confirmation of the reduction of share capital by the Tribunal in such manner as the Tribunal may direct. |

| Clause 14 | Power of Company to Purchase its Own Securities

sub-section (11) of section 68 |

To omit the punishment of imprisonment in relation to an officer of the company who is in default for the offense specified therein. |

| Clause 15 | Debentures

to omit subsection (11) of section 71 |

To remove the penal provisions in case of any default by the officer of the company in complying with the order of the Tribunal under the said section. |

| Clause 16 | Punishment for Contravention

to substitute sub-section (1) of section 86 |

To omit the punishment of imprisonment in relation to an officer of the company who is in default reduced penalty in place of fine, in case of failure to comply with the provisions of Chapter VI of the Act. |

| Clause 17 | Register of Members, etc

to substitute sub-section (5) of section 88 of the Act |

To reduce penalty in place of fine, in case of failure to comply with the provisions of subsections (1) and (2). |

| Clause 18 | Declaration in Respect of Beneficial Interest in any Share

to substitute sub-section (5) and (7) and insert subsection (11)insection 89 |

To provide for a penalty in place of fine, for failure in making a declaration or in the filing of a return, as the case may be, under sub-section (1), (2), (3) or (6).

To insert a new sub-section (11) to enable the Central Government to notify a class or classes of persons who shall be unconditionally or subject to such conditions, as may be specified in such notification, be exempted from complying with the said section, except sub-section (10). |

| Clause 19 | Register of significant beneficial owners in a company

to substitute sub-section (10) and (11) of section 90 |

To provide for a penalty in place of fine, for failure in making a declaration, maintaining the register, filing of information, or taking necessary steps, as the case may be, in subsections (1), (2), (4) or (4A). |

| Clause 20 | Annual Return

to amend sub-section (5) and (6) of section 92 |

To modify the amount of penalty provided therein in case of default made in complying sub-section (4) of the said section as per the amendment to sub-section (5).

A PCS certifying annual return, not in conformity with the section or rules made thereunder shall be liable to a penalty in place of a fine of two lakh rupees as per the amendment to subsection (6). |

Read & Download the full copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.